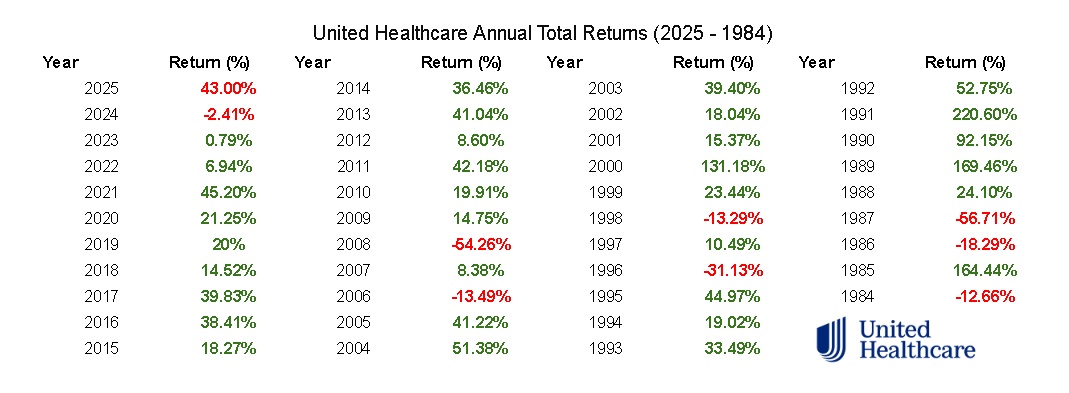

$UNH (-1.16%) has not experienced two consecutive years of negative returns since 1987.

Who is still invested here, who is buying, what are your assessments? 🤔

In my opinion, a lot of negative things are already priced in here.

- There is no evidence for the accusations

- Every accusation is contradicted and more openness is also suggested

- They are regularly reviewed and nothing negative has been found

- Bad "old" news is constantly being rehashed which has already been dismissed as unfounded and unproven

- CEO and other insiders have set an example by buying it

- $UNH (-1.16%) is one of the largest employers in the US and also system relevant

- Medicare/Medicaid accounts for only 15% of revenue

- Outlook/expectations have already been reduced

- Historically high dividend yield of just under 3%

- Possible penalties already priced in in my opinion

yes, of course there is still downside potential, but the risk/reward ratio is already very attractive

The entire sector has similar ways of working and a decline/reduction in Medicare could $UNH (-1.16%) as the top dog in the private sector could even play into its hands.

UnitedHealth Group $UNH (-1.16%) has traded at the largest deviation from the S&P 500 price-to-earnings ratio since its IPO ...

This stock has literally NEVER been this cheap relative to the S&P 500.

Incredibly exciting to follow the story.

$CNC (-1.13%)

$CVS (-0.55%)

$OSCR (-1.47%)

$HUM (-0.66%)

$CI (-1.01%)

$ELV (-2.75%)

$XDWH (-0.88%)