$RYA (-0,75 %)

$UNH (-0,11 %)

$GM (-0,12 %)

$RTX (-0,09 %)

$UPS (+1,43 %)

$UNP (+1,06 %)

$NOC (-2,23 %)

$BA (-0,81 %)

$MC (+4,98 %)

$TXN (+0,98 %)

$STX (+0,37 %)

$SSAB A (+0,29 %)

$ASML (+0,76 %)

$GEV (-0,49 %)

$SBUX (+1,95 %)

$T (+0,3 %)

$GD (-0,45 %)

$MSCI (+1,09 %)

$META (+1,59 %)

$NOW (-2,85 %)

$IBM (+0,05 %)

$LRCX (+3,29 %)

$TSLA (-0,19 %)

$MSFT (-0,3 %)

$000660

$005930

$SAP (+1,12 %)

$ABBN (+0,61 %)

$DBK (+2,11 %)

$ROG (+0,49 %)

$DOW (-1,69 %)

$NDAQ (-0,3 %)

$LMT (-1,36 %)

$CAT (-0,15 %)

$TMO (-0,59 %)

$HON (+1,07 %)

$MA (+1,25 %)

$BX (-3,54 %)

$WM (-1,44 %)

$WDC (-0,04 %)

$SNDK

$V (+0,55 %)

$AAPL (+1,51 %)

$SOFI (-1,41 %)

$CL (+0,82 %)

$AXP (+0,94 %)

$XOM (-2,45 %)

$CVX (-0,5 %)

SSAB

Price

Discussion sur SSAB A

Postes

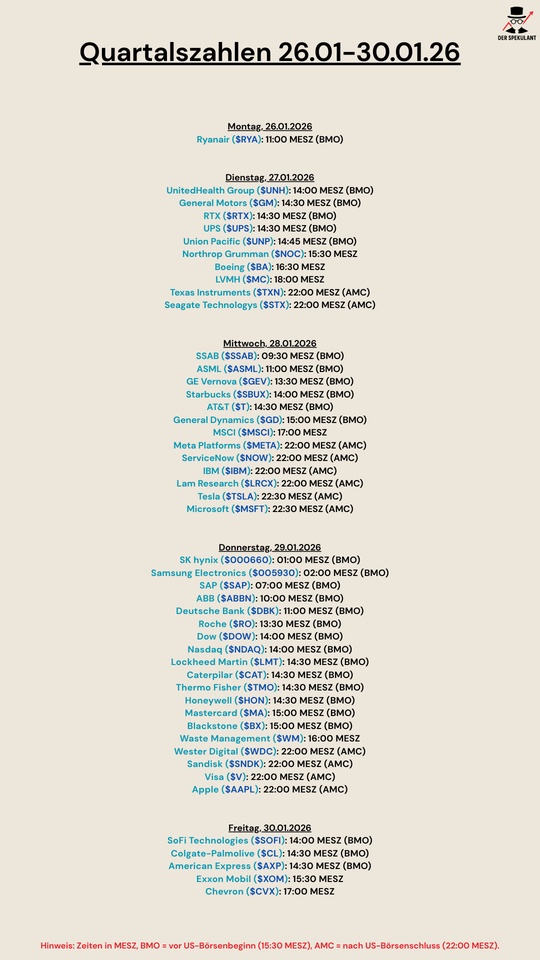

4Quartalszahlen 26.01-30.01.2026

Bank of America bets on 14 rising infrastructure stocks

Bank of America (BofA) has put together a basket of stocks to list the winners of the German infrastructure package.

The basket contains 14 stocks that the US bank expects to benefit in particular.

- The German technology group Siemens

$SIE (+1,82 %) (weighted at 10.3 percent, as of August 21) - The French construction group Eiffage $FGR (+0,21 %) (9 percent)

- The German building materials manufacturer Heidelberg Materials

$HEI (+0,44 %) (8.8 percent) - The German energy technology group Siemens Energy $ENR (+0,35 %) (8.6 percent)

- The German truck manufacturer Daimler Truck

$DTG (+1,76 %) (8.4 percent) - The Italian building materials company Buzzi S.p.A.

