Top Movers

$DE (+0,02%) +20%

$CNQ (+1,49%) +17%

$CNR (-0,09%) +17%

$8002 (-5,32%) +17%

$CSL (-0,89%) +17%

Top Loosers

$HIMS (-3,74%) -44%

$NOVO B (-1,92%) -32%

$3350 (-4,28%) -30%

$MELI (-1,24%) -18%

$BX (-1,51%) -17%

Messaggi

913Top Movers

$DE (+0,02%) +20%

$CNQ (+1,49%) +17%

$CNR (-0,09%) +17%

$8002 (-5,32%) +17%

$CSL (-0,89%) +17%

Top Loosers

$HIMS (-3,74%) -44%

$NOVO B (-1,92%) -32%

$3350 (-4,28%) -30%

$MELI (-1,24%) -18%

$BX (-1,51%) -17%

In terms of my portfolio performance/volatility, the last few weeks have probably been the craziest weeks since I started investing. Within a week, my portfolio lost over 100,000 euros in value during the precious metals crash only to gain back over 200,000 euros in value in the subsequent recovery by the end of February.

As a result, I reached a new milestone at the end of February. For the first time, the portfolio value exceeded the EUR 1.5 million mark. 😊

👉🏻 February:

Start: 1,368,240 euros + 100 cash

End: 1,559,4604 euros + 300 cash

Deposit: 5,400 euros

Profit: +186,020 euros (+13.59%)

The increase in value is mainly due to the good performance of my gold portfolio stocks (K92 Mining $KNT (-0,96%) and Equinox Gold $EQX (-2,2%) ). In the meantime, the gold price has slowly risen again and this is of course also reflected in the share prices. The two companies together now account for over 50% of my portfolio... This is actually an unreasonable ratio, but I am still convinced that there is still a lot of potential here. Both companies are in a great operational position, are debt-free and have even announced small dividend payments as a reward. 👍🏼

Otherwise, I continued to sell and buy here and there in February. I took profits on Puma $PUM (-1,69%) , Vonovia $VNA (-3,53%) , Henkel $HEN3 (-2,98%) , K+S $KSC , Target $TGT (-0,31%) and Western Union $WU (+0,26%) while I increased my position in SAP $SAP (-2,51%) , PayPal $PYPL (-2,02%) and Novo-Nordisk $NOVO B (-1,92%) further expanded.

The Iran war will certainly cause some turbulence on the stock market in the coming days. Experience shows that precious metals will benefit in times of uncertainty, but the oil price is also likely to receive a significant tailwind. With my high exposure to gold and my position in Occidental Petroleum $OXY (+3,82%) I believe I am well positioned, at least in the short term. 👍🏼

➡️🆓: On my way towards 4 million total assets, the target achievement level is now 49.8%.

Here's to good stock market trading and see you in a few days! 😊

YT: https://youtube.com/shorts/4JajeFZRUrg

Wow this last week really kicked my butt with $NOVO B (-1,92%) . Even though Novo is not one of my biggest positions in my portfolio, this drop really hurt my performance... I am hesitating if I should by any #novonordisk stock in the future or wait until it will find a bottom.

What are your thoughts on $NOVO B (-1,92%)

As every Sunday, the most important news from the past week, as well as the most important dates for the coming week.

Also as a video:

https://youtube.com/shorts/Xr1TBk7MCoo?si=Qhs6BGsKjAccR_OX

Monday:

The ifo business figures are positive. The business climate rises by one point to 88.6 points, more than expected (88.3). At the same time, companies' expectations also improved.

https://www.ariva.de/news/deutschlands-wirtschaft-mit-belebungssignalen-11917308

Tuesday:

The new weight loss drug Cagrisema from $NOVO B (-1,92%) Novo Nordisk disappoints in a comparative study. The drug is not at least as effective as the drug tirzepatide from competitor Eli Lilly. The share price slumped significantly.

