$DPZ (-0,38%)

$HIMS (-0,67%)

$KTOS (-9,24%)

$DOCN (-4,89%)

$FME (+1,61%)

$KDP (+1,54%)

$AMT (+1,11%)

$HD (+0,84%)

$WDAY (-1,52%)

$FSLR (+2,98%)

$TEM (-2,07%)

$O (+1,13%)

$MELI (-0,16%)

$HPQ (+0,9%)

$LCID (-1,81%)

$DRO (-0,77%)

$HSBA (+1,43%)

$FRE (-0,06%)

$AG1 (+2,62%)

$CRCL (+2,48%)

$UTHR (-1,54%)

$LDO (+0,24%)

$IDR (+1,17%)

$NTNX (-3,65%)

$PARA (-1,35%)

$NVDA (+1%)

$TTD (+0,14%)

$AI (-2,75%)

$CRM (-0,11%)

$SNPS (-0,54%)

$SNOW (-3,7%)

$PSTG (+0,82%)

$ZIP (+11,17%)

$ZM (-0,43%)

$NU (+1,09%)

$RR. (+1,31%)

$MUV2 (+0,8%)

$BIDU (-1,12%)

$CELH

$DTE (+0,29%)

$STLAM (+2,73%)

$WBD (+0,08%)

$HAG (+0,69%)

$QBTS (-7,11%)

$LKNCY (+0,91%)

$BABA (+0%)

$G24 (+1,36%)

$HTZ (-1%)

$PUM (+0,37%)

$AIXA (-0,54%)

$RUN (+1,53%)

$INTU (-0,11%)

$WULF (-2,68%)

$MNST (+1,52%)

$SQ (+0,2%)

$ADSK (-1,05%)

$MP (-5,53%)

$RKLB (-6,56%)

$SOUN

$SMR

$CRWV (-9,31%)

$CPNG (+1,03%)

$DUOL

Scout 24

Price

Discussione su G24

Messaggi

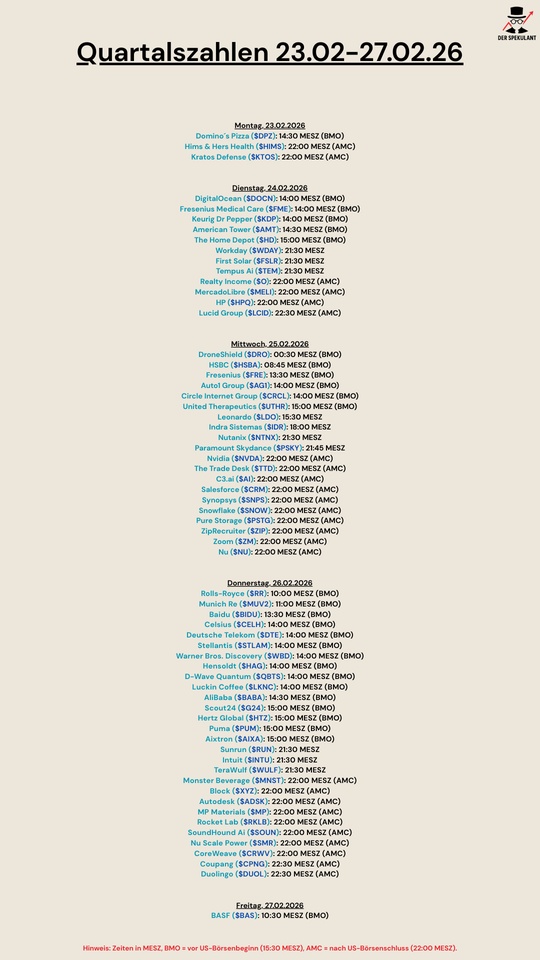

15Quartalszahlen 23.02-27.02.2026

Acquisition of Scout24

Some time ago we $G24 (+1,36%) Scout24 into our value portfolio.

We had had Scout24 on our watchlist for a long time and we wanted to buy in the event of a price setback. However, this did not happen for a very long time.

It was not until the AI hype and a potential new threat from established players such as Scout24, as well as the inclusion in the DAX, which often leads to a sell-off. Scout24 experienced the long hoped-for price setback.

We have analyzed the share in detail here:

https://youtu.be/v69PMmCNCwM?si=diW44WCIwckzMwFK

What do you think of the company?

How are you doing with the purchase?

What stop 🛑 loss did you set after the losses?

Also thinking of investing after the sell off.

Thanks for a reply

New acquisition

We recently carried out a partial sale at Bayer and took profits on a subsequent purchase. This enabled us to secure a small tax advantage after the FIFO.

