$KSPI (-1,72%)

$NCLH (+3,06%)

$STNE (+0,93%)

$BEI (-2,11%)

$SE (-1,89%)

$ONON (-1,26%)

$TGT (-0,77%)

$GTLB (-1,4%)

$CRWD (+0,74%)

$BAYN (+4,78%)

$WIX (-1,74%)

$ADS (-1,1%)

$AVGO (+3,82%)

$DHL (+0,66%)

$R3NK (-0,32%)

$JD (+1,61%)

$BILI (+6,13%)

$1913 (-0,24%)

$MRK (-1,13%)

$MRVL (+2,8%)

$GPS (-2,15%)

$COST (+0,36%)

$IOT

$LHA (-3,6%)

Discussão sobre WIX

Postos

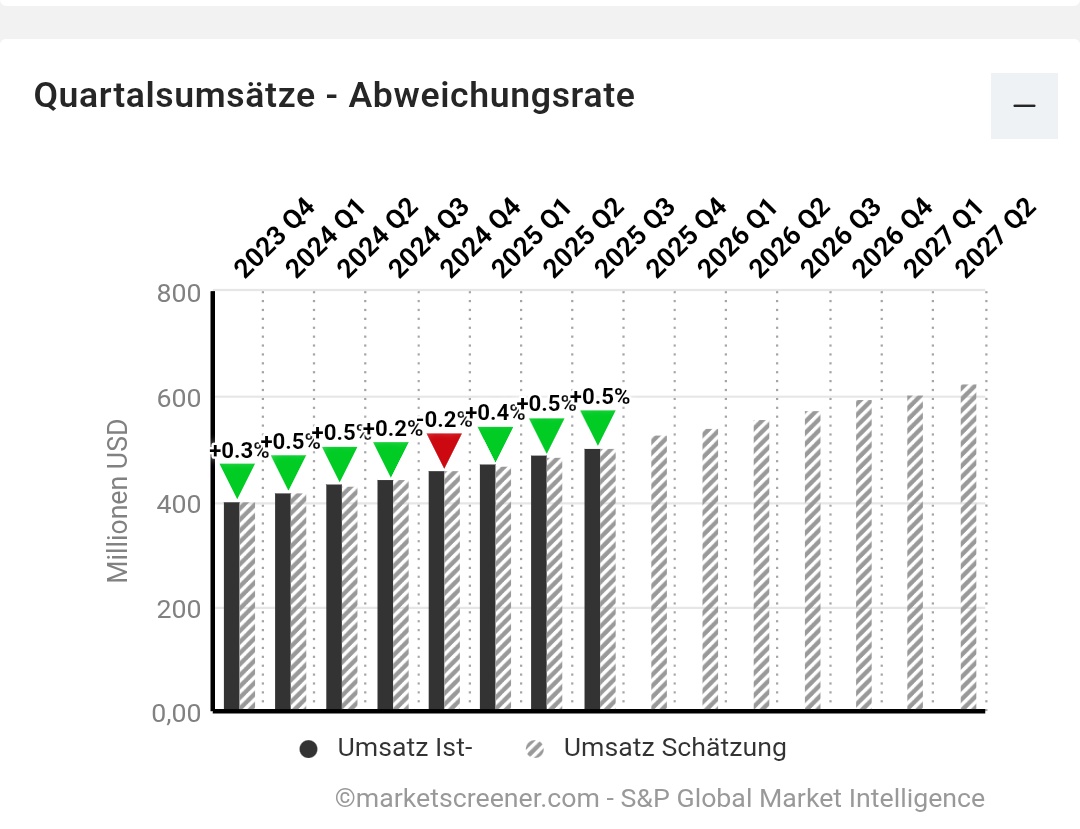

12Quarterly figures 02.03-06.03.26

Rewind January 2026

I don't know if the display is quite correct, but what about you? :)

$RKLB (+1,66%)

$NBIS (+5,83%)

$DLO

$HROW

$OMDA (+2,32%)

$PGY

$WIX (-1,74%)

@Klein-Anleger

@Iwamoto

@PikaPika0105

@Semos25

Wix market error: Why the stock market values a billion-euro potential at zero

We are dealing with an asymmetrical setup here: On the downside, the share is protected by a highly profitable core business, while on the upside there are considerable opportunities that the market has hardly noticed so far.