Wednesday:

The demand for chips from $NVDA (-1,98%) NVIDIA is unbroken. Sales increased by 73% in the last quarter. Adjusted earnings per share almost doubled. The Group also expects further growth in the next quarter.

Thursday:

$G24 (-0,71%) Scout24 continues to grow at double-digit rates, both in terms of revenue and profit. Double-digit growth is also expected this year

double-digit growth again this year, partly due to the acquisition in Spain, which will reduce the company's dependence on Germany.

Saturday:

Israel and the USA attack Iran and its head of state is killed. There is a threat of oil supply shortages and a spread of the conflict to other countries, as Iran attacks several Gulf states.

https://www.tagesschau.de/newsticker/liveblog-israel-usa-angriffe-iran-102.html

These are the most important dates for the coming week:

Monday: 02:45 EMI (China)

Tuesday: 11:00 Inflation data (EUR)

Wednesday: 14:30 ADP Employment (USA)

#china

#inflation

#euro

#arbeitsmarkt

#usa

Can you think of any other dates?

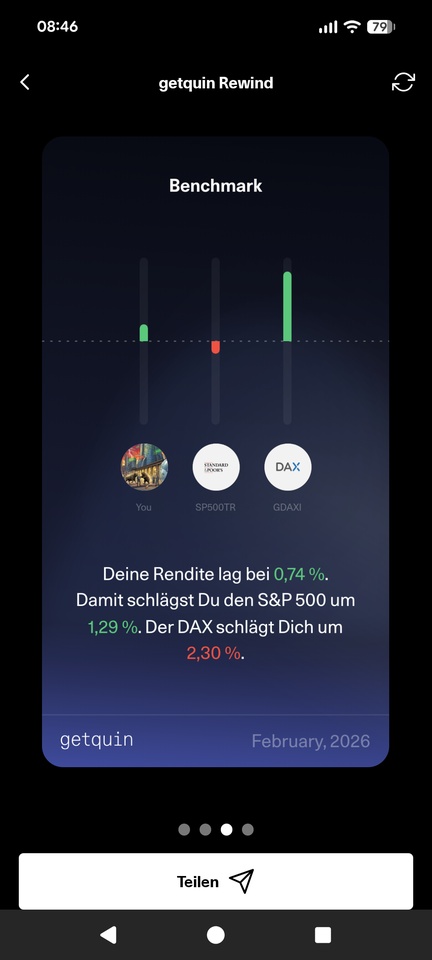

February was a challenging and volatile month.

A strong start to the year was followed by a significant sector-rotationtriggered by risk-off-flowsa reassessment of growth stocks and the need to consistently address operational weaknesses in the portfolio.

Despite the volatility, it was a month of strategic realignment:

