Discussion sur XRP

Postes

265Bitcoin & Ethereum or co?

Hello everyone,

I would like to hear your opinions. Of course there's a lot on the Internet, but I would be more than happy to have an exchange here in the community.

What are your current thoughts on the chewing of $BTC (+6,88 %) or perhaps $ETH (+6,62 %) .

The price has halved in the last few months.

What do you think about the other coins like $SOL (+6,11 %) , $ADA (+4,15 %) or also $XRP (+4,25 %)

Looking forward to your opinions.

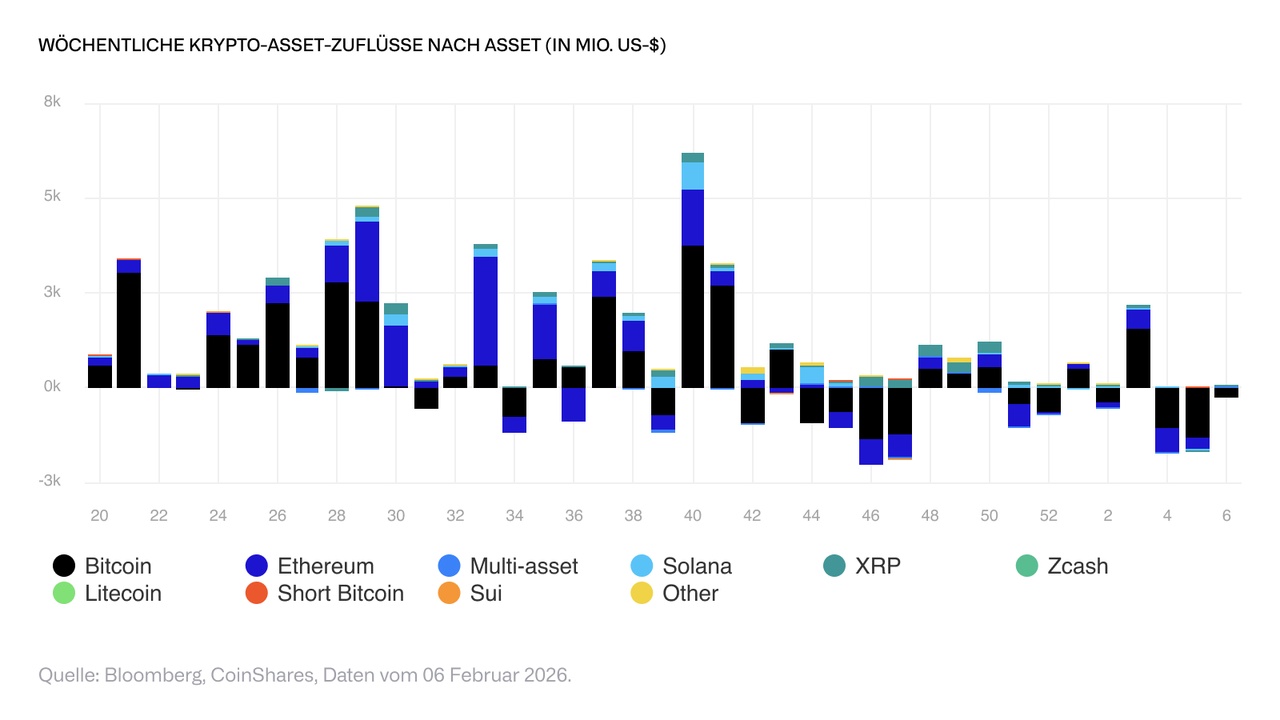

Bitcoin under pressure: outflows dominate, while XRP and Solana see inflows

$BTC (+6,88 %) recorded the weakest investor sentiment last week. A total of USD 133 million flowed out of corresponding investment products. At the same time, there were also outflows from short Bitcoin products, totaling USD 15.4 million over the past two weeks - a pattern that has historically often been observed near local lows.

Also $ETH (+6,62 %) was also affected by outflows, with withdrawals totaling USD 85.1 million. $HYPE (+4,64 %) The US dollar market also saw outflows, albeit at a much lower level of USD 1 million.

