- 🧬 ASM International — Technologie / Semi-conducteurs $ASM (-2,73 %)

🪙 iShares Physical Gold ETC — Métaux précieux / Couverture $IGLN (+1,03 %)

💻 iShares NASDAQ 100 ETF — Indice US / Croissance $CSNDX (-0,02 %)

🧠 Atoss Software — Logiciels / SaaS $AOF (-0,06 %)

🇪🇺 Amundi EURO STOXX 50 II ETF — Indice européen / Stabilité $MSE (-0,84 %)

🌍 Vanguard FTSE All-World High Dividend Yield ETF D — Dividendes mondiaux $VHYL (+0,42 %)

₿ Bitcoin — Crypto / Diversification $BTC (+1,46 %)

🧩 Ethereum — Crypto / Innovation & Web3 $ETH (+1,34 %)

📊 S&P Global (SPGI) — Données financières / Notation / Indices $SPGI (-0,26 %)

ASM Intl

Price

Discussion sur ASM

Postes

13🗓️ Résumé des achats – 29 octobre 2025

Value Stocks!

Last weeks value stocks bought such as Deutsche Telekom ($$DTE (+0,44 %) ) Ahold $AD (+0,56 %) Heineken $HEIA (-0,65 %) and Engie $ENGI (+0,68 %) . ASML $ASML (+0,7 %) and ASMI $ASM (-2,73 %) trimmed and sold to bring my tech weighting to around 25%. Cost some redemenent this week, but a more stable portfolio.

Megatrend robotics, freshly updated, added value guaranteed!

After my first post on humanoid robots received a lot of positive feedback, I went into more detail. I have subsequently added my favorites in each sector.

Extended analysis of the value chain including shovel manufacturers and potential hidden champions

New categorySecondary key sectors (sales, marketing, financing)

In additionTop 25 companies worldwide, as well as Top 10 Europe and Top 10 Asia

I have also added a video link for beginners. This will give you an idea of how far the development of humanoid robotics has already progressed.

Thank you for your attention and your support 🙏

🌐 1. value chain of humanoid robots (with hidden champions)

1. research & chip design

$ARM (-1,53 %) ARM (UK) - CPU-IP, energy-efficient processors

$SNPS (-0,37 %) Synopsys (US) - EDA software, chip design

$CDNS (-1,14 %) Cadence (US) - EDA & Simulation

$PTC PTC (US) - Engineering Software, CAD/PLM

$DSY (-1,12 %) Dassault Systèmes (FR) - 3D Design & Digital Twin

$SIE (-0,73 %) Siemens (DE) - Industrial Software & Lifecycle Mgmt

$ADBE (+0,33 %) Adobe (US) - Design, AR/UX

ANSYS (US) - multiphysical simulation - acquisition by Synopsis

Altair (US) - CAE, simulation, digital twin - acquisition by Siemens

$HXGBY (-0,27 %)

Hexagon (SE) - Metrology & Simulation

$AWE Alphawave IP Group (UK) - High-speed chip IP for AI/robotics

1.Synopsis, 2.Siemens and 3.Adobe are my top 3 in this sector

2. manufacturing technology & equipment

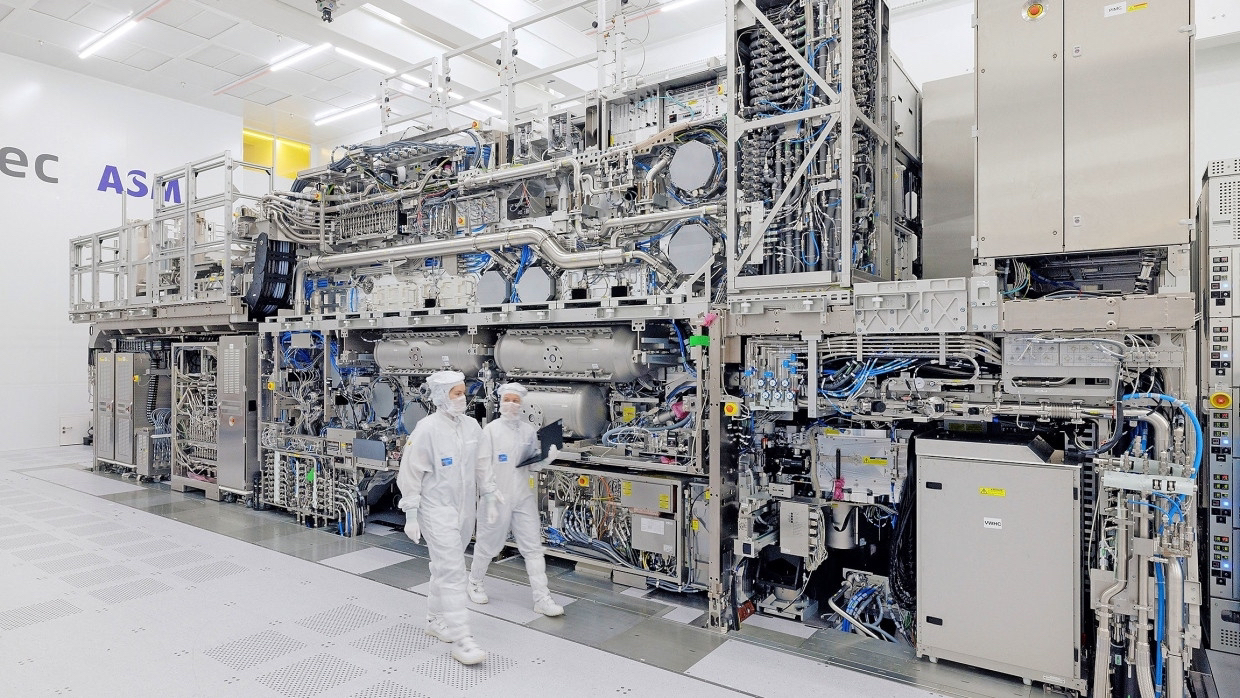

$ASML (+0,7 %) ASML (NL) - Lithography (EUV)