📊 Monthly performance: -3,15%

📊 Portfolio value: ~39.144 €

📊 Performance max: +27,58%

📊 Performance YTD: -1,32%

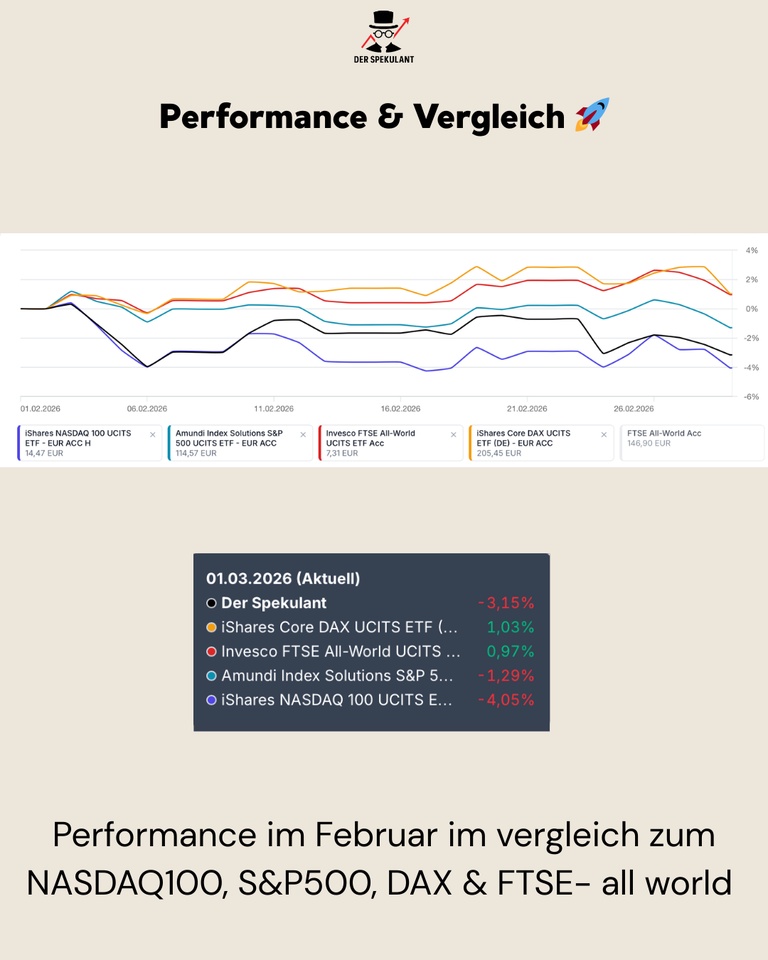

Performance & comparison 🚀

February was characterized by a clear sector rotation:

Software & high-beta tech corrected under pressure, while selected hardware stocks and broadly diversified value stocks showed relative stability.

Performance in comparison (01.02-28.02.2026):

My portfolio: -3,48%

NASDAQ 100: -4,05%

S&P 500: -1,29%

DAX: +1,03%

FTSE All-World: +0,97%

👉 The relative underperformance is due to the high growth exposure, although the portfolio just managed to outperform the NASDAQ 100, which was under heavy pressure.

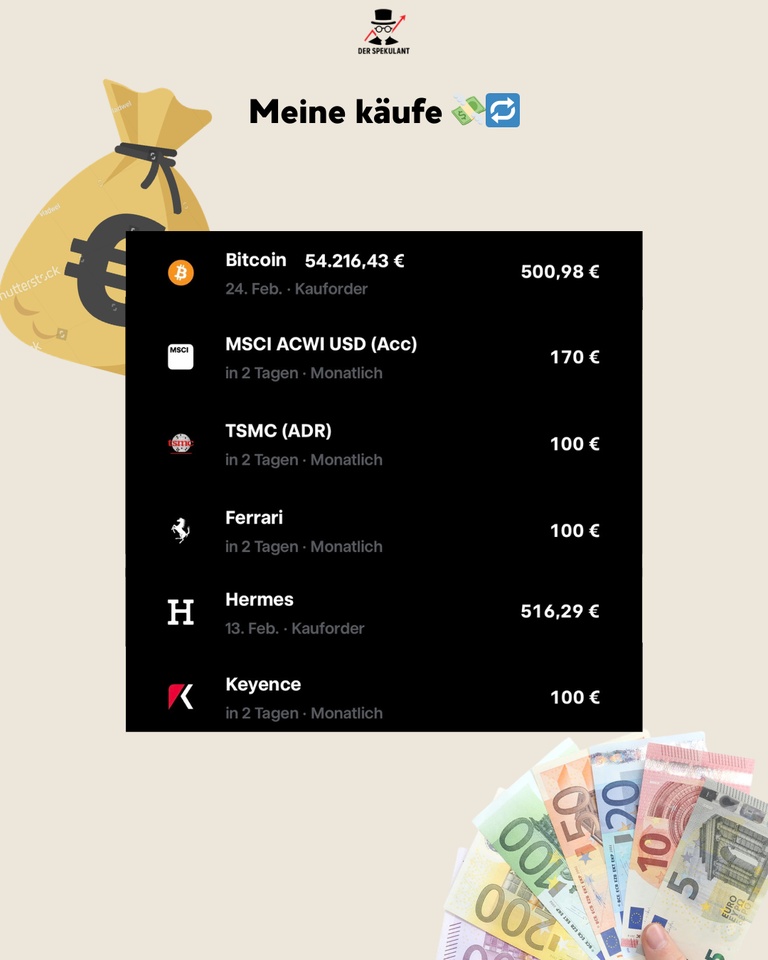

Purchases, sales & allocation 💶

The focus in February was clearly on portfolio streamlining and strategic shift:

