$PANW (-1,12 %)

$CDNS (-0,71 %)

$SEDG (+8,15 %)

$FVRR (+2,83 %)

$MCO (+0,64 %)

$ADI (+3,24 %)

$BKNG (+1,8 %)

$CAKE (+1,7 %)

$DASH (+0,21 %)

$EBAY (+3,98 %)

$FIG (+1,84 %)

$CVNA (+1,39 %)

$AIR (+0,87 %)

$NESN (-0,62 %)

$LMND (-7,45 %)

$WMT (-1,92 %)

$KLAR (-5,77 %)

$DE (+0,58 %)

$PAAS (+5,47 %)

$MONC (+6,26 %)

$OXY (+0,48 %)

$OPEN (-5,9 %)

$NEM (-1,41 %)

$BN (-1,14 %)

$AI (+4,58 %)

Nestlé

Price

Discussion sur NESN

Postes

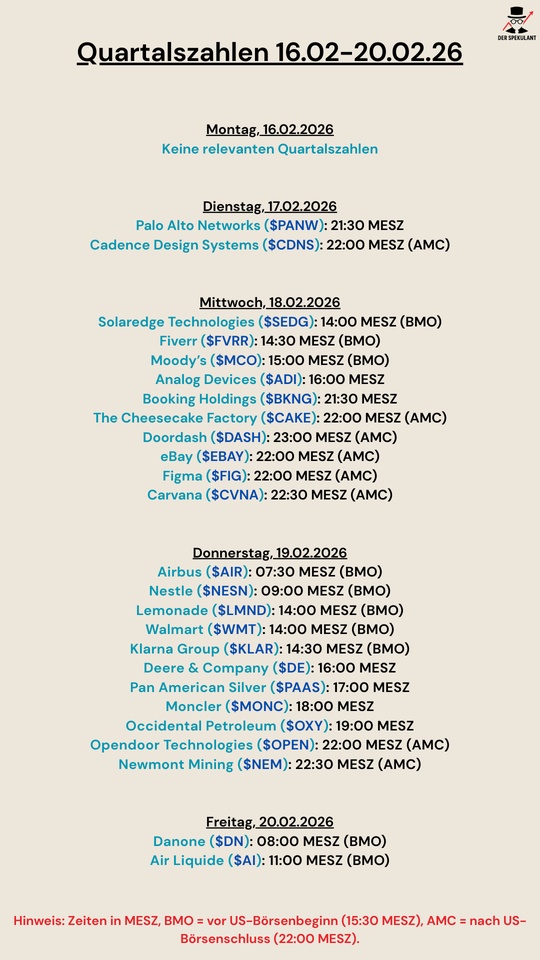

135Quarterly figures 16.02-20.02.26

On to the next million 🚀🚀

I secured my second tranche today.

The sale of $NESN (-0,62 %) enabled me to acquire further shares.

Carrefour - underestimated retail giant?

This post is not aimed at traders or people looking for "hot stocks", but at the long-term buy & hold shareholders in this forum.

In the past, I have repeatedly asked myself who benefits most from the constantly rising prices of food and everyday consumer goods. In my opinion, it is primarily the retailers, not the producers of these products. Manufacturers of branded products such as Unilever $ULVR (+1,38 %) , Nestle $NESN (-0,62 %) or KraftHeinz $KHC (+1,13 %) suffer from the fact that they do not have their own distribution channels and retailers have built up massive competition through private labels, which puts additional pressure on the margins of branded companies.

In Germany, the retail sector is largely in the hands of family businesses (Lidl, Aldi, Kaufland, Rossmann, DM, etc.), so it is not possible to invest via the stock market. Internationally, however, things look better, as there are companies traded on the stock exchange such as Walmart $WMT (-1,92 %) , Costco $COST (-0,19 %) or Target $TGT (+0,82 %) which also earn good money. I would say that these stocks are also the ones that get the most public attention. At the same time, these companies are also very US-centric and have struggled to expand into markets outside the US in the past.

Recently, however, I came across a video that compares the expansion of retail chains around the world and here I noticed a value that I had hardly noticed before. It's about Carrefour $CA (+0,33 %) . I can no longer find the exact video, but it was close to the one I'm linking here: https://www.youtube.com/watch?v=vhszDvl7Lbg

I wonder why Carrefour is hardly noticed by investors. Is it because of the chart development? Is it because of the company's figures? Is it because the company is based in France and the withholding tax on dividends there? Or is it simply a brand that you rarely come across in this country?

I have put the stock on my watchlist. What is your opinion?