In contrast, sentiment towards $XRP (+4,25 %), $SOL (+6,11 %) and $LINK (+5,64 %) remained constructive. These assets recorded inflows of USD 33.4 million, USD 31 million and USD 1.1 million respectively in the past week.

$XRRL (+4,2 %)

$SLNC (+8,75 %)

$CTEN (+1,76 %)

$GB00BMY36D37 (+7,65 %)

Laughed at early…. Respected later…..

+47% 🤲🏻

Markets don’t reward opinions they reward positioning….$BTC (+6,88 %)

$XRP (+4,25 %)

$TAO (+6,92 %)

$ONDO (+4,9 %)

$FET (+2,39 %)

$HBAR (+3,77 %)

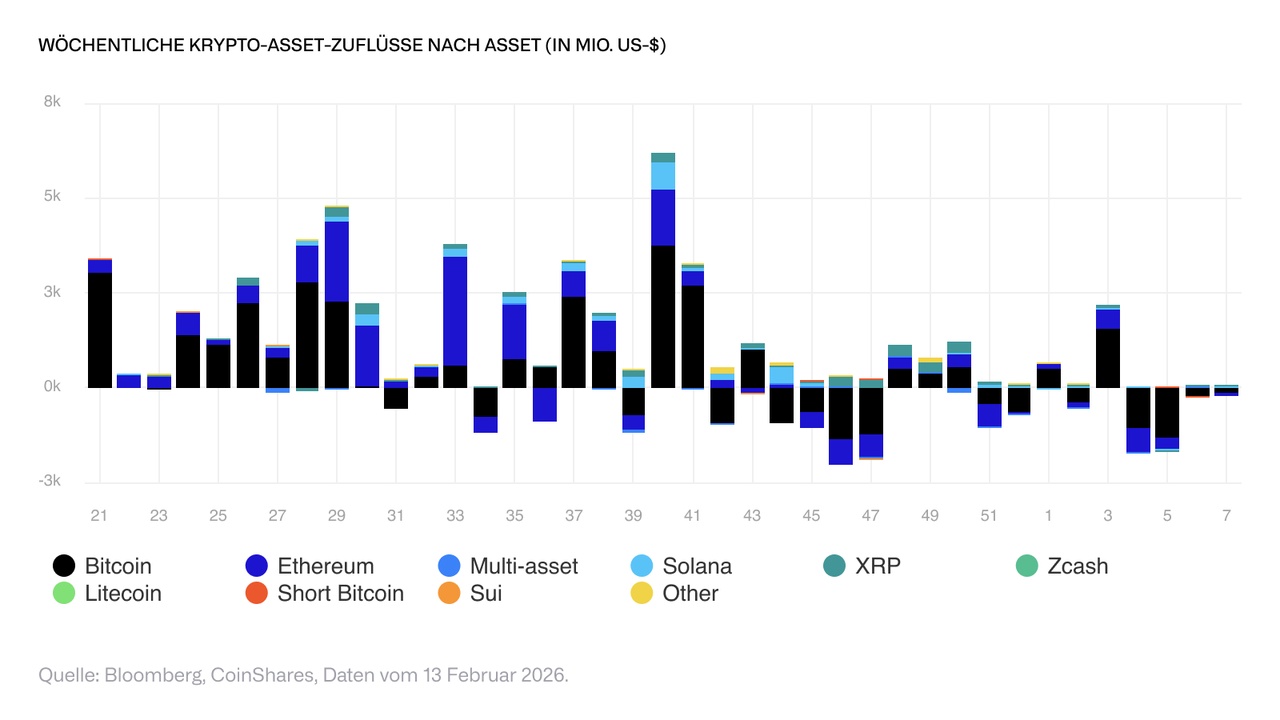

Bitcoin down, altcoins up

$BTC (+6,88 %) is the only area with negative investor sentiment and recorded capital outflows of USD 264 million. In contrast $XRP (+4,25 %), $SOL (+6,11 %) and $ETH (+6,62 %) lead inflows, with USD 63.1 million, USD 8.2 million and USD 5.3 million respectively. XRP thus remains the most successful asset since the beginning of the year, with cumulative capital inflows of USD 109 million.

