$RYA (+1,04 %)

$UNH (-1,35 %)

$GM (-0,93 %)

$RTX (-1,1 %)

$UPS (-2,5 %)

$UNP (-0,43 %)

$NOC (-1,31 %)

$BA (-2,64 %)

$MC (+0,44 %)

$TXN (+1,83 %)

$STX (+5,45 %)

$SSAB A (-0,28 %)

$ASML (+4,35 %)

$GEV (+5,17 %)

$SBUX (+0,68 %)

$T (-3,86 %)

$GD (-0,58 %)

$MSCI (-1,16 %)

$META (+0,27 %)

$NOW (-2,08 %)

$IBM (-2,22 %)

$LRCX (+5,21 %)

$TSLA (+0,13 %)

$MSFT (-0,07 %)

$000660

$005930

$SAP (-0,33 %)

$ABBN (-0,11 %)

$DBK (+0,54 %)

$ROG (-2,8 %)

$DOW (+2,27 %)

$NDAQ (+0,17 %)

$LMT (-2,02 %)

$CAT (+3,59 %)

$TMO (+2,45 %)

$HON (+0,82 %)

$MA (-1,06 %)

$BX (-0,07 %)

$WM (-0,38 %)

$WDC (+5,84 %)

$SNDK

$V (-0,53 %)

$AAPL (+0,7 %)

$SOFI (-1,29 %)

$CL (-0,31 %)

$AXP (+1,19 %)

$XOM (-1,69 %)

$CVX (-1,57 %)

Ryanair Holdings

Price

Discussion sur RYA

Postes

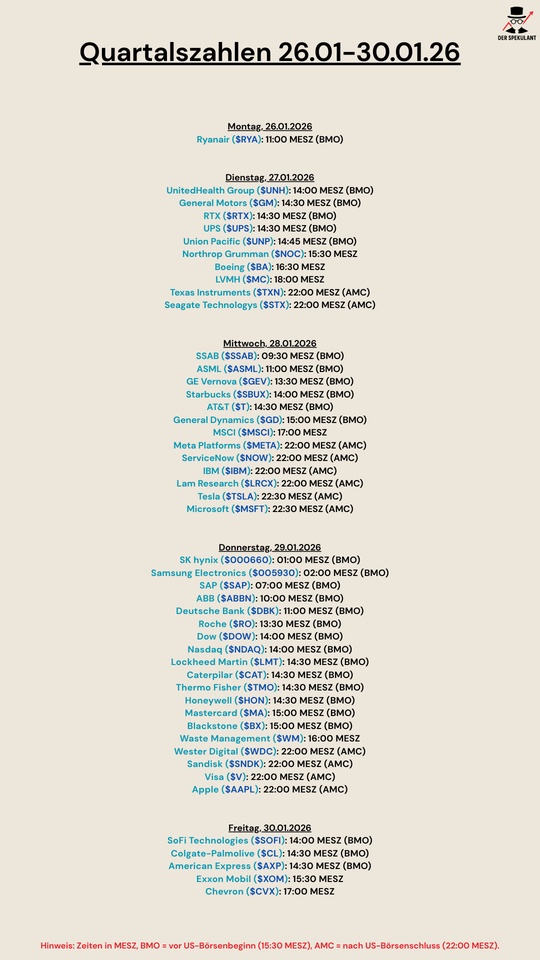

15Quartalszahlen 26.01-30.01.2026

Share analysis - Europe's most efficient airline in a valuation check

Reading time: approx. 5 minutes

Many of my recent posts have been about key figures, models and valuation logic - and how to use them to systematically classify companies. I've been wondering for some time whether Ryanair could be a good addition to my portfolio. This is precisely why the airline is particularly well suited to show how an established business model can be valued using HQR logic, a 10B approach, fundamental ratios and a clearly derived scenario model.

Ryanair $RYAAY (+0 %) / $RYA (+1,04 %) at first glance appears to be a classic low-cost company. However, behind this simple concept lies an efficiency model that has been optimized over decades. Complete standardization on Boeing 737 aircraft, extremely fast turnarounds, strict cost discipline and a stable logic of additional revenues - from baggage to seat selection to partner services - form an operational framework that is virtually unrivalled in Europe. The strength of this model lies less in price setting than in the consistent implementation of clear cost leadership.