🌎📈 Mercosur agreement: Mega free trade - opportunities for the stock market & potential profiteers

After more than 25 years of negotiations, the EU and the South American economic alliance Mercosur (Brazil, Argentina, Paraguay, Uruguay) have concluded a historic free trade agreement. This creates one of the largest free trade zones in the world - with over 700 million people and a combined economic area worth around 22 trillion USD.

This agreement could trigger global economic and stock market effects - for companies, industries and investors.

_________________________

🛃🚢 What will happen to the Mercosur agreement?

- Tariffs on up to 91% of EU exports and 92% of Mercosur exports are to be gradually eliminated.

- The aim is to create a larger single market, better market access, simplified rules and more stable trading conditions between Europe and South America.

- Until now, high tariffs have applied to cars (approx. 35%), machinery (14-20%) and chemical products (up to 18%).

_________________________

📊 Possible effects on the stock market

📈 1. industries with strong exports benefit from higher demand

Europe can sell its products more easily in South America:

- 👩🏭 Cars & car parts

- 🏭 Mechanical engineering

- 🧪 Chemicals & pharmaceuticals

- 🪄 Electronics & high-tech

The elimination of customs duties and fewer trade barriers will increase the margins and competitiveness of these industries.

Possible examples of Frofiteurs:

- VW $VOW (+0,93 %) BMW $BMW (+0,52 %) Daimler $DTG (+1,76 %)

- Siemens $SIE (+1,82 %)

- BASF $BAS (+0,7 %) Covestro $1COV (-0,1 %)

- SAP $SAP (+1,12 %) , ASML $ASML (+0,76 %)

➡️ Expected share price impetus from higher export revenues and capped production costs.

_________________________

🍖 2. agricultural & food sector in focus

The agricultural business is also becoming more closely networked on both sides:

- Tariffs on wine, oil, cheese, dairy products and luxury foods are being reduced or gradually created.

- EU producers will gain greater market access in South America; conversely, South American agricultural exports (e.g. beef, sugar) will have better access to the EU.

Possible beneficiaries:

- Nestlé $NESN (-0,62 %) Danone $BN (-1,14 %)

- Heineken $HEIA (+0,43 %) AB InBev $ABI (-0,39 %)

- FrieslandCampina $FCEPL

⚠️ However, critics point out that price pressure on local farmers* also arises and environmental risks can increase, for example due to cheaper imports.

_________________________

🚗 3. raw materials & energy: medium to long-term effects

Mercosur countries export large quantities of raw materials:

- Soy, sugar, coffee, ethanol, grain

- Brazil is also a major supplier of crude oil and minerals

One of the aims of the agreement is more stable commodity trade with fewer tariffs, which can influence commodity prices and move the shares of commodity and energy companies.

Possible beneficiaries:

- Vale $VALE3 (+2,93 %) Petrobras $PETR3 (+0,64 %)

- Bunge $BG (-1,38 %) , ADM $ADM (-0,03 %)

_________________________

🏦 4. finance & services sector

The agreement also facilitates:

- Market access for financial services

- Opening of telecom and transportation markets

- Opening of public procurement to EU suppliers

➡️ This could strengthen banks, insurers and logistics companies that operate across borders.

Possible beneficiaries:

- Allianz $ALV (+1,65 %) Deutsche Bank $DBK (+2,11 %)

- DHL/Deutsche Post $DHL (+0,52 %) Kuehne + Nagel $KNIN (+1,03 %)

_________________________

🔄 Short-term market risks

Not everything is automatically positive:

- 🇪🇺 Agricultural protests in Europe show resistance to cheap imports.

- Political uncertainties remain - many parliaments need to ratify.

- Sectors with low competitiveness could come under price pressure.

_________________________

📌 Conclusion

The Mercosur agreement could be an issue with far-reaching effects:

✅ Strong export industry gains new sales markets

✅ Agricultural and luxury food sector gains sales opportunities

✅ Financial and service sector benefits from market expansion

✅ Raw material exporting countries in South America could become more integrated

⚠️ At the same time, there are risks for local producers and price distortions that could have a regional impact on share prices

_________________________

Question for you: What is your opinion on the agreement? And in which sectors or listed companies do you see the biggest winners in the long term?

_________________________

Sources:

- 💶📈 Wirtschaftliche Chancen für EU-Exporteure und Importeure durch Zollerleichterungen

- ⚙️🚗 Branchenanalysen mit Zollabbau-Effekten für Maschinen, Autos, Chemie etc.

