Inter & Co $INTR (-6,37 %) is a Brazilian fintech company that started out as a digital bank and now offers a wide range of financial services. The company is listed on the Nasdaq and is one of the fastest growing digital banks in Latin America. But what makes Inter & Co special, how does it compare to the competition and what are the opportunities and risks?

Overview: What is Inter & Co?

Inter & Co started out as a traditional bank, but in recent years has transformed itself into a digital financial platform with a wide range of products:

🔘 Digital banking: free current account, credit cards, transfers

🔘 Loans & mortgages: consumer loans, SME financing

🔘 Investment & trading: shares, ETFs, cryptocurrencies

🔘 Insurance: Various policies for customers

🔘 E-commerce & cashback: Inter Shop combines online shopping with cashback systems

The business model aims to bundle as many services as possible in one app ("super app" approach), similar to Nubank or MercadoLibre with MercadoPago.

Competition: Who are the competitors?

Inter & Co is in direct competition with other digital banks and fintechs in Brazil and Latin America. The most important players are:

🔸Nubank $NU (-5,72 %) The market leader with over 80 million customers in Brazil, Mexico and Colombia. Very strong in credit cards and loans.

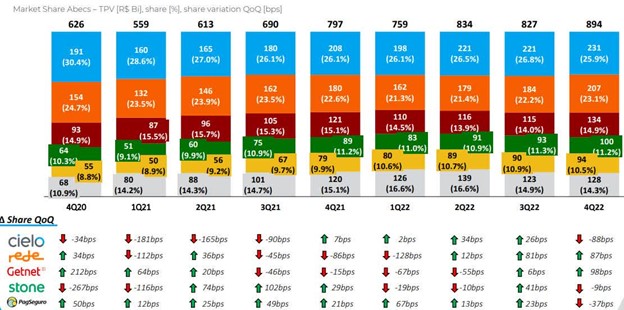

🔸PagSeguro $PAGS (-5,79 %) : Focus on payment services and small businesses.

🔸StoneCo $STNE: (-5,82 %) Also strong in the payment sector, but with more focus on merchant solutions.

🔸Banco do Brasil $BBAS3 The traditional banks that are increasingly developing digital offerings.

Inter & Co is differentiated by its broad platform, which goes beyond banking and is strongly integrated into e-commerce and cashback.

Opportunities: Why is Inter & Co interesting?

🟢 Growth market Brazil: The digitalization of the financial sector is progressing rapidly in Latin America. Millions of people are still underserved and the demand for simple digital solutions is high.

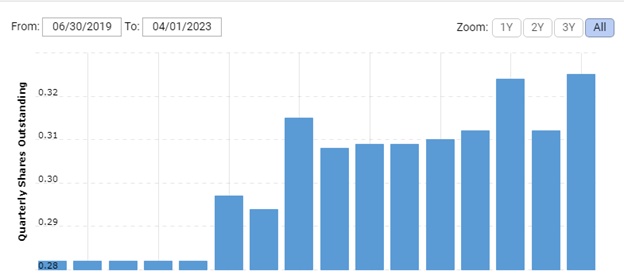

🟢 Scalable model: Inter & Co has over 30 million customers (as of 2024) and continues to grow. The platform approach enables cross-selling of financial products and increases customer loyalty.

🟢 Profitability in sight: While many fintechs are making high losses, Inter & Co has its cost structure under control and could become profitable in the medium term.

🟢 Expansion potential: In addition to Brazil, Inter & Co is slowly expanding into other Latin American markets. If growth continues, the share could benefit from rising market shares in the long term.

🟢 E-commerce integration: The combination of banking and shopping platform (Inter Shop) brings additional sales potential. This model is unique in Brazil and could be a strong source of income in the long term.

Risks: What could go wrong?

⚠️Starker Competition: Nubank $NU (-5,72 %) is an extreme competitor with massive financial resources. Traditional banks are also responding with digital offerings.

⚠️ Interest rate environment & loan defaults: Brazil traditionally has high interest rates. If the interest rate level continues to change, it could affect lending and therefore the profits of Inter & Co.

⚠️ Slow internationalization: While Nubank is already very active in Mexico and Colombia, Inter & Co has so far focused almost exclusively on Brazil. International expansion could prove difficult.

⚠️ Macroeconomic uncertainties: Brazil is susceptible to economic fluctuations and currency risks. A recession or inflation could have a negative impact on credit quality.

Conclusion: Is an investment worthwhile?

Inter & Co is definitely an exciting fintech with an innovative business model. The integration of banking, investments and e-commerce in one platform offers enormous potential. The market in Brazil continues to grow and the company has a solid customer base.

However, Inter & Co also faces major challenges: Competition is tough and expansion is slower than at Nubank. In addition, profitability and scaling have yet to be proven.

For risk-tolerant investors with a long-term horizon, Inter & Co could be an interesting turnaround opportunity - especially if the company continues to gain market share and becomes more profitable.

What do you think? Is Inter & Co a potential high-flyer or more of a risk investment? I look forward to hearing your opinions!