Greetings,

I generally don't think much of posts on feeds from any media, as they don't bring me any added value but merely serve to present myself. Now that I have followed the publications and reactions a bit, I think I have seen more than less constructive members here.

For this reason, I have decided to make the first post of my life here. It's not directly about sums, I just want to ask for your assessment of my savings plan and target allocation. Constructive criticism and suggestions for improvement are expressly welcome.

The whole thing is intended to reflect a core-satellite strategy with a 1:1 risk/reward ratio.

Global diversification (core) - 60%:

Individual securities (satellites) - max. 20%:

Buffer (security) - approx. 20%:

Raw materials:

Bonds:

Real estate:

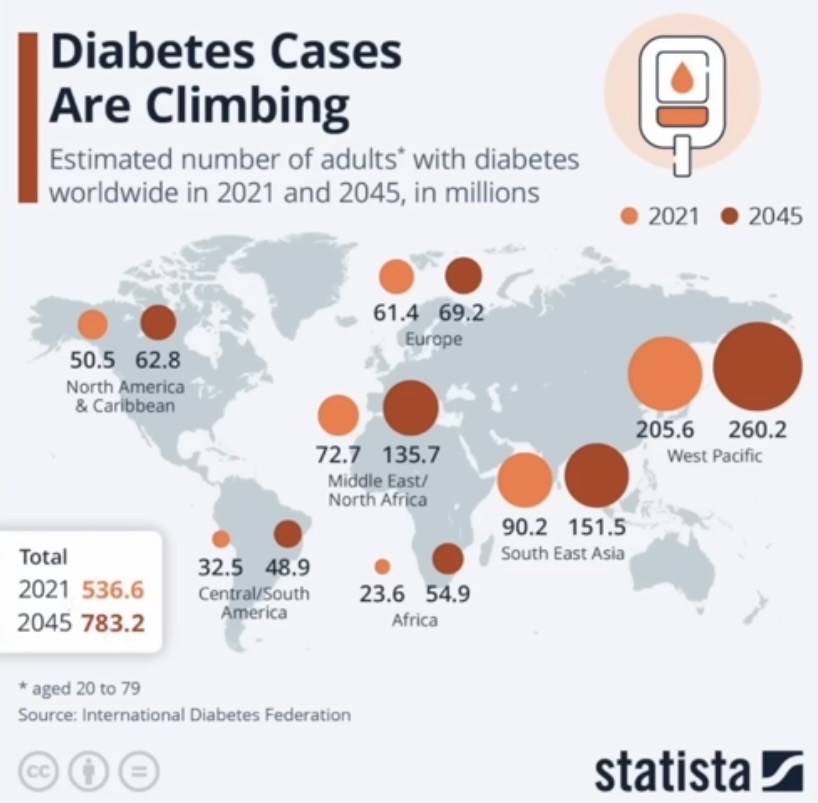