- 🌾🥩 Agrar- und Rohstoff-Impakte durch neue Marktchancen und Quotenregelungen

Podcast episode 125 "Buy High. Sell Low." 20 European dividend stocks

Novo Nordisk 3.0% $NOVO B (-2,32 %) NVO

LVMH 2.0% $LVMH

Pernod Ricard 6.35% $RI (+3,49 %)

Imperial Brands 5.5% $IMB (-0,39 %)

BAT 6.2% $BATS (+2,33 %)

Sunrise Communications 8.00%

Nestle 4.05% $NESN (-0,62 %)

Roche 2.85% $ROG (+0,49 %)

Novartis 3.07% $NOVN (-0,23 %)

Shell 4.07% $SHEL (-0,01 %)

German Post 3.86% $DHL (+0,52 %)

Swisscom 3.75% $SCMN (-0,74 %)

German Telekom 3.52% $DTE (+0,29 %)

Strabag 2.72% $STR (+3,37 %)

Vonovia 4.82% $VNA (+0,18 %)

BASF 5.01% $BAS (+0,7 %)

Puma 2.8% $PUMA

Hannover Re 3.62% $HNR1 (+1,13 %)

Munich Re 3.8% $MUV2 (+0,8 %)

Allianz 4.00% $ALV (+1,65 %)

BP 5.76% $BP. (-1,45 %)

Spotify

https://open.spotify.com/episode/1zt05UZlehInr81iaZMdY5?si=e676f0a812014943

YouTube

Appple Podcast

The way it ends is the way it begins ...

