BEFORE: I have completely revised my portfolio review. There are now even more in-depth figures to see and I have greatly reduced the body text. Only my introduction is a little more detailed. The visual overview on Instagram has also been completely revamped. There is also a budget review, which I am not publishing here as a post. However, I have included a few key figures from this one in the portfolio review.

I am very happy about likes here at GQ and on both IG posts, as the complete renewal has cost me a lot of nerves and time. 🙃 If you also want to know how my personal finances have developed, I'd like to refer you to my personal budget review on Instagram.

In future, I will publish my detailed assessments on individual topics that were previously part of the review (such as crypto cycles or my succession strategy for crypto) separately in individual posts on GQ. Perhaps as a kind of supplementary post.

Are you missing important key figures or do you have suggestions for optimization? Constructive suggestions are always welcome.

For me, May was characterized by calm and composure, because I kept the noise of the markets and US trade policy away from me. I can do no more than simply buy more. I like to refer here to the stoic way of thinking, which focuses on prioritizing what you can influence. And that is my personal development. So that meant doing sport (at home with YouTube cardio and strength, abs, core, running), stockpiling Instagram posts so that I have some breathing space in the summer and delving deeper into the topic of AI. And the tax return was also completed. Meanwhile, dividends have been stable with the second strongest month ever, which was April. Time for a deep dive into my figures.

Overall performance

My portfolio performed well in May. Bit by bit, we are fighting our way up from the tariff lows. The key performance indicators are

- TTWROR (month of May): +4.83 %

- TTWROR (since inception): +65.84 %

- IZF (month of May): +74.24 %

- IZF (since inception): +9.94 %

- Delta: +€3,368.39

- Absolute change: +4,486.96 €

Share allocation & performance

Which shares performed particularly well in May? Which are at the top of the chain and which at the bottom? Which were the biggest losers?

Size of individual share positions by volume

Share: Share of total portfolio in % (portfolio)

- $AVGO (-0,41 %) : 2,71 % (main share portfolio)

- $NFLX (+1,88 %) : 2,12 % (main share portfolio)

- $WMT (-1,92 %) : 1,83 % (main share portfolio)

- $SAP (+1,12 %) : 1,69 % (main share portfolio)

- $FAST (-0,03 %) : 1,59 % (main share portfolio)

Smallest individual share positions by volume:

Share: Share of total portfolio in % (securities account)

- $SHEL (-0,01 %) : 0,44 % (crypto follow-on portfolio)

- $HSBA (+1,43 %) : 0,54 % (crypto follow-on portfolio)

- $TGT (+0,82 %) : 0,62 % (main share portfolio)

$DHR (-0,42 %) : 0,66 % (main share deposit)

$NKE (-0,41 %) : 0,67 % (main share portfolio)

Top-performing individual shares

Share: Performance since first purchase % (securities account)

Flop performer individual stocks

Share: Performance since first purchase % (securities account)

ETFs vs. shares

The breakdown of ETFs vs. shares across all portfolios is 38.8% to 61.2%. This differs slightly from the breakdown of my ETFs to equities savings plans (43% to 57%).

