Okay, this is the first portfolio update of the year and let’s just say it was not a great month in terms of performance. That said, I made some quality additions that I feel very comfortable holding for the long term.

The first half of January was strong. My portfolio reached a new all-time high on January 6. Since then, performance deteriorated, mainly due to two almost contradictory AI narratives hitting the market at the same time.

The first one was the idea that AI is about to destroy the entire SaaS industry. I have shared my thoughts on that before, and I do think there is some truth to it. Seat-based pricing models, like those used by Atlassian, Adobe, and even Salesforce, could face pressure if AI meaningfully changes workflows and reduces headcount. That is a legitimate risk.

What is not legitimate is selling off every single software company indiscriminately. ServiceNow, Microsoft, cybersecurity names, anything remotely connected to software got punished. That reaction, in my view, was irrational. Have people actually looked at the moats of these businesses? Their margins? Their retention rates? Their growth? Their role inside enterprises?

I did. And I bought.

Throughout the month, I added mainly to ServiceNow and Microsoft. At the same time, I reduced my Atlassian position and reallocated that capital into those two names. ServiceNow and Microsoft are clear AI beneficiaries in my opinion, not victims. Atlassian might still work out, but the investment case is less straightforward, and I prefer clarity in uncertain environments.

The second headwind was the cooling AI infrastructure narrative. On the one hand, the market claims AI will wipe out multi-trillion dollar industries. On the other hand, it suddenly treats AI infrastructure as if it were a short-lived flu. The contradiction is obvious.

In that segment, I did not make major moves. I re-evaluated my Nvidia position thoroughly and came to the conclusion that there is no reason to panic right now. Hyperscaler spending remains strong, demand indicators are intact, and nothing material has changed in the fundamental story.

Lastly, I bought Netflix twice, once at the beginning of January and once toward the end of the month. I am very confident in that position. The business is executing extremely well, and the potential Warner Bros acquisition looks increasingly realistic. As I mentioned before, that deal would significantly strengthen Netflix’s content ecosystem, and the cost could easily be offset through modest price increases of one or two dollars per subscription. Regardless of whether the acquisition ultimately closes, Netflix remains the dominant force in streaming.

Overall, January was not a great month in terms of headline performance, but it was productive. I increased my exposure to core positions like Microsoft, re-tested multiple investment theses under pressure, and was forced to reassess certain assumptions. That process is uncomfortable, but necessary.

Looking forward to the rest of 2026.

January Performance: -4%

Performance since inception: +7%

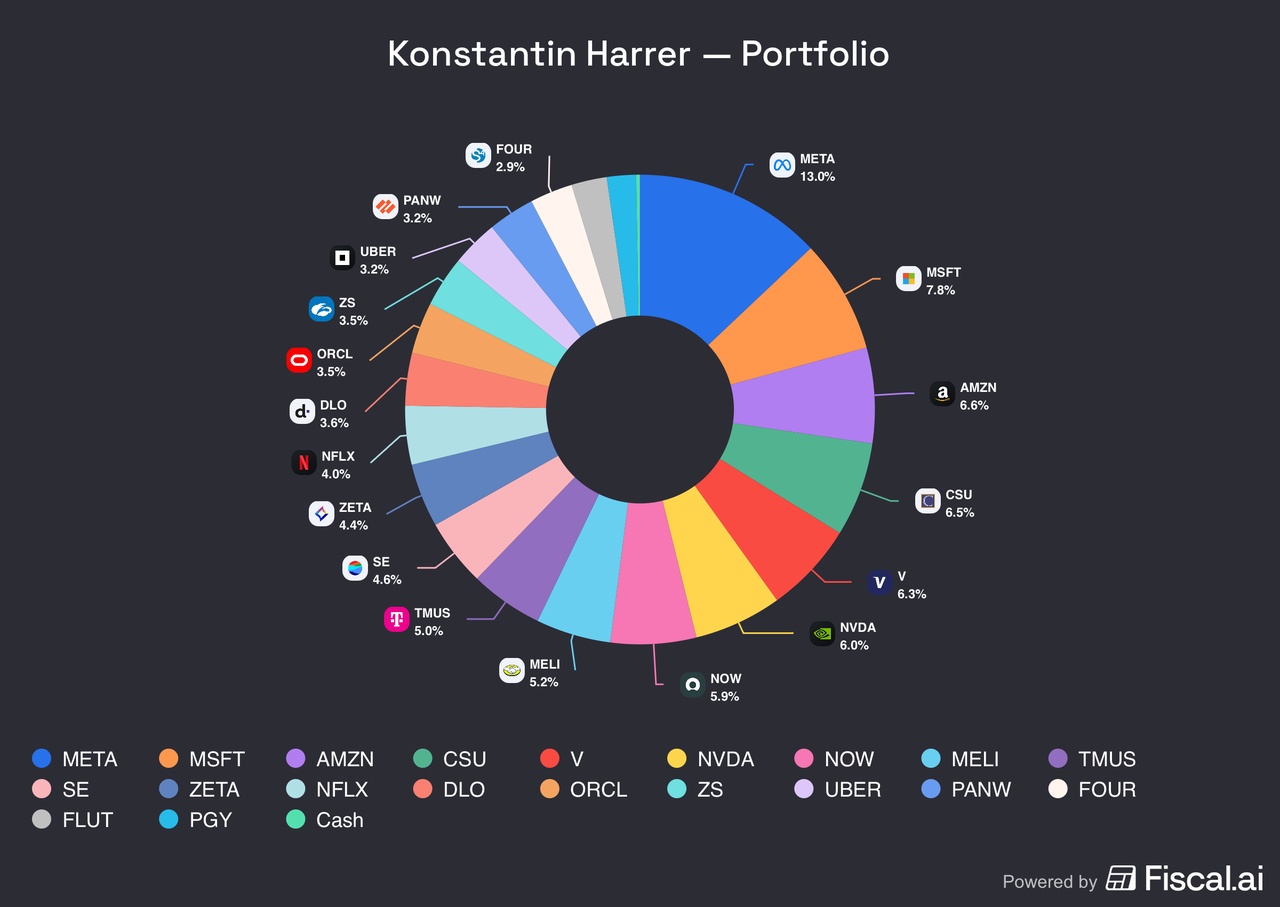

$META (-2,49 %)

$MSFT (-0,48 %)

$AMZN (-2,34 %)

$CSU (+6,34 %)

$V (-0,47 %)

$NVDA (-2,56 %)

$NOW (+2,94 %)

$MELI (+0,44 %)

$TMUS (+1,04 %)

$SE (-3,65 %)

$ZETA (-0,31 %)

$NFLX (-0,39 %)

$DLO

$ORCL (-2,6 %)

$ZS (+0,95 %)

$UBER (-0,62 %)

$PANW (+1,21 %)

$FLTR (-1,01 %)

$PGY

$TEAM (-6,72 %)

$ADBE (+0,44 %)

$CRM (-0,17 %)