Through subsidiaries in Ireland, Malta, Poland and the UK, Ryanair can flexibly shift capacities and rebalance routes according to demand. More than 200 million passengers per year generate economies of scale that have a lasting effect and are difficult to copy. This is precisely why the moat is less spectacular than it is effective: a large, standardized fleet, an extremely disciplined organization and a business model that works in a self-contained manner.

The current business figures underpin this construction. In FY25, Ryanair achieved a turnover of 13.95 billion euros and a profit of 1.61 billion euros. In the current half-year, the result is already above 2.5 billion euros. The balance sheet shows net liquidity of around two billion euros and the equity ratio remains in the region of 40 percent. The operating margin is 14 to 15 percent - and thus noticeably above the previous year's level.

The most important key figures at a glance:

- P/E ratio (TTM): approx. 13.4

- P/E ratio (forward): approx. 12.5

- P/E ratio: approx. 1.9

- EV/Sales: approx. 1.78

- EV/EBITDA: approx. 7.8

- Free cash flow yield: approx. 7.4

- ROE: approx. 27

- ROIC: approx. 13

- Debt/EBITDA (gross): approx. 0.69

- Operating margin (TTM): approx. 14-15%

- PEG ratio: approx. 0.74

- Rule of 40: approx. 29

The German listing (ISIN IE00BYTBXV33 / $RYA (+1,04 %)) is quoted in the range of EUR 25 to 26. The US ADR listing ($RYAAY (+0 %) ) was last quoted at USD 68.16 and serves as a reference for most analyst models, as this is where the highest trading volume takes place. Valuation ratios such as the P/E ratio are independent of the currency, but price targets are calculated in USD and later translated into euros.

The current level provides a useful starting point for the profit paths of the coming years. Earnings per share are around 4.25 US dollars. Traffic is growing steadily, additional revenue per passenger is increasing and the operating margin has stabilized again after two volatile years. This triad results in a neutral expected value of around five dollars. This means that Ryanair will continue its core business without any additional positive or negative stimuli.

A bullish earnings level assumes that several factors have a constructive effect at the same time: a more stable fuel environment, unchanged or only moderately rising fees in Italy, Spain and the UK and a more reliable delivery performance at Boeing. This would give the margin additional leeway and anchor the development of demand at the upper end of previous expectations. In such an environment, earnings of between USD 6.0 and 6.4 per share are realistic.

On the other hand, there are the cyclical risks that reliably accompany airlines. Higher kerosene prices, regulatory interventions or further delays in the fleet program can put pressure on the operating margin and temporarily depress growth. Under these conditions, the result is more likely to be between 3.8 and 4.2 US dollars - a range that is historically well covered by comparable years.

Weighting the three scenarios together leads me to a target value close to USD 66 to 67:

- Bullish (25%, probability of occurrence: own estimate):

- EPS USD 6.0-6.4 → Target price USD 90-102

- Neutral (50%, probability of occurrence: own assessment):

- EPS USD 5.0-5.3 → Target price USD 60-70

- Bearish (25%, probability of occurrence: own assessment):

- EPS USD 3.8-4.2 → Target price USD 35-42

From an HQR perspective, Ryanair is clearly a quality stock: high returns on capital, robust balance sheet, strong operating structure. The under-the-radar potential remains low, as the market has known the company for years and the key figures are largely transparent. The 10B model shows the same pattern: a clear moat, but no structural leverage for a revaluation. Ryanair is efficient, stable and predictable - but not structurally undervalued.

For me, this does not make it an immediate buy. The valuation is fair, not cheap. The operational strength is visible and is rewarded accordingly. Ryanair remains a high-quality stock that will only become interesting at a more attractive entry level with a sufficient safety buffer. Until then, the share remains a watchlist candidate for me.

I'll read your post later.

@SAUgut777 has an idea for collecting contributions. In a kind of encyclopedia.

May he also integrate your great contributions and would you perhaps help him.