$AMAT (-0,5 %) Applied Materials (US) - Semiconductor equipment

$8035 (-1,53 %) Tokyo Electron (JP) - wafer fabrication

$KEYS (-1,36 %) Keysight Technologies (US) - Metrology

$6857 (-1,03 %) Advantest (JP) - Chip test systems

$TER (-0,74 %) Teradyne (US) - test systems + cobots

$6954 (-2,56 %) Fanuc (JP) - Industrial robots, CNC

$CAT (-0,16 %) Caterpillar (US) - autonomous machines

$KU2G KUKA (DE) - industrial robots

Comau (IT) - automation - not listed on the stock exchange

$ROK Rockwell Automation (US) - industrial automation

$JBL (-0,69 %) Jabil (US) - contract manufacturing (EMS/ODM)

$KIT (+0,31 %) Kitron (NO) - European EMS/ODM manufacturer

$AIXA (+2,1 %) Aixtron (DE) - deposition equipment for compound semiconductors

$LRCX (-1,48 %)

Lam Research (US) - Etch/deposition systems

$MKSI (-0,3 %)

MKS Instruments (US) - Plasma/vacuum technology

$ASM (-2,73 %)

ASM International (NL) - Deposition systems

1.ASML, 2.Keysight Technologies, 3.Fanuc are my top 3 in this sector

3. chip manufacturing (foundries)

$TSM (-0,33 %) TSMC (TW) - leading foundry

$SMSN Samsung Electronics (KR) - foundry + memory

$GFS (+0,22 %) GlobalFoundries (US) - specialty chips

$INTC (-0,81 %)

Intel Foundry Services (US) - new western foundry player

$981

SMIC (CN) - largest Chinese foundry

$UMC

UMC (TW) - Power/RF/Embedded chips

1.TSMC, 2.Intel, 3.Samsung Electronics are my top 3 in this sector

4. computing & control unit ("brain")

$NVDA (-0,11 %) Nvidia (US) - GPUs, AI chips

$INTC (-0,81 %) Intel (US) - CPUs, FPGAs

$AMD (-0,38 %) AMD (US) - CPUs, GPUs

$MRVL (-0,4 %) Marvell (US) - Network Chips

$MU (-0,89 %) Micron (US) - Memory

$DELL (-0,36 %) Dell Technologies (US) - Edge & Infrastructure

Graphcore (UK) - AI chips (IPU) - not a listed company

Cerebras (US) - Wafer-scale engine - not a listed company

SiPearl (FR) - European HPC chip - not a listed company

1.Nvidia, 2.Marvell, 3.Micron are my top 3 in this sector

5. sensors ("senses")

$6758 (+0,01 %) Sony (JP) - image sensors

$6861 (+0,24 %) Keyence (JP) - Industrial sensors

$STM (-0,73 %) STMicroelectronics (FR/IT) - Sensors, MCUs

$TDY Teledyne (US) - optical/infrared sensors

$CGNX (-0,68 %) Cognex (US) - Machine Vision

$HON (-0,48 %) Honeywell (US) - sensor technology, security

ANYbotics (CH) - autonomous sensor fusion - not a listed company

$AMBA (-1,26 %) Ambarella (US) - video & computer vision SoCs for real-time image recognition

$OUST

Velodyne Lidar (US) - Lidar sensors - acquisition by Ouster

$AMS (-0,17 %)

OSRAM (AT/DE) - optical sensors

1.Teledyne, 2.Keyence, 3.Ouster are my top 3 in this sector

6. actuators & power electronics ("muscles")

$IFX (+0,33 %) Infineon (DE) - Power Electronics

$ON (-1,55 %) onsemi (US) - Power & Sensors

$TXN (-0,28 %) Texas Instruments (US) - Mixed-Signal Chips

$ADI (-0,36 %) Analog Devices (US) - Signal Processing

$PH Parker-Hannifin (US) - Hydraulics/Pneumatics

$MP (-0,95 %) MP Materials (US) - Magnets

$APH (-0,59 %) Amphenol (US) - Connectors

$6481 (-4,14 %) THK (JP) - Linear guides & actuators

$6324 (-2,07 %)

Harmonic Drive (JP) - Precision gears & servo drives for robotics

$6594 (+24,16 %)

Nidec (JP) - Electric motors

$6506 (+0,57 %)

Yaskawa (JP) - Drives & Robotics

$SU (-0,88 %)

Schneider Electric (FR) - Energy & control solutions

$ZIL2 (+0,61 %)

ElringKlinger (DE) - Battery & fuel cell technology, lightweight construction

1.Parker-Hannifin, 2.MP Materials, 3.Infinion are my top 3 in this sector

7. communication & networking ("nerves")

$QCOM (-0,21 %) Qualcomm (US) - mobile communications, edge AI

$ANET (-0,57 %) Arista Networks (US) - Networks

$CSCO (-0,05 %) Cisco (US) - Networks, Security

$EQIX (-0,38 %) Equinix (US) - Data centers

NTT Docomo (JP) - 5G/6G carrier - not a listed company

$VZ Verizon (US) - Telecommunications

$SFTBY SoftBank (JP) - Carrier + Robotics

$ERIC B (-0,03 %)

Ericsson (SE) - 5G/IoT infrastructure

$NOKIA (-0,71 %)

Nokia (FI) - 5G/6G for industry

$HPE (-0,35 %)

Juniper Networks (US) - Network technology - acquisition by HP

1.Arista Networks, 2.SoftBank, 3.Cisco are my top 3 in this sector

8. energy supply

$3750 (-2,05 %) CATL (CN) - Batteries

$6752 (-0,42 %) Panasonic (JP) - Batteries

$373220 LG Energy (KR) - Batteries

$ALB (-0,43 %) Albemarle (US) - Lithium

$LYC (+1,39 %) Lynas (AU) - Rare earths

$UMICY (+0,7 %) Umicore (BE) - recycling

WiTricity (US) - inductive charging - not a listed company

$ABBN (-0,27 %) Charging (CH) - charging infrastructure

$SLDP

Solid Power (US) - Solid state batteries

Northvolt (SE) - European batteries - not a listed company

$PLUG

Plug Power (US) - fuel cells

$KULR (+0,41 %)

