Entry into $KLAR (+1,39 %) -50% of the IPO. Super case for me. Super integrated, sales + profit right for the time being. A few regulatory issues that are kindergarten in my opinion. Deliberately go in before earnings with 50% of the desired end position. Just paid my half-yearly gym purchase with Klarna as a thinking shareholder :)

Klarna Group Plc

Price

Discussion sur KLAR

Postes

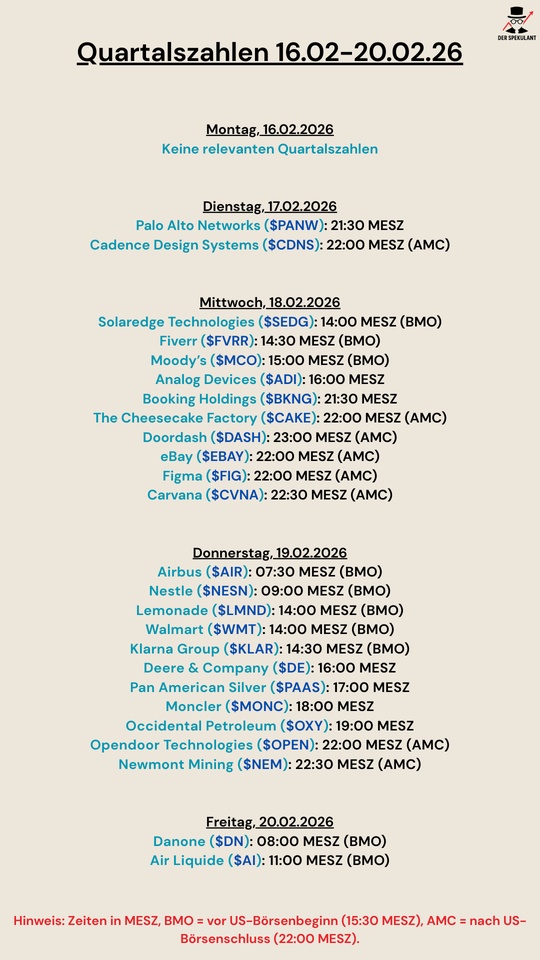

10Quarterly figures 16.02-20.02.26

$PANW (+0,75 %)

$CDNS (-0,96 %)

$SEDG (+1,28 %)

$FVRR (+2,08 %)

$MCO (-0,23 %)

$ADI (+0,14 %)

$BKNG (-0,15 %)

$CAKE (-0,71 %)

$DASH (+0,05 %)

$EBAY (+0,17 %)

$FIG (+1,14 %)

$CVNA (+0,66 %)

$AIR (-0,6 %)

$NESN (-0,26 %)

$LMND (+0,99 %)

$WMT (-0,36 %)

$KLAR (+1,39 %)

$DE (-0,29 %)

$PAAS (+3,41 %)

$MONC (+0,94 %)

$OXY (-2,12 %)

$OPEN (+0,58 %)

$NEM (+2,21 %)

$BN (+2,91 %)

$AI (-0,84 %)

A little quieter next week

$SON (+1,26 %)

$MDT (-0,06 %)

$LDOS (-0,51 %)

$PANW (+0,75 %)

$CDNS (-0,96 %)

$KRYS (-0,31 %)

$HL (+2,64 %)

$TOL (-0,13 %)

$KVUE (-0,38 %)

$DEVON

$ADI (+0,14 %)

$GRMN (+0,47 %)

$SEDG (+1,28 %)

$MCO (-0,23 %)

$FVRR (+2,08 %)

$PODD (-0,91 %)

$CVNA (+0,66 %)

$DASH (+0,05 %)

$FIGX

$EBAY (+0,17 %)

$RELY

$WMT (-0,36 %)

$PWR (-0,22 %)

$DE (-0,29 %)

$LMND (+0,99 %)

$KLAR (+1,39 %)

$W (-0,57 %)

$NICE

$YETI (-0,35 %)

$OPEN (+0,58 %)

$NEM (+2,19 %)

$AKAM (+0,2 %)

$SFM (-0,04 %)

$TXRH (-0,18 %)

$BCPC (-0,26 %)

$BKNG (-0,15 %)

Portfolio update

Here’s an update on my current portfolio. I know some people will say I’m holding too many positions, but the smaller ones are all grouped into one pie with a weekly auto-invest, so it stays structured and disciplined rather than messy.

I also added $KLAR (+1,39 %) today. Klarna looks attractive at current levels after significantly improving cost control and moving closer to sustainable profitability. Consumer adoption of Buy Now, Pay Later remains strong, and Klarna is increasingly positioning itself as a broader fintech platform rather than just a BNPL provider. With a much leaner operation and a valuation still well below past highs, the risk-reward looks compelling to me.

let me know what you think?