The Wix case: from "SaaS dinosaur" to AI bet

The current market narrative is simple: AI is making website builders superfluous, Wix is finished. But this pessimism is precisely where the opportunity lies.

The initial situation: market scepticism and AI fear

Investors believe that software barriers are melting. If anyone can build websites using voice commands, why do we still need Wix?

Legacy stamp: The share is valued as a discontinued model, as if a structural decline were inevitable.

The game changer: Base44

Change of strategy: Instead of just defending the old business, Wix has fully focused on AI-native app building with the acquisition of Base44 (June 2025).

Valuation gap: While private AI start-ups are valued at billions, Wix currently receives "zero" credit from the market for its AI division.

The asymmetrical setup

Security (downside): The core business generates massive cash (strong FCF) and finances share buybacks. This stabilizes the share price.

Leverage (upside): Base44 could revolutionize the way software is built. As soon as this is reflected in the figures, the market will have to adjust the valuation massively upwards.

Conclusion: You are buying a highly profitable cash machine at a "junk price" and getting one of the most exciting AI bets in the software sector for free on top.

Wix was born out of a simple but groundbreaking realization: most people who want to be present online are not engineers or computer scientists, and they shouldn't be forced to think like them. When Wix launched in 2006, creating a website still meant the hassle of dealing with hosting providers, technical installations, constant maintenance and a long list of technical details that had nothing to do with running a business. Wix's breakthrough was not a purely technical innovation, but the principle of abstractionDesign, infrastructure, hosting, updates and later also online commerce were bundled into a single, reliable platform that even non-technical users could trust.

This abstraction proved to be extremely effective. Despite the skepticism of tech-savvy providers, Wix eventually developed into one of the world's largest software platforms for small and medium-sized enterprises. Today, the company serves hundreds of millions of registered users and has built one of the strongest brands in this field. Importantly, the product did not remain a simple website builder. Wix has evolved in line with the growing needs of its customers. What began as a tool for publishing simple pages became a comprehensive operating platform for small businesses.

Wix's success is not based purely on technical innovation, but on the abstraction of complexity. Wix recognized early on (2006) that most users want an online presence without having to deal with technical hosting, maintenance or infrastructure.

Today, Wix encompasses far more than just building websites. It includes e-commerce, payment processing, booking systems, email marketing, analytics, domains and an ever-growing range of business solutions that build on top of the core site. For many users, Wix is no longer just the place where their website "lives", but the hub through which key parts of their business operations run. This breadth is critical because it transforms Wix from a simple standalone solution into a deeply rooted infrastructure.

The result is a platform that sits right at the intersection of simplicity and functionality. Wix doesn't compete by offering maximum flexibility or full technical control. It competes by removing complexity, bundling features and allowing users to focus on the outcome rather than the technical implementation.

The "SaaS panic mode": Why Wix is under pressure

The market is currently asking itself an existential question: what is software still worth when AI can create it almost for free? Investors' fears are based on three trends:

1. the end of the "pixel barrier"

Designing a website used to be work. Today, the creation of front-ends (landing pages, simple websites) by AI has become a commodity product. Those who are only "easy to use" are losing their moat because AI tools massively reduce the effort required to switch platforms (switching costs).

2. from menus to "vibe coding"

We are experiencing a paradigm shift in software interaction:

Old: rigid menus, templates and drag-and-drop panels.

New: vibe coding. Users describe what they want and the software materializes dynamically around this intention. In this world, static modular systems suddenly seem like relics from the Stone Age.

3 The erosion of relevance

When software becomes "fluid" and constantly changes through instructions, rigid products lose relevance. Investors fear that platforms that are only fixated on one output (the website) will be marginalized in an ecosystem of automated workflows and AI agents.