Investments and subsequent purchases

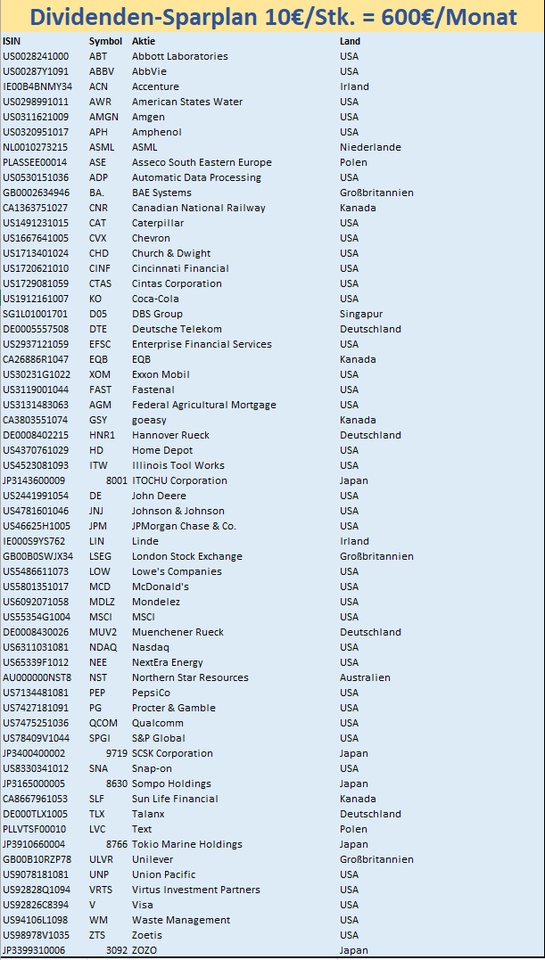

Here is a small overview of what I have invested via savings plans according to my fixed planning.

- Planned savings plan amount from the fixed net salary: €1,030

- Planned savings plan amount from the fixed net salary, with reinvested dividends: €1,140

- Savings ratio of the savings plans to the fixed net salary: 49.75

In addition, there were the following additional investments from returns, refunds, cashback, etc. as one-off savings plans/repurchases:

- Subsequent purchases as a cashback annuity from refunds: € 70.50

- Dividend automatically reinvested by broker: € 2.99

Additional purchases: as one-off savings plans as part of my cashback pension, reinvested discounts from previous grocery and drugstore purchases and a refund from the health insurance bonus program.

If you want to know how my cashback pension tops up the share and ETF pension, please let me know.

Passive income from dividends

My income from dividends amounted to € 163.13 (€ 89.68 in the same month last year). This corresponds to an increase of +42.32 % compared to the same month last year. The following is further key data on the distributions:

- Number of dividend payments: 11

- Number of payment days: 21 days

- Average dividend per payment: € 14.83

- average dividend per payment day: € 7.72

The top payers are:

My passive income from dividends (and some interest) mathematically covered 21.08% of my expenses in the month under review.

Crypto performance

My crypto investments also moved a little:

- Monthly performance portfolio: +0.72%

- Performance since inception: +70.90%

- Proportion of holdings for which the tax holding period has expired: 100%. This means that there have been no additional purchases for over a year.

- Crypto share of the total portfolio: 2.23%

I find the topic exciting, but it is very underrepresented in my overall portfolio due to my strategy. Profits have long since been realized, my focus here has long been elsewhere. Accumulation will take place in the coming bear market.

Performance comparison: portfolio vs. benchmarks

A comparison of my portfolio with two important ETFs shows:

Outlook and conclusion

According to the tax estimate, I can expect a tax refund. When this arrives, part of it will be donated and the rest will of course be reinvested. May was also a no-spend month for me and, as a convinced frugalist, this went off without a hitch. I was able to reflect more closely on my spending behavior and even found further potential despite my basic low spend attitude. Now I'm preparing a Hartz IV/citizen's allowance experiment for at least 3-4 months (or more) for the second half of the year. Simply because I feel like challenging myself. My planned expenses and provisions according to the budget only just exceed my theoretical entitlement to citizen's allowance. More info coming soon on Instagram. After March and April, I was again able to record expenses of less than €1,000 per month in May. This will change in June due to a large annual insurance premium, but maybe I'll be lucky and stay at a maximum of €1,100 to €1,200. As in the previous months, I will continue to use the early summer in June for hiking, swimming and day trips.

👉 You want my review as an Instagram post?

Then follow me on Instagram:

📲 As well as the depot and budget review, there's also: @frugalfreisein

- One-pagers and carousel posts every Monday, Wednesday and Friday on topics such as wealth accumulation, frugalism and minimalism

- more story insights in the future

- Mindset, motivation & money-saving life hacks for your own journey

How was your May at the depot? Do you have any tops & flops to share? Leave your thoughts in the comments!