Crypto

Rip to all $XRP (+4,25 %)

$BTC (+6,88 %)

$ETH (+6,62 %)

$SOL (+6,11 %) and generally crypto holder my condolences but at least you can buy more but today was hard for everyone

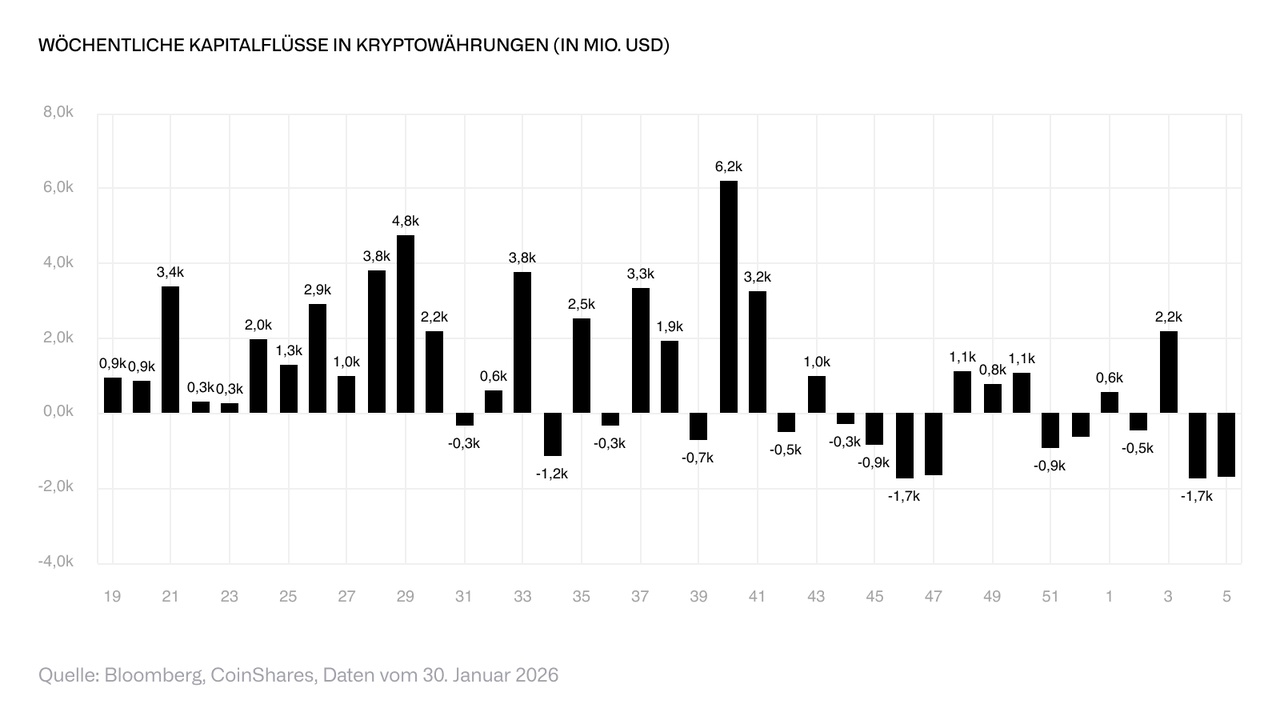

Investor sentiment clouds as crypto outflows accelerate

Digital investment products recorded a second consecutive week of outflows totaling USD 1.7 billion. This completely reversed the inflows achieved since the beginning of the year, resulting in a net global outflow of USD 1 billion since the start of the year. This indicates a noticeable deterioration in investor sentiment towards the asset class. In our view, this reflects a combination of factors, including the appointment of a more dovish Fed Chair, continued selling by large market participants in the context of the four-year cycle and increased geopolitical volatility. Since the price highs in October 2025, global assets under management (AuM) have fallen by USD 73 billion.

The negative sentiment was broad-based across individual assets. $BTC (+6,88 %) recorded outflows of 1.32 billion US dollars, $ETH (+6,62 %) of 308 million US dollars. The most recently favored assets $XRP (+4,25 %) and $SOL (+6,11 %) were also affected, with outflows of USD 43.7 million and USD 31.7 million respectively. Short Bitcoin products, on the other hand, recorded inflows of USD 14.5 million; assets under management here have risen by 8.1 percent since the beginning of the year.