KULR Technology (US) - Thermal management & battery safety for mobile systems

1.Albemarle, 2.CATL, 3.Panasonic are my top 3 in this sector

9. cloud & infrastructure

$AMZN (-0,31 %) Amazon AWS (US) - Cloud, AI

$MSFT (-0,19 %) Microsoft Azure (US) - Cloud, AI

$GOOG (-0,17 %) Alphabet Google Cloud (US) - Cloud, ML

$VRT (-0,5 %)

Vertiv Holdings (US) - Data center infrastructure (UPS, cooling, edge)

$ORCL (-0,2 %)

Oracle Cloud (US) - ERP + Cloud

$IBM (-0,04 %)

IBM Cloud (US) - Hybrid cloud + AI

$OVH (-2,17 %)

OVHcloud (FR) - European cloud

1.Alphabet, 2.Microsoft, 3.Oracle are my top 3 in this sector

10. software & data platforms

$PLTR (-0,57 %) Palantir (US) - Data integration

$DDOG (+0,07 %) Datadog (US) - Monitoring

$SNOW (-0,13 %) Snowflake (US) - Data Cloud

$ORCL (-0,2 %) Oracle (US) - Databases, ERP

$SAP (-0,44 %) SAP (DE) - ERP systems

$SPGI (-0,26 %) S&P Global (US) - financial/market data

ROS2 Foundation - robotics middleware - not listed on the stock exchange

$NVDA (-0,11 %) NVIDIA Isaac (US) - robotics development - part of Nvidia

$INOD (-0,8 %) Innodata (US) - data annotation & AI training data

$PATH (-0,05 %)

UiPath (RO/US) - Robotic process automation

$AI (-0,94 %)

C3.ai (US) - AI platform

$ESTC (-0,74 %)

(NL/US) - Search & data analysis

1.S&P Global, 2.Palantir, 3.Datadog are my top 3 in this sector

11. end applications / robots

$ABBN (-0,27 %) ABB (CH/SE) - Industrial Robots

$6954 (-2,56 %) Fanuc (JP) - Industrial robots

$TSLA (-0,37 %) Tesla Optimus (US) - humanoid robot

$9618 (-2,74 %) JD.com (CN) - logistics robot

$AAPL (-0,19 %) Apple (US) - Platform & UX

$700 (+0,4 %) Tencent (CN) - Platform & AI

$9988 (-1,83 %) Alibaba (CN) - logistics & platform

PAL Robotics (ES) - humanoid robots - not a listed company

Neura Robotics (DE) - cognitive humanoid robots - not a listed company

$TER (-0,74 %) Universal Robots (DK) - cobots - belongs to the Teradyne Corporation

Engineered Arts (UK) - humanoid robots - not a listed company

$ISRG (+0,07 %) Intuitive Surgical (US) - surgical robotics

$GMED (+0 %)

Globus Medical (US) - surgical robotics (ExcelsiusGPS platform)

$7012 (-4,37 %) Kawasaki Heavy Industries (JP) - industrial robots, automation

$CPNG (-2,38 %) Coupang (KR) - Logistics end user

$IRBT

iRobot (US) - consumer robotics (e.g. Roomba), non-humanoid, but navigation/sensor fusion

Boston Dynamics (US) - humanoid & mobile robots-no listed company

Hanson Robotics (HK) - humanoid robots (Sophia) - not a listed company

Agility Robotics (US) - humanoid robot "Digit" - not a listed company

1.Apple, 2.Tencent, 3.Alibaba are my top 3 in this sector

🛠 2. cross enablers (shovel manufacturers) - with hidden champions

Raw materials & battery materials

Albemarle - Lynas - Umicore

$SQM

SQM (CL) - Lithium

$ILU (+1,83 %)

Iluka Resources (AU) - Rare earths

$ARR (-4,73 %)

American Rare Earths (US/AU) - New supply chains

my number 1 in the sector is Albemarle

manufacturing technology

ASML - Applied Materials - Tokyo Electron

$LRCX (-1,48 %)

Lam Research (US) - Plasma/etching processes

$ASM (-2,73 %)

ASM International (NL) - ALD equipment

$MKSI (-0,3 %)

MKS Instruments (US) - Plasma/vacuum technology

my number 1 in the sector is ASML

Quality assurance

Keysight - Advantest - Teradyne

$EMR (-0,82 %)

National Instruments (US) - Measurement technology - from Emerson Electric adopted

$300567

ATE Test Systems (CN) - test systems

$FORM (-0,31 %)

FormFactor (US) - Wafer probing

my number 1 in the sector is Keysight

Motion & Drive

Parker-Hannifin

Festo (DE) - Pneumatics, Soft Robotics - not a listed company

Bosch Rexroth (DE) - Drives, Controls - not a listed company

$6481 (-4,14 %)

THK (JP) - Linear guides

my number 1 in the sector is Parker-Hannifin

Sensors/Imaging

$TDY Teledyne

$BSL (-2,1 %) Basler (DE) - Industrial cameras

FLIR (US) - Thermal imaging sensors - acquisition by Teledyne

ISRA Vision (DE) - Machine Vision - not a listed company

my number 1 in the sector is Teledyne

Magnets & Materials

MP Materials

$6501 (+3,28 %)

Hitachi Metals (JP) - Magnetic materials

VacuumSchmelze (DE) - Magnetic materials - not a listed company

$4063 (+2,02 %)

Shin-Etsu Chemical (JP) - Specialty materials

my number 1 in the sector is MP Materials

Chip Design & Simulation

Synopsys - Cadence - ARM

$SIE (-0,73 %)

Siemens EDA (DE/US)-Mentor Graphics-strategic business unit of Siemens AG

Imagination Tech (UK) - GPU-IP - not a listed company

$CEVA (-0,28 %)

CEVA (IL) - Signal Processor IP

my number 1 in the sector is Synopsys

Engineering & Lifecycle

PTC - Dassault - Siemens

Altair (US) - Simulation - no longer a listed company

$HXGBY (-0,27 %)

Hexagon (SE) - Metrology

$SNPS (-0,37 %)

ANSYS (US) - Simulation - takeover by Synopsys

my number 1 in the sector is Siemens

Networks & Data Centers

Arista - Cisco - Equinix

$HPE (-0,35 %)

