$JKS (-0,22 %)

$HIVE (-0,61 %)

$9868 (+0,04 %)

$1810 (-0,09 %)

$BIDU (+0,26 %)

$PDD (+0,23 %)

$KLAR (-0,6 %)

$TGT (-1,05 %)

$WIX (-0,12 %)

$BLSH

$PANW (+0,12 %)

$NVDA (-0,16 %)

$992 (+0,29 %)

$WMT (-2,34 %)

$PSH (-1,07 %)

$ASC (-0,4 %)

Discussion sur ASC

Postes

7Quarterly figures 17.11-21.11.25

⬆️⬆️⬆️

- UBS raises its price target for NVIDIA from USD 150 to USD 185. Buy. $NVDA (-0,16 %)

- METZLER raises the price target for MUNICH RE from EUR 535 to EUR 543. Buy. $MUV2 (-0,04 %)

- GOLDMAN lowers the target price for NOVO NORDISK from DKK 1040 to DKK 1025. Buy. $NOVO B (-0,43 %)

- GOLDMAN upgrades MTU from Neutral to Buy and raises target price from EUR 276 to EUR 400. $MTX (-1,68 %)

- GOLDMAN upgrades BASF from Neutral to Buy and raises target price from EUR 45 to EUR 53. $BAS (-0,88 %)

- DEUTSCHE BANK RESEARCH raises the price target for FRESENIUS SE from EUR 42 to EUR 44. Buy. $FRE (+1,26 %)

- DEUTSCHE BANK RESEARCH raises the price target for EMBRACER from SEK 24 to SEK 28. Hold. $TH9A

- DEUTSCHE BANK RESEARCH raises the price target for AMADEUS IT from EUR 62 to EUR 65. Hold. $AMS (+0,78 %)

- DEUTSCHE BANK RESEARCH raises the price target for NEMETSCHEK from EUR 85 to EUR 100. Hold. $NEM (+1,74 %)

- WARBURG RESEARCH raises the price target for DÜRR from EUR 32 to EUR 33. Buy. $DURYY (+2,57 %)

- HAUCK AUFHÄUSER IB upgrades CANCOM from Hold to Buy. Target price EUR 32. $COK (+1,47 %)

- ODDO BHF upgrades GENERALI to Neutral. Target price EUR 26.10. $G (-0,32 %)

- METZLER raises the price target for HEIDELBERG MATERIALS from EUR 131 to EUR 138. Buy. $HEI (-0,07 %)

- BERENBERG raises the price target for FLATEXDEGIRO from EUR 16 to EUR 18. Buy. $FTK (-5,05 %)

- BERENBERG raises the price target for FREENET from EUR 29 to EUR 32. Buy. $FNTN (-5,89 %)

- JPMORGAN raises the target price for HEIDELBERG MATERIALS from EUR 108 to EUR 149. Overweight. $HEI (-0,07 %)

⬇️⬇️⬇️

- UBS lowers the price target for MUNICH RE from EUR 560 to EUR 540. Buy. $MUV2 (-0,04 %)

- ODDO BHF downgrades MODERNA to Outperform. Target price USD 86. $MRNA (-0,79 %)

- UBS downgrades VALE from Buy to Neutral and lowers target price from USD 14 to USD 11.50. $VALE (-0,55 %)

- DZ BANK lowers target price for DEUTZ from EUR 6.80 to EUR 5.80. Buy. $DEZ (+0,09 %)

- DZ BANK lowers the price target for BECHTLE from EUR 51 to EUR 45. Buy. $BC8 (-0,33 %)

- BERENBERG lowers the target price for ESTEE LAUDER from USD 87 to USD 76. Hold. $EL (-1,15 %)

- RBC lowers the target price for ASOS from GBP 4.60 to GBP 4. Sector Perform. $ASC (-0,4 %)

- RBC lowers the price target for EVOTEC from EUR 12 to EUR 11.60. Outperform. $EVT (+0,91 %)

- RBC lowers the price target for VESTAS from DKK 222 to DKK 156. Outperform. $VWS (+0,88 %)

- BERENBERG lowers the price target for SUSS MICROTEC from EUR 80 to EUR 75. Buy. $SMHN (-0,57 %)

- JEFFERIES downgrades NEL from Hold to Underperform and lowers target price from NOK 5.50 to NOK 3. $NEL (+0,37 %)

- RBC lowers the price target for BMW from EUR 81 to EUR 80. Sector Perform. $BMW (-1,86 %)

- JEFFERIES lowers the price target for KNAUS TABBERT from EUR 26 to EUR 20. Hold. $KTA (-0,25 %)

$ASC (-0,4 %) has now made almost +74% within a month. Even though I have a few shares of it in my portfolio, this increase has nevertheless passed me by somewhat.