Acquisitions 💰

Hermes ($RMS (-2,03%)) targeted expansion in the quality segment. TSMC ($2330) tactical entry due to the observed shift on the stock market from software to hardware. Bitcoin ($BTC (-3,02%)) - purchase of € 500 from the Euro Overnight Rate Swap ETF ($XEON (+0,01%)) at € 54,216 to lower the average price to € 63,000.

Sales ❌

Complete separation of Tomra Systems ($TOM (-2,25%)) and Novo Nordisk ($NOVO B (-1,92%)), as the companies have been operationally disappointing in recent quarters and there were no clear signs of a turnaround from management.

👉 The cash ratio is currently being used dynamically for opportunities through targeted acquisitions.

Top movers in February 🟢

Despite the market environment, February was driven by quality stocks and successful rebounds.

The strongest performer was Keyence ($6861 (-2,63%)), which showed massive relative strength with +16.21%. Another strong performer was Ferrari ($RACE (-1,72%)) was also strong with +13.45%, followed by Berkshire Hathaway ($BRK.B (+0,09%)), which acted as a stable anchor with +6.22%.

The iShares MSCI World Small Cap ($WSML (-1,6%)) gained +3.61%, while the iShares MSCI ACWI ($ACWI) formed a solid base with +0.70%. The Xtrackers II EUR Overnight Rate ($XEON (+0,01%)) rounded off the picture with +0.15% and served as a source for the Bitcoin investment.