Juniper (US) - Networks - Acquisition of HPE

$DTE (+0,44 %)

T-Systems (DE) - Industry cloud

$OVH (-2,17 %)

OVHcloud (FR) - European cloud

my number 1 in the sector is Arista

Cloud infrastructure

AWS - Azure - Google Cloud

$ORCL (-0,2 %)

Oracle Cloud (US) - ERP & databases

$IBM (-0,04 %)

IBM Cloud (US) - Hybrid Cloud

$9988 (-1,83 %)

Alibaba Cloud (CN) - Asian Cloud

$VRT (-0,5 %)

Vertiv Holdings (US) - Cloud/Infra

my number 1 in the sector is Alphabet (Google)

finance/information infra

S&P Global

$MCO (-0,7 %)

Moody's (US) - Ratings

$MSCI (-0,15 %)

MSCI (US) - Indices

$MORN

Morningstar (US) - Investment Research

my number 1 in the sector is S&P Global

Creative/Experience Infra

Adobe

$ADSK (-0,05 %)

Autodesk (US) - CAD & Design

$U

Unity (US) - 3D/AR simulation

Epic Games (US) - Unreal Engine - not a listed company

my number 1 in the sector is Adobe

Platform & Ecosystem

Apple - Tencent - Alibaba

$META (-0,17 %)

Meta (US) - AR/VR, Social Robotics

ByteDance (CN) - AI & platforms - not a listed company

$9888 (-1,1 %)

Baidu (CN) - AI & Cloud

my number 1 in the sector is Tencent

Infrastructure/Edge

Dell

$HPE (-0,35 %)

HPE (US) - Edge Computing

$SMCI

Supermicro (US) - AI servers

$6702 (+6,13 %)

Fujitsu (JP) - Edge & HPC

my number 1 in the sector is Dell

storage solutions

Micron

$HY9H

SK Hynix (KR) - Memory

$285A (-0,92 %)

Kioxia (JP) - NAND

$WDC

Western Digital (US) - Storage solutions

my number 1 in the sector is Micron

🏛 3. secondary key sectors with hidden champions

Financing & Capital

$GS (-0,18 %) Goldman Sachs (US) - investment bank; ECM/DCM, M&A, growth financing

$MS Morgan Stanley (US) - investment bank; tech banking, capital markets

$BLK (+0,11 %) BlackRock (US) - asset manager; capital allocation, ETFs/index funds

$9984 (-3,58 %) SoftBank Vision Fund (JP) - mega VC; growth equity in robotics/AI

Sequoia Capital (US) - venture capital; early/growth in AI/robotics - this is a classic venture capital fund

DARPA (US) - government R&D funding (robotics/defense) - independent research and development agency

EU Horizon (EU) - research funding/grants for DeepTech - Innovative Europe pillar

China State Funds (CN) - state industry/technology fund

Lux Capital (US) - VC for DeepTech - Uptake (US) - AI-based predictive maintenance

DCVC (US) - Robotics & AI focus - investing exclusively via VC fund investments

Speedinvest (AT) - EU VC for robotics - access to investment only via fund investments

my number 1 in the sector is Softbank

Maintenance & Service

$SIE (-0,73 %) Siemens (DE) - Industrial Service, Lifecycle & Retrofit

$ABBN (-0,27 %) ABB (CH/SE) - Robotics Service, Spare Parts, Field Support

$GEHC (-0,33 %) GE Healthcare (US) - Medtech service incl. robotic systems

Uptake (US) - AI-based predictive maintenance - not a listed company

Augury (US/IL) - condition monitoring, condition diagnostics - not a listed company

$KU2 KUKA Service (DE) - Robotics maintenance

$6954 (-2,56 %) Fanuc Service (JP) - global service network

Boston Dynamics AI Institute (US) - Robotics longevity - funded by Hyundai Motor Group

my number 1 in the sector is Siemens

Marketing & Advertising

$WPP (+0,36 %) WPP (UK) - global advertising group; branding/communications

$OMC Omnicom (US) - marketing/PR network

$PUB (-0,68 %) Publicis (FR) - communications/advertising group

$META (-0,17 %) Meta (US) - Digital Ads (Facebook/Instagram)

$GOOG (-0,17 %) Google Ads (US) - search & display advertising

TikTok / ByteDance (CN) - social ads & distribution - not a listed company

$AAPL (-0,19 %) Apple (US) - Branding/UX; Acceptance & Platform Marketing

$WPP (+0,36 %)

AKQA (UK/US) - Tech branding - Since 2012 majority owned by the WPP Groupbut continues to operate as an autonomous operating unit

R/GA (US) - Innovation marketing - not a listed company

Serviceplan (DE) - largest independent EU agency - not a listed company

my number 1 in the sector is Meta

Law, Regulation & Ethics

ISO (CH) - international standards, robotics standards

TÜV (DE) - certification & safety tests

UL (US) - safety/conformity testing

EU AI Act (EU) - legal framework for AI & robotics

UNESCO AI Ethics (UN) - global ethics guidelines

Fraunhofer IPA (DE) - Robotics safety standards

ANSI (US) - standards

IEC (CH) - Electrical engineering standards

Training & Talent

MIT (US) - Robotics/AI Research & Education

ETH Zurich (CH) - autonomous systems & robotics

Stanford (US) - AI/Robotics labs & spin-offs

Tsinghua University (CN) - Robotics/AI in Asia

CMU (US) - Robotics Institute

EPFL (CH) - Robotics research

TU Munich (DE) - humanoid robot "Roboy"

🌍 Top 25 companies for humanoid robotics

These companies are central to the development & production of humanoid robotsbecause without them, crucial parts of the chain would be missing:

Chips & computing power (brain of the robots)

$NVDA (-0,11 %) Nvidia (US) - AI GPUs & Isaac platform, foundation for robotic AI

$2330 TSMC (TW) - world's most important foundry, produces the AI chips

$ASML (+0,7 %) ASML (NL) - EUV lithography, indispensable for chip production

$005930 Samsung Electronics (KR) - memory, logic, foundry

$HY9H SK Hynix (KR) - DRAM & NAND memory for AI

$MU (-0,89 %) Micron (US) - Memory solutions for AI workloads

my number 1 in the sector is ASML

Sensors & perception (senses of robots)

