Shortly before the end of the week, I completed my position in $4901 (+0.23%) with a second tranche. Thanks again for the top presentation of @PikaPika0105 - the company is very broadly positioned and has great potential in my view. In the meantime, I am also interested in a new test for the early detection of cancer in dogs ;-)

Fujifilm

Price

Discussion about 4901

Posts

6The future of the pharmaceutical industry bought!

I have today increased my position in Fujifilm $4901 (+0.23%) as I remain convinced that they represent the future of the pharmaceutical industry. And all this at a ridiculously low valuation, as Fujifilm is still valued like an ordinary conglomerate (P/E ratio: 13.5).

In the future, the most advanced stem cell therapies, mRNA vaccines or antibodies will be produced by Fujifilm, within their global network of state-of-the-art biologics manufacturing facilities. They are currently expanding aggressively, opening additional sites in the US, Japan and the UK. The trend is clearly moving towards foundries, as was the case in the semiconductor industry. In future, pharmaceutical companies will only conduct research and develop active ingredients; they will no longer build the expensive production facilities themselves, but order everything from Fujifilm.

I've already written a longer post about Fujifilm, but yesterday there was big news for the global pharmaceutical industry that prompted me to write another little something. Two stem cell therapies have been provisionally approved in Japan, with full approval likely to follow in March, making them the first country in the world to bring this technology to commercialization. These are based on iPS cell technology, which can revert ordinary cells back to an embryonic (pluripotent) state, allowing them to subsequently develop into any cell. This technology is truly groundbreaking as it is capable of curing numerous conditions such as Parkinson's disease, heart failure, blindness, paraplegia and more. The first two approved therapies focus on Parkinson's and heart failure.

Fujifilm is positioning itself as one of the leading manufacturers of these complex cell therapies. This market alone could bring them additional billions.

Overall, I think Fujifilm's enterprise value is very likely to multiply. I expect 5-12x by 2035. Which end of the range we aim for depends primarily on the achievement of medium-term targets.

And that's it for my mini update! If you find the company interesting, you can also take a look at my previous detailed article! :)

Further profit-taking

Today I sold another 5-8% of my position at the ATH and $RKLB (+0.84%) position and invested in other promising stocks. Rocket Lab is catapulting my portfolio to new heights, but the leverage is slowly decreasing. I still see 5-10x potential, but I also see that in other stocks and as the cluster risk is increasing, I want to gradually diversify. I also want to try to find "the next Rocket Lab", even if that won't be easy with such high valuations as we currently have.

Today I invested in PKSHA $3993 (+0.56%) (AI algorithms), Envipco $ENVI (+1.46%) (recycling), SEALSQ $LAES (-5.95%) (PQC semiconductors and satellites), BTQ Technologies $BTQ (-4.91%) (PQC semiconductors and IP), Fujifilm $4901 (+0.23%) (++Bio-CDMO), Furukawa Electric $5801 (-3.96%) (HTS and lasers) and 01 Quantum $ONE (-1.71%) (PQC software).

I wish you all a successful 2026 :)

Conversion to rebalancing has taken place.

As announced, I have parted with my broad mass of numerous individual stocks and ETFs and focused on these 21 positions.

The core here is the Kommer and the All World (ACWI is held exclusively for my daughter).

The 4 main satellites are $GOOGL (-0.59%) , $SIE (-0.81%) , $4901 (+0.23%) and the cost environment consisting of $MCD (+0.3%) , $KO (+0.05%) and $ULVR (-0.98%)

In addition, I have created $PNG (-4.95%) and $DMAG (-1.56%) two larger segments in the future-oriented area - also with $IREN (-7.48%) , $VKTX (+5.1%) and $ONDS (-4.5%) albeit much smaller.

The $XDWU (-0.98%) is intended to bring a little more security into the system. The $EUDF (+0.78%) clearly speaks for itself and the $XDWH (-0.75%) likewise.

I have now slightly exceeded my target of 60/35/5 in etf/equities/crypto, so the savings rate will go into equities and crypto over the next few months.

The stocks I will be saving in now are: Alphabet, Siemens, Fuji, coca-Cola, McDonald's and Unilever.