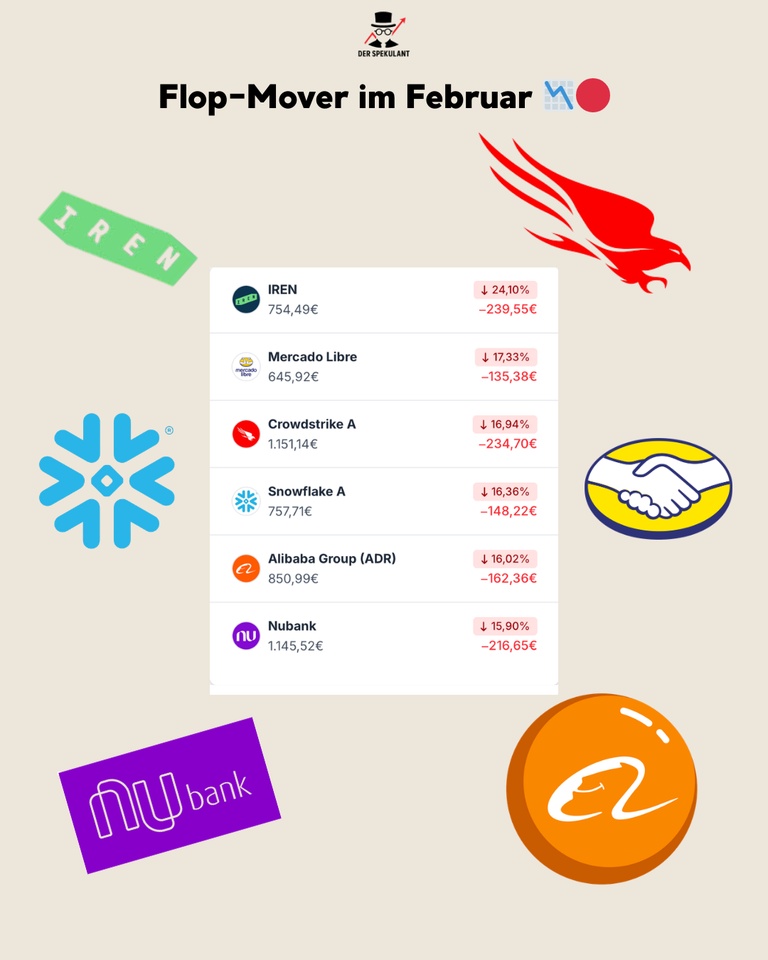

Flop movers in February 🔴

The weaker side of the portfolio was clearly to be found in the growth and crypto segment.

IREN ($IREN (-3,03%)) corrected by -24.10% after the strong previous month. Also Mercado Libre ($MELI (-1,24%)) also came under significant pressure at -17.33%. CrowdStrike ($CRWD (-1,22%)) -16.94% and Snowflake ($SNOW (-1,8%)) -16.36% suffered from the general shift in sentiment in the software sector.

Also Alibaba ($BABA (-2,24%)) also gave back the gains of the previous month with -16.02%. Nubank ($NU (-1,57%)) rounded off the list of losers with -15.90% due to the poor sentiment among payment providers.

👉 Important: These are primarily valuation and sentiment moves, not fundamental breaks - nevertheless, the lack of operational momentum made it necessary to sell positions.

Conclusion 💡

February was not an easy month, but a necessary for rebalancing:

➡️ Strategic separation of stocks without operational momentum

➡️ Focus shiftFrom software/high growth to hardware (TSMC) and focus on quality (Hermes)

➡️ Volatility deliberately used to lower the average Bitcoin price

The environment remains challenging:

Interest rates, Fed expectations and the rotation into hardware stocks will continue to shape the markets in March. The focus remains on quality, operational excellence and liquidity.

❓ Question for the community

Which stock surprised you the most in February - positively or negatively?

👇 Write it in the comments!

+ 2

I plan to enter Bitcoin and have placed the order at 59000$ or 50000€ to use the support there as an entry point.

Do you think it is realistic that the limit will be broken by Monday?

I have two plans:

Sell with 1000€ to take advantage of the tax-free limit for private sales transactions.

HODL

Brings a little more diversification to the money market ETF (house purchase) and the MSCI Wolrd in the savings plan. Size of the BTC approx. 5%

small addendum: My decision at the end of 2025 to shift all shares into the two positions has saved me a lot of money. I only say $PYPL (-2,02%)

$ADBE (-0,87%)

$NOVO B (-1,92%)

$TEAM (-1,12%)

Hello,

yesterday I had to pull my stop loss for the first time this year at $NOVO B (-1,92%) . My stop loss was at 34.00. I had already considered selling at 37 the day before (as there was no rebound after a 15% fall), but then I thought that the SL was set for a reason, so let's wait and see. It didn't work out, but that's the way it is. Proceeds were immediately reinvested, half in approx.$IBM (-1,13%) and $EXXW.

How is it with you? Do you consistently stick to SL?

$SDZ (-1,06%)

$NOVO B (-1,92%)

$LLY (-0,01%)

$HIMS (-3,74%)

Basel (awp) - In its second year as an independent company, the generics specialist Sandoz has grown as planned. In an interview with journalists, CEO Richard Saynor and CFO Remco Steenbergen emphasized that both divisions and all regions contributed to the good performance.

The CFO said he was particularly proud of the 160 basis point increase in the core EBITDA margin to 21.7%. "This is in line with our medium-term targets for 2028 (between 24% and 26%)." The higher proportion of biosimilars in the sales mix contributed significantly to the margin improvement, Steenbergen adds.

While Sandoz is therefore moving towards its medium-term margin targets, the Group has already achieved another target ahead of schedule. "Our biosimilar mix ratio was already 30 percent in 2025, originally planned for 2028 - so we are ahead of schedule," announces Steenbergen. CEO Saynor adds that the "30 percent was more of a guideline than an exact figure." Ultimately, Sandoz wants to further accelerate this development.