$SONY Sony (JP) - image sensors, market leader

$6861 (+0,24 %) Keyence (JP) - Industrial sensors & vision systems

$CGNX (-0,68 %) Cognex (US) - Machine Vision, precise image processing

my number 1 in the sector is Keyence

Actuators & motion (muscles of robots)

$IFX (+0,33 %) Infineon (DE) - power electronics, motor control

$6594 (+24,16 %) Nidec (JP) - World market leader for electric motors

$PH Parker-Hannifin (US) - hydraulics/pneumatics, motion technology

$6481 (-4,14 %) THK (JP) - Linear guides & actuators

my number 1 in the sector is Parker-Hannifin

Communication, cloud & infrastructure (nerves & data flow)

$QCOM (-0,21 %) Qualcomm (US) - Mobile & Edge Chips

$AMZN (-0,31 %) Amazon AWS (US) - Cloud & AI infrastructure

$MSFT (-0,19 %) Microsoft Azure (US) - Cloud, AI services

$CSCO (-0,05 %) Cisco (US) - Networks & Security

$VRT (-0,5 %) Vertiv Holdings (US) - Data Center Infrastructure

my number 1 in the sector is Microsoft

End Applications & Platforms (robots themselves)

$TSLA (-0,37 %) Tesla (US) - humanoid robot Optimus

$ABBN (-0,27 %) ABB (CH/SE) - Robotics & Automation

$6954 (-2,56 %) Fanuc (JP) - industrial robots & CNC systems

$7012 (-4,37 %) Kawasaki Heavy Industries (JP) - industrial robots

PAL Robotics (ES) - humanoid robots (TALOS, ARI, TIAGo) - not a listed company

Neura Robotics (DE) - cognitive humanoid robots - not a listed company

Universal Robots (DK) - cobots

my number 1 in the sector is Tesla

🇪🇺 Top 10 European key companies for humanoid robotics

$ASML (+0,7 %)

ASML (NL)

World market leader in EUV lithography - no modern chips for AI & robotics without ASML.

$IFX (+0,33 %) Infineon (DE)

Leading in power electronics & motor control - crucial for actuators of humanoid robots.

$STM (-0,73 %)

STMicroelectronics (FR/IT)

Sensors, microcontrollers & power chips - the basis for control & perception.

$SAP (-0,44 %)

SAP (DE)

ERP & data platforms, important for integrating humanoid robots into industrial processes.

$SIE (-0,73 %)

Siemens (DE)

Industrial software, automation, digital twin - key for engineering & lifecycle management.

$KU2 KUKA (EN)

Robotics pioneer, industrial robots & automation - know-how for humanoid motion mechanics.

PAL Robotics (ES) - not a listed company

Specialist for humanoid robots (TALOS, ARI, TIAGo), internationally used in research & service.

Neura Robotics (DE) - Not a listed company

Young high-tech company, develops cognitive humanoid robots with advanced AI (4NE-1).

Universal Robots (DK) - Not a listed company

Market leader for cobots - platform for safe human-robot collaboration.

Engineered Arts (UK) - not a listed company

Develops humanoid robots such as Amecaknown for realistic facial expressions & gestures - important for HRI (Human-Robot Interaction)

🌏 Top 10 Asian key companies for humanoid robotics

$2330

TSMC (Taiwan)

World's largest semiconductor foundry, produces high-end chips (e.g. Nvidia, AMD, Apple) - no AI hardware without TSMC.

$005930

Samsung Electronics (South Korea)

Foundry, memory, logic chips, image sensors - extremely broadly positioned in robotics components.

$HY9H

SK Hynix (KR) - Memory

$SONY

Sony (Japan)

Market leader in CMOS image sensors, essential for robotic vision & perception.

$6861 (+0,24 %)

Keyence (Japan)

Sensor technology & machine vision for industrial automation, widely used in robotics.

$6954 (-2,56 %)

Fanuc (Japan)

Industrial robots & CNC systems, one of the most important manufacturers of robotics hardware worldwide.

$6506 (+0,57 %)

Yaskawa Electric (Japan)

Drives, motion control & robot arms - relevant for humanoid motion control.

$6594 (+24,16 %)

Nidec (Japan)

World market leader for electric motors (from mini motors to high-performance drives).

$7012 (-4,37 %)

Kawasaki Heavy Industries (JP) - Industrial robots

$9618 (-2,74 %)

JD.com (China)

Driver for robotics in e-commerce & logistics, invests in humanoid robotics applications

Build robots, earn shovels

The hype is all about humanoid robots, but the constant winners are in the background.

I have divided the analysis into two perspectives. 1. the complete value chain of humanoid robots, which shows all the players from the chip to the finished robot, and 2. the blade manufacturers in the background, who always earn money as enablers, regardless of which manufacturer wins the race.

ASML, Applied Materials and Tokyo Electron dominate in manufacturing technology. Quality assurance comes from Keysight, Advantest and Teradyne. Chip design is supported by Synopsys, Cadence and ARM. Data streams are secured by Arista Networks, Cisco and Equinix. The computing basis is created in the cloud by Amazon, Microsoft and Alphabet. Albemarle, Lynas and Umicore play a central role in raw materials and battery materials. These companies monetize their customers' investment waves, have high barriers to entry, service revenues and pricing power, but remain cyclical with risks from export rules, capex cuts and currency movements.

