$BNTX (-1,07%)

$KSPI (+1,45%)

$HIMS (-1,06%)

$MELI (-0,12%)

$PLTR (-1,3%)

$DRO (-3,58%)

$IFX (+0,36%)

$9434 (-0,17%)

$FR0010108928

$DHL (-0,32%)

$BOSS (+1,22%)

$CONTININS

$DOCN (-1,92%)

$LMND (-0,66%)

$BP. (+0,56%)

$FRA (+1,48%)

$PFIZER

$SNAP (-1%)

$AMD (-1,33%)

$SMCI (-0,84%)

$OPEN (-1,81%)

$CPNG (+1,05%)

$LCID (+0%)

$CBK (+2,34%)

$ZAL (-1,41%)

$NOVO B (-13,6%)

$VNA (-0,22%)

$BAYN (-0,71%)

$UBER (-0,84%)

$SHOP (-0,71%)

$MCD (-0,06%)

$DIS (-0,28%)

$ROK (-0,62%)

$ABNB (-0,45%)

$RUN (-0,68%)

$FTNT (-0,4%)

$O (-0,31%)

$DASH (-3,75%)

$DUOL

$S92 (-0,77%)

$DDOG (-0,42%)

$SEDG (-0,88%)

$QBTS (-1,46%)

$RHM (-2,38%)

$DTE (+0,92%)

$ALV (+0,37%)

$LLY (+2,63%)

$CYBR

$PTON (+0,61%)

$DKNG (-0,83%)

$RL (-1,53%)

$PINS (+0%)

$TTWO (-0,25%)

$TWLO (-0,12%)

$MNST (+0,39%)

$STNE (-1,34%)

$MUV2 (+1,04%)

$WEED (-2,04%)

$GOOS (-0,43%)

$PETR3T

$ANET (-0,58%)

Petrobras

Price

Discussão sobre PETR3T

Postos

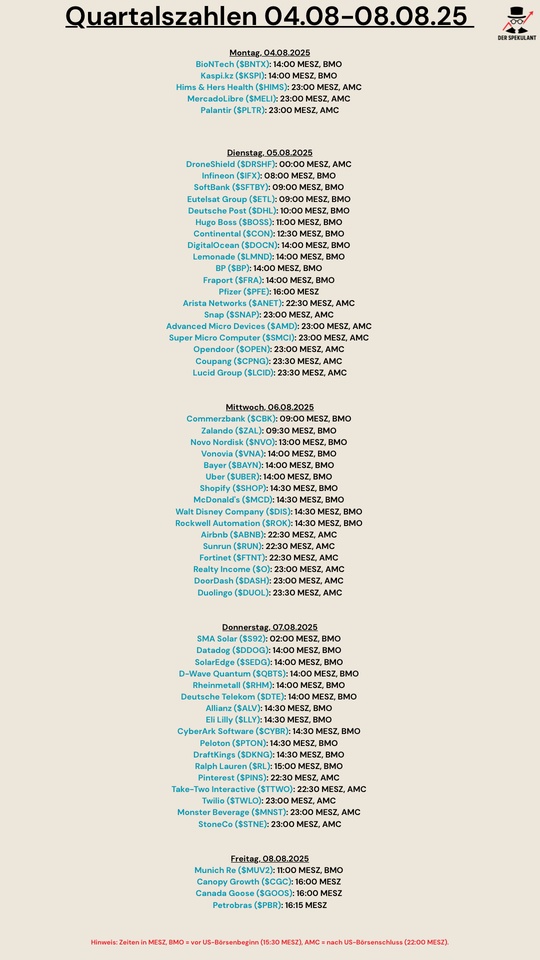

3Quartalszahlen 04.08-08.08.2025

Billionaire plans control of Braskem - Petrobras reacts!

Executive summary for investors: Petrobras & Braskem (July 24, 2025)

Background:

Brazilian billionaire Nelson Tanure plans to indirectly take control of Braskem S.A. through the purchase of NSP Inv. (subsidiary of Novonor S.A.). The antitrust authorities (CADE) have already approved this possible takeover.

Reaction from Petrobras:

Petrobras, itself a co-shareholder of Braskem, is now formally asserting its co-determination rights and applying to join the merger control proceedings as a "third interested party". This is based on the valid shareholders' agreement with Novonor, which grants Petrobras pre-emption rights and tag-along rights in the event of share sales.

