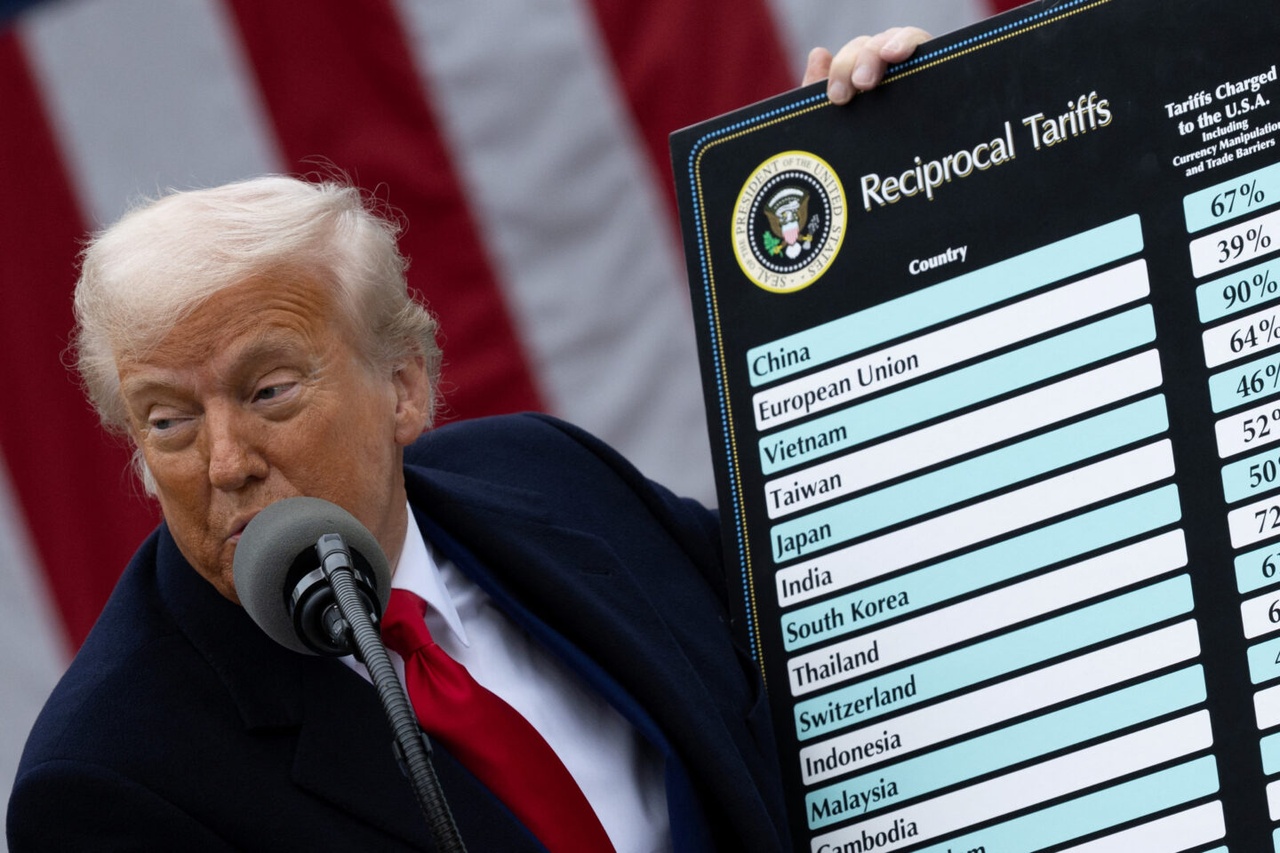

After Switzerland, Brazil and the EU, India has become the latest target of Donald Trump’s trade war fantasies. India now faces a tariff rate of up to 50% for purchasing oil from America’s legacy enemy Russia.

Why is President Trump doing this? Doesn’t it do more harm than good to his economy and global trade relations? Probably, but the truth is that the former businessman doesn’t seem to care much. By know, we know his tactic: Scare the enemy. No matter how mighty their economy may be, slap a ridiculously high tariff on them, then start negotiating.

While seasoned diplomats or old-school presidents might prefer to talk first, threaten later, if inevitable, Trump flips the script. In fact, he’s a bully, the greatest of them all. And the negative connotations of the word “bully” aside, his strategy seems to work. President Trump has a unique ability to force outcomes that favor his agenda.