Wix is not ignoring the change

The management has made it explicitly clear that AI is not a cosmetic addition, but a structural change.

- Product side: With the launch of Wix AI Studio, users can create and manage websites using natural language. Wix is positioning itself here as an AI-mediated operating level.

- Visibility: Wix emphasizes that for companies today it is no longer just about Google rankings, but about being correctly represented and "actionable" within AI assistants such as ChatGPT or Gemini. Thanks to vertical integration, Wix can complete transactions (bookings, payments) directly within its infrastructure instead of passing users on to third-party providers.

- Commercial strategy: Wix is increasingly focusing on multi-year subscriptions and higher prices for standard tariffs. The aim is to increase revenue predictability and focus on high-intent users while accepting higher churn at the lower end of the market.

For users who utilize integrated payments and workflows, switching isn't just a new design, it's the unraveling of an entire operating system. Paying a few hundred dollars more per year is often more rational than this loss of friction.

More than just defense: Why Wix had to close the gap

To address exactly this, Wix secured Base44 in June 2025.

This deal was not about a few cosmetic upgrades for the website builder. It was about taking Wix's recipe for success of radically simplifying complex technology to the next level of the software stack. In a world where AI creates sleek websites almost at the touch of a button, the real problem for companies is no longer design. The real bottleneck today is the question: how does the business actually run in the background?

Wix has always been the first port of call for people who want results rather than fiddling with tools. Base44 serves exactly the same type of people, but occupies a field that Wix has so far ignored: internal software and operational logic. In other words, precisely the workflows that previously required either expensive developers or rigid standard software.

Instead of wasting valuable time on in-house development in an extremely fast-paced market, Wix made a smart purchase. They grabbed a product that already had traction and shared the same DNA. Base44 is not a replacement for what Wix was doing before, but the perfect add-on for a new era: custom apps.

Base44 occupies a completely unique niche in the vibe coding trend.

While other tools are aimed at devs or tech nerds, Base44 is the radical solution for people who have absolutely no idea about code and don't want to have any. Basically, Base44 is exactly what Wix used to be for websites: a tool that delivers results without you having to know how it works technically.

