Z. E.g. with Itochu $8001 (+3,85 %) simply beautiful. In the depot since 09/23 and now well established.

Itochu

Price

Discussion sur 8001

Postes

89Dramatic crash?

No. Just a reallocation. $PLTR (+3,52 %) I have halved the share of Schneider Electric (still 26% - it used to be more than 30) and added Schneider Electric $SU (+1,98 %) as a tech infrastructure play. The rest is still in the ETF, $ALV (+0,18 %) and $8001 (+3,85 %) distributed.

Further effects: US share reduced from just under 60% to 47%. ETF share increased from just over 38% to just over 40%. ROI since 02/2023 is 51%.

Adjustment of share split

When is the share split expected to be adjusted at $8001 (+3,85 %) ? I am still 94% in the red because the entire portfolio is currently "no longer available".

Go to your last purchase transaction, open it, don't change anything and save it again directly. This then updates the entire position again and retrieves the split from the database.

At the latest then it should fit.

However, I don't quite understand what is meant by "stock no longer available". You should have more shares due to the split.

Opinion on Itochu

Happy New Year everyone!

What do you think of the current rating of $8001 (+3,85 %) ? Cheap, neutral or expensive? Are there similar alternatives?

Two depots, one goal: peace, freedom and a predictable transition

Dear Community,

At the end of the year, I would like to share my portfolio and my strategy with you.

I am 38 years old, have been in the stock market since 2024 and am aiming for financial freedom at the age of 58. Time will tell whether that will work out... 😉 I'm not investing to maximize my profits, but to be able to live a relaxed life in the long term. To this end, I have deliberately separated my investments into two portfolios with a clear purpose.

Portfolio 1 - Growth (ING)

$VWCE (+0,71 %) , $XNAS (+1,37 %) , $WGLD (+0,98 %) and as an admixture some Bitcoin via ETP $IB1T (+7,7 %) .

This portfolio is saved monthly until 58 and then remains more or less untouched.

My savings rates would be:

800€ $VWCE (+0,71 %)

375€ $XNAS (+1,37 %)

150€ $WGLD (+0,98 %)

0€ $IB1T (+7,7 %) - Position is currently at 10% and should rest for the time being

Portfolio 2 - Cash flow (SC)

Here I am investing via 2 dividend ETFs ($VHYL (+0,8 %) , $TDIV (-0,63 %) ) and selected quality stocks to build up a steadily growing cash flow. All distributions are reinvested equally in the ETFs. Furthermore, a small cushion is built up here via $XEOD (+0 %) is built up here.

My savings rates would be

250€ $XEOD (+0 %)

200€ $VHYL (+0,8 %) - Start January 26

200€ $TDIV (-0,63 %) - Start January 26

425€ Individual assets (as required, no savings plan, no obligation)

My individual stocks:

Allianz $ALV (+0,18 %)

Munich Re $MUV2 (+1,11 %)

Procter & Gamble $PG (-0,98 %)

PepsiCo $PEP (-0,79 %)

Johnson & Johnson $JNJ (-1,21 %)

Novo Nordisk $NOVO B (+4,77 %)

Lime $LIN (-0,72 %)

ADP $ADP (+0,18 %)

Waste Management $WM (-0,2 %)

Siemens $SIE (+2,29 %)

Accenture $ACN (-0,61 %)

Alphabet $GOOGL (+0,19 %)

Itochu $8001 (+3,85 %)

visas $V (-0,18 %)

No speculation, no trading. For most people here, extremely boring... 😴 But hopefully the selection will bring some stability to the portfolio in turbulent times. 😉

For the time being, we will stick with these stocks and gradually buy more when good opportunities arise. Each individual position will of course be capped later and should make up between 2-3% of the portfolio (including the proportion within the ETFs). Alphabet would be an exception.

The reallocation idea

Nothing is invested from 58. The plan is to reallocate around 5 % annually from custody account 1 to custody account 2. In this way, growth is gradually converted into cash flow - without significant erosion of assets. And in the best-case scenario, my growth portfolio can continue to grow. I consciously accept taxes 😉

Thank you for reading and have a successful 2026.