Looking ahead, Sandoz CEO Saynor also emphasizes once again that the Group is facing a "golden decade" in which a record number of biologics patents are expiring, while regulations are also changing.

The generics specialist should clearly benefit from this thanks to its broad and deep product pipeline, the CEO is convinced. "Around 600 billion US dollars in drug patents will expire in the next few years, of which we currently cover around 60 percent." Biosimars account for around half of this.

Both pillars important

With its two main pillars - generics and biosimilars - Sandoz is also well positioned to benefit from future trends, Saynor emphasized in an interview with AWP Financial News after the conference call. "The generics business continues to be important as a stable cash generator, as small molecules can be developed quickly and cost-effectively." Although biologics are more expensive to develop, they offer greater value in the long term. "We see the combination of both segments as our strategic strength."

Challenges exist in the antibiotics segment in particular, where price falls due to global overproduction are putting pressure on profitability. The management is therefore calling for support from the European and Swiss governments to keep these important medicines available. "Europe must recognize how important these products are," appeals Saynor. "We are the last major producer of penicillin antibiotics in the West. Prices for raw materials are falling too much, which is not sustainable."

Meanwhile, the market is expecting new products such as the novel diabetes and weight loss GLP1 preparations to be launched in 2026 as soon as they have been approved in Canada and Brazil. However, no approval has yet been granted. "We expect a launch later this year."

While it $HIMS (-3,74%) will certainly not make it onto the market with their cheap "Wegovy copies", they will soon be joining $NOVO B (-1,92%) and $LLY (-0,01%) another pharmaceutical heavyweight (nice pun) in the GLP-1 sector will soon be entering the market: generics specialist $SDZ (-1,06%) from Switzerland

From Gemini:

Sandoz's planned GLP-1 products are primarily based on the active ingredient semaglutide.

As Sandoz specializes in the development of biosimilars and generics, the company aims to launch more cost-effective versions of the well-known originator products (such as Novo Nordisk's Ozempic® and Wegovy® ) as soon as their patent protection expires.

Details of Sandoz's drug strategy:

Sandoz is a global leader in generics and biosimilars, now operating as an independent player in the market following its spin-off from Novartis in 2023. With a portfolio of around 1,500 products, the company covers almost all important therapeutic areas and relieves the burden on healthcare systems worldwide with low-cost generics. Its pioneering role in biosimilars (biotechnologically produced drugs) and its strong position as one of the last major vertically integrated antibiotics producers in Europe are particularly noteworthy.

Two years ago, Novo Nordisk $NOVO B (-1,92%) was regarded as the best European company, as evidenced by the fact that it was the most valuable European company by market capitalization. Added to this was the seemingly endless fantasy for the weight loss product GLP-1.

After two years, the company has now reached a new low: the announcement that its own "weight loss pill" failed to meet expectations in a study and also performed worse than the product of its biggest competitor Eli Lilly $LLY (-0,01%) . This can happen; after all, the success of such a new drug is by no means guaranteed.

However, the company's management does not present a good picture at all. First, the CEO is fired to make a fresh start clear - including downward adjustments to the forecast, of course. Not an unusual move to come clean and deliberately keep expectations low. But this was followed by further forecast cuts and earnings misses. Earnings are now expected to shrink in the coming financial year.

As a shareholder, you get the feeling that you are only being told half the truth. The salami-slicing tactic is being used. This is rarely a good sign, because there is a lack of clear transparency and a strategy for getting out of this situation.

This is why I sold 2/3 of my Novo Nordisk position at a price of around €45 before yesterday's sell-off. I am keeping the remaining position as a "watcher" position. The loss of around 25% hurts, but without confidence and a clear plan from the top management, I see little perspective here.

How are you dealing with your Novo Nordisk position? What recovery prospects do you see? Let's have a discussion.

Stay tuned

I migliori creatori della settimana