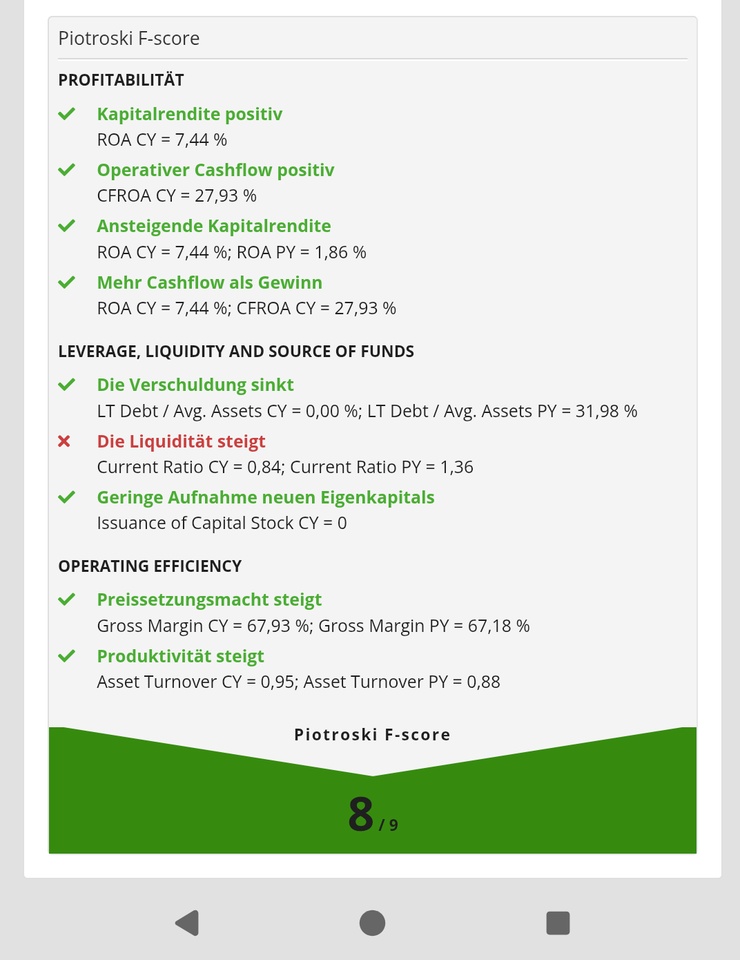

Wix core business: Already strong, still on course for success

At the core business level, Wix's margins remain extremely healthy and should continue to improve in 2026 according to management. As of the last quarter, the FCF margin (free cash flow) is over 30%, while the gross margin has remained stable at around 68% in recent years.

The drivers for this:

-Economies of scale: Classic economies of scale in the software sector.

Terms: As mentioned above, Wix has moved to multi-year subscriptions for its most engaged users. This not only increases the predictability of revenue, but also lowers the cost of customer retention.

-Pricing: By increasing list prices for standard plans, Wix is effectively divesting itself of its lowest margin customers. This leaves a core base of more professional partners and serious SMEs with a much higher LTV (Lifetime Value) relative to their support costs.

-AI efficiency: AI improves internal productivity, from support to development.

-Discipline: Organizational discipline is being tightened. Wix recently asked its employees to return to a 5-day office attendance requirement. There are rumors that this was a deliberate attempt to encourage voluntary resignations. If true, this would be positive for margins in the short term. Shopify operates with much better efficiency ratios per employee, suggesting that Wix still has room for improvement here without jeopardizing operational execution.

Base44: Margin brake today, margin lever tomorrow

The real confusion arises at Base44.

In the short term, Base44 is pushing margins down. This is mainly due to the high marketing expenses and the costs for AI/LLM inference, which management classifies as variable and quickly scalable (up or down).

Despite this burden, management continues to expect FCF margins of "at least" mid-20% for 2026, which is still extremely healthy.

Currently, Base44's gross margins with paying users are already at 30-40%, with a clear path upwards.

Base44 is sacrificing short-term margins for long-term profitability.

- Decreasing AI operating costs: The most expensive phase (the initial building of an app) is at the beginning. As soon as an app is up and running, the computing costs (token consumption) fall dramatically. As the prices for AI models on the market generally fall at the same time (deflation) and the technology becomes more efficient, the profit margin per existing user increases automatically.

- Delayed profitability (cohort effect): Marketing and AI costs are incurred immediately, while revenue flows monthly. The balance sheet currently looks "worse" than it is due to strong growth. From 2027, the mature, highly profitable user groups should outweigh the costs for new customers.

- Efficiency lever: Technical fine-tuning (caching, intelligent routing) and increasing brand awareness (falling acquisition costs) will make every dollar invested more efficient.

- Stabilization through Wix: While Base44 still has many monthly subscriptions, the stable core business of Wix (80% long-term subscriptions) supports the company financially until Base44 develops its full margin potential.

At the moment, it is not about optimizing every cent of profit immediately. The goal is clear: Wix is using its enormous reach and sales power to take the market for "vibe coding" (AI-supported programming) by storm. While Wix takes care of the sales, the Base44 team can keep its head clear and concentrate fully on developing the product as well and as quickly as possible.

This is a huge competitive advantage: unlike many start-ups, Base44 doesn't have to waste time looking for investors or constantly looking at their bank account in a panic. They have their backs free to simply build the best product.

This division of labor works: Base44 is growing extremely quickly and, according to current analysis data, is leaving the competition far behind in terms of user traffic.

