As many of you may or may not have noticed, the Trump Media & Technology Group ($DJT) launched five ETFs under the Truth.Fi label at the end of 2025.

They are positioned as "America First" investment products with a focus on security, energy, innovation, iconic companies and real estate in Republican-leaning states.

At first glance, these sound like clear themes. However, a second glance reveals structural weaknesses, small fund sizes and a very strong political narrative. The following is a sober, deliberately skeptical analysis of all five ETFs.

1) Truth Social American Security & Defense ETF

($TSSD)

🛡️

Focus: Defense, security, cybersecurity

Expense ratio: approx. 0.65

Fund assets: approx. USD 246,000

Number of positions: around 58

Largest positions:

RTX Corp ($RTX) (-0,83 %)

Palantir Technologies ($PLTR) (-4,13 %)

Palo Alto Networks ($PANW) (-1,97 %)

Classification:

The fund has a logical thematic structure and combines traditional defense stocks with modern software and cybersecurity. The big problem, however, is the extremely low fund assets. With only around a quarter of a million USD, liquidity is very limited. High spreads and a potential closure risk are realistic scenarios. Comparable defense ETFs are much larger, cheaper and more stable.

2) Truth Social American Energy Security ETF ($TSES) ⚡

Focus: US energy, oil, gas and energy infrastructure

Expense ratio: approx. 0.65%

Fund assets: not reported transparently, presumably very low

Number of positions: around 68

Largest positions:

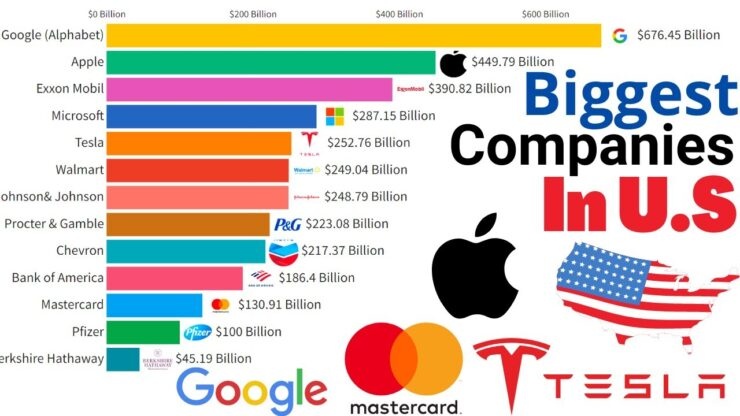

Exxon Mobil ($XOM) (+0,55 %)

Chevron ($CVX) (+0,2 %)

Eaton Corporation ($ETN) (-2,32 %)

Classification:

The ETF focuses on traditional US energy champions. This is not an innovative approach, but a very traditional sector bet. The political term "energy security" does not change the fact that investors are essentially buying an expensive energy ETF with an unclear fund volume. Without sufficient inflows of funds, tradability remains questionable.

3) Truth Social American Next Frontiers ETF ($TSNF) 🚀

Focus: Future technologies, innovation, space, industry

Expense ratio: approx. 0.65%

Fund assets: not clearly stated, probably very low

Largest positions:

Planet Labs ($PL) (-1,72 %)

Marvell Technology ($MRVL) (-2,61 %)

Intuitive Machines ($LUNR) (-2,02 %)

Classification:

The name sounds visionary, the structure remains vague. "Next Frontiers" is not a clearly defined investment factor, but a collective term. Many smaller, sometimes speculative stocks, little transparency in weightings and a lack of track record make the fund difficult to assess. The ETF looks more like a thematic vendor's tray than a stringent innovation strategy.

4) Truth Social American Icons ETF ($TSIC) ⭐

Focus: well-known US brands and large companies

Expense ratio: approx. 0.65%

Fund assets: approx. USD 248,000

Number of positions: around 54

Largest positions:

Procter & Gamble ($PG (+0,32 %))

Lowe's ($LOW) (+1,76 %)

Altria Group ($MO) (+0,88 %)

Classification:

The fund invests in established US companies that are familiar to many investors. The term "icons" creates a positive gut feeling, but is not a measurable investment factor. In terms of content, the ETF is similar to a classic large-cap approach - but with significantly higher costs, a very small fund volume and no clear added value compared to existing standard ETFs.

5) Truth Social American Red State REITs ETF ($TSRS) 🏘️

Focus: Real estate companies with a focus on Republican-dominated states

Expense ratio: approx. 0.65

Fund assets: not transparently disclosed, presumably low

Number of positions: around 28

Largest positions:

VICI Properties ($VICI) (+0,89 %)

Broadstone Net Lease ($BNL) (+0,31 %)

NNN REIT ($NNN) (+0,29 %)

Classification:

Filtering real estate by political geography is unusual. Economically relevant factors such as rental structure, location quality or financing conditions take a back seat here. The fund is highly concentrated, sensitive to interest rates and offers no clear advantage over broad REIT ETFs.

Overarching points of criticism ⚠️

Very low fund assets

Several ETFs are only in the low six-figure range or below. This is critical for ETFs and increases the risk of wide spreads, low liquidity and possible fund liquidation.

High costs

All five ETFs charge around 0.65% in fees. This is high, especially as there is no demonstrable outperformance, no track record and no unique strategy.

Political narratives instead of investment logic

The funds are heavily politically branded. This can generate attention, but is no substitute for a clean investment strategy. Political conviction is neither a risk factor nor a driver of returns.

Conclusion

The Truth Social ETFs are less traditional investment products and more of a financial statement. They are obviously aimed at investors who want to reflect political convictions in their portfolios.

From a rational investment perspective, they appear topical:

- very small

- expensive

- not very liquid

- conceptually interchangeable

Or to put it more bluntly:

America First is on the ETF name, but rather not in the foreground in terms of the risk/return ratio.

There are much more robust alternatives for a seriously constructed, long-term portfolio. However, the funds are certainly entertaining as discussion material in the community.

What do you think of the ETFs?

Lg

Don