$BNTX (+3,43 %)

$KSPI (-2,18 %)

$HIMS (+4,12 %)

$MELI (+3,16 %)

$PLTR (+3,48 %)

$DRO (+1,06 %)

$IFX (+4,41 %)

$9434 (+0,91 %)

$FR0010108928

$DHL (+1,97 %)

$BOSS (-1,58 %)

$CONTININS

$DOCN (-5,74 %)

$LMND (+5,31 %)

$BP. (-0,86 %)

$FRA (+0,64 %)

$PFIZER

$SNAP (+2,1 %)

$AMD (+5,88 %)

$SMCI (+6,25 %)

$OPEN (-0,35 %)

$CPNG (-0,76 %)

$LCID (+1,15 %)

$CBK (+1,65 %)

$ZAL (+1,3 %)

$NOVO B (+4,77 %)

$VNA (-1,52 %)

$BAYN (+0,31 %)

$UBER (+0,16 %)

$SHOP (+6,42 %)

$MCD (-0,59 %)

$DIS (-0,33 %)

$ROK (-4,11 %)

$ABNB (+1,47 %)

$RUN (+7,02 %)

$FTNT (+2,8 %)

$O (-1,21 %)

$DASH (+0,41 %)

$DUOL

$S92 (+9,02 %)

$DDOG (+5,95 %)

$SEDG (+0,26 %)

$QBTS (+2,84 %)

$RHM (+3,49 %)

$DTE (+0,78 %)

$ALV (+0,18 %)

$LLY (-0,65 %)

$CYBR

$PTON (-1,48 %)

$DKNG (+3,99 %)

$RL (-0,12 %)

$PINS (+1,22 %)

$TTWO (-0,82 %)

$TWLO (-0,86 %)

$MNST (-0,68 %)

$STNE (+3,91 %)

$MUV2 (+1,11 %)

$WEED (+1,09 %)

$GOOS (+0 %)

$PETR3T

$ANET (+8 %)

SoftBank

Price

Debate sobre 9434

Puestos

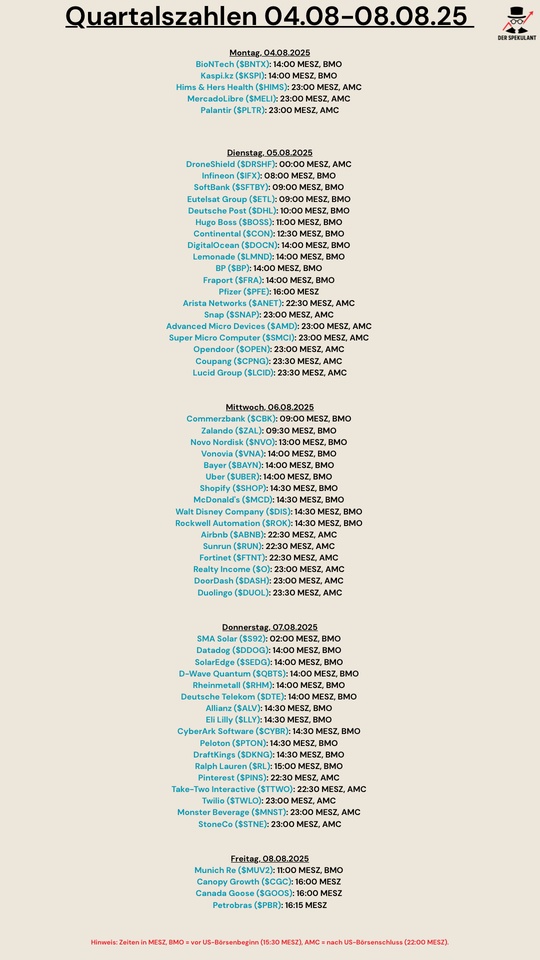

12Quartalszahlen 04.08-08.08.2025

Insights from the Softbank Q3 analyst conference

In addition, today $9434 (+0,91 %) Softbank presented their latest figures and gave an outlook on their future business. I was particularly interested to see if they had any news on OpenAI's unprecedented financing round.