$BZU (+0,76 %) (7.9 percent) - The Swiss cement group Holcim $HOLN (+0,49 %) (7.6 percent)

- The Swiss chemicals group Sika AG $SIKA (+3,8 %)

(7.4 percent) - The German forklift manufacturer Kion

$KGX (+0,5 %) (6.7 percent) - The French communications and energy company Spie $SPIE (+1,02 %) (6.4 percent)

- The German industrial group Thyssen-Krupp $TKA (+5,16 %) (6.4 percent)

- The German wind turbine manufacturer Nordex

$NDX1 (-0,44 %) (4.6 percent) - The Swedish steel group SSAB $SSAB A (+0,29 %)

(4.1 percent) - The German industrial services provider Bilfinger

$GBF (-0,98 %) (4.0 percent)

Hopes for the infrastructure package have already caused the shares to rise significantly in some cases in recent months. Since the beginning of the year, the shares included in the basket have risen by around 47 percent. BofA has been offering the share basket to its major clients since the beginning of July.

Despite the jump in the prices of many infrastructure stocks in the first half of the year, BofA manager Klein is confident that the stocks in the basket will continue to rise. According to him, it now depends on when the investments really show up in the profits of the companies.

Oliver Schneider, portfolio advisor at US asset manager Wellington, says: "In the past six to nine months, investor interest in infrastructure stocks has grown rapidly." This is particularly true for European investors.

He cites two factors that he believes will drive infrastructure stocks worldwide in the future. Firstly, there is a great need to modernize infrastructure. Secondly, the demand for electricity is growing due to artificial intelligence. Schneider says: "This is a growth topic that will be with us for the next ten to 20 years."

Source: Text (excerpt) & graphic, Handelsblatt 01.09.25

💥 Trump doubles steel tariffs to 50% - Germany and EU affected! 🇺🇸🔩

It doesn't stop...

Donald Trump has announced that he will increase import tariffs on steel and aluminum from 25% to 50%. This measure will come into force on June 4, 2025 and will also affect imports from Germany and the EU.

🔍 Background:

- Trump justified the tariff increase with the protection of national security and the strengthening of the US steel industry.

- In a speech at US Steel in Pennsylvania, he emphasized that tariffs are his "absolute favorite word".

- The measure affects imports from countries such as Canada, Brazil, Mexico, South Korea and Germany.

📈 Effects:

- Importing steel products into the US is likely to become more difficult with the doubling of tariffs.

- Prices for steel in the USA could rise in the medium term, which could have an impact on the construction and automotive sectors.

- Germany, the leading steel producer within the EU, exported around one million tons of steel to the US in 2023.

🌍 International reactions:

- Canada's Chamber of Commerce criticized the tariff increase as costly for both countries.

- Australia described the move as "unjustified and not the act of a friend".

Proposal for his tombstone:

🪦 Here rests Donald J. Trump

"Tariffs were my favorite word - now I'm paying the last tax." 💸🇺🇸

$TKA (+5,16 %)

$SZG (-0,55 %)

$MT (+0,91 %)

$OUT1V (+0 %)

$SSAB A (+0,29 %)

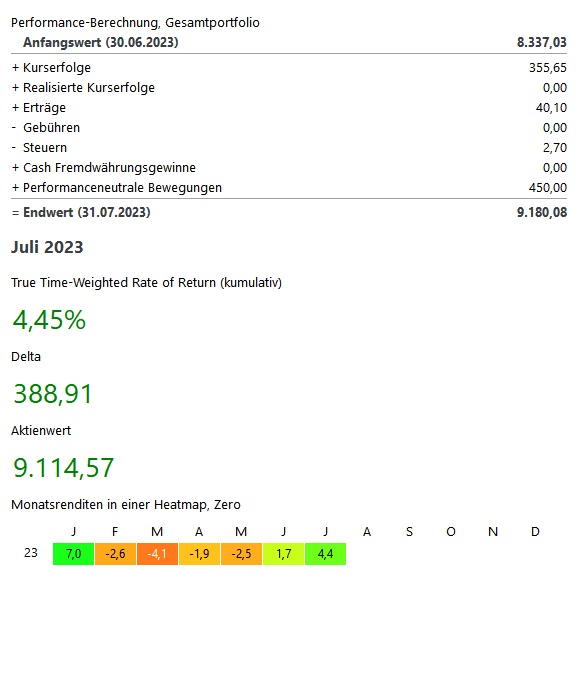

Depot Performance: July 2023 +4.45%.

Top share: Ambari Brands $AMB +79,37%📈

Flop Share: SSAB $SSAB A (+0,29 %) -12,15%📉

Net dividends: 37.40€.

Titres populaires

Meilleurs créateurs cette semaine