Conclusion

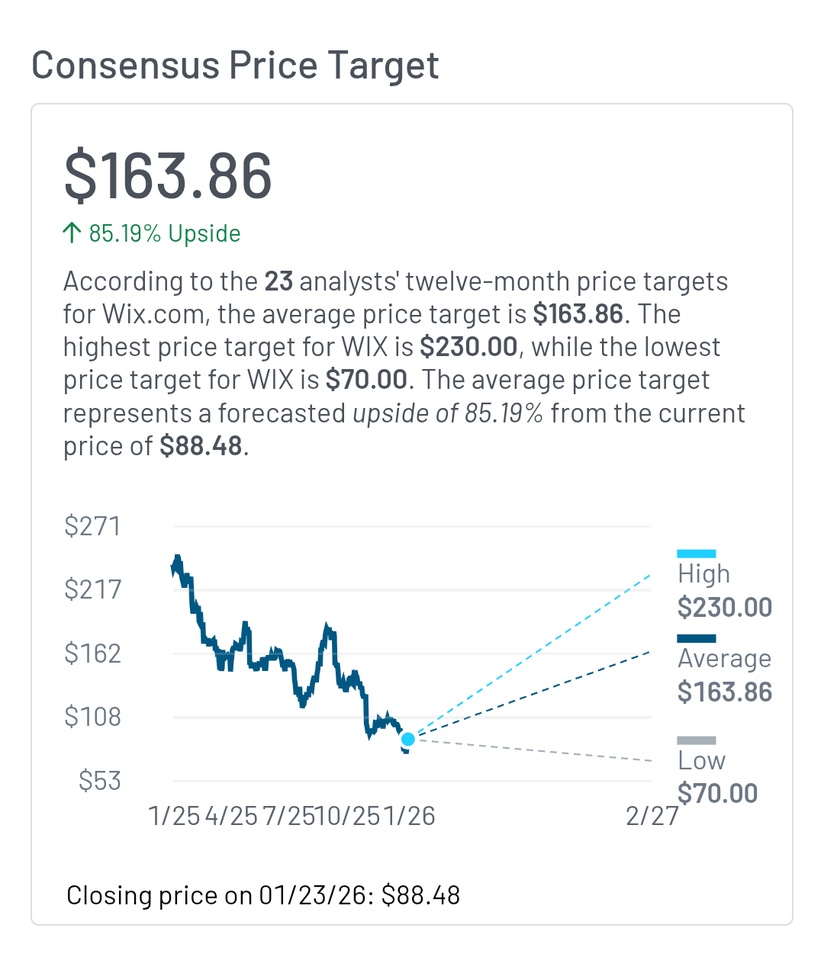

Ultimately, it's not about Wix being a perfect company. It's about the gap between the current market price and what Wix actually owns.

On the one hand, the market is treating Wix like a struggling software company with declining growth. The valuation reflects the skepticism towards old business models: anything that is considered "outdated" in an AI-driven world is punished. From this perspective, there is already a lot of bad news in the current share price.

On the other hand, here we have a company that continues to earn massive cash (FCF), returns money to shareholders and owns a rapidly growing AI platform (Base44). Base44 doesn't even need to "save" the old core business for this math to work out. It is enough if it continues to grow so successfully that it can no longer be ignored.

The upside opportunity: Base44's potential is currently valued at practically zero euros, mainly because it is not yet big enough in the company's overall figures to stand out. Once Base44 goes from a small experiment to a visible revenue driver, the market can no longer ignore this opportunity.

Important: This is not a bet on a quick profit next week. Sentiment for software stocks is currently poor and the chart does not look inviting. I wouldn't be surprised if the share becomes even cheaper at some point, even if I think the current price is already extremely attractive in relation to the risk.

+ 1

3-point checklist for the turnaround - does Wix have what it takes?

The stock market year is coming to an end and the cards are being reshuffled. Because stock market history shows: Today's losers are often tomorrow's stars.

On the winners' podium

The year is slowly drawing to a close. The big winners and losers have been announced.

The top 5 in the S&P 500 this year consists almost entirely of hardware manufacturers. With share price gains of between 216 % and 560 %, Sandisk, Western DigitalSeagate, Robinhood and Micron occupy the top spots.

Anyone who was there can rejoice. For example, I commented positively on Seagate and Micron several times during the year.

At the other end of the range are Trade Desk, Fiserv, Deckers OutdoorAlexandria Real Estate and Gartner. The share price losses are between 48 and 68 %.

