The DZ Bank analysts have drawn up two lists of shares that they consider to be particularly attractive. For more defensive investors and for investors who rely on continuous cash flows, they recommend the so-called "dividend aristocrats": In other words, companies that have regularly paid and raised dividends.

Top dividend aristocrats:

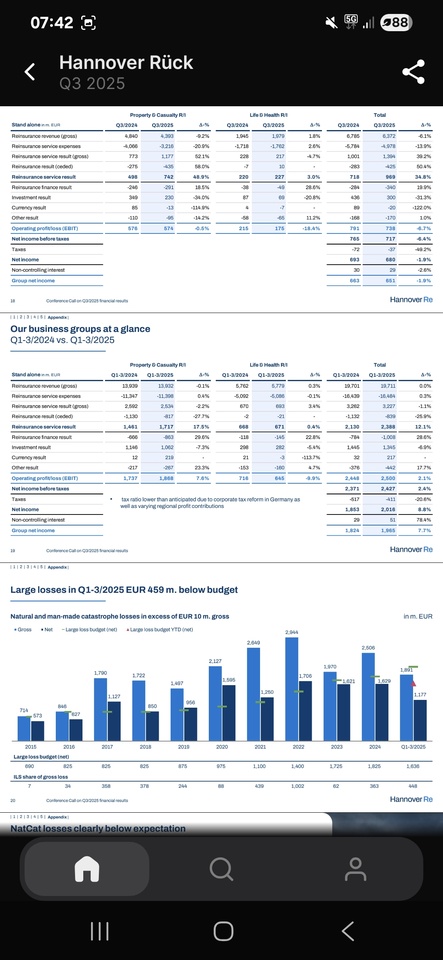

Pfizer $PFE (-1,42 %), Verizon $VZ (+2,36 %), BNP Paribas $BNP (-2,56 %)Zurich Insurance $ZURN (-3,17 %), Enel $ENEL (-4,75 %), Sanofi $SAN (-1,32 %), Hannover Re $HNR1 (-1,85 %) , Man and Machine $MUM (-1,54 %), Generali $G (-3,44 %) and Allianz $ALV (-2,77 %)

Another list has been compiled for investors with a somewhat higher risk appetite: Stocks with attractive dividend yields and additional share price potential. These not only pay a good dividend of at least three percent, but could also increase significantly in price in the future. However, the continuity of dividends in the past plays a lesser role - and this strategy is correspondingly riskier.

Top dividend rockets:

Man and machine $MUM (-1,54 %) , Cancom $COK (+1,18 %), Bastei Lübbe $BST (-0,58 %), Sixt $SIX2 (-2,01 %), Kontron $KTN (-1,67 %), Fresenius Medical Care $FME (+0,2 %), Vonovia $VNA (-3,15 %), Hawesko $HAW (+1,23 %), ElringKlinger $ZIL2 (-4,83 %) and Hannover Re $HNR1 (-1,85 %)

Source text (excerpt) & graphic: World | AAA, 19.02.2026