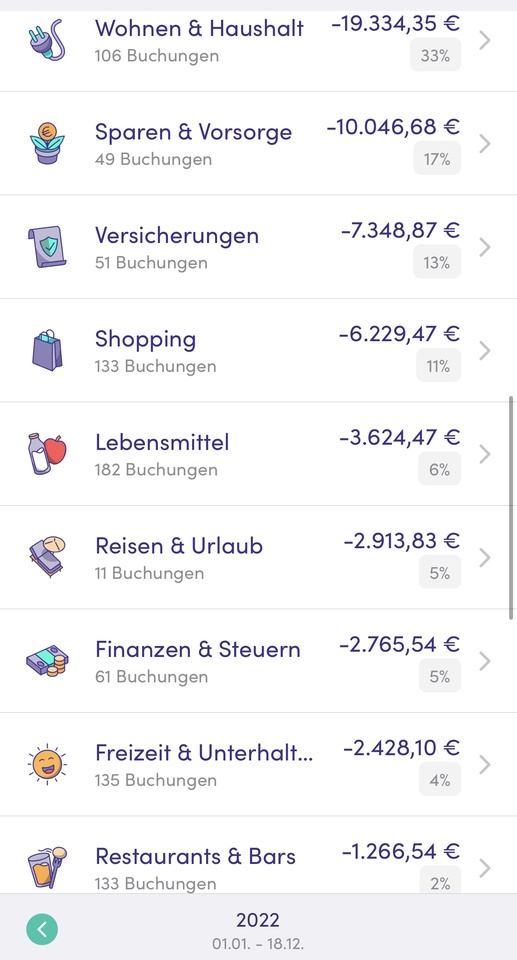

Expenditure/Revenue Recap 2022

Money is what people talk about! #recap2022

In the sense of getquin, which allows us all not only to track our own portfolios, but also to discuss money and investments.

First I want to talk about my income, then about my expenses and be as transparent as possible.

(For tracking I use Finanzguruwhich I use since May)

First my income:

In 2022 I have 55.222,26€ received.

My main source of income is my work in the white collar relationship, there I have 40.464,78€ received (December salary outstanding). The rest came from "rental income" of my girlfriend, tax office, profits (shares, sweepstakes, Ebay) and Co.

The income point is I think but not as interesting as the expenditure point:

My expenses:

In 2022 I have 58.218,25€ spent.

The biggest chunk with 19.334€ lies there with the Living. The rent is always deducted in full from my account, my girlfriend then transfers your part. In total, I / we have paid 9,463 € in rent, and moved in April together. The Deposit from 2.550€ I took over alone (Rheinmetall 7er lever of March runs) and the largest part of the furnishings with 5.686€.

The rest comes from electricity, parking and miscellaneous.

Next comes Invest with 10.046€.

There went 8.213€ to TradeRepublic, 1.148€ in Crypto, 380€ in gold/silver and my little old building society contract was allowed to settle with 300€ happy.

The third point is 7.349€

InsurancesThis includes private health insurance and pension insurance, which is why the amount is so gigantic.

The PKV takes since August 3.487€ and the RV

2.425€Thus remain occupational disability with 784 €, legal protection, accident and liability with a total of 651 €.

Let's move on to a nicer point: Shopping with 6.229€

This of course includes forever of small items.

The ones that stick out are a new cell phone from $AAPL , a lot of $AMZN (-0,22 %) and $EBAY (+2,16 %) clothing $YOU

$ASC (-0,4 %) and a lot of untitled stuff from $PYPL (-0,17 %) and Klarna.

But also some gifts for friends and family.

Right after even better: Food with 3.624€

3.315€ went to supermarkets and discounters (I work in a grocery store, so I see a lot of great and tasty things every day) and 262€ to $HFG (+0,87 %)

2.913€ are for travel have been spent.

Of course beautifully well-behaved with $ABNB (-0,36 %) !

Likewise, a vacation is included, which I will make only in February 23, but is already paid 🎌.