The astonishing thing is that some of these shares were previously long-term performers.

As in every year, the question arises as to which shares offer the potential for a turnaround. Experience shows that the losers from one year always rise sharply in the following year. There are several examples of this.

Micron, for example, crashed significantly in the course of 2024 and was trading at around USD 61 just a few months ago - today the price is around USD 265.

But caution is advised: Most shares have crashed with good reason. A successful turnaround therefore requires a healthy core business that has only been impacted by temporary factors or economic headwinds.

The 3-point checklist for a turnaround

Before investing in a stock that has crashed, you should ask yourself three questions:

Has the stock crashed because there are general economic problems or the industry has fallen out of favor? Or are there structural problems?

Is there a reason why 2026 could be better? For example, through cost-cutting programs, an improving economy, falling key interest rates, new management, etc.?

Is the company on a solid footing or could it be in trouble?

A company should meet all of these criteria. Ideally, business should be going well and the share price should have fallen for other reasons. An astonishing number of shares currently fall into this category.

Just as some supposed or real AI winners have virtually gone through the roof, many supposed AI losers have also crashed.

Stock market losers with potential

In my view, Wix is a particularly extreme example. The share has lost more than half of its value, even though the company has consistently delivered.

There are fears on the stock market that the website builder business will be displaced by AI. This thesis cannot simply be dismissed out of hand. However, it seems to overlook the fact that Wix does not earn its money with the website builders themselves, but with the associated services such as hosting, marketing packages, payment processing, etc.

If companies and private customers create their websites with an AI instead of a website builder in the future, they will still need all of these services.

On top of that, they could use Wix's AI, because the company is of course not idle in this area - quite the opposite. With Base44, Wix is one of the stronger companies in this area and appears to be gaining market share.

This is an AI-supported platform that can create fully functional individual apps based on simple text commands - completely without programming.

When the narrative changes ...

Wix could therefore just as easily be classified as an AI winner. If the narrative on the stock market changes, the valuation is also likely to change drastically.

According to recent press reports, OpenAI has just secured fresh capital. In the financing round, the company was apparently valued in the high three-digit billion range, although OpenAI does not yet have an established business model.

Wix, on the other hand, is highly profitable and Base44 is growing at an enormous pace. One can and may ask oneself what stock market value Base44 would currently achieve on its own.

At the end of the year, the annualized turnover should be USD 40 - 50 million.

Base44 now has more than 2 million users and is gaining more than 1,000 new paying customers every day.

The growth momentum is increasing and has far exceeded expectations. I would not be surprised if Base44's turnover increases to USD 100 - 200 million in the coming year.

Bottom formation or next setback?

All this is underpinned by an equally growing core business. In the course of the quarterly figures, the forecast for sales in the current financial year was raised from USD 1.97 - 2.00 billion to USD 1.98 - 2.00 billion and for free cash flow from USD 590 - 610 million to USD 595 - 610 million.

This gives Wix a P/FCF of slightly less than 10.

A few days after the quarterly figures, further share buybacks were therefore decided and the budget for this was increased by USD 200 million to USD 500 million, which corresponds to more than 8% of the market capitalization.

There are therefore several possibilities that could cause share prices to rise. On the one hand, Wix has a profitable core business, which enables share buybacks on a large scale and has a low valuation. In addition, there is the growth in the core business and Base44 and the possibility that the market could appreciate the value of Base44 more in the future.

Wix share: Chart from 22.12.2025, price: USD 104.43 - symbol: WIX | source: TWS

The share is currently trying to form a bottom near the support zone at USD 92 - 100. Starting from this base, there could now be a recovery towards USD 115 or 118.

The chart picture would brighten above USD 120.

However, if the share falls below USD 92, the bulls will have lost their chance for the time being.

Source

Hidden Gem?

The analysis of Wix.com Ltd.'s latest business figures and strategic developments following the publication of Q2 2025 results on August 6, 2025 shows a company in a phase of significant transformation and strong operational performance.