We have now used the cash to build up a position in Scout 24. We took advantage of the sell-off here. Our thesis: AI will only do limited damage to the platform economy.

We will publish a detailed analysis on our YouTube channel.

Let's see if it works. What do you think of the acquisition?

Range change in the DAX

As of September 22, 2025, Porsche AG will be removed from Germany's leading index $P911 (+1,21%) will be removed from the leading German index DAX 40 due to a massive drop in share price of over a third last year - triggered by US import tariffs and declining demand, particularly in China. This makes Porsche one of the weakest DAX stocks in 2025. Deutsche Börse is making this change as part of the regular index recomposition. After being kicked out, Porsche will move to the mid-cap index MDAX .

Who moves up - the climbers in the DAX

Two newcomers fill the gap in the DAX:

- Scout24 AG $G24 (+1,36%) - the online real estate platform operator, moves from the MDAX to the DAX.

- Gea Group AG $G1A (+0,27%) - a major machinery and engineering group, also moved up from the MDAX.

Further index changes (MDAX, SDAX etc.)

The DAX is not the only index to be shaken up:

- Fielmann AG $FIE (+0,33%) moves up from the SDAX to the MDAX.

- Evotec SE $EVT (-0,36%) leaves the MDAX to make room for Fielmann.

- 1&1 AG $1U1 (-4,33%) joins the SDAX and replaces SGL Carbon $SGL (-5,84%)

In addition, 1&1 $1U1 (-4,33%) is included in the TecDAX - instead of the biosimilar developer Formycon $FYB (+0,11%)

And then I have another idea

$G24 (+1,36%) is currently No.1 in the MDAX in terms of market capitalization and free flow and is on the verge of moving up the Dax. As it will not be enough for an almost entry in June, an entry in September would be possible for $PAH3 (+2,68%) or $SRT (+0,78%) probable. Speculating on this in a stock that is performing well anyway with a humane derivative with leverage 3 such as UM88M3 would be a charming option. Shares are of course also an option.

16.05.2025

UnitedHealth under criminal investigation for possible fraud + Borussia Dortmund continues to rise ahead of final match day + Scout24 at record high + Bayer wants further Roundup settlements and is reviewing Monsanto bankruptcy petition

UnitedHealth $UNH (-0,11%)under criminal investigation by the US Department of Justice for possible fraud in connection with Medicare

- UnitedHealth Group (UNH) is facing a criminal investigation by the U.S. Department of Justice for possible fraud related to its Medicare Advantage business, according to the Wall Street Journal.

- The investigation, led by the Justice Department's health care fraud division in New York, has been ongoing since at least mid-2023 and complements ongoing civil and antitrust investigations into the company, the news agency reported.

- The WSJ quoted UnitedHealth as saying that the company had not been informed of the criminal investigation and stands by the integrity of its Medicare Advantage program.

- An earlier civil case against UnitedHealth related to allegedly unfounded diagnoses is reportedly still pending before a judge, although a court-appointed special master has recommended dismissal of the case.

- UnitedHealth and the DOJ did not immediately respond to MT Newswires' request for comment.

- It is alleged that the company systematically upcoded diagnoses in order to receive higher payments from Medicare.

- Medicare Advantage plans pay insurers a fixed amount per enrollee, with additional payments for patients with more severe or more diagnoses.

- UnitedHealth allegedly took advantage of this and provided healthy insureds with non-existent or exaggerated diagnoses in order to collect these additional payments.

- But that's not all: the DOJ has also opened an investigation into antitrust violations.

- The investigation focuses on the links between the insurance division UnitedHealthcare and its subsidiary Optum as well as the impact of acquisitions of physician groups on competition and consumers.

- UnitedHealth is also alleged to have used faulty AI to process benefits.

- The error rate of this is said to have been 90 percent. As a result, a number of claims were wrongly rejected.

- UnitedHealth shares fell by more than 6.4% on Thursday before the start of trading.

Borussia Dortmund $BVB (+0,15%)continue to rise ahead of last match day

- The shares of Borussia Dortmund reached another high since August on Thursday at 3.84 euros.

- Investors are optimistic going into the decisive final matchday of the Bundesliga season and are banking on the club reaching the Champions League, which is so important both financially and in sporting terms.

- As rivals Freiburg and Frankfurt will meet at the very end of the season, thus taking important points away from each other, a conciliatory end to the disappointing season is quite realistic for BVB.

- The prerequisite is that Borussia win their home game - as convincingly as possible - against Kiel, who have already been relegated.

- BVB sporting director Sebastian Kehl's statements on squad planning may also have provided some reassurance for investors.

- "We certainly won't be making five or six top transfers - in case anyone thinks that," Kehl told "Kicker".