CEO, Miyakawa, presented the results of the 3rd quarter of the fiscal year and it became clear that SoftBank is on a promising path.

Financial performance:

The figures presented showed solid growth in various areas. Sales increased by 6.6% to JPY 4,811.5 billion, and operating profit operating profit improved by 12.3% to JPY 821.9 billion. The net profit also increased by 7.4% to JPY 436.6 billion.. The financial division even exceeded internal expectations with a performance of 130%. The positive development of PayPay is also noteworthy, with a 19% increase in sales and a significant improvement in profitability.

Looking at the details, the consumer business achieved an increase in sales of 2.8 %, with mobile sales recovering steadily since the previous year2.... The Enterprise business grew by 10.4 %, in particular due to cloud and security solutions4.... The Media & EC business recorded an increase in sales of 4.4%, particularly in the media sector.

Challenges:

Despite the positive development, some challenges were also addressed. The price cuts in the telecommunications sector four years ago had a negative impact on the industry, but SoftBank has managed to return to a growth trajectory. The rising cost of electricity and the need to invest in 5G and future technologies were cited as further challenges. In addition, concerns were raised about the impact of the global economic situation and possible tariff increases, although SoftBank emphasized that it does not currently see any direct impact.

Future direction:

A central point of the conference was the focus on AI and building the next generation of social infrastructure. The company has invested in a new AI data center in Sakai and will significantly expand its capabilities in this area. The partnership with OpenAI and the development of Cristal (proprietary enterprise AI model) were presented as key to the future business development and transformation of Japanese companies. SoftBank plans to invest heavily in generative AI and related infrastructure in the coming years The strategic importance of the collaboration with OpenAI was underlined by the plans for a joint venture SB OpenAI Japan.

The Q&A session provided interesting insights. For example, the importance of the cooperation with OpenAI was highlighted, emphasizing that SoftBank sees itself as a pioneer in the use of AI and wants to take advantage of OpenAI. Questions about the costs for the use of OpenAI solutions were answered in detail, emphasizing a pay-as-you-go agreement and the joint sharing of development costs.

Analysts also showed interest in the relationship between SoftBank's data centers and the Stargate projectwhich led to an explanation that the data centers are primarily intended for Japanese companies, but cooperation with Stargate is possible.

Questions about the future of DeepSeek and its impact on SoftBank's strategy were also were also answered, emphasizing that SoftBank is open to using new technologies when they make sense.

In summary, SoftBank is well on track with a clear focus on growth, AI and developing the next generation of social infrastructure. The partnership with OpenAI and the reorganization of the financial division under the leadership of PayPay are important strategic moves that could lead the company to a promising future.

Stay tuned!

Day 4 | WEF 2025

The CEO of $SAP (-0,18 %), Christian Kleindescribed the recently announced investment of 500 billion US dollars in the US AI infrastructure, the so-called Stargate project, as a "wake-up call for Europe". In an interview at the #wef2025 Klein called the project, which was initiated by OpenAI, $9434 (+0,91 %), $ORCL (+2,54 %) and led by the Trump Administration, "a great step". He explained that it was the right decision and would also help to increase government productivity. Klein pointed out that Europe often complains about regulations and too many AI laws, while the Stargate project is a good role model for Europe.

He added that he would "absolutely support".

"We work with all public sectors worldwide and of course we would welcome it in Europe as well"

"Europe needs it the most, from my point of view."