The remarkable earnings per share of $2.28, which significantly exceeded expectations, as well as the acceleration of revenue growth and bookings for new cohorts reaching pre-COVID peak levels, are clear indicators of improved operational efficiency and successful strategic execution.

Wix is pursuing a sophisticated, multi-pronged growth strategy. The aggressive investments in AI-powered website builders, the acquisition of Base44 to tap into the application development market and the launch of financial services for merchants position Wix as a more comprehensive digital business platform that goes beyond just website building. This diversification into higher value segments and new revenue streams strengthens the resilience of the business model and offers significant potential for sustainable growth in average revenue per user.

The strong growth forecasts for the AI market in web development and the overall website builder market also provide a favorable macroeconomic tailwind.

Nevertheless, Wix is not without risks. The market is highly competitive and saturated, especially with dominant players such as WordPress and Shopify.

Despite these challenges, the opportunities outweigh the risks. The current valuation of the stock, which is close to its 52-week low, combined with the recent positive financial results and analysts' optimistic price targets, indicates an attractive risk/reward ratio.

Wix's ability to drive innovation and adapt to changing market demands, particularly through the increased use of AI, makes the company a promising candidate for investors interested in long-term growth in the digital ecosystem.

In view of the strong Q2 performance, the strategic expansion into high-growth areas and the attractive risk/reward ratio, a Strong Buy recommendation is issued for Wix.com Ltd.

Source: Deepsearch Gemini

The investment bank sees these stocks as the big beneficiaries of AI adaptation

$AAPL (+0,7%) Apple, Inc. (ISIN: US0378331005)

$ADBE (-0,51%) Adobe Inc (ISIN: US00724F1012)

$AES (+0,01%) AES Corp (ISIN: US00130H1059)

$AMZN (-0,22%) Amazon.com Inc (ISIN: US0231)

$APP (+3,2%) AppLovin Corp (ISIN: US03831W1080)

$AXON (-2,63%) Axon Enterprise, Inc. (ISIN: US05464C1018)

$BE (+9,65%) Bloom Energy Corp. (ISIN: US09

$CRM (-1,39%) Salesforce.com, Inc. (ISIN: US79466L3024)

$GOOGL (+2,31%) Alphabet Inc (Class A) (ISIN: US02079K3059)

$GTLS (-0,17%) Chart Industries, Inc. (ISIN: US16115Q3083)

$HUBS (-3,24%) HubSpot Inc (ISIN: US4435731009)

$JCI (+0,18%) Johnson Controls International plc (ISIN: IE00BY7QL619)

$NEE (+0,51%) NextEra Energy, Inc (ISIN: US65339F1012)

$NVDA (+2,01%) NVIDIA Corp (ISIN: US67066G1040)

$SLB (-0,12%) Schlumberger N.V. (ISIN: AN8068571086)

$SPGI (-1,51%) S&P Global Inc (ISIN: US78409V1044)

$TSLA (+0,13%) Tesla Inc (ISIN: US88160R1

$TT (+0,85%) Trane Technologies PLC (ISIN: IE00BK9ZQ967)

$$VRTX (+7,9%) Vertex Pharmaceuticals Inc (ISIN: US92532F1003)

$VERTEX (-0,21%) Vertex, Inc (ISIN: US92538J1060)

$VST (+2,36%) Vistra Corp (ISIN: US92840M1027)

$WIX (-1,74%) Wix.com Ltd (ISIN: IL0011301780)

Morgan Stanley expects these companies to benefit greatly from the global trend towards AI integration, whether through leading chips such as NVIDIA, cloud and software solutions such as Amazon, Alphabet or Salesforce, or specialized applications in energy, industry and biotechnology. With tech giants expected to invest almost 400 billion US dollars by 2026, demand in many of these segments could explode. But while the list reads impressively, there is still the intriguing question of who will ultimately benefit not only from the hype, but also from the sustainable use of this technology.