🌐 Value chain of humanoid robots Sector overview

1. research & chip design (IP / EDA)

$ARM (-1,53 %)

ARM Holdings (ARM, UK/USA) - CPU architectures

$SNPS (-0,37 %)

Synopsys (SNPS, USA) - Chip design software

$CDNS (-1,14 %)

Cadence Design Systems (CDNS, USA) - EDA & Simulation

2. manufacturing technology & equipment

$ASML (+0,7 %)

ASML (ASML, NL) - EUV lithography, key monopoly

$AMAT (-0,5 %)

Applied Materials (AMAT, USA) - Process equipment

$8035 (-1,53 %)

Tokyo Electron (8035.T, JP) - Wafer equipment

$KEYS (-1,36 %)

Keysight Technologies (KEYS, USA) - Test & RF measurement technology

$6857 (-1,03 %)

Advantest (6857.T, JP) - Semiconductor test systems

$TER (-0,74 %)

Teradyne (TER, USA) - Test systems + robotics (Universal Robots)

3. chip production (Foundries)

$TSM (-0,33 %)

TSMC (TSM, TW) - Largest contract manufacturer

$005930

Samsung Electronics (005930.KQ, KR) - Memory + Foundry

$GFS (+0,22 %)

GlobalFoundries (GFS, USA) - Specialized production

4. computing & control unit ("brain")

$NVDA (-0,11 %)

Nvidia (NVDA, USA) - GPUs, AI accelerators

$INTC (-0,81 %)

Intel (INTC, USA) - CPUs, FPGAs

$AMD (-0,38 %)

AMD (AMD, USA) - CPUs/GPUs

$MRVL (-0,4 %)

Marvell Technology (MRVL, USA) - Network/data center chips

5. sensors ("senses")

$6758 (+0,01 %)

Sony (6758.T, JP) - CMOS image sensors

$6861 (+0,24 %)

Keyence (6861.T, JP) - Vision systems, sensors

$STM (-0,73 %)

STMicroelectronics (STM, CH/FR) - MEMS sensors

6. actuators & power electronics ("muscles")

$IFX (+0,33 %)

Infineon (IFX, DE) - Power semiconductors, SiC

$ON (-1,55 %)

N Semiconductor (ON, USA) - SiC/Power Chips

$STM (-0,73 %)

STMicroelectronics (STM, CH/FR) - Motor control & power

$TXN (-0,28 %)

Texas Instruments (TXN, USA) - Motor control, power ICs

$ADI (-0,36 %)

Analog Devices (ADI, USA) - Energy & BMS chips

7. communication & networking ("nerves")

$QCOM (-0,21 %)

Qualcomm (QCOM, USA) - 5G/SoCs

$AVGO (-0,16 %)

Broadcom (AVGO, USA) - Network & radio chips

$SWKS (+0,27 %)

Skyworks Solutions (SWKS, USA) - RF components

8. energy supply

$300750

CATL (300750.SZ, CN) - Batteries

$6752 (-0,42 %)

Panasonic (6752.T, JP) - Batteries for automotive/robotics

$373220

LG Energy Solution (373220.KQ, KR) - Batteries

9. cloud & infrastructure

$AMZN (-0,31 %)

Amazon (AMZN, USA) - AWS

$MSFT (-0,19 %)

Microsoft (MSFT, USA) - Azure

$GOOG (-0,17 %)

Alphabet (GOOGL, USA) - Google Cloud

$EQIX (-0,38 %)

Equinix (EQIX, USA) - Data center operator

$ANET (-0,57 %)

Arista Networks (ANET, USA) - Network infrastructure

$CSCO (-0,05 %)

Cisco Systems (CSCO, USA) - Edge & Data Center Networks

10. software & data platforms

$PLTR (-0,57 %)

Palantir (PLTR, USA) - Data integration, decision software

$DDOG (+0,07 %)

Datadog (DDOG, USA) - Cloud monitoring / observability

$SNOW (-0,13 %)

Snowflake (SNOW, USA) - Cloud-native data platform

$ORCL (-0,2 %)

Oracle (ORCL, USA) - Databases, ERP

$SAP (-0,44 %)

SAP (SAP, DE) - ERP/cloud systems

$PATH (-0,05 %)

UiPath (PATH, USA) - Automation software (RPA)

$AI (-0,94 %)

C3.ai (AI, USA) - Enterprise AI platform

11. end applications / robots

$ABB

ABB (ABB, CH) - Industrial robots

$6954 (-2,56 %)

Fanuc (6954.T, JP) - Industrial robots, CNC

$TSLA (-0,37 %)

Tesla (TSLA, USA) - Optimus" humanoid robot

$9618 (-2,74 %)

JD.com (JD, CN) - E-commerce & automated logistics

🛠️ Shovel manufacturer for humanoid robots

🔹 Hardtech (physical "shovels")

These companies provide the material basis: manufacturing machines, raw materials, semiconductor base.

Semiconductor Equipment & Manufacturing

$ASML (+0,7 %)

ASML (ASML, NL) - EUV lithography (monopoly).

$AMAT (-0,5 %)

Applied Materials (AMAT, USA) - Wafer equipment.

$8035 (-1,53 %)

Tokyo Electron (8035.T, JP) - Process equipment.

Test systems (hardware-side)

$6857 (-1,03 %)

Advantest (6857.T, JP) - Semiconductor test.

$TER (-0,74 %)

Teradyne (TER, USA) - Test systems + industrial robots.

Materials & raw materials

$ALB (-0,43 %)

Albemarle (ALB, USA) - Lithium (batteries).

$LYC (+1,39 %)

Lynas Rare Earths (LYC.AX, AUS) - Rare earths for magnets.

$UMICY (+0,7 %)

Umicore (UMI.BR, BE) - Cathode materials, recycling.

🔹 Soft/infra (digital "shovels")

These companies supply the infrastructure & toolswithout which development, training and operation would be impossible.

Design Software & IP

$SNPS (-0,37 %)

Synopsys (SNPS, USA) - EDA software.

$CDNS (-1,14 %)

Cadence Design Systems (CDNS, USA) - Chip design & simulation.

$ARM (-1,53 %)

ARM Holdings (ARM, UK/USA) - CPU architectures (license model).

Test & Measurement (software/signal level)

$KEYS (-1,36 %)

Keysight Technologies (KEYS, USA) - Electronics & RF test systems.

Network & data center backbone

$ANET (-0,57 %)

Arista Networks (ANET, USA) - High-speed networks.

$CSCO (-0,05 %)

Cisco Systems (CSCO, USA) - Data center/edge networks.

$EQIX (-0,38 %)

Equinix (EQIX, USA) - Data centers (colocation).

Cloud infrastructure

$AMZN (-0,31 %)

Amazon (AMZN, USA) - AWS (cloud, AI training).