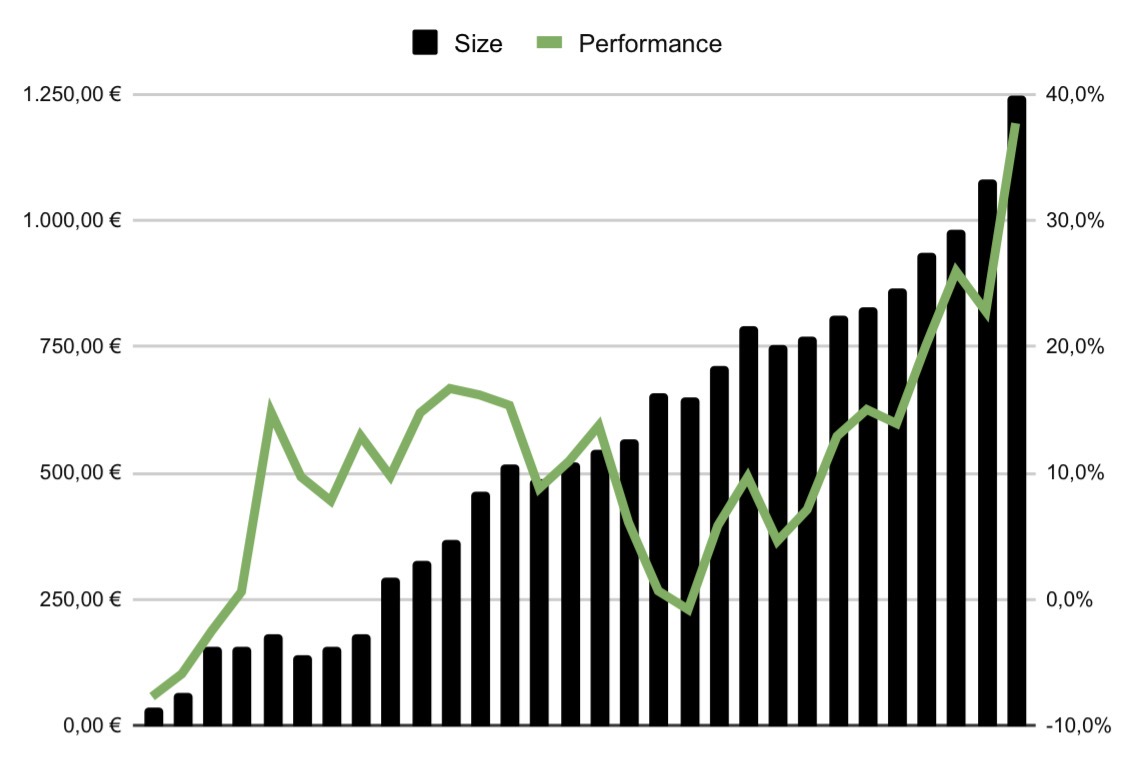

P.S. My allocation doesn't fit yet because I've been focusing more on my individual stocks in recent weeks. Chart is also not meaningful because of ING Autosync and Itochu split 🥲

Also an exciting strategy.

I've also spent the last few evenings restructuring my portfolio. Simply because I can't keep my feet still and a few individual stocks just spice things up.

I think my portfolio could look similar without the dividend stocks. I will probably increase the core share instead and go for S&P and EU momentum. 👍

Investment decisions

Dear Getquinners,

I would be interested in your opinion again.

I would like to expand my portfolio with a few shares in the long term.

Long-term investment is my goal with good growth (target at least 10-12% annually), dividends are nice but not a must, may also have some risk (of course the position size will be adjusted accordingly).

Which positions would you punch (Austrian for sell🤣) from the existing ones in the portfolio or just add to them?

Stocks that I find interesting as additions:

-Netflix $NFLX (+1,04 %)

-Broadcom $AVGO (+2,03 %)

-Waste Management $WM (-0,2 %)

-Zoetis $ZTS (-0,18 %)

-Kawasaki Heavy $7012 (-0,05 %)

-Intuitive $ISRG (+1,32 %)

-Chipotle $CMG (-0,22 %)

-Amgen $AMGN (-0,02 %)

-Crowdstrike Hldg $CRWD (+3,36 %)

-Vistra Corp $VST (+1,66 %)

-Constellation PA $CEG (+0,35 %)

-Amphenol $APH (+2,49 %)

-Nestle $NESN (-1,02 %)

-Monster Beverage $MNST (-0,63 %) (I love Monster)

-AMD $AMD (+5,9 %)

-Palo Alto Networks $PANW (+2,83 %)

-Contemporary Amperex $3750 (-2,05 %)

-Albermale $ALB (+2,26 %)

-Synopsys $SNPS (+1,96 %)

-Taiwan Semiconductor $TSM (+1,15 %)

-Datadog $DDOG (+6,07 %)

-Itochu $8001 (+3,85 %)

-Eaton $ETN (-0,44 %)

-Procter&Gamble $PG (-0,98 %)

-Pepsico $PEP (-0,79 %)

-Coca Cola $KO (-1,87 %)

-Hims&Hers $HIMS (+4,19 %)

-Kraken Robotics $PNG (-2,63 %)

etc.