Scout24 $G24 (+1,36%)at record high - JPMorgan very optimistic

- Scout24 shares reached another record high of EUR 112.50 on Thursday.

- This means that the shares of the Internet portal operator have gained 32 percent in the current year.

- With a place on the "Analyst Focus List", they are now among the favorites of the investment bank JPMorgan.

- Analyst Marcus Diebel has raised his price target significantly to 141 euros and shows investors how, in the best-case scenario, even 165 euros could be possible.

- Namely, if the operating margin in 2028 is not "only" 66% as in the base scenario, but even an ambitious 71%.

- Diebel also emphasized the dividend potential that beckons thanks to strong cash flow.

Bayer $BAYN (-4,34%)wants further Roundup settlements and examines Monsanto bankruptcy petition

- Bayer is making a further push to settle lawsuits linking the popular weedkiller Roundup to cancer, while also considering a bankruptcy filing for its Monsanto agricultural business in case the settlement plan fails, according to people familiar with the matter.

- According to people familiar with the matter, Bayer plans to settle some of the class action lawsuits against Roundup in a Missouri court, where most of the lawsuits are pending.

- Given the difficulties in resolving the Roundup litigation in the civil courts, the German pharmaceutical and agricultural company is preparing a bankruptcy petition for Monsanto, the US manufacturer of the weedkiller, as another option.

- Bayer has hired restructuring consultants from the law firm Latham & Watkins and the consulting firm Alixpartners to examine its options, the informants added.

- Filing for Chapter 11 bankruptcy protection would halt the lawsuits against Monsanto and pave the way for Bayer's share of Roundup liability to be resolved in bankruptcy court.

- Bayer and Alixpartners declined to comment. Latham was unavailable for comment at short notice.

Friday: Stock market dates, economic data, quarterly figures

Small expiry day

- ex-dividend of individual stocks

- E.ON SE € 0.55

- adidas AG € 2.00

- Heidelberg Materials AG € 3.30

- Commerzbank AG € 0.65

- Starbucks Corp $0.61

- Tencent Holdings Ltd HK$ 4.50

- Amgen Inc $2.38

- Eli Lilly and Co $1.50

- Quarterly figures / company dates Europe

- 07:00 Swiss Re Quarterly figures

- 07:30 Richemont annual results

- 09:00 Michelin AGM

- 10:00 Hella | Volkswagen | Elringklinger | Jost | Wienerberger | Thales AGM

- 11:00 TAG Immobilien | Dürr AGM

- 14:00 Biontech AGM

- Economic data

01:50 JP: GDP (1st release) 1Q FORECAST: -0.1% yoy previous: +0.7% yoy

07:30 FR: Unemployment rate 1Q FORECAST: 7.5% 4th quarter: 7.3%

14:30 US: Housing starts/permits April housing starts PROGNOSE: +2.7% yoy previous: -11.4% yoy Building Permits PROGNOSE: -2.2% yoy previous: +1.6% yoy

14:30 US: Import and Export Prices April Import Prices PROGNOSE: -0.4% yoy previous: -0.1% yoy

16:00 US: Consumer Sentiment Index Uni Michigan (1st survey) May FORECAST: 53.5 previous: 52.2

Analyst updates, 05.12.

⬆️⬆️⬆️

- HSBC upgrades SIEMENS to Hold. Target price EUR 185. $SIE (+1,82%)

- DEUTSCHE BANK RESEARCH raises the price target for MUNICH RE from EUR 450 to EUR 535. Hold. $MUV2 (+0,8%)

- DEUTSCHE BANK RESEARCH raises the price target for HANNOVER RÜCK from EUR 255 to EUR 294. Buy. $HNR1 (+1,13%)

- DEUTSCHE BANK RESEARCH raises the price target for TALANX from EUR 70 to EUR 76. Hold. $TLX (+1,59%)

- JEFFERIES raises the price target for ORACLE from 190 USD to 220 USD. Buy. $ORCL (-5,5%)

- HAUCK AUFHÄUSER IB raises the target price for MTU from EUR 264 to EUR 280. Sell. $MTX (+1,02%)

- BARCLAYS upgrades AUTO1 from Equal-Weight to Overweight and raises target price from EUR 9 to EUR 19. $AG1 (+2,62%)

- JPMORGAN raises the price target for HELLOFRESH from EUR 14 to EUR 16. Overweight. $HFG (-1,37%)

- JPMORGAN raises the target price for DELIVERY HERO from EUR 42 to EUR 55. Overweight. $DHER (+0,07%)

- JPMORGAN raises the price target for CTS EVENTIM from EUR 104 to EUR 112. Overweight. $EVD (+2,01%)