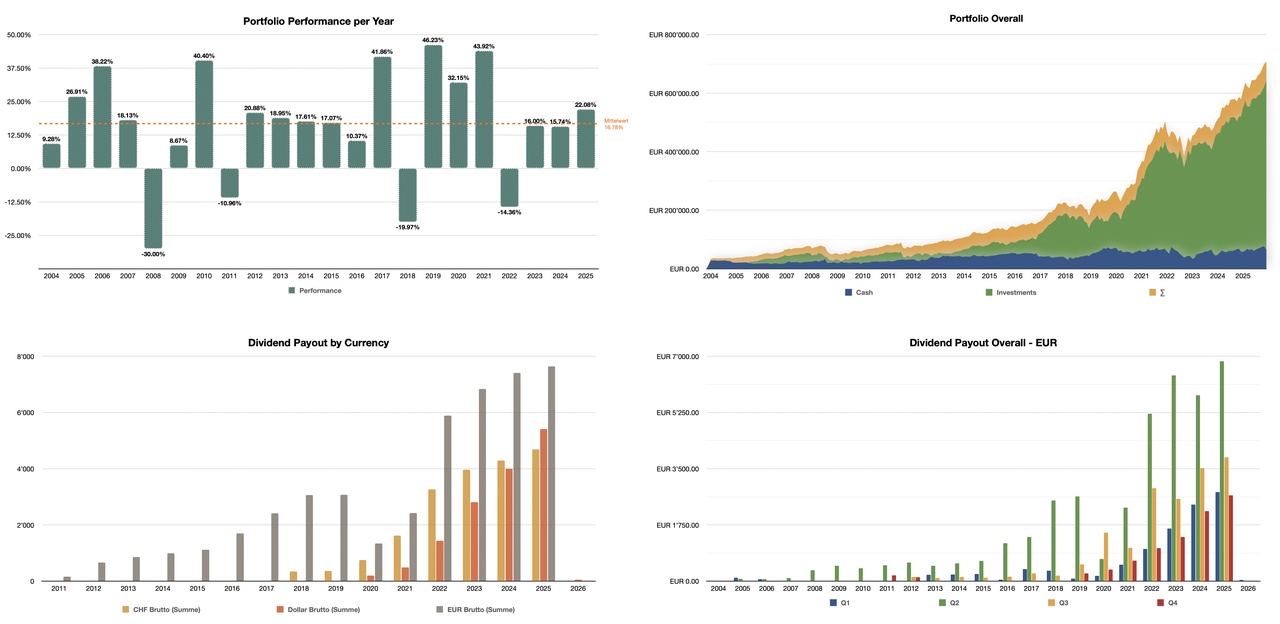

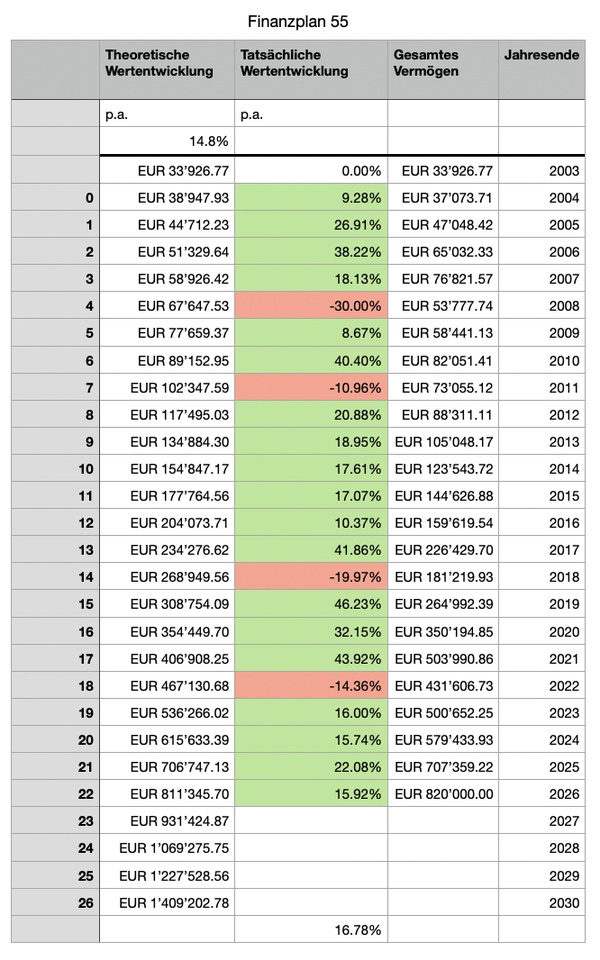

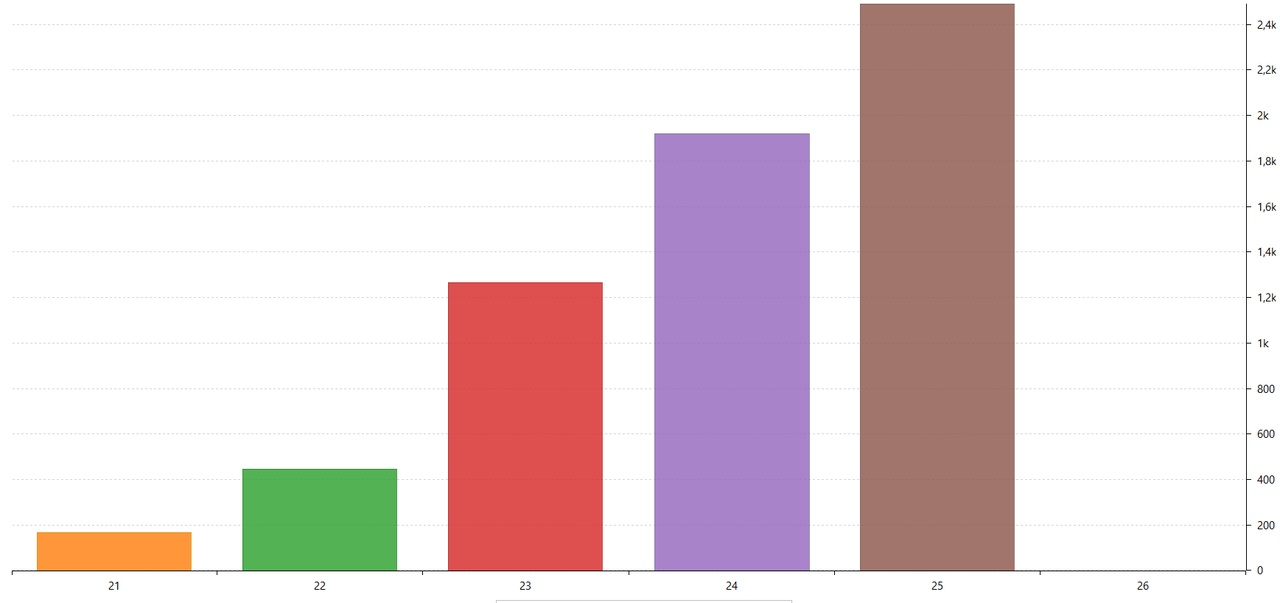

I have now also managed to update my good old tables and complete the year 2025. Small depot turbo at the end of the year and the first week 26 was already great again.