$MSFT (-0,19 %)

Microsoft (MSFT, USA) - Azure.

$GOOG (-0,17 %)

Alphabet (GOOGL, USA) - Google Cloud.

Takeaway: Investing in the infrastructure stack allows you to participate in the robotics trend regardless of the subsequent product winner and reduces the individual product risk, but you have to live with cycles. In your opinion, which stage of the chain offers the best risk/return combination and fits into a disciplined portfolio?

Source: Own analysis based on publicly available company information and IR materials of the companies mentioned.

Image material: Techa Tungateja/iStockphoto

ASMI Bought!

This week 2 pieces $ASM (-2,73 %) added to my stock portfolio for a nice buyback of €409. Enough tech for now with $ASML (+0,7 %) and $BESI (+0,9 %) . Coming months looking for defensive positions for extra balance in the portfolio.

China as an opportunity for European equities?

Until recently, close business relations with China were considered a blemish - investors punished such shares with discounts. But now the narrative has changed abruptly: Following the agreement in the trade dispute with the USA, China is suddenly being seen as an opportunity again.

"Welt" has analyzed data from the US investment bank Goldman Sachs analyzed. Goldman has compiled several indices that are heavily influenced by the China issue and which show how much of a discount the values still have.

Some European tech stocks with high China business are also identified as potential winners.

Some examples:

$ASM (-2,73 %) - ASM International | Potential +27%

$ASML (+0,7 %) - ASML +16%

$SHL (+0,49 %) - Siemens Healthineers +26%

$MC (-0,51 %) - LVMH +15%

$ADS (-8,04 %) - Adidas +19%

Source: Welt, 13.05.25 (excerpt)

Vertiv and ASM International: A Closer Look for Investors

Vertiv Holdings $VRT (-0,5 %) and ASM International $ASM (-2,73 %) are two companies gaining attention for their roles in critical industries. Vertiv focuses on data center infrastructure, capitalizing on trends like cloud computing and edge computing. Its steady growth reflects increasing global demand for reliable IT infrastructure.

ASM International, a leader in semiconductor equipment, benefits from the booming chip industry driven by AI, 5G, and IoT. Its strong market position and R&D focus make it a key player in the semiconductor value chain.

Both firms align with transformative global trends. Which one fits your portfolio depends on your focus: data center growth (Vertiv) or semiconductor innovation (ASM). I believe they both have a great potential to ride the AI wave

$ASML (+0,7 %) - Interesting information and facts about ASML

In my opinion one of the biggest moats ever.

ASML was founded through a joint venture. Philips invented a new chip machine (wafer stepper) that was much more efficient.

However, as they did not want to take the risk of commercialization, they found a suitable partner in ASM International. $ASM (-2,73 %) a suitable partner.

ASM Lithography was founded in 1984.

The laser used by ASML is manufactured by Trumpf in Germany.

- This laser consists of more than 450,000 different components. That shows how difficult it is.

Trumpf only sells this to ASML.

- The laser is a special product that was developed jointly by Trumpf, ASML and Zeiss.

The laser from Trumpf is used to

generate plasma for EUV light. The

plasma reaches temperatures of over

100,000 °C, hotter than the surface of the sun.

surface of the sun.

- Zeiss manufactures high-precision mirrors and lenses that reflect the generated EUV light and guide it to the exact position to print the chip.

Zeiss does not sell its unique products

to competitors

- In 2012, ASML bought 25 percent of Zeiss, a very significant stake.

- In 2013, they bought Cymer, an important supplier of light sources. This is one of the most important parts of the machine. The purchase of this company was crucial for the scaling of EUV machines.

- the first high NA EUV machines should be installed at Intel in the fourth quarter of this year. More will

follow in the coming years.

- This machine will cost around 400 million euros, require seven cargo ships and could potentially produce 1 nm chips in the future.

- They are the only ones who can build an EUV machine. These are used for the best, smallest and most innovative chips.

- DUV sales are still bigger than EUV sales, but that will change in the future.

- The machine is so complicated that no one else will be able to make it for years to come, so they have a 100% market share in these machines. They also have DUV machines (the previous generation). There they have an 80% -85% market share.

- ASML already has a new generation of EUV (High NA EUV) and the next one is planned for 2030. The first company other than ASML that will be able to produce an EUV generation will probably be later than 2030, especially because the machines consist of tens of thousands of parts and ASML has bought up several important suppliers.

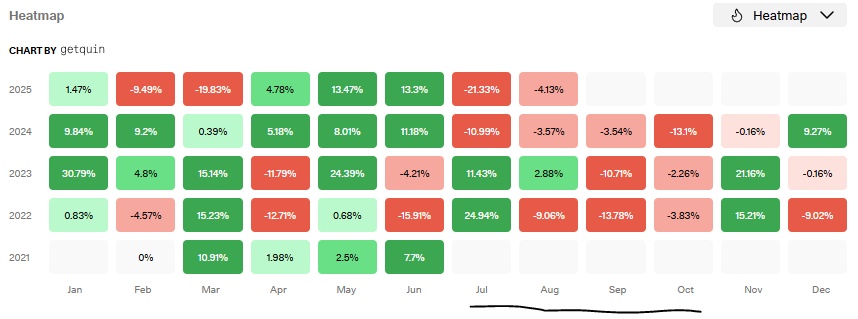

https://getqu.in/RcBeBD/

⬆️⬆️⬆️

- DEUTSCHE BANK RESEARCH raises its price target for BMW from EUR 90 to EUR 95. Buy. $DBK (-0,6 %)

- BERNSTEIN raises the price target for QUALCOMM from USD 200 to USD 215. Outperform. $QCOM (-0,21 %)

- UBS raises the price target for LYFT from USD 13 to USD 18. Neutral. $LYFT (-0,39 %)

- BARCLAYS raises the price target for SIEMENS HEALTH from EUR 60.50 to EUR 62.50. Overweight. $SHL (+0,49 %)

- WARBURG RESEARCH raises the price target for KONTRON from EUR 28 to EUR 28.40. Buy. $KTN (-1,16 %)

- UBS upgrades KINGSPAN GROUP from Neutral to Buy. Target price 90 EUR. $KRX (-0,06 %)