From my point of view, I now have a portfolio that offers greater security overall, but is also forward-looking in terms of sectors.

What do you think?

Fujifilm - One of the most impressive transformations in industry history

What do you think of when you think of Fujifilm? Cameras, printers or maybe just nothing at all? Behind the scenes, the Japanese company that grew up with film and cameras has produced one of the most remarkable metamorphoses in industry history. The moment they realized that their business model was on the brink of collapse due to the rise of the smartphone, they radically rethought their approach. They thought very clearly about where their strengths lay and used these, combined with targeted acquisitions, to reinvent themselves.

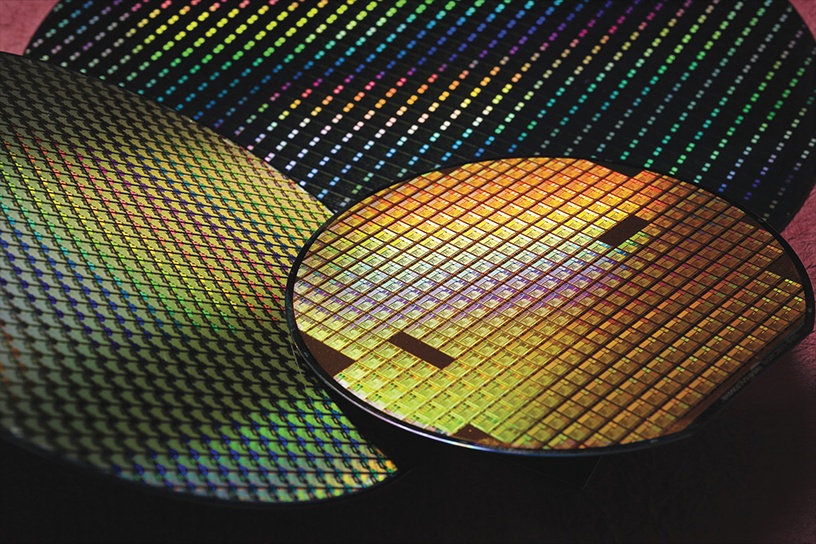

Today, Fujifilm is an essential supplier of specialty chemicals for the semiconductor industry. They hold a dominant market share, particularly in the high-end sector. There are hardly any alternatives to their EUV photoresists and they are strong in polyimides for new growth markets such as advanced packaging. Fujifilm has thus built up an advanced, globally relevant and steadily growing segment for semiconductor materials. Two weeks ago, they opened a new advanced facility for those materials in Shizuoka. They are also planning to invest in Rapidus, which is currently the most ambitious semiconductor project in the world. Of course, this is also a bit about honor, but it is also a gigantic customer in the not-so-distant future, so it makes a lot of sense to get involved or at least make direct contact.

But the big story is actually a different one. It's about organic CDMOs. About two decades ago, there was a radical change in the semiconductor industry - no more in-house production, instead production is outsourced to so-called foundries. This model has long since become established and players like TSMC are worth billions. But what does this have to do with it? A similar trend has been gaining ground in the pharmaceutical industry for some time now. Production is being taken over by CDMOs (Contract Development and Manufacturing Organizations). Bio-CDMOs are by far the fastest-growing sub-sector and could be described as the elite. Many CDMOs produce simple molecules and chemicals, while bio-CDMOs produce complex organic structures and biologics. This is much more difficult. The current trend in the pharmaceutical industry is moving strongly in this direction. mRNA, specific antibodies, ADCs, cell therapies, ever more advanced but also ever more complicated approaches are emerging.

The four major bio-CDMO companies worldwide include Lonza $LONN (+0.09%) Fujifilm $4901 (+0.23%) Samsung Biologics $207940 and WuXi Biologics $WXXWY (+0.97%) . What can be said about the market? A few aspects are that it is growing at double-digit rates per year, the barriers to entry are high, the business is very "sticky" (customers hardly change) and it is regulatory sensitive.