Then please get in touch with him.

I have also put you on the list of consultants for multiples and key figures. Do you agree with that?

Analyst updates, 05.11.

⬆️⬆️⬆️

- ODDO BHF raises the price target for BIONTECH from USD 110 to USD 130. Outperform. $BNTX (+0,63 %)

- BARCLAYS raises the price target for AIRBUS from EUR 161 to EUR 165. Overweight. $AIR (+0,05 %)

- CITIGROUP raises the price target for SCOUT24 from EUR 91 to EUR 94.50. Buy. $G24 (+0,64 %)

- WARBURG RESEARCH raises the price target for REDCARE PHARMACY from EUR 174 to EUR 176. Buy. $RDC (-0,26 %)

- DEUTSCHE BANK RESEARCH raises the price target for RYANAIR from EUR 17 to EUR 17.50. Hold. $RYA (+1,04 %)

- BERNSTEIN rates EBAY from Market-Perform to Outperform. Target price USD 70. $EBAY (-0,38 %)

- ODDO BHF raises the price target for SALZGITTER from EUR 14 to EUR 15.50. Underperform. $SZG (-4,38 %)

- BARCLAYS raises the target price for COMMERZBANK from EUR 16 to EUR 17. Equal-Weight. $CBK (+0,06 %)

- BARCLAYS raises the target price for MTU from EUR 295 to EUR 340. Equal-Weight. $MTX (-1,58 %)

- MORGAN STANLEY rates LUFTHANSA to Equal-Weight. Target price EUR 7. $LHA (-3,6 %)

- BERENBERG raises the price target for DEUTSCHE KONSUM REIT from EUR 3.50 to EUR 5. Hold.

⬇️⬇️⬇️

- GOLDMAN lowers the price target for MERCEDES-BENZ from EUR 65 to EUR 63. Buy. $MBG (+0,67 %)

- UBS lowers target price for 1&1 from EUR 21.60 to EUR 21. Buy.

- WARBURG RESEARCH lowers the price target for GFT TECHNOLOGIES from EUR 40 to EUR 37.50. Buy. $GFT (+3,66 %)

- HAUCK AUFHÄUSER IB lowers the price target for ECKERT & ZIEGLER from EUR 63.50 to EUR 55. Buy. $EUZ (-0,13 %)

- BARCLAYS lowers the price target for BNP PARIBAS from EUR 90 to EUR 85. Overweight. $BNP (+0,1 %)

- BERENBERG downgrades SCHNEIDER ELECTRIC from Buy to Hold and lowers price target from EUR 261 to EUR 255. $SU (+1,21 %)

- BERENBERG lowers the price target for BEFESA from EUR 41 to EUR 31. Buy. $BFSA (-3,3 %)

As every Sunday, the most important news from the past week, as well as the most important dates for the coming week.

Also as a video:

https://youtube.com/shorts/N2Ux73t4Z70?si=qkahQMBuwcfTOfpx

Monday:

Another increase in orders for German industry, orders rose by 0.2% in September. A decline of one percent was expected. However, the August figures had to be revised downwards significantly. In addition, different sectors are developing very differently. Mechanical engineering is doing much better than vehicle construction.

Sentiment in companies has fallen to its lowest level since 2020. The Purchasing Managers' Index fell to 46.5 points. The worst it has been in 35 months. Less than 50 points signal an economic contraction.

$RYA (+1,04 %) Ryanair achieves a record profit and introduces a regular dividend. In future, 25 % of profits will always be distributed. Previously there were only special dividends. The company is benefiting from high demand and expects a profit of between EUR 1.85 and 2.05 billion for the financial year.

$BNTX (+0,63 %) Biontech remains profitable despite a slump in demand for vaccines. A profit of EUR 161 million was achieved in Q3. The sales forecast for 2023 has been reduced from EUR 5 billion to EUR 4 billion.

Tuesday:

$EVK (+0,87 %) Evonik makes sales of EUR 4.9 billion, 23% less than in the same quarter last year. The bottom line was a loss of EUR 96 million. The forecast is maintained.