Finances and taxes forms a small loan from my dad, which I paid him back and Donations for good causes with 2.765€.

The 2.428€ at leisure expenses include books, subscriptions to $NFLX (+0,07 %)

$GOOGL (-0,34 %)

$AAPL (-0,25 %)

$AMZN (-0,22 %) and $DIS (-0,29 %) , ventures, sports, hobbies, hairdresser, cinema and Rock in the Park.

The last of the major items that remain are Restaurants with 1.266€. The most went real restaurants at home and abroad with 684€ and 582€ to fast food from $MCD (-0,02 %)

$DPZ (-0,08 %)

$SBUX (-0,12 %)

$RBD and $YUM (-0,16 %)

The rest are then still smaller other expenses.

So... Holy Moly, that took longer than expected 😂.

I think I just took over an hour for all the analyses and the written record, but I think that I have also learned something from it.

Overall, I think that the expenses were ok, especially for the circumstances this year.

Next year I will invest and travel more and spend less on the apartment.

Who has made it down to here I would like to thank upright ❤️

It gives me so much pleasure to talk with you, to write posts and to get to know other views!

Absolutely gigantic thank you to everyone who has liked and commented on my posts this year! ❤️❤️❤️

I think that was my last big post this year, in the next it goes on 😃

Stop stop! There was something else! I want to know how it was with you!

I am clear, not all want to write something like that in numbers but I would be interested in how the expenses and income of you look in percent!

What percentage of your expenses go into investing? How many for rent/house away?

And to anyone doing a post on this, feel free to link, would love to see it! 😃

(Especially what a donkey spends on his meadow or a panther in Bali!).

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗞𝗲𝗶𝗻 𝗛𝗮𝗳𝗲𝗻 𝗶𝗻 𝗦𝗶𝗰𝗵𝘁 / 𝗩𝗪 𝗺𝗮𝗰𝗵𝘁 𝗲𝗶𝗻𝗲𝗻 𝗮𝘂𝗳 𝗧𝗲𝘀𝗹𝗮 / 𝗨𝗦𝗔 𝗶𝗺 𝗕𝗶𝘁𝗰𝗼𝗶𝗻-𝗛𝗶𝗺𝗺𝗲𝗹

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, Blackrock ($BLQA), Citigroup ($TRVC (-0,32 %)) and EMCOR Group ($EM4 (+0,9 %)) are trading ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, Domino's Pizza ($DKOB (+1,72 %)), Morgan Stanley ($DWD (+0,32 %)), Wells Fargo ($NWT (-0,22 %)) and Bank of America ($NCB (-0,28 %)) present their figures.

𝗜𝗣𝗢𝘀 🔔

Veganz - The Berlin-based company is planning to go public in the next few months. The offering volume is expected to be around 50 million euros. The targeted 35 million euros in gross proceeds are to be invested in a new production facility and in the growth of the company, which specializes in vegan and plant-based products.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

USA - The extreme backlog of container ships on the West Coast is to be relieved by making the Port of Los Angeles operate around the clock. Currently, there are about 500 thousand containers on board waiting to be cleared.

Especially fashion groups specializing in fast fashion are hit hard by the delivery bottlenecks, as Asian goods are very much behind schedule. Both H&M ($HMSB (+0,62 %)), Bohoo ($1B9 (+0 %)), as well as ASOS ($DYQ (-0,4 %)) are complaining about the current situation and expect further delays and rising raw material prices.

Volkswagen ($VOWA (-1,69 %)) - The automotive group wants to make production more efficient. VW CEO Diess has presented scenarios in the meeting of the control body with a strong reduction of jobs, which should affect up to 30,000 employees. This would mean that every 4th employee would be affected by the job cuts.

However, this measure is only to come into effect if the Group fails to make the transition to e-mobility quickly enough. Diess wants to compete with Tesla in the future, which plans to produce 500 thousand cars per year in Grünheide in the future.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

U.S. Becomes Bitcoin Stronghold - In the United States, the Bitcoin hash rate of 35% now ranks #1 in the world. The mining ban by the Communist Party of China is hitting Chinese miners hard. But as a result, other countries are benefiting greatly. Even Germany is overtaking China, currently carrying 4.5% of the Bitcoin hash rate. However, it is possible that Chinese miners, disguised by a VPN, continue their business in other countries.

Titres populaires

Meilleurs créateurs cette semaine