I would say that everything is still going in the right direction. What is striking is that dividends now make up a really big slice of the cake. My US dividends have overtaken the CHF dividends. In a total of 26 years on the stock market, around €100k gross has been added in dividends alone 🤓

I already stopped my savings plan at the end of 25 $SPY (+0,04 %) and for the time being am only saving in selected US individual stocks and the $VHYL (+0,81 %) . Currently running

$V (+0,55 %)

$UPS (+1,43 %)

$EIX (+1,82 %)

$AXP (+0,94 %)

$CMCSA (-0,11 %)

in savings plans. Individual purchases depending on the situation, currently e.g.

$KHC (+1,13 %)

$GIS (-0,92 %)

$PG (+0,98 %)

$MO (-0,33 %)

$VZ (+1,21 %)

New in the Swiss portfolio is $BCHN (+0,24 %)

$VZN (+0,88 %) and $SIKA (+3,8 %) in it. $NESN (-0,62 %) I will probably buy more in the short term.

The euro portfolio currently remains as it is, the euros are invested in ETFs.

$XD5E (+1,18 %)

$VAPX (+2,1 %)

$VFEM (+1,18 %)

I will try to increase my cash holdings again. The target for 26 has also been set, to increase total assets to 820Tsd. That would be another +16%, which is exactly my average for the last 21 years.

So here's to another one, keep going!

Very nice to see such consistency 🙇♂️

Your depot size will probably be the goal for 2028 😬

Review of the year 2025

Or: Volatility, dividends and why the tax office was my biggest cost factor

2025 is over and, looking back, it was a year that really had everything. Volatile markets, constant political bombardment, a portfolio with its own ideas and a private life that took very little interest in whether the market was red or green.

Nevertheless, at the end of the day, it was a year with which I am very satisfied overall.

Market and performance 2025

Looking at the major indices, 2025 was anything but boring:

- S&P500 fluctuated strongly and closed the year slightly negative or sideways (in EUR).

- MSCI World was able to catch up over the course of the year, but also remained without much euphoria.

- The DAX consistently outperformed and was up over 15 percent at times

As usual, my portfolio was more defensively positioned. In good market phases, I lost returns, but lost significantly less in weak phases. This is exactly what paid off, especially in the spring and summer.

The original target of 130,000 euros portfolio value (all portfolios together) was actually achieved by the end of the year. Not in a straight line, not without detours, but achieved is achieved.

Individual stocks and typical 2025 candidates

2025 had some clear winners, but also stocks that regularly demanded my patience.

Some of the stronger phases included

- Eli Lilly ($LLY (-1,18 %) ) with several double-digit monthly gains

- Tesla ($TSLA (-0,19 %) ) with typical +30 percent months, followed by equally typical setbacks

- UnitedHealth ($UNH (-0,11 %) ) as an absolute rollercoaster with months between -20 percent and +15 percent

On the other side were

- Texas Instruments ($TXN (+0,98 %) ), strongly influenced by tariffs and political uncertainties

- Ferrari ($RACE (-0,43 %) ) with a rather disappointing performance despite a strong brand

- Classic consumer stocks such as Nestlé ($NESN (-0,62 %) ) or Procter & Gamble ($PG (+0,98 %) ), which were surprisingly weak at times

All in all, however, it has once again become clear why I focus on broad diversification and defensive stocks.

Dividends 2025, my personal highlight

The area that gave me the most pleasure in 2025 was clearly dividends.

Almost every month was up on the previous year. In some cases very significantly:

- February around +65%

- March around +29%

- April almost +50%

- June over +110%

- September around +45%

- December about +12%

July was weak, as expected, but that's part of it.

At the end of the year, I reached my personal target of of around 2,400 euros net dividends or even slightly exceeded it. In the end, the total net amount was €2491.38. This is an extremely important point for me because this figure is independent of market sentiment. The dividends also came in when share prices fell or the market was collectively in a bad mood.

My dividend ladder also looks good.

If things go well, I will even receive a net dividend of €3,000 in 2026. All I need is for the USD to get a little stronger.

Portfolio reorganization and better overview

I reorganized my portfolio in the summer.

- Share portfolio with individual stocks (and gold)

- Pension portfolio with ETFs

$XEON (+0,01 %) as a separate building block for the later loan repayment

Nothing has changed in terms of strategy, but mentally it was a huge advantage. Since then, it has been clear what needs to be valued and what can simply be left to run. The view of the portfolio has become more relaxed and the reviews are much more structured.

The nest egg and the year of bills

2025 was also the year in which the topic of nest eggs caught up with me very clearly.

- Car repairs in the region of around 1,500 euros

- Tax arrears of over 4,000 euros

- In between, the charming idea of the tax office to make an additional advance payment of 6,500 euros

In the end, this was corrected, but the damage was done. At times, the nest egg had dwindled to less than 1,000 euros. And that's where you quickly realize why you build up such a cushion in the first place.