In contrast to the other western industrialized nations, Australia is raising its key interest rates to 4.35 %. Inflation remains stubbornly high and is not yet in the 2 - 3 % range.

https://www.ft.com/content/60aa314b-b8e2-4299-ac0e-d212f6d1ae0b

$O2D (-1,08 %) Telefonica Deutschland is fully taken over by the parent company. The share price rises again as a result. The Spanish parent company offers the minority shareholders a price of EUR 2.35 per share in this squeeze-out. A premium of more than 37% on the previous share price.

Wednesday:

$BAYN (+4,78 %) Bayer disappoints with its quarterly figures. Instead of an expected EBITDA of EUR 1.725 billion, it was only EUR 1.685 billion. Sales slumped by 8% due to the poor performance of the agricultural division. Bayer is nevertheless sticking to its forecast. We continue to hold on to Bayer in our public portfolio, things can hardly get any worse.

The $DHL (+0,66 %) DHL Group has been accused of conservative forecasts by analysts. However, they were probably not conservative enough. The Group had to cut its forecast. The maximum EBIT for 2023 is now only EUR 6.6 billion. Revenue fell by almost a fifth to EUR 19.4 billion in the third quarter.

Retail sales in the eurozone continue to fall. In September, the figure was 0.3 % down on the expected 0.2 %. Nevertheless, the stock market was able to continue its successful trend reversal today.

https://stock3.com/news/eur-usd-eu-einzelhandelsumsaetze-gehen-zurueck-13542061

Thursday:

Inflation in China remains at a low level. According to the National Bureau of Statistics, core inflation is at 0.6% (excluding food and fuel). Imports also rose significantly, while exports shrank. Foreign direct investment was negative for the first time ever. The days of Chinese investors buying up a new company every week seem to be over for the time being.

https://www.n-tv.de/wirtschaft/der_boersen_tag/Anstieg-der-Inflation-in-China-article24519017.html

The announcement by $ADYEN (+1,71 %) Adyen to become more profitable boosted the share price on Thursday.

Fed Chairman Jerome Powell explained in a speech at the IMF meeting that the monetary authorities are not convinced that interest rates are sufficiently restrictive. In other words, there may well be further interest rate hikes. This depressed sentiment on the stock market.

Friday:

Allianz $ALV (+0,3 %) Allianz makes significantly less profit. Operating profit slumped by 14.6% to EUR 3.5 billion in the past quarter. This was mainly due to storms in the Alps in the summer.

$JUN3 (-1,54 %) Jungheinrich only reports a slight increase in incoming orders. Analysts had expected more. EBIT fell by 1% to EUR 103 million.

Poor consumer confidence data from the USA, the value was 60.4, 63.7 was expected, mainly due to higher consumer inflation expectations.

The most important dates for the coming week:

Monday: 11:00 Growth forecast (EU)

Tuesday: 11:00 Economic Sentiment (DE)

Wednesday: 03:00 Retail Sales (China)

Thursday: 14:30 Manufacturing Index (USA)

Friday: 14:30 Building Permits (USA)

Jooo,

I wanted to know which company you find more interesting and are invested in. It's about the airlines $LHA (-3,6 %) and $RYA (+1,04 %) . I would just like to know what you think of these companies and what you think of them. Thank you very much for your answers and have a wonderful evening.

mfG

As every Sunday, the most important news of the last week and the dates of the next week.

The dates of the next week as a video:

https://youtube.com/shorts/Z2rjD3rE6NY?feature=share

Monday:

$RYA (+1,04 %) Ryanair benefits from the resurgence in travel. In the 2nd quarter, profits increased significantly. To a surplus of 663 million euros. A year ago, the profit was still 188 million euros. Nevertheless, Ryanair expects fewer guests for the full year. This is due to delays in the delivery of new Boeing jets.

Bad industrial data from Germany, things are just not going well at the moment. The purchasing managers' index is even worse than expected. The manufacturing index fell to 38.8 (forecast: 41). This is the worst value in 38 months. In the service sector, the result is also worse than expected. The industrial sector is now downsizing its workforce, while the service sector is at least hiring less.

https://finanzmarktwelt.de/deutsche-wirtschaft-industrie-weiter-im-freien-fall-277800/

New logo for $0QZBl Twitter, instead of the bird in the future the 'X'. Elon Musk has once again taken the cake. Twitter is coming under pressure due to the successful launch of Threads, among other things. The meta company was able to gain more than 100 million users in a very short time with its Twitter counterpart.