There are so many interesting titles that you can easily be overwhelmed.^^

At the moment mainly the $VWRL (+1,3 %) and $BTC (+0,04 %) monthly, share purchases are made when opportunities arise. (Financially and chart-wise).

I look forward to your opinion.

Interest rate decision Bank of Japan

The BoJ's interest rate decision is due tomorrow. Anyone who remembers August 24 knows that this can also lead to increased volatility here and in the USA.

The consensus among market participants is that key interest rates will be raised from 0.25% to 0.75%. This may sound relaxed against the backdrop of European and US key interest rates, but it could have a direct impact on our portfolio.

- Most of the Japanese companies in our portfolios are heavily dependent on exports ($6367 (+3,33 %)

$8001 (+3,85 %)

$SUMICHEM

$8002 (-0,66 %) ...). An appreciation of the yen therefore has a direct impact on company results, the outlook and thus possibly on share performance. - For decades, carry trades took place due to the low level of interest rates. In other words, cheap money was borrowed in Japan and invested primarily in US stocks or Bitcoin $BTC (+0,04 %) were invested. Due to the lower interest rate spread, many carry trades will no longer be worthwhile and will be settled. This leads to less investable money and can therefore lead to lower prices.

Basically, I believe that the actual interest rate hike is already priced into both prices and carry trades and will therefore only lead to low volatility.

As always, the outlook for the continuation of interest rate policy is much more decisive. If a tighter interest rate policy with several rate hikes is announced next year, I actually expect losses of >10%, especially for Japanese stocks.

I will try to pick up Itochu $8001 (+3,85 %) during the day on Friday.

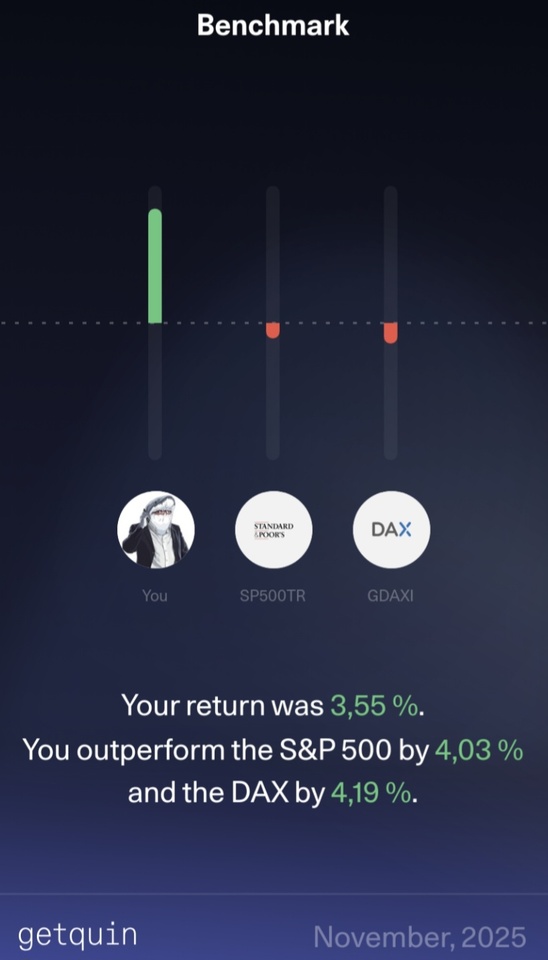

Tops and flops -Rewind November 2025

🟢 🚀

$GOOGL (+0,19 %) +11%

$MC (+0,46 %) +4%

$HNR1 (+0,84 %) +3,4%

$BRK.B (+1,16 %) +3,7%

$8001 (+3,85 %) +2%

🔴🛝

$BTC (+0,04 %) -15%

$MSFT (+0,44 %) -6%

@Tenbagger2024 I have now done it like this

Just too many AI stocks. And Bitcoin

Earnings today

I look at my investments

$APP (+10,13 %)

$QCOM (+0,93 %)

$ELF (-1,2 %)

$FICO (+0,56 %)

$8001 (+3,85 %)

+ 1

Titres populaires

Meilleurs créateurs cette semaine