We started the year with practically zero tariffs on major imports. Then came April 2nd, “Liberation Day”, where markets experienced a cold awakening. That day, everybody’s worst fears came true: exorbitant tariff rates on every country from Germany to the Easter Islands. No one was spared. And what was the cherry on top? The rates were based on a flawed formula not even his advisors seemed to fully grasp, though I doubt Peter Navarro could grasp the breakfast menu, let alone math. The man that managed to start a feud with everyone, from Elon Musk to John Doe.

Since then, several deals have been struck, with varying degrees of success. The EU, for instance now faces 15%, which is celebrated as a massive win, while forgetting that it’s 15% points more than before. And what did markets do? Nothing. Completely disconnected from fundamentals, equities marched higher setting fresh all-time highs.

While that’s largely due to the phenomenon of the “TACO-Trade”, what investors take lightly is the fact that tariffs remain elevated and significantly higher than last year. Yes, Trump tends to chicken out, but his plan is more calculated than it appears: The order of events is repetitive:

1. Look for a camera

2. Announce absurd tariffs, while markets collapse and WSJ’ journalists type their fingers sore

3. Extend the deadline a few days later

4. Strike a “historical”, though rather symbolic deal

5. Redistribute corporate profits into Treasury coffers

But enough criticism for now. In the end, only time will tell whether Trump’s strategy results in an economic boom and global investment into the U.S., or a lasting decline in American influence and global standing. Though I would bet on the latter.

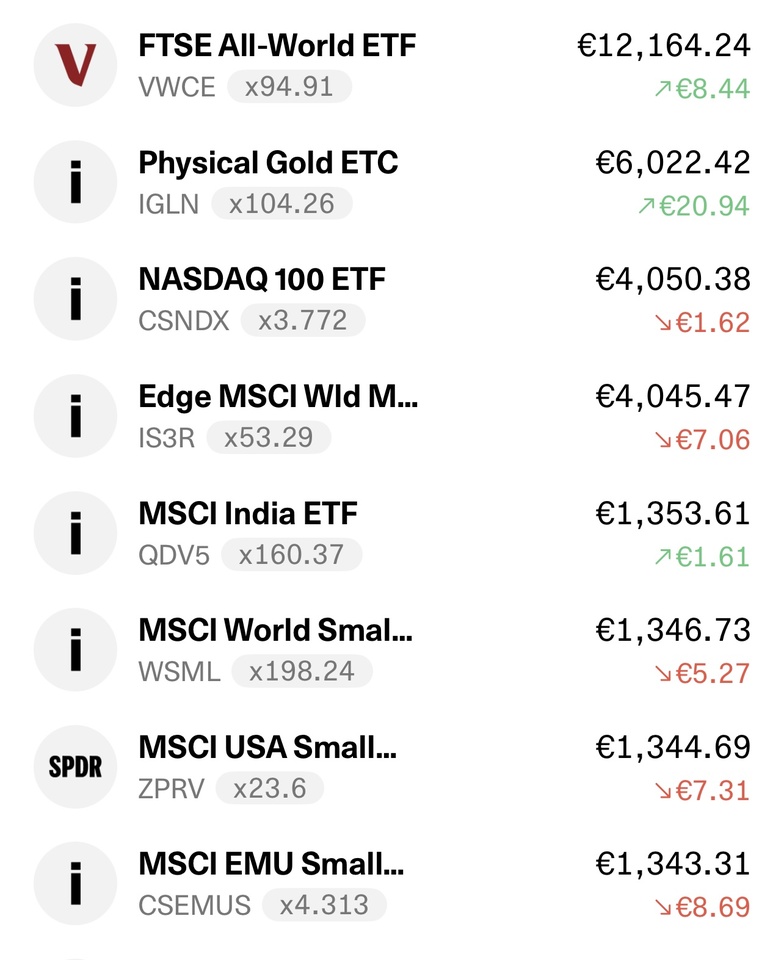

$IWDA (+0.57%)

$EIMI (+1.48%)

$LYPS (+0.63%)

$QDV5 (+1.98%)

$VWRL (+0.63%)

$VWCE (+0.76%)

$MEUD (+0.81%)

$MEU (+0.89%)

$SEMI (+1.78%)

$CSNDX (+0.8%)

$AAPL (+1.51%)

$NVDA (+1%)

$AMZN (+2.51%)

$NOVO B (-2.32%)

$AMD (-1.53%)

$MU (+2.55%)

$ASML (+0.76%)

$TSLA (-0.19%)