My personal resting point is now 5,000 euros. That lets me sleep peacefully. Nevertheless, I'm still consistently building up my nest egg to 10,000 euros, simply because 2025 has shown that unplanned expenses are always more creative than any planning.

Goals for 2025 and personal conclusion

Not everything went perfectly. I adjusted goals, reduced savings rates and questioned decisions several times. Nevertheless:

- Portfolio target of 130,000 euros achieved

- Around 20,000 euros invested in total including ETFs

- Net dividend target of approx. 2,400 euros achieved

- Structure and overview significantly improved

2025 was not a year for heroic stories or social media screenshots with all-time highs. It was a year for realism, learning and clean positioning.

And to be honest: if you can say at the end of the year that you achieved your goals, slept soundly and didn't permanently win the tax office, then the bottom line is that it was a good year on the stock market.

Is there anything else that interests you?

How did your 2025 go?

What did you take away from it?

If you liked the review, please follow me.

If you didn't, keep scrolling and hope that 2026 will be more spectacular.

A look back

I have looked at my portfolio review of 2025 and my start to 2026 - not just "how much", but above all: why and what I have learned from it. I am happy to share this with you and look forward to discussion & feedback and, above all, your views: what was the result and also your perception of your stock market year 2025 - and what set-up are you starting the new year with?

Time to reflect 🧘♂️

1) Change of mood at the end of 2024

After a rather sobering (for me) stock market year 2024, there was a clear turnaround in sentiment in November 24: on the day of Trump's election victory in Nov 24, the market jumped significantly (Dow +3.57 %, S&P 500 +2.53 %, Nasdaq +2.95 %). This made the "risk-on" narrative credible again - and you could see it in the behavior of many portfolios. At least in mine, if I'm honest with myself ;)

2) Q1/Spring 2025: Unusually Europe-friendly

The first few weeks of 2025 were indeed unusually Europe-heavy: in the first six weeks of 2025, the STOXX 600 was up >5.5%, while the S&P 500 was only up +2.7% in the same period.

This also became clear later in hindsight: in 2025, defense and banks were extremely strong drivers in Europe at times. I was also right in this upswing ($DHL (+0,52 %) , $GBF (-0,98 %) , $RIO (+0,67 %) ) but unfortunately also some disastrous ($NESN (-0,62 %) , $MC (+4,98 %) , $NKE (-0,41 %) ,$NOVO B (-2,32 %) ) decisions were made. Partly also trend- and community-driven -> yes, you are to blame ;)

3) Beginning of April: Bad times

Then came the break: The strong start to the year was literally "wiped out" in just a few sessions, partly due to the customs/trade war shock. YTD turned completely negative, and by April 7 the STOXX 600 was around 12% below the closing price on April 2. $TSLA (-0,19 %) and $NVDA (+1 %) purchases. I also $PEP (+0,19 %) I bought cheaply, but a real breakout is still a long way off.

4) Shortly afterwards: fireworks

Then a tailwind came back in the US from the middle/end of April, when the market repriced parts of the Trump escalation in the direction of "negotiations/de-escalation". The Donald kept a few election promises that were perhaps not quite official .-)

5) H2/late year: AI + interest rates as a "macro tailwind"

Towards the end of the year, the environment was then more strongly characterized by two factors: AI-driven risk assets and falling interest rates. It was an AI-driven rally, which also supported sentiment and inflows into US equity again.

And on the interest rate side: the Fed set the key interest rate at 3.50 % to 3.75 % in December after a further cut.

At the end of the year, the major benchmarks were also closer together again: STOXX 600 +16.66 % in 2025, S&P 500 ~+17 %.

6) Golden times 🥇🏅

Then there was the beautiful gold (u.W.). 2025 was a real exclamation mark: spot gold was up around 66% over the year (according to Reuters, the strongest increase since 1979).

Silver was even more extreme at around +168 % per year.

I have already written about gold in more detail here on getquin - if you are interested in the topic, you can find the article in my profile.

Personal performance 2025

- Internal rate of return: approx. +10 %

- TTWROR: approx. -33 %

- Dividend yield: approx. 1.3 % p.a.

The figures confirm what I described above: in my opinion, I made very good operational decisions (realized profits, used tax aspects, built up cash flow). At the same time, the TTWROR shows quite clearly that the portfolio structure was too volatile and too strongly growth/trend-oriented in the meantime. Too often, I have taken the "falling knife".