Source: Boerse-Online (Morgan Stanley report on AI-related stocks)

Image material: Techa Tungateja/iStockphoto

WIX Q4'24 Earnings Highlights

🔹 Adj. EPS: $1.93 (Est. $1.59) 🟢

🔹 Revenue: $460.5M (Est. $461.75M) 🟡; UP +14% YoY

🔹 Bookings: $464.6M (Est. $461.75M) 🟢; UP +18% YoY

🔹 Free Cash Flow: $131.8M (Est. $130.12M) 🟢

Q1'25 Guidance:

🔹 Revenue: $469M-$473M (Est. $481.47M) 🔴; UP +12-13% YoY

FY'25 Guidance:

🔹 Revenue: $1.97B-$2.0B (Est. $2.018B) 🔴; UP +12-14% YoY

🔹 Bookings: $2.03B-$2.06B (Est. $2.08B) 🔴; UP +11-13% YoY

🔹 Free Cash Flow Margin: 30-31% (Est. 29%) 🟢

Q4'24 Segment Revenue:

🔹 Creative Subscriptions: $329.7M (Est. $330.46M) 🟡; UP +11% YoY

🔹 Business Solutions: $130.7M (Est. $131.31M) 🟡; UP +21% YoY

🔹 Partners: $168.1M; UP +29% YoY

🔹 Transaction: $57.1M; UP +23% YoY

Q4'24 Geographical Insights:

🔸 ~40% of revenue from non-USD currencies; FX headwinds expected in 2025

Other Q4'24 Key Metrics:

🔹 Creative Subscriptions ARR: $1.343B; UP +13% YoY

🔹 Non-GAAP Gross Margin: 70%; Flat YoY

🔹 Creative Subscriptions Gross Margin (Non-GAAP): 85%; UP +1% YoY

🔹 Business Solutions Gross Margin (Non-GAAP): 32%; UP +2% YoY

🔹 FCF Margin: 29%; UP from 22% YoY

Announcements & Strategic Updates:

🔸 Completed $200M share repurchase in Jan 2025; $725M total since Aug 2023

🔸 Achieved first year of positive GAAP operating income in 2024

🔸 On track for Rule of 45 in 2025 at high end of outlook

Management Commentary:

🔸 "Wix sets a high standard for innovation and creativity, and we’re constantly exceeding expectations," said Avishai Abrahami, Co-founder and CEO. "2025 is poised to reimagine and expand the Self Creator experience with two transformative products planned for the spring and early fall, delivering immense value to users and accelerating growth."

🔸 "We wrapped 2024 with accelerated growth and profitability, driven by successful execution of our product roadmap and pricing strategy," added Lior Shemesh, CFO. "Solid growth coupled with efficiencies puts us on track to achieve Rule of 45 in 2025."

Wix Q3 FY24 #EarningsReport Summary | $WIX (-1,74%)

In Q3 FY24, http://Wix.com sustained strong momentum through strategic AI integrations, robust partner activity, and innovative product launches. These efforts culminated in accelerated bookings growth and increased profitability metrics.

📊 Income Statement Highlights (vs Q3 FY23):

▫️ Net Income: $26.78M vs $6.98M (+283.70%)

▫️ Revenue: $444.67M vs $393.84M (+12.91%)

▫️ Adjusted EPS: $1.50 vs $1.10 (+36.36%)

▫️ Total Bookings: $449.80M vs $389.10M (+15.62%)

▫️ Free Cash Flow (FCF): $127.76M vs $44.77M (+185.46%)

📊 Segment Revenue Highlights:

▫️ Creative Subscriptions: $318.83M (+9.71%)

▫️ Business Solutions: $125.85M (+21.98%)

💼 Balance Sheet Highlights:

▫️ Total Assets: $1.71B

▫️ Cash and Cash Equivalents: $439.43M

▫️ Deferred Revenues: $656.67M

🔮 Future Outlook:

Wix has raised its FY24 revenue outlook to $1.76B, projecting 13% YoY growth. It anticipates continued AI-driven momentum, robust cohort retention, and FCF margin expansion into FY25.

Títulos em alta

Principais criadores desta semana