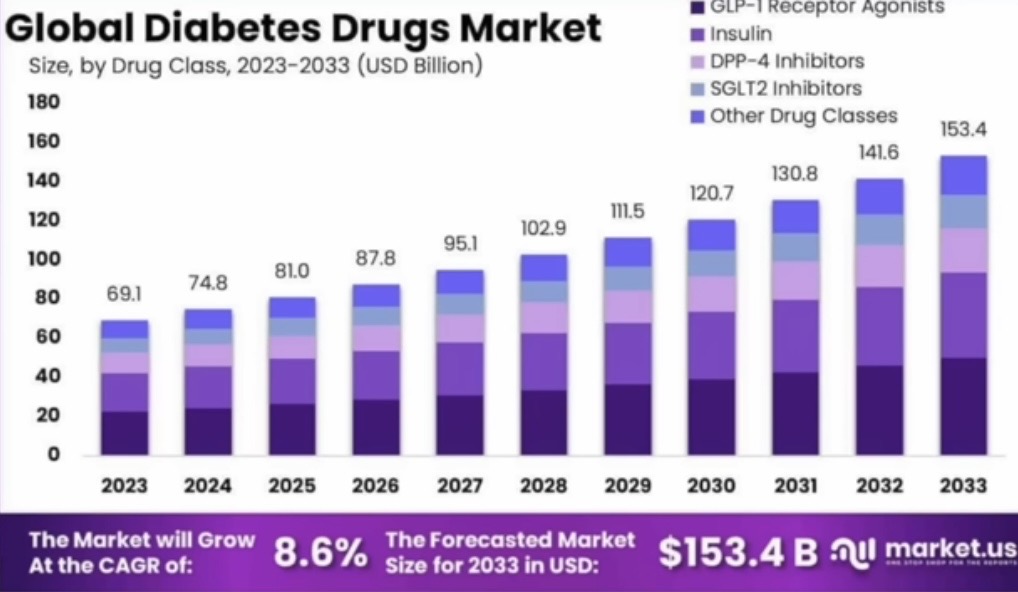

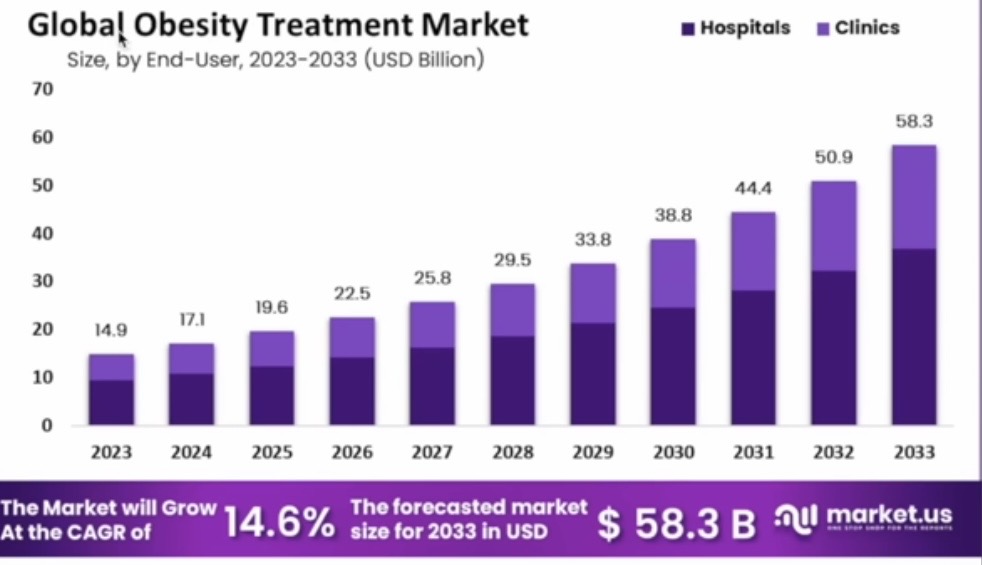

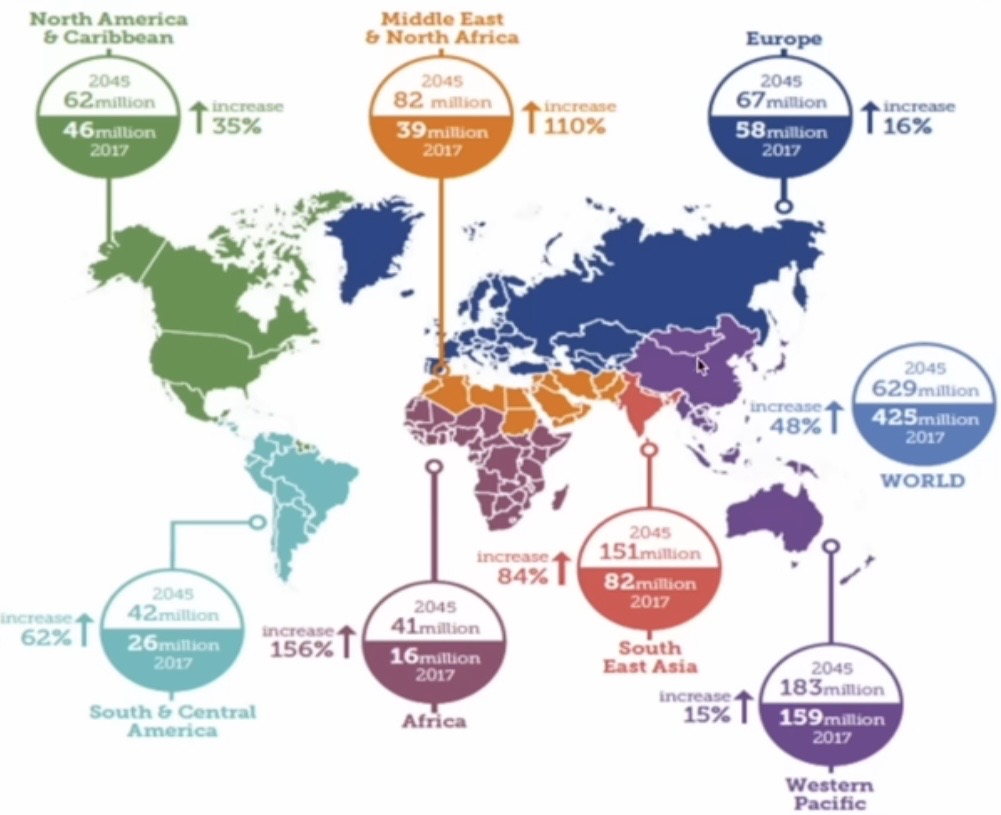

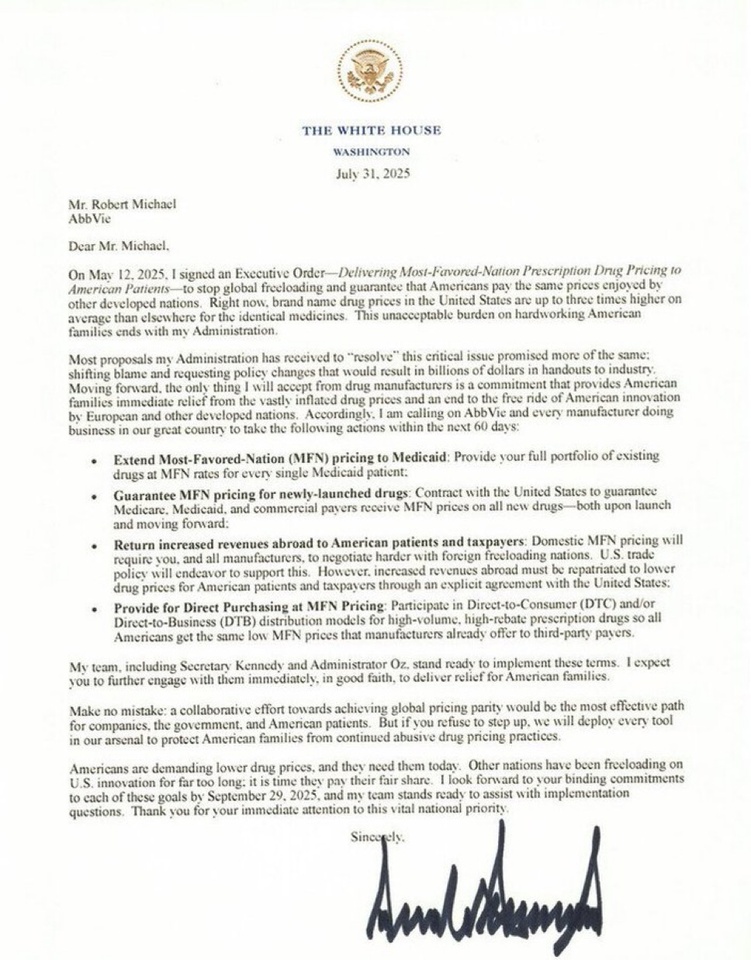

My thought process should be clear. The core should cover global performance with a percentage distribution based on economic strength. Separately, the World Health Care ETF, as people are getting older and sicker and, in my opinion, the healthcare sector is not so strongly represented in the other ETFs.

For the satellites, my thought process is as follows:

Berkshire can be seen as an ETF and covers successful individual stocks.

Nothing works without energy, hence BWX (USA) and Iberdrola (Europe). I see digital security threatened by AI and the further development of data centers etc., hence CrowdStrike. Companies will always need good software to be able to expand and still keep track of things, hence HubSpot. In connection with AI and the armed conflicts in our world, I see drones as a future-oriented technology in all possible areas, hence AeroVironment. And I discovered Intellia as a medical catapult, which is admittedly a bit of a gamble, but always gets a lot of drugs into the test phase.

I don't think I need to say much about the buffers, as in my view these are the investments that remain stable or grow in difficult market phases when everything else is falling.

This gives you a little insight into my thinking and actions. Please don't tear it apart, I'm not a professional but I'm sacrificing some of my remaining free time to get a bit of an insight into the world of capital and maybe get a small slice.

I welcome any opinions and suggestions for improvement.

I wish everyone a successful week!

Best regards

Nils