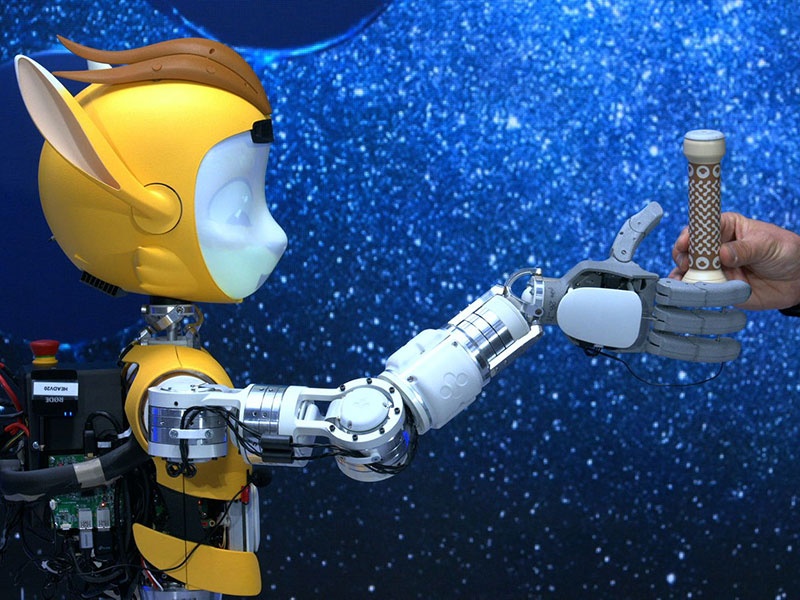

Humanoid robots tried out.

c't 3003 went to the "Humanoids" robot fair in Nancy and took a close look at two-legged apparatuses.

Hello my dears, I found an exciting report for you in which some companies appear that are active or invested in this field. Something like $9434 (+0,91 %) . $TSLA (+3,2 %)

$HYUD

You are welcome to name other players in the comments. And whether you already see potential here or whether it could still take years, as I can read from the report here.

There was a big discussion the other day at the presentation of Tesla's Optimus robots or videos like this one with the X1 Neo. It all looks nice and futuristic, but I'll say diplomatically - and hopefully not judicially - that I personally won't believe that it works like in all the PR videos until I've seen it with my own eyes.

Is there a lot of fakery and PR involved with Tesla - what's your opinion?

Yes, and unfortunately walking on two legs is extremely difficult for robots. Which is why the robot that looked the most practical wasn't walking on two legs, but on a ball.

We're talking about the Mirokaï - plural, because one is called Miroki and the other is called Miroka - from Enchanted Tools. This is a French company. They have made the rather rapid announcement that they want to produce 100,000 of these things by 2032. The target price is 30,000 euros. The early access program is due to start next year.

But unfortunately, the Mirokaï are not yet helping in the household or, let's say, in logistics, but are supposed to make things a bit more human in hospitals and retirement homes, for example. Yes, yes, I can see the contradiction. Or just interact a bit with customers in airports, restaurants and hotels and show them the way.

That all sounds very ambitious, but the founder of Enchanted Tools co-developed the robots Pepper and Now from Aldebaran - now Softbank - a long time ago. And in fact, these are the robots that I personally have seen most often in the wild. Even the Hanover City Library has a Pepper. So, the makers of Mirokaï definitely know their way around robots that interact directly with people. That's why it could actually work.

But the truth is that it's all still in, let's say, a discovery phase. There are test projects with humanoid robots, for example at Amazon with Digit from Agility Robotics and at BMW with Figur from Figur AI, both US companies.

Then there is also Optimus from Tesla and, of course, the retreaded Atlas from Boston Dynamics. But unfortunately none of the four were on show in Nancy or at any other trade fair I've been to so far. So I have to rely on PR videos.

Well, now back to Unitree. So the G1, I was actually able to play around with it, and I also tried to push it a bit. And it actually seems very stable. However, it's only 1.30 meters high, which is about the height of a primary school child. Its successor, the H1, is already 1.80 meters tall, but is also said to cost 90,000 US dollars. It was also on the stand, but was unfortunately never shown in action.

Unfortunately, this was often the case with Fourier robots, for example. There were also brochures that looked as if they were finished products, but even after asking several times, I wasn't allowed to see any of these robots in action.

The only demonstration was here [hand moves]. Yes, nothing more really.

Conclusion

So, I think you've noticed by now: it's really difficult to distinguish technical progress from hot air in this industry.

Are we on the verge of a robot revolution? Or are they actually something like remote-controlled cars with a slightly more complicated mode of locomotion - something that has been around for decades?

In any case, what I took away from Humanoids 2024 in Nancy: While such real, large, humanoid robots were only developed and built for research purposes for many years - by the DLR in Germany, by the IIT in Italy - humanoid robots are now very slowly materializing as products.

