Last quarter I managed my options almost perfectly. I significantly reduced the number of positions. One of my favourite name $NU (-0.93%) , is still in the portfolio. This stock gives me a great balance: I can almost always identify the right strike price, it has excellent option volume, and it’s still growing at a reasonable pace.

I added $NOVO B (-0.55%) by removing some other stocks. I purchased 200 shares, which significantly boosted my monthly option premium. As expected, Novo started to grow from its recent bottom, so I had to make several adjustments to avoid getting called away.

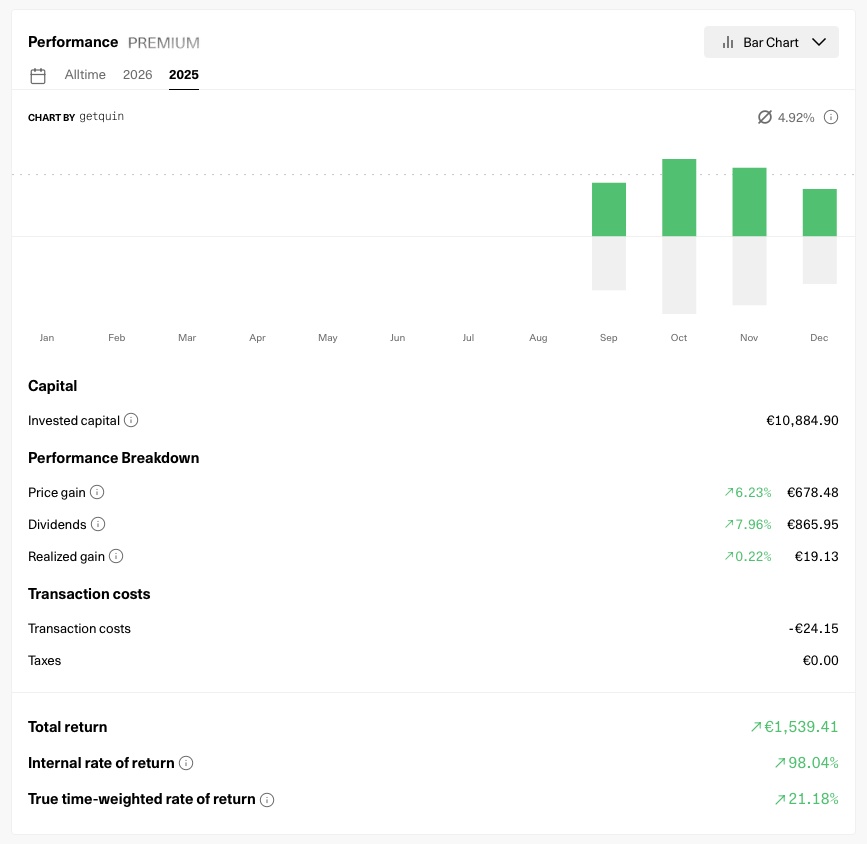

Here are some results:

This journey started at Sept 2025

During this period, I invested a total of €13,875.

Unrealised price gain: €678

Dividends (this is also how I track my option premiums): €865

Realized gain: €19

That’s about a 11% return in 4 months. My normal price returns were almost doubled just by doing option trading as well.

What I really like is that these are not just unrealised gains. That €865 is already in my hands, not just on paper. I’m currently reinvesting this into $FWRG (-1.42%) . That said, this options portfolio has grown too large compared to my other investments, so I’ve already started to scale it down in January.

Efforts

I spent around 2–4 hours per week managing this portfolio, mostly because I’m still learning. Without prior experience, it can be tough to react properly when things move fast. Some stocks jump so high, so quickly, that you need to handle the time pressure well and roll or buy back your calls at the right moment.

A lot of the time, it feels like you’re missing out on gains. So the saying that selling call options limits your upside without protecting you from downside is partly true. However, in most cases these are actually good problems to have—you’ve already locked in a solid return, and you’re only missing some extra upside.

By understanding time, market behaviour, and the kind of spikes that can happen, I’ve learned that there are multiple ways to make back what you "missed". That’s why having a clear strategy is so important, and knowing exactly why you’re trading options in the first place. Patience and respect for the power of time make a big difference.

If you’re thinking about starting today, my recommendation is to start small—one or two stocks at most. Choose a stock that’s expected to grow, that you’d be happy to own anyway, and that has good option activity.

Accept that, especially at the beginning, your shares will get called away. Don’t get greedy, and aim for far out-of-the-money contracts to reduce this risk. Understand that time is your friend—you don’t need to pressure yourself into making mistakes. Sometimes the best move is simply to wait.

Read a lot, watch YouTube, and have deep conversations with AI tools about how options actually work to learn the mechanics. But it’s super important not to ask for recommendations, because those are usually wrong or missing some additional context you might not provide.

A reminder that within this period I’ve spent more than 50 hours actively trading, and at least the same amount of time just preparing and learning—and I still know very little and make mistakes.