"Bitcoin is useless, nobody pays with it!"

You hear this sentence - or something similar - relatively often. From critics, in comment columns, sometimes even from people who themselves $BTC (+4,04 %) hold it themselves. And at first glance, the argument sounds logical:

If Bitcoin is supposed to be money - and then also the money with the best properties - why does almost nobody pay with it?

The answer is provided by economics, or more precisely by two laws that have described for centuries how people behave when different forms of money exist side by side.

In my article on "What is money actually?" https://getqu.in/XMAb83/ we looked at the so-called convergence process - i.e. the path that a good has to go through to become money: first a store of value, then a means of payment, then a unit of account.

Today we look at why this sequence is mandatory, why Bitcoin is currently in phase 1 and what mechanism triggers the transition to phase 2.

Gresham's law: bad money drives out good money

The principle is named after the English financial advisor Sir Thomas Gresham, who formulated it to Queen Elizabeth I in the 16th century. However, it has been observed since ancient times.

The short version:

When two forms of money exist at the same time, people spend the bad money and keep the good.

That sounds abstract at first, so here's a concrete example:

In 16th century England, King Henry VIII mixed cheap copper into silver coins. The coins officially had the same face value, but the old, pure silver coins were of course worth more. So what happened?

People paid with the new, inferior copper-silver coins and hoarded the old, pure silver coins. The good money disappeared from circulation.

It is precisely this principle that explains why hardly anyone in the West pays with Bitcoin.

Imagine you have €100 and €100 in Bitcoin. You want to buy a pizza. What money do you spend?

The euro, of course. The euro loses purchasing power every year. The euro is like a melting ice cube that you want to hand over before it melts even further.

Bitcoin, on the other hand, is limited to just under 21 million units. Nobody can "print" new Bitcoin. The trend over any longer period of time: increasing purchasing power. So why should you pay for your pizza with an asset that may be worth a lot more in five years' time when you can also pay for it with euros, which are guaranteed to be worth less by then?

Exactly. You wouldn't. And that's Gresham's law in action.

So hoarding Bitcoin is not a bug - it's a feature.

It's proof that people perceive Bitcoin as the harder, better money. Because only "good money" is hoarded. Bad money is spent as quickly as possible.

Incidentally, gold has also gone through exactly the same phase in history. Nobody ever voluntarily paid with gold coins as long as they could also issue paper bills. We know the result.

And that brings us directly to the convergence process:

Gresham's law explains why bitcoin is little used as a means of transaction and instead tends to be hoarded.

The means of payment function cannot come before the store of value function because rational people first hoard superior money before paying with it. This is not a flaw in the system. It is the process.

But if Bitcoin is only hoarded forever, it can never become a means of transaction and therefore never become money, can it? Yes, and there is also a law for that.

Thiers' law: good money displaces bad money

It was named by the economist Peter Bernholz in honor of the French politician Adolphe Thiers. It describes the inverse of Gresham's law:

If the bad money becomes so bad that people lose confidence completely, the game turns around. Then the good money displaces the bad.

The tipping point is reached when traders and sellers no longer want to accept the bad money - no matter what the state prescribes. In the Weimar Republic in 1923, farmers refused to sell their food for worthless Reichsmarks. In Zimbabwe in 2009, practically no one accepted the Zimbabwe dollar - the economy switched to US dollars and barter. These were the moments when Thiers' law replaced Gresham's law.

In the context of the convergence process, Thiers' law describes the trigger for the transition from phase 1 (store of value) to phase 2 (means of payment). When fiat currencies become so bad that they are no longer suitable as a means of payment, harder money fills the gap.

And that is exactly what is happening today - not in Europe, but in many parts of the world.

A look at the global South

While we in Germany view Bitcoin primarily as an investment and it enjoys relatively little popularity apart from among investors, it can already be something of a necessity in countries with unstable currencies. There, it's not just about "numbers go up" - it's about somehow saving your own purchasing power from the collapse of the national currency and protecting yourself from authoritarian rulers.