But what is Fujifilm's position? Fujifilm can create synergies in research between its bio and chemistry division (e.g. knowledge for working on a microscopic level or cleanrooms can be applied not only for semiconductor materials but also for the bio-CDMO division). They are focusing on more complex processes instead of entering into a price war with Samsung Biologics for standard products. In addition, they have produced decisive innovations in production itself. Fujifilm builds its bioreactors modularly and in the same way all over the world, which is a great advantage for customers. They have also managed to build a continuous process (in a figurative sense, a kind of assembly line) instead of working with large boilers like their competitors, which costs efficiency. They also pursue a vertical approach in which they produce the individual components (such as cells, "feed", etc.) themselves. Once in the platform, it is almost impossible to switch away from Fujifilm. Existing customers include Novo Nordisk, Eli Lilly $LLY (+0.32%) Regeneron $REGN (-0.84%) or Merck $MRK (-0.3%) .

On the financial side: Fujifilm's Bio-CDMO division is expected to grow by around 20% per year, twice as fast as the industry as a whole. They expect sales of around €3 billion in 2030. With investments of over €7 billion, particularly in plants in Denmark and the USA, the company's focus is clearly defined. Most of these plants will be in full operation from 2028. When they are fully utilized, the margin is typically a high 30%. So today's investments are tomorrow's cash flow. I also believe that this is just the tip of the iceberg compared to what is coming in the next few years to decades.

Fujifilm's timing is also perfect. WuXi Biologics is losing more and more market share due to the new US regulation ("Biosecure Act"), which plays heavily into the hands of Fujifilm with its production facilities in the western hemisphere (+ western value community with Japan). In addition, a potential competitor of Novo Nordisk was recently $NOVO B (-0.55%) for part of its own requirements.

I assume that by 2035 around 60% of sales will come from the healthcare division (30% today), which also includes modern medical imaging devices. However, the focus will clearly be on bio-CDMOs. The Electronics division will also develop very well by then and increase its share. The Imaging division (cameras and co.) will continue to exist as a professional and lifestyle product and produce permanent cash, which will, however, be invested in other areas. The Business Innovation division (laser printers and co.) will become increasingly insignificant and slowly shrink, while remaining profitable and generating cash. In due course, it may be sold or spun off if no other solution can be found. A five- to seven-fold increase in profit by 2035 seems plausible. From 300 billion yen (about €1.8 billion) today to 1.5-2 trillion yen (€9-12 billion), driven by the high margins in the fast-growing Bio-CDMO segment, which is definitely the most relevant business area for the future.

You could almost call Fujifilm an infrastructure play in two system-relevant areas, semiconductors and biopharma. They make money on every blockbuster drug and every high-end chip without having to bet on anyone specific. They are the shovel manufacturers of these super trends. At the moment, everything is going in the right direction for them. Technological foundation, strategic brilliance and perfect geopolitical timing. They definitely have the momentum.

This entire story is available for a P/E ratio of 15!!! A classic "conglomerate discount" is priced in here, but this completely ignores the momentum and growth potential. In my opinion, the company is absolutely undervalued and if the entire roadmap is implemented, I see a significantly higher valuation in 2035. With an earnings estimate of €5 billion (super conservative) and a P/E ratio of 25 (a reasonable level for the realignment of the business), that would already be a valuation of €125 billion (>5x). If we assume a realistic-optimistic profit estimate, i.e. around €9 billion, we would already be at €225 billion (≈tenbagger).

What do you think of the company? An impressive comeback story from an almost hopeless situation. An investment for you?

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗙𝗲𝗱 𝘄𝗶𝗲 𝗲𝗿𝘄𝗮𝗿𝘁𝗲𝘁 / 𝗣𝗮𝗸𝗲𝘁𝗲 𝘀𝗶𝗻𝗱 𝗴𝗲𝗳𝗿𝗮𝗴𝘁 / 𝗣𝗵𝗮𝗿𝗺𝗮𝗿𝗶𝗲𝘀𝗲𝗻 / 𝗞𝗿𝘆𝗽𝘁𝗼𝗵𝗮𝗻𝗱𝗲𝗹 𝗶𝗻 𝗔𝘂𝘀𝘁𝗿𝗮𝗹𝗶𝗲𝗻

𝗜𝗣𝗢𝘀 🔔

Veganz - The Berlin-based company has now revealed the official issue price of €87 for its IPO on November 10. This results in gross issue proceeds of €47.6 million.