In other words, devices that can be bought. And of course, for the time being, they are only being bought by companies and institutions that want to experiment with them and conduct research.

But in any case, they are no longer one-offs costing millions, but products.

And the biggest surprise for me was the price of 16,000 euros for the Unitree G1, a real human robot.

That's only as much as eight fully equipped iPhones cost. I'm therefore cautiously optimistic that I might live to see a humanoid robot move into my home to do my laundry, perhaps chop my onions for me and beat me at chess.

So as I said: cautiously optimistic.

And what I definitely noticed very clearly at Humanoids in Nancy: How great I actually think robots are, on such a non-rational, emotional level.

Of course, I don't know how humanoid robots will affect humanity in concrete terms at some point. Maybe that's a really bad idea.

But just on an emotional level: am I somehow weird or something? Am I the only one? Or do you feel the same way?

Feel free to write in the comments.

https://www.heise.de/news/Humanoide-Roboter-ausprobiert-10183284.html

Summary Earnings, 12.11. 👇🏼

$VOD (-0,06 %) | Vodafone Q2/H1 24 Earnings

Q2 Service Rev EU7.64B (est EU7.62B)

H1 Oper Profit EU2.38B (est EU2.41B)

Still Sees FY Adj Free Cash Flow At Least EU2.4B

FY25 Guidance Reiterated

$AZN (+0,74 %) | AstraZeneca Q3 24 Earnings

Core EPS $2.08 (est $2.06)

Rev. $13.57B (est $13.08B)

Raises FY Core Eps View To High Teens Percentage Growth

To Invest $3.5B In R&D And Manufacturing In The US

Upgrades FY Guidance

$9434 (+0,91 %) | SoftBank Q2/H1 Earnings 2024

Q2 SVF Profit 313.14B Yen (est 83.11B Yen)

Q2 Net Income 1.181 Yen (est 294.83B Yen)

Q2 Dividend 22.00 Yen

H1 Net Income 1,011 Yen

H1 Net Sales 3,471 Yen (est 3.42T Yen)

Still FY Dividend 44.00 Yen (est 44.00 Yen)

$BAYN (+0,31 %) | Bayer Q3 24 Earnings

Sales EU9.97B (est EU10.15B)

Core EPS EUO.24 (est EU0.31)

Adj. EBITDA EU1.25B (est EU1.33B)

Sees FY Adj. EBITDA EU10.4B To EU10.7B (est EU10.35B)

Now Sees FY Pharma Outlook At Upper End Of Range

Bayer Confirms Sales Growth Outlook

$IFNNY (+4,26 %) | Infineon Q4 24 Earnings

Rev, EU3.92B (est EU3.98B)

Total Segment Profit EU832M (est EU792.5M)

Infineon Sees Q1 Revenue About EU3.2B (est EU3.77B)

Sees Q1 Rev. About EU3.2B (est EU3.77B)

2025 Revenue Is Expected To 'Slightly' Decline

$BNR (-4,58 %) | Brenntag Q3 24 Earnings:

- Oper EBITA EU281.1M (est EU295.8M)

- Still Sees FY Oper EBITA EU1.1B To EU1.2B

- Cites Challenging Geopolitical, Macroeconomic Operating Conditions

$VBK (+2,48 %) | Verbio recorded an operating loss of 6.6 million euros in the first quarter of the financial year due to a weak biofuel market. Group CEO Claus Sauter expects significant increases in earnings in the second half of the year due to possible new legal regulations.

$JUN3 (+1,51 %) | Jungheinrich faces a subdued business outlook due to the weak economy and expects sales and incoming orders to be at the lower end of the forecast ranges. In the third quarter, however, the company recorded a 6.5 per cent increase in incoming orders to 1.3 billion euros, while sales declined slightly.