All the tips help!

Get ready for entry 🔥

Hi guys, wanted to let you know which stocks are on my watchlist and when I would get in, looking forward to your feedback.

The alerts are active in TR and Tradingview, just waiting for the notifications 🤑

$1810 (+3,45 %) 3,50€

$UNH (-0,24 %) 220€

$UBER (+0,43 %) 60€

$AVGO (+0,76 %) 230€

$CRWD (-0,33 %) 335€

$WM (-0,16 %) 175€

$ISRG (-0,01 %) 380€

$WKL (-0,9 %) 72€

$KLAR (+1,39 %) 20€

$SRAD (-1,9 %) 14€

$PNG (+0 %) 3,50€

$MC (-0,76 %) 530€

What's on your watchlist?

Kind regards 👋🚀

You find the 12 stocks fundamentally attractive and they are worth considering for an investment, yes?

But you need a (further) dip of at least around 10% for each stock, right?

Is there such a thing as an investment case for you or is it based on chart technology/ turnaround forecasts?

Greetings

🥪

Opinion on Klarna?

Dear Getquin User

What is your opinion on $KLAR (+1,39 %) ?

Do you think the IPO was a good move or wasted talent?

And maybe you've already given an answer to your question...

Dates week 39

As every Sunday, the most important news from the past week, as well as the most important dates for the coming week.

Also as a video:

https://youtube.com/shorts/sE7jANUi8eM?si=4EI7ZTjZvFiGjBAj

Wednesday:

Consumer credit, the worst form of debt, is becoming increasingly popular. With fewer barriers to online purchases, more and more people are turning to services from $KLAR (+1,39 %) Klarna & Co.

The EU is coordinating with the USA and wants to adopt the next sanctions package. According to von der Leyen, the package is aimed at cryptocurrencies, the energy sector and banks. In particular, oil refineries in India and China that process Russian oil are to be affected. The crypto sector is also likely to be included, as it has been easy to circumvent sanctions with cryptocurrencies up to now. Russian banks are also to be denied access to the European financial system.

For the first time this year, the Fed lowers

year by 0.25 percentage points. This is in line with expectations, even if some had hoped for 0.5 percentage points. According to the Fed 'to avoid a recession'.

https://www.tagesschau.de/ausland/amerika/fed-notenbank-leitzines-senkung-100.html

Thursday:

🚀 $NVDA (+0,76 %)

NVIDIA relies on $INTC (+1,09 %)

Intel! 💥

With an investment of USD 5 billion, NVIDIA secures a 4% stake in Intel - and with a clear goal: to revolutionize the future of AI chips for data centers! 💡🔌

This partnership could redefine competition in the field of high-performance processors and pave the way for powerful AI applications. 🧠💻

Friday:

Surprisingly large drop in producer prices in Germany. Prices fell by 2.2% in August compared to the same month last year. Energy prices are primarily responsible for the fall.

These are the most important dates for the coming week:

Tuesday: 10:00 Economic data (EU)

Tuesday: 15:45 Economic data (USA)

Friday: 01:30 Inflation data (Japan)

Can you think of any other dates?

Klarna share

What do you think about the $KLAR (+1,39 %) share?

They are currently making losses. Personally, I often use Klarna to pay when it's offered online. Of course, there is a lot of competition like $PYPL (-1,18 %) .

The IPO has been postponed again and again. Now the shares are also available from my broker.

Should I wait and see which way the price moves, or should I go in with a small tranche?

The competition is huge, some of the competitors are valued more favorably.

I don't expect a high-flyer here for the time being.

Not an investment for me personally.

Klarna with stock market debut 💳⬛️🟪

Klarna's $KLAR (+1,39 %) stock market debut is complete.

Klarna's shares rose sharply on Wednesday at its eagerly awaited IPO in New York.

The shares opened at 52 dollars and thus 30 percent above the issue price of 40 dollars. They were last 24 percent higher at 49.46 dollars. This gives the Swedish "buy now, pay later" provider a valuation of around 19.5 billion dollars.

Turnover rose by almost a quarter to 2.8 billion US dollars in 2024. For the first time in a long time, Klarna posted a profit of 21 million US dollars (around 18 billion euros) last year.

Summarized once again 💡

- 93 million active customers in 26 countries

- Cooperation with over 675,000 retailers

- Turnover: 2.81 billion US dollars

- Profit margin - approx. 0.11%

- Free cash flow margin - 19.3%

- Revenue growth (YoY) - 23.51%

Sources

investing.com

the shareholder

Titres populaires

Meilleurs créateurs cette semaine