Before the turn of the year, I invested in $NVDA (+1 %) , $TSLA (-0,19 %) , $GBF (-0,98 %) and $DHL (+0,52 %) - each with positive returns - for the following reasons:

- Utilize saver's allowance

- Reduce tech-heaviness

- Cash generation (you can read why below)

Starting point Jan 2026:

Brief overview of the 2026 start setup

Asset mix

- Individual shares: 71.4 %

- ETFs: 16.0 %

- Gold: 9.2 %

- Crypto: 3.4 %

Regional breakdown

- North America: approx. 45.7 %

- Europe developed: approx. 26.0

- Rest of the world (including EM/Asia/Australasia): approx. 22.5 %

Sector structure

- Financial services: 20.5 %

- Consumer goods (cyclical): 19,2 %

- Consumer staples: 15.7

- Information technology: 14.8

- Materials: 7.9

- Healthcare: 4.7

Start to the new year

Parallel to the sales at the end of 2025, I reallocated or increased my holdings in January, including in $O (+1,13 %), $VNA (+0,18 %) and $ZAL (-0,93 %)- with the logic:

- Strengthen cash flow/dividend components

- Turnaround opportunities as a limited admixture

- Reduce volatility in the portfolio

Why I am thinking more defensively in 2026

Next week, the purchase of an apartment on beautiful Lake Tegernsee 🏝️ will be notarized. This is a step into a completely new asset class for me, as it's my first property of my own. - In addition to construction financing, it will of course also be a liquidity issue over the next few weeks.

I may make a separate post about this, perhaps some of you are also currently facing this step?

I can mentally cope well with drawdowns. But: being able to bear risk does not automatically mean having to bear risk.

My portfolio should fit in with this new phase of my life.

What I will do differently in 2026

Because a new asset class will be added to my portfolio in 2026 with the purchase of an apartment, I want to position my portfolio more defensively in future - without completely foregoing opportunities for returns : risk. Otherwise we would be completely wrong on the stock market :)

1) ETF core should dominate

I want my portfolio to be dominated by my ETFs in future. My target scenario is therefore

- 60% of the deposits via a savings plan in my 4 core ETFs ($VWRL (+0,63 %) , $COMM (+0,72 %) , $WSML (+0,93 %) , $IEMS (+0,93 %) ).

- 30 % stocks

- 10 % commodities

- Play money: crypto, certificates, pennies (weighting < 5%)

Important! This is a start-in-2026 setup

Of course, as always in life, a plan is there to be thrown overboard - so you have to wait and see how assets perform in the year ahead and reassess regularly.

2) Stocks yes - but with more discipline

Turnaround/opportunity stocks and trends remain part of my approach, but clearly limited. I want these positions to be what they should be again: An addition, not a foundation.

I will reduce (basic) consumption and strengthen healthcare. And tech?

3) Tech: more controlled

Tech will remain a driver of returns in 2025 - but I want to build it up again in a controlled manner after my sales. I will monitor the trend from a distance for the first few weeks and possibly months and bet on corrections. You can't do without it - as you can see from the Mag-7 performance in 2025:

- $GOOGL (+3,81 %) : +65,3 %

- $NVDA (+1 %) : +38,9 %

- $MSFT (-0,3 %) : +14,7 %

- $META (+1,59 %) : +12,7 %

- $TSLA (-0,19 %) : +11,4 %

- $AAPL (+1,51 %) : +8,6 %

- $AMZN (+2,51 %) : +5,2 %

On that note, happy new year!

$VWRL (+0,63 %)

$EWG2 (+2,08 %)

$O (+1,13 %)

$PEP (+0,19 %)

$MSFT (-0,3 %)

$P911 (+1,21 %)

$BLK (+1,63 %)

$NKE (-0,41 %)

$RIO (+0,67 %)

$MC (+4,98 %)

$NOVO B (-2,32 %)

$NESN (-0,62 %)

$ZAL (-0,93 %)

$COMM (+0,72 %)

$IEMS (+0,93 %)

$BTC (+0,22 %)

$ETH (+0,85 %)

$XRP (+0,87 %)

$PEPE (-1,41 %)

If you do this consistently, your plan will work. I wish you every success and lots of fun with your new apartment