- WARBURG RESEARCH raises the price target for ZEAL NETWORK from EUR 59 to EUR 64. Buy. $TIMA (-0,81 %)

- GOLDMAN raises the price target for VONOVIA from EUR 42.70 to EUR 43.70. Buy. $VNA (-0,56 %)

- BARCLAYS raises the price target for AHOLD DELHAIZE from EUR 30 to EUR 31. Equal-Weight. $AD (+0,56 %)

- BARCLAYS raises the target price for FMC from EUR 38.50 to EUR 39. Equal-Weight. $FMC (-0,25 %)

- JPMORGAN raises the target price for COMMERZBANK from EUR 18 to EUR 18.40. Overweight. $CBK (-0,44 %)

- JPMORGAN raises the target price for PUMA SE from EUR 40 to EUR 44. Neutral. $PUM (-0,46 %)

- JPMORGAN raises the target price for JUST EAT TAKEAWAY from GBP 13.96 to GBP 14.15. Overweight. $TKWY

⬇️⬇️⬇️

- JEFFERIES downgrades PALANTIR from Hold to Underperform. Target price USD 28. $PLTR (-0,57 %)

- DEUTSCHE BANK RESEARCH lowers the price target for NOVO NORDISK from DKK 1100 to DKK 1000. Buy. $NOVO B (+1,09 %)

- RBC lowers the price target for NIKE from 82 USD to 80 USD. Sector Perform. $NKE (-0,69 %)

- ODDO BHF downgrades ASM INTERNATIONAL to Outperform. Target price EUR 960. $ASM (-2,73 %)

- KEPLER CHEUVREUX downgrades HENSOLDT from Buy to Hold. Target price EUR 34. $HAG (-0,26 %)

- DEUTSCHE BANK RESEARCH lowers the price target for ZALANDO from EUR 40 to EUR 36. Buy. $ZAL (-0,86 %)

- DEUTSCHE BANK RESEARCH lowers the price target for VESTAS from DKK 165 to DKK 150. Hold. $VWS (+0,31 %)

- BOFA downgrades SIEMENS ENERGY from Buy to Neutral. Target price EUR 40. $ENR (+0,76 %)

- METZLER lowers the price target for VONOVIA from EUR 28.50 to EUR 28. Sell. $VNA (-0,56 %)

- BARCLAYS lowers the price target for TEAMVIEWER from EUR 18 to EUR 15.50. Overweight. $TMV (-0,04 %)

- WARBURG RESEARCH lowers the price target for KLÖCKNER & CO from EUR 6 to EUR 5.70. Buy. $KCOB

- HAUCK AUFHÄUSER IB lowers the target price for NORMA GROUP from EUR 32 to EUR 27. Buy. $NOEJ (-1,67 %)

- WARBURG downgrades EDAG ENGINEERING from Buy to Hold and lowers target price from EUR 13 to EUR 9.50. $ED4 (+0,79 %)

- LBBW lowers the price target for ALLGEIER from EUR 24 to EUR 20. Buy. $AEIA

- BARCLAYS lowers the price target for HENKEL from EUR 79 to EUR 77. Equal-Weight. $HEN (-0,17 %)

- BERENBERG lowers the price target for KRONES from EUR 157 to EUR 154. Buy. $KRN (-0,55 %)

Analyst updates, 04.11.

⬆️⬆️⬆️

- BERENBERG raises the target price for SHELL from GBP 31 to GBP 31.50. Buy. | $SHEL (+0,42 %)

- BERENBERG raises the price target for MTU from EUR 270 to EUR 350. Buy. | $MTX (-0,59 %)

- BRYAN GARNIER raises the price target for HELLOFRESH from EUR 8.50 to EUR 10. Neutral. | $HFG (-0,12 %)

- DEUTSCHE BANK RESEARCH raises the price target for SCOUT24 from EUR 84 to EUR 92. Buy. | $G24 (-0,43 %)

- DEUTSCHE BANK RESEARCH raises the price target for SANTANDER from EUR 5.75 to EUR 5.80. Buy. | $SAN (-0,16 %)

- RBC raises the target price for NEXT PLC from GBP 105 to GBP 108. Sector Perform. | $NXT (-2,77 %)

- UBS raises the price target for CHEVRON from USD 192 to USD 194. Buy. | $CVX (+0,48 %)

⬇️⬇️⬇️

- UBS lowers the price target for BERKSHIRE HATHAWAY from USD 806.724 to USD 796.021. Buy. | $BRK.B (-0,58 %)

- CITIGROUP lowers the price target for STMICRO from EUR 36 to EUR 30. Buy. | $STMPA (-0,42 %)

- JPMORGAN lowers the price target for ASM INTERNATIONAL from EUR 806 to EUR 716. Overweight. | $ASM (-2,73 %)

- RBC downgrades CARL ZEISS MEDITEC from Outperform to Sector-Perform and lowers target price from EUR 85 to EUR 70. | $AFX (-0,59 %)

- WARBURG RESEARCH lowers the price target for KION from EUR 65 to EUR 58. Buy. | $KGX (+2,28 %)

- ODDO BHF downgrades JENOPTIK from Neutral to Outperform and lowers target price from EUR 32 to EUR 30. | $JEN (+0,38 %)

- ODDO BHF lowers the price target for AIXTRON from EUR 22 to EUR 21. Outperform. | $AIXA (+2,1 %)

- ODDO BHF lowers the price target for FIELMANN from EUR 45.70 to EUR 44.60. Neutral. | $FIE (+0,7 %)

- HAUCK AUFHÄUSER IB lowers the price target for KNORR-BREMSE from 65.50 EUR to 63.60 EUR. Sell. | $KBX (+0 %)

- GOLDMAN downgrades STANDARD CHARTERED to Neutral. Target price GBP 9.37. | $STAN (+0 %)

- GOLDMAN lowers the price target for GENERALI from EUR 31.50 to EUR 30.50. Buy. | $G (-0,01 %)

- GOLDMAN lowers the price target for PHILIPS from EUR 35 to EUR 32. Buy. | $PHIA (-0,5 %)

Titres populaires

Meilleurs créateurs cette semaine