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, América Móvil ($MV9L), Bank Of Princeton ($BPRN), Columbus McKinnon Corp. ($VC3 (-8.83%)), CMS Energy ($CSG (+0%)), Dana Corp. ($4DH (-4.75%)), First Commonwealth Bank ($FCF (-2.3%)), FirstEngergy ($FE7 (+1.62%)), Howmet Aerospace ($48Z (-0.99%)), Idacorp ($IDJ (+0.41%)), Intel ($INL (-5.24%)), J. B. Hunt ($JB1 (-5.78%)), Lamb Weston Holdings ($0L5 (-1.57%)), National Western Life ($NWLI) and Warrior Met Coal ($WJ4 (-3.66%)) traded ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, Alibaba Group ($2RR (+1.04%)), Barrick Gold ($ABR), Citrix ($CTX), Commerzbank ($CBK (-2.79%)), Credit Suisse ($CSX), Deutsche Post AG ($DPW (+1.07%)), Elmos Semiconductor ($ELG (-5.51%)), Evonik ($EVK (-1.46%)), Expedia ($E3X1 (-1.36%)), Freenet ($FNTN (-0.87%)), Fujifilm ($FJI (+0.23%)), Hannover Re ($HNR1 (-0.79%)), HeidelbergCement ($HEI (-3.17%)), Hugo Boss ($BOSS (-0.67%)), ING ($INN1 (-1.08%)), Kellogg Company ($KEL), Lanxess ($LXS (-18.72%)), Mitsubishi Motors ($MMO (-0.93%)), Moderna ($0QF (-2.04%)), Monster Beverage ($MOB (-1.58%)), Motorola Solutions ($MTLA (-2.83%)), Nikon ($NKN (-1.43%)), Peloton ($2ON (-0.62%)), Pfeiffer Vacuum ($PFV (-0.18%)), ProSiebenSat.1 Media ($PSM (+1.48%)), RTL Group ($RRTL (+0%)), Siemens Healthineers ($SHL (-0.72%)), Toyota ($TOM (-0.87%)) and Vonovia ($VNA (-0.63%)) presented their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Fed - As expected, the Federal Reserve decided to reduce its bond purchases. Instead of the previous $120 billion per month, only $105 billion will be invested in the purchase of government bonds and mortgage-backed securities starting in mid-November. Further cuts are planned from December.

Now all eyes are on possible interest rate hikes, but the ECB considers an increase in the key interest rate next year unlikely. Similarly, Deutsche Bank does not expect interest rates in the USA to be adjusted before December 2022.

Deutsche Post ($DPW (+1.07%)) - Deutsche Post stock has been on the upswing lately and it is one of the best performers of the day. The paper was able to improve by 2.8 percent and was at EUR 57.35 in the meantime. An average price target of EUR 64.72 is targeted. Analysts expect earnings of EUR four per share for 2022.

Roche ($RHO5 (-3.01%)) / Novartis ($NOT (-0.67%)) - In order to achieve full strategic independence, pharmaceutical giant Roche has repurchased from a competitor Novartis its Roche shares for 19 billion Swiss francs. It was agreed to buy back 53.3 million shares at a price of 356.9341 Swiss francs. Christoph Franz said that he is convinced that this planned transaction is in the best interest of Roche and its shareholders from a strategic and economic point of view.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Commonwealth Bank ($CWW (-1.4%)) - Australia's largest bank stated over the past day that they are working on making Bitcoin and other cryptocurrencies tradable for their customers in the coming weeks. Furthermore, they elaborated that they also want to offer it to their customers to store the cryptocurrencies for them. Initially, only Bitcoin ($BTC-EUR (-0.56%)), Bitcoin Cash ($BCH-EUR (-0.47%)), Ethereum ($ETH-USD (-0.59%)) and Litecoin ($LTC-EUR (-0.79%)) will be available. The implementation will take place in collaboration with Gemini, a U.S.-based company specializing in the safekeeping of crypto assets. Commonwealth Bank is by far the largest financial institution on the continent, with total assets of $688.4 billion, so this news is a big step for the crypto industry.

Follow us for french content on @MarketNewsUpdateFR

Trending Securities

Top creators this week