Status:

No decision yet on a possible entry or withdrawal. Petrobras is awaiting the reaction of the competition authorities to the application to join.

Classification:

Petrobras could gain strategic time with this step, exert influence on the transaction or keep its own options open - for example to acquire a stake at a later date or prevent a change of control at Braskem that would be unfavorable for Petrobras.

Classification of ChatGPT:

📉 Stock market psychology assessment: Petrobras & Braskem - what's behind it all

1. market impact in the short to medium term:

The news is neutral to slightly positive for the share price because Petrobras is showing a willingness to act.

The market does not like powerlessness - and Petrobras is signaling here: "We will not be ignored."

At the same time, there is no obligation to buy anything - the move is more tactically defensive than offensive.

→ Reaction: No jump in the share price, but a confidence boost among institutional investors.

---

2. possible scenarios from an investor's perspective:

🟢 Best-case:

Petrobras blocks or delays Tanure's takeover, thereby improving its own negotiating position - and possibly acquires Braskem shares itself on better terms.

→ High-dividend joint venture is secured, or Petrobras strengthens its industrial control.

🟡 Neutral case:

Petrobras remains on the outside, but receives a settlement or participation through the contractual clauses - effectively a windfall bonus without commitment.

🔴 Worst case (unlikely):

Petrobras outbids Tanure for political reasons or due to pressure from the state, pays too much - and burdens the balance sheet for a company (Braskem) that does not fit structurally with the core business.

→ Cash flow risk and political misallocation.

Petrobras Information according to Form 6-K dated 11.07.25

🔄 Translation of the current Petrobras communiqué (Form 6-K dated July 11, 2025)

Original: Petrobras filed a Form 6-K announcing Board's election of Angélica Garcia Cobas Laureano as Chief Energy Transition and Sustainability Officer, Mandate till 13 April 2027. 45 years of experience, of which 37 years at Petrobras, in various areas - Materials, Downstream, Gas & Energy, President of Gaspetro and operator of the Bolivia-Brazil Pipeline. Governance, compliance and integrity checks completed. Board of Directors now with a majority of women for the first time (5 to 4).

German:

Petrobras has officially announced, according to a Form 6-K, that Angélica Garcia Cobas Laureano has been elected Chief Energy Transition & Sustainability Officer - her mandate runs until April 13, 2027. She brings 45 years of industry experience (37 of them at Petrobras), has served in key roles - materials, downstream, gas/energy and led Gaspetro plus the Bolivia-Brazil pipeline. All governance and compliance checks have been passed. For the first time, there are more women than men on the Executive Board (5 women, 4 men).

---

🎯 Evaluation of ChatGPT&Dirk: Pro Contra

Competence & experience 45 years of experience, 37 of them at Petrobras - solid continuity, no green newcomer. Instant know-how, but: same clique - risk of mental blocks, standstill. No breath of fresh air.

Gender majority on the Executive Board First-time majority of women - strong signal, it hardly gets more diverse. A tick in the share register for ESG fans. Symbolism remains symbolism - real power? Or just a cosmetic fig leaf?

Mandate until April 2027 Medium-term planning security, strategic consistency possible, but can also lead to inertia - Petrobras needs undead flexibility instead of stage puppets.

Governance check completed Fine - no scandals in the run-up, clean transition. This is exactly what we expect. No killer praise for this.

Sustainability & energy transition Title meant seriously - top management level for energy transition. Petrobras remains relevant in green-washing. Without clear targets, it's just window dressing. Where is the CO₂ plan? Where are the investment calculations in renewable projects?

Insider focus Internal appointment - broadly supported, no shockwaves. Cash for external specialists is left lying around. Petrobras appears conservative instead of transformative.

---

💥 Short summary (thinking out loud)

Petrobras is delivering what is probably a conservative upgrade in the energy sector: experienced manager, well integrated into the system, as ESG-compliant as it looks on prescription. No revolutionary cut, well-established structures remain in place - and the big climate change? That now depends on the will of Laureano and her mandate. The signal is strong: a majority of women on the Executive Board. The implementation remains: watch until April 2027.

As with our getquin rounds: A solid move in the show - but there's only real impact if the hambonis pull the thing off and don't just paint it a bit pretty green.

---

Títulos em alta

Principais criadores desta semana