$JEN (+4,13 %) | Jenoptik increases its operating result (EBITDA) by 14.9% to 59.1 million euros in the third quarter and confirms its annual targets for 2024 despite an uncertain market environment. Revenue grows by 4.0% to 274.3 million euros, but falls short of expectations

$SIX2 (+4,95 %) | Sixt is again lowering its profit forecast for the full year to a pre-tax profit of around EUR 340 million, while analysts had expected an average of EUR 352 million. Despite a ten percent increase in revenue in the third quarter, the negative impact of falling residual values is expected to remain high.

$SFQ (+0,33 %) | SAF-Holland is lowering its sales expectations for 2024 from EUR 2 billion to EUR 1.95 billion, but is maintaining its target margin of around ten percent for adjusted EBIT. In the third quarter, the company recorded a decline in sales of over 20 percent and a 63 percent drop in net profit to EUR 9.3 million.

$UTDI (+1,37 %) | United Internet reports a slight decline in EBITDA to EUR 978 million in the first nine months due to increased expenses for the 1&1 mobile network. Sales of the 1&1 mobile subsidiary rose by 2.5 percent, but EBITDA fell by nine percent to EUR 463 million, while the sales forecast was lowered.

$IOS (+0,91 %) | Ionos increases sales in the first nine months by almost eight percent to over 1.1 billion euros and adjusted EBITDA by nine percent to 334.5 million euros. The company confirms its annual targets and is optimistic about the remaining months of the financial year.

$KWS (+2,87 %) | KWS Saat increases net sales by 18 percent to 248.6 million euros in the first quarter and reduces its loss before taxes by 19.4 percent to 37.4 million euros. The company confirms its guidance for fiscal 2024/25 and records extraordinary income of EUR110 million from the sale of its South American corn and sorghum business.

Asian stock markets mixed

The Asian markets are mixed ahead of the upcoming quarterly figures of the major US technology companies. In Japan, the leading Nikkei index rose despite political uncertainty following the ruling party's loss of majority, while the Chinese stock exchanges came under pressure. The Shanghai stock exchange lost 0.6% to 3300.52 points. The index of the most important companies in Shanghai and Shenzhen fell by 0.6% to 3940.23 points. In Tokyo, the Nikkei index, which comprises 225 stocks, rose by 0.7% to 38,872.30 points, while the broader Topix was up 0.9% at 2681.40 points. Positive company figures and price gains on Wall Street supported sentiment. "Share prices have already fallen far enough that there should now be a revaluation," said Kenji Abe from investment bank Daiwa Securities. Technology stocks such as the investor specializing in artificial intelligence $9434 (+0,91 %) SoftBank, which specializes in artificial intelligence, rose by 2.2%, the chip tester manufacturer $6857 (+4,08 %) Advantest by 1.5%.

Attention is now turning to the upcoming quarterly figures of major technology groups such as $GOOGL (+0,2 %)

$GOOG (+0,15 %) Alphabet, $META (+1,89 %) Meta and $MSFT (+0,41 %) Microsoft. "The results of the Magnificent Seven will set the tone this week," said one trader. Alphabet, the parent company of Google, will open the round of tech giants on Tuesday, followed by Facebook parent Meta Platforms and Microsoft on Wednesday and $AAPL (-0,54 %) Apple and $AMZN (+4,03 %) Amazon on Thursday.

- FuW, 29.10.2024

📈 Furious start to 2024 for the $XDJP 🇯🇵

The Nikkei 225 index rose by 13.5% in the first seven trading weeks of the current year and things are also looking very good for Japanese quality stocks in the near future (e.g. $6758 (+1,38 %)

$8058 (+1,74 %)

$9434 (+0,91 %) ) are looking very good.

Hier die ZusammenfassungWhy Japanese shares are particularly interesting at the moment

A number of positive factors such as robust GDP growth and investments in the semiconductor industry have already supported the index in the first two months. In addition, the hype surrounding artificial intelligence is also boosting the market there, while improved corporate governance and share buybacks are strengthening investor confidence. (1)

Despite a temporary dip in the Japanese economy in the second half of 2023, GDP growth should continue to surprise on the upside. More on this from paragraph 3 of the Artikels.

How can you participate now?