$ADS (-1,1 %) Adidas is probably doing better than expected. The group is now raising its forecast, the reason being a successful sell-out of the Yeezy collection. Sales will drop less than expected, and the operating loss will be less than expected.

$BAYN (+4,78 %) Bayer collapses in the short term. The forecast had to be scrapped because of glyphosate sales. Glyphosate remains the biggest risk for Bayer. FCF is expected to drop to 0!!! instead of 3 billion euros this year.

However, such behavior is typical after a CEO change. Also known as 'cleaning the desk' the new CEO puts everything bad into the inaugural year, blames the predecessor and then looks really good afterwards because they got the company on track.

dpa-AFX ProFeed

Tuesday:

The business climate in Germany deteriorated significantly. The ifo barometer fell to 87.3 points, 88 points had been expected. Germany is already in recession. For Thursday, a further interest rate hike by the ECB is nevertheless expected. However, with such data, this could be the last for the time being.

#china shares rise sharply. The reason is not the sudden disappearance of Foreign Minister Qin Gang, who is being replaced by his predecessor Wang Yi. It is an announced economic stimulus program. Consumption is to be boosted, aid is to be provided for companies and the real estate sector is to be stabilized. Exact details are not yet known, however.

https://amp.cnn.com/cnn/2023/07/25/economy/china-politburo-economy-hnk-intl/index.html

As a result of the interest rate turnaround, companies have taken out significantly fewer loans. This is the result of an ECB survey. Investment loans in particular fell sharply. Another alarm signal from the economy. Italy was hit hardest by the decline in loans among the four major economies in the EU. Banks expect a further decline in the third quarter.

Forecast increases by $DB1 (+0,64 %) Deutsche Börse and by $RWE (+2,35 %) RWE. Both companies expect a better result for the full year.

Also $GOOGL (+2,31 %) Alphabet and $MSFT (-0,07 %) Microsoft also delivered figures above expectations.

Wednesday:

Also the $DBK (+0,54 %) Deutsche Bank exceeds analysts' expectations. In the 1st half, a pre-tax profit of EUR 3.3 billion was achieved, the best result since 2011. A share buyback program of EUR 450 million was also announced.

$P911 (-0,68 %) Porsche earns slightly more than expected, however the Taycan is not selling well in China. The electric Macan also cannot yet be sold. Despite good figures and confirmation of the forecast, the stock market is therefore going down a bit for the time being.

$VOW3 (-0,83 %) Volkswagen takes a 5% stake in XPENG, and the share price makes a huge leap upwards. With XPENG, the company wants to develop cars, especially for the Chinese market. Audi has already announced a cooperation with SAIC in recent days. In any case, the investment has already paid off for VW. After the announcement, the share price increased by 30%.

The #fed at raised the key interest rate to a range of 5.25 - 5.50%. This is the highest it has been in 22 years. Inflation in the USA is now at 3.0%. Only 1 percentage point away from the 2.0% target. Initially, there was no real reaction. Jerome Powell also left the further course of action open in the press conference. So there may be another interest rate hike in September.

Also $MBG (+0,67 %) Mercedes also raises its annual forecast, probably catching some investors on the wrong foot. Many market participants had rather expected forecast reductions in the automotive sector.

Also $META (+0,27 %) Meta delivers. The Group was still in a slumber during the winter, but now growth fantasies seem to have reawakened. Here, too, the forecast has been raised.

https://stock3.com/news/meta-uebertrifft-die-erwartungen-12783323

Thursday:

The situation at VW is different from that at Mercedes. Profits continue to rise, but the sales forecast is capped. Profit and sales are expected to be achieved as planned. In the 2nd quarter, sales have increased by 15% to EUR 80 billion.