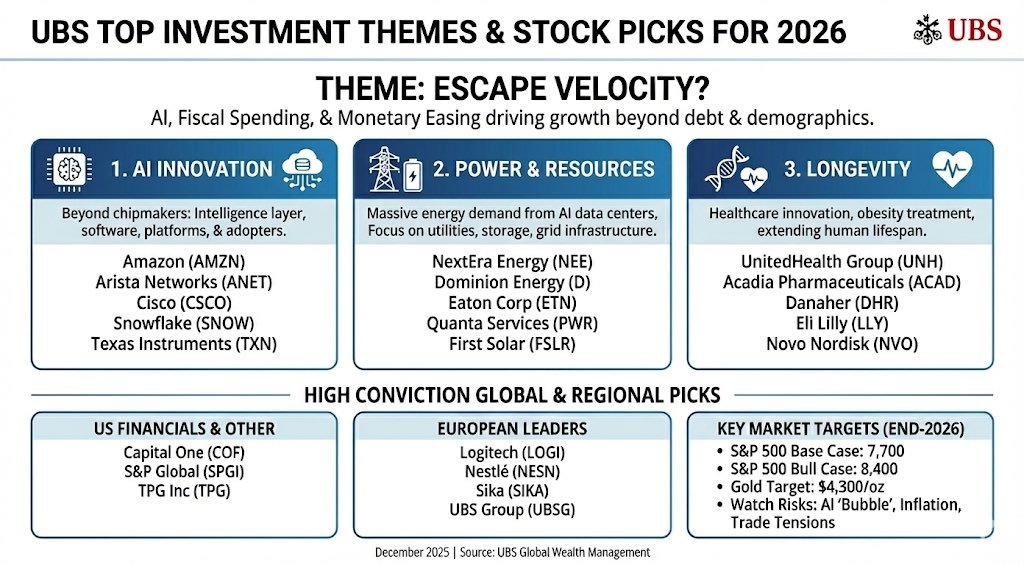

Equities | UBS Top Picks

The best shares for 2026 from the $UBSG (+0,03 %)

$AMZN (+2,51 %)

$ANET (-3,29 %)

$CSCO (+1,04 %)

$SNOW (-3,7 %)

$TXN (+0,98 %)

$NEE (+0,49 %)

$D (+1,58 %)

$ETN (-1,23 %)

$PWR (+0,16 %)

$FSLR (+2,98 %)

$UNH (-0,11 %)

$ACAD (-1,83 %)

$DHR (-0,42 %)

$LLY (-1,18 %)

$NOVO B (-2,32 %)

$COF (+1,15 %)

$SPGI (-0,01 %)

$TPG (+1,06 %)

$LOGN (+0,5 %)

$NESN (-0,62 %)

$SIKA (+3,8 %)

Investment decisions

Dear Getquinners,

I would be interested in your opinion again.

I would like to expand my portfolio with a few shares in the long term.

Long-term investment is my goal with good growth (target at least 10-12% annually), dividends are nice but not a must, may also have some risk (of course the position size will be adjusted accordingly).

Which positions would you punch (Austrian for sell🤣) from the existing ones in the portfolio or just add to them?

Stocks that I find interesting as additions:

-Netflix $NFLX (+1,88 %)

-Broadcom $AVGO (-0,41 %)

-Waste Management $WM (-1,44 %)

-Zoetis $ZTS (+1,27 %)

-Kawasaki Heavy $7012 (+6,33 %)

-Intuitive $ISRG (+1,04 %)

-Chipotle $CMG (-1,05 %)

-Amgen $AMGN (-0,16 %)

-Crowdstrike Hldg $CRWD (-7,77 %)

-Vistra Corp $VST (-0,75 %)

-Constellation PA $CEG (+1,13 %)

-Amphenol $APH (+0 %)

-Nestle $NESN (-0,62 %)

-Monster Beverage $MNST (+1,52 %) (I love Monster)

-AMD $AMD (-1,53 %)

-Palo Alto Networks $PANW (-1,12 %)

-Contemporary Amperex $3750 (-0,87 %)

-Albermale $ALB (-0,08 %)

-Synopsys $SNPS (-0,54 %)

-Taiwan Semiconductor $TSM (+2,62 %)

-Datadog $DDOG (-4,15 %)

-Itochu $8001 (-2,76 %)

-Eaton $ETN (-1,23 %)

-Procter&Gamble $PG (+0,98 %)

-Pepsico $PEP (+0,19 %)

-Coca Cola $KO (+0,78 %)

-Hims&Hers $HIMS (-0,67 %)

-Kraken Robotics $PNG (+1,38 %)

etc.

There are so many interesting titles that you can easily be overwhelmed.^^

At the moment mainly the $VWRL (+0,63 %) and $BTC (+0,22 %) monthly, share purchases are made when opportunities arise. (Financially and chart-wise).

I look forward to your opinion.

Titres populaires

Meilleurs créateurs cette semaine