The SG Japan Quality Income Index (Fig. 1) would be one way to participate specifically in the performance of Japanese quality companies. It comprises 60 companies that have been selected on the basis of good financial ratios and their dividend strength, among other factors.

If Japanese dividend stocks were not perfect for reducing the US overrepresentation in the portfolio (as @PowerWordChill

it would do🌚) ?

More information on the index selection process:

https://www.ideas-magazin.de/2024/ausgabe-263/titelthema/

(1)Section "Corporate governance and other drivers"

(3) ibid. "Japanese economy with dip in the second half of 2023"

#finance 📊

This article is part of an advertising partnership with Societe Generale

but I've been looking for another individual stock for my savings plan for some time, preferably a dividend growth company of course. Unfortunately, I haven't found one yet.

More good news for $SAND/EUR (+3,83 %). Investors from Softbank ($3AG1 (+0,91 %))have invested $93 million in the NFT gaming platform.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗢𝗣𝗘𝗖 𝗯𝗹𝗲𝗶𝗯𝘁 𝗵𝗮𝗿𝘁 / 𝗧𝗲𝗹𝗲𝗸𝗼𝗺 𝗗𝘂𝗺𝗽 / 𝗘𝗹𝗼𝗻 𝘁𝗵𝗲 𝗗𝗼𝗴𝗲𝗳𝗮𝘁𝗵𝗲𝗿

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

Unfortunately, there are no interesting ex-dates to report today.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, Levi's ($LV2B (-0,11 %)) presents its figures after the US market close.

𝗜𝗣𝗢𝘀 🔔

𝗚𝗹𝗼𝗯𝗮𝗹𝗳𝗼𝘂𝗻𝗱𝗿𝗶𝗲𝘀 - The chip manufacturer that emerged from processor manufacturer AMD ($AMD (+5,88 %)) emerged chip manufacturer actually planned only in the coming year the IPO. Now, however, the company announced that the positive market situations will be used and the IPO will be moved forward. Last year, GlobalFoundries reported revenue of $4.85 billion and a loss of $1.35 billion. In the first half of 2021, it said revenue grew another 13 percent. Currently, GlobalFoundries is wholly owned by investment fund Mubadala, which is based in Abu Dhabi. As Mubadala explained, the fund intends to keep a substantial stake in the company even after the IPO, which has put paid to rumors that possibly Intel ($INL (+5,97 %)) was planning to take over GlobalFoundries.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

𝗚𝗼𝗹𝗱𝗺𝗮𝗻 𝗦𝗮𝗰𝗵𝘀 ($GOS (+0,69 %)) - According to Handelsblatt, the U.S. investment bank sold 91 million Telekom ($DTE (+0,78 %)) shares on the market overnight, raising 1.54 billion euros. The deal is part of a derivatives transaction between the U.S. bank and technology investor Softbank ($3AG1 (+0,91 %)). Softbank recently raised 225 million Telekom shares, which it must hold until the end of 2024. Part of this is now being used as collateral in a deal with Goldman Sachs. This does not change Softbank's stake in Telekom.

𝗢𝗣𝗘𝗖 - Despite the sharp rise in oil prices, the OPEC+ countries want to continue to produce little oil in the future. According to a message from the OPEC states, production will be raised by 400,000 barrels per day in November. As justification a possible fourth Corona wave is cited.

The prices rise further, because with a view of the winter months an end of the demand is not in view.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

𝗦𝗵𝗶𝗯𝗮 𝗜𝗻𝘂 - The meme coin successor to Dogecoin ($DOGE-USD (+12,73 %)) has caused quite a stir in recent days with huge price increases. With a current market capitalization of $9.3 billion, SHIB's price has grown 215 percent in the past 7 days. Currently, the coin is ranked 18th among the largest cryptocurrencies. The reason for this rapid price increase is not directly apparent. However, a partial reason could be, once again, a tweet by Tesla ($TL0 (+3,2 %)) founder Elon Musk. He posted a photo of his dog Floki, a Shiba Inu, sitting in the trunk of his Tesla. We have attached the picture for you below. Shortly after the tweet appeared, SHIB's share price shot up.

Valores en tendencia

Principales creadores de la semana