$KGX (-1,79 %) raises its forecast again. EBIT up 11.7% year-on-year. Sales increase by 1.5%. Cash flow also improved significantly and debt was reduced. A capital increase thus appears to be off the table.

https://www.nebenwerte-magazin.com/kion-group-steigert-profitabilitaet/

The ECB also raises its key interest rate by 0.25 percentage points. This brings the key interest rate in the euro zone to 4.25%. Prices rose significantly immediately after the announcement. Presumably, some shorts were liquidated as a hedge.

The president leaves open what will happen in September. However, she emphasizes that a decision will be made based on new data. She also emphasizes that this time they are deliberately saying that they do not need to take any further steps. The current key interest rate could therefore be sufficient to limit inflation. Whether it was really the last rate hike depends on the further development of inflation. There is a lot to be said for it being the last rate hike in this interest rate cycle. Perhaps, however, there will still be surprising price drivers in the coming weeks.

https://www.ecb.europa.eu/press/pressconf/press_conference/html/index.de.html

Friday:

No real interest rate hike in Japan 🇯🇵 However, a step away from the ultra-loose interest rate policy. In Japan, the central bank controls the interest rates on government bonds. Officially, the yield curve here is 0.5%, but now they want to allow interest rates of up to 1.0%. The key interest rate remains at -0.1%.

$INTC (+4,01 %) Intel convinces with its quarterly figures. Both the decline in sales and profits were below expectations. The share was therefore able to increase significantly.

Key dates for the coming week:

Monday: 11:00 Consumer prices (EURO)

Tuesday: 16:00 Trade data (USA)

Wednesday: 14:15 Employment data (USA)

Thursday: 13:00 Interest rate decision (UK)

Friday: 11:00 Retail Sales (EURO)

In recent weeks, the debate about whether people prefer to go on vacation by train or bus instead of by plane has grown again. All the more astonishing are the figures of Ryanair for the 2nd quarter!

In the 1st business quarter, Ryanair achieved a profit of 663 million euros - which was even more than analysts had expected! The high profit was achieved, among other things, by the increase in ticket prices. Ticket prices increased by an average of 42% year-on-year.

Aircraft utilization has also improved and revenue has increased by a full 40% to 3.65 billion euros.

But despite these strong numbers, Ryanair's stock is down nearly 4% at times. Perhaps that has to do with the muted outlook for the full fiscal year to the end of March 2024, as they now only expect growth to 183.5 million passengers, instead of the 185 million previously targeted.

RyanAir would not be an investment for me despite the good numbers. What is your view? Can you find the $RYA (+1,04 %) share in your portfolio?

Time to sell $RYA (+1,04 %) Sell shares... 😏

Attention Message Control 😉

+++ Benefit from population growth +++

Servus Börsianer,

We are now 8 billion people worldwide who consume every day, and 80 million more are added every year. In addition, many nations are undergoing demographic change, which brings new opportunities and risks.

How can you benefit from this trend?

In principle, almost every sector benefits from a growing population, but there are sectors that benefit more from this trend.

The healthcare sector:

Demographic change and a steady expansion of the healthcare system will lead to a strong growth sector in the future.

This will benefit companies such as $PFE (-0,43 %) through their vaccines in the future or $HIMS (+41,58 %) through the digitalization of the healthcare system. In addition, the demand from hospitals is also benefiting from this $MPW (+0 %) or an increasing number of diabetes patients with $NVO (+3,01 %) and a demand for medicines $BAYN (+4,78 %) .

Food industry (consumer sector):

Due to a growing population, more food is consumed, e.g. food from $PEP (+2,24 %) & $KO (+0,63 %) or hygiene articles from $ULVR (-0,73 %) & $PG (+0,96 %) .

e-commerce:

Higher population = more potential buyers $SHOP (+1,55 %) & $AMZN (-0,22 %)

travel industry:

There are numerous businesses that benefit from tourism such as $RYA (+1,04 %)

$TUI1

$LHA (-3,6 %)

This list can be extended further, but the core statements are recognizable.

(Negative conclusion -> population decline)

Are you already investing in the healthcare sector?

🦍 = Yes, of course

🆘 = No

Titres populaires

Meilleurs créateurs cette semaine