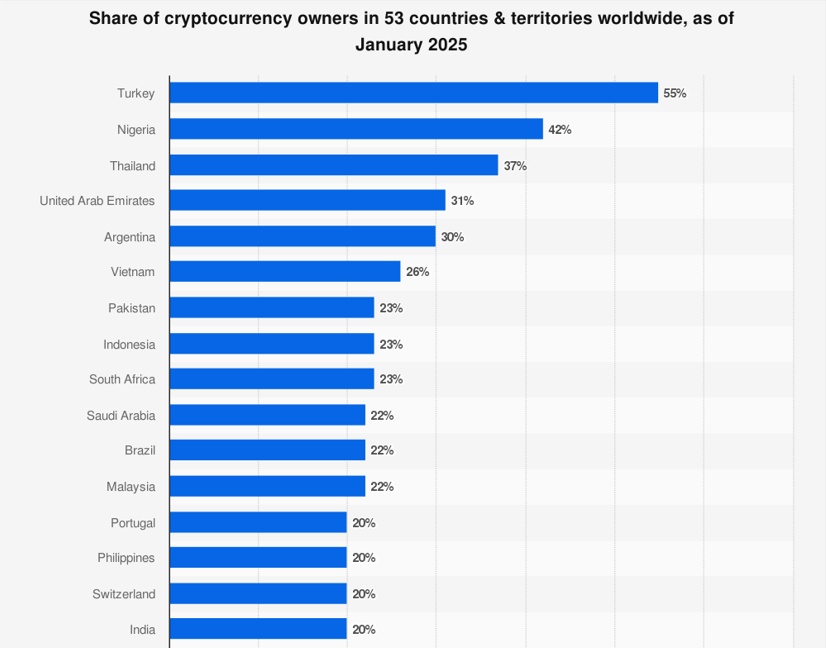

Source: https://www.statista.com/forecasts/1452605/share-of-cryptocurrency-owners-in-selected-countries-worldwide/

The pattern is clear: the countries with the highest crypto adoption are almost without exception countries with weak currencies - Turkey (55%), Nigeria (42%), Argentina (30%)... The unfortunately often poor population there does not use Bitcoin & Co. because they want to speculate. They are forced to use it because their national currencies are failing.

This is Thiers' law in its purest form: where fiat fails, Bitcoin is no longer just hoarded, but actively used. The convergence process is already moving towards phase 2 in these countries.

The game theorist Prof. Rieck describes Bitcoin in his book "Der Bitcoin-Gelduntergang" as a "bet on the monetary demise" of the fiat system. And he is not wrong. The worse our fiat money system gets, the more Bitcoin comes to the fore as an alternative.

Governments always have the incentive to print more money - for wars, crises, election promises. This incentive will not disappear. This does not mean that the euro will collapse tomorrow, but as long as the structural direction remains, the pressure towards Thiers' law will continue to build. It is less a question of if than a question of when.

So anyone holding Bitcoin today while spending euros is not betting blindly on the demise of the euro. They are acting according to the same economic principle according to which people have been keeping the harder money and spending the weaker money for centuries.

And what many do not see: Bitcoin doesn't have to do anything for the convergence process to continue. Bitcoin simply remains Bitcoin. The change is not coming because Bitcoin is changing. It is coming because fiat is changing.

Conclusion

The fact that hardly anyone pays with Bitcoin at the bakery today is not a sign of weakness. It is Gresham's law in action - and therefore a sign of strength. We are in the accumulation phase of a superior money. Those who spend fiat and hold bitcoin today are acting completely rationally economically.

History shows us what comes next. As soon as confidence in fiat currencies erodes - and in large parts of the world this is already happening - the dynamic will tip. Then the good money displaces the bad. Thiers' law replaces Gresham's law. The store-of-value phase turns into the means-of-payment phase. The convergence process is progressing.

What about you? Do you sometimes pay with Bitcoin, or are you more of a "HODL and spend fiat" team?

#bitcoin