- JPMORGAN raises the target price for SCOUT24 from EUR 92 to EUR 105. Overweight. $G24 (+1,36%)

- JPMORGAN raises the target price for JUST EAT TAKEAWAY from GBP 16.02 to GBP 18.32. Overweight. $TKWY

- JPMORGAN upgrades DELIVEROO from Neutral to Overweight and raises target price from GBP 1.70 to GBP 1.92. $ROO

- JPMORGAN raises the price target for HEIDELBERG MATERIALS from EUR 150 to EUR 151. Overweight. $HEI (+0,44%)

- JPMORGAN raises the price target for FRAPORT from EUR 49 to EUR 59. Neutral. $FRA (-1,1%)

⬇️⬇️⬇️

- METZLER lowers the price target for HYPOPORT from EUR 220 to EUR 185. Sell. $HYQ (-1,06%)

- ODDO BHF lowers the target price for SCHOTT PHARMA from EUR 38 to EUR 37. Outperform. $1SXP (+0%)

- BARCLAYS lowers the target price for RIO TINTO from GBP 61 to GBP 60. Overweight. $RIO (+0,67%)

- JPMORGAN downgrades STRÖER from Overweight to Neutral and lowers target price from EUR 79 to EUR 57. $SAX (+1,91%)

Analyst updates, 14.11. 👇🏼

⬆️⬆️⬆️

- JEFFERIES raises the price target for TESLA from USD 195 to USD 300. Hold. $TSLA (-0,19%)

- WARBURG RESEARCH raises the price target for INIT from EUR 49.50 to EUR 53. Buy $INIT

- WARBURG RESEARCH raises the price target for DEUTSCHE BANK from EUR 21.10 to EUR 21.30. Buy. $DBK (+2,11%)

- DEUTSCHE BANK RESEARCH raises the price target for AUTO1 from EUR 11 to EUR 12. Buy. $AG1 (+2,62%)

- DEUTSCHE BANK RESEARCH raises the price target for SIEMENS ENERGY from EUR 43 to EUR 52. Buy. $ENR (+0,35%)

- BERENBERG raises the price target for SCOUT24 from EUR 83 to EUR 110. Buy. $G24 (+1,36%)

- GOLDMAN raises the target price for RIVIAN from USD 10 to USD 12. Neutral. $RIVN (-1,6%)

- GOLDMAN raises the price target for MOLLER-MAERSK from DKK 12000 to DKK 12300. Neutral. $MAERSK B (+0,85%)

- UBS raises the price target for CISCO from USD 55 to USD 62. Neutral. $CSCO (+1,04%)

⬇️⬇️⬇️

- WARBURG RESEARCH downgrades PORSCHE SE from Buy to Hold and lowers price target from EUR 60 to EUR 36. $PAH3 (+2,68%)

- WARBURG RESEARCH lowers the price target for EXASOL from EUR 6.30 to EUR 6. Buy. $EXL (-3,52%)

- WARBURG RESEARCH lowers the price target for BRENNTAG from EUR 75 to EUR 69. Buy. $BNR (-0,02%)

- WARBURG RESEARCH lowers the price target for INFINEON from EUR 43 to EUR 39. Buy. $IFX (-1,28%)

- DEUTSCHE BANK RESEARCH lowers the price target for VERBIO from EUR 20 to EUR 17. Hold. $VBK (-2,02%)

- DEUTSCHE BANK RESEARCH lowers the price target for JENOPTIK from EUR 45 to EUR 39. Buy. $JEN (+0,81%)

- DEUTSCHE BANK RESEARCH lowers the price target for ELRINGKLINGER from EUR 6 to EUR 4.50. Hold. $ZIL2 (+0,12%)

- DEUTSCHE BANK RESEARCH lowers the price target for BAYER from EUR 29 to EUR 23. Hold. $BAYN (-4,34%)

- HAUCK AUFHÄUSER IB lowers the target price for SAF-HOLLAND from EUR 30 to EUR 28. Buy. $SFQ (+0%)

- KEPLER CHEUVREUX lowers the target price for RWE from EUR 40 to EUR 36. Buy. $RWE (+0,8%)

- METZLER lowers the price target for JUNGHEINRICH from EUR 42 to EUR 38. Buy. $JUN3 (+3,55%)

- BARCLAYS lowers the target price for RTL from EUR 33 to EUR 26.50. Equal-Weight. $RTLL (+0,41%)

- BERENBERG downgrades VESTAS from Buy to Hold and lowers target price from DKK 180 to DKK 120. $VWS (+0,21%)

Titoli di tendenza

I migliori creatori della settimana