Hello dear getquin community 😊

Before I start with my review of 2025, I wanted to check in with you briefly.

I was almost completely inactive here last month. No posts, no replies, at most a 👍 and a quick skim of the content. That was simply all I could do.

The main reason was clearly time. Family comes before ❤️ and anyone who has a family knows how quickly their own resources are used up. Then there was a health incident in the family, which automatically shifted my priorities. My focus was clearly elsewhere: support, be there, help.

Another point is the issue of appreciation within the community. @Multibagger , @Tenbagger2024 and I have already discussed this recently. Many people give a lot here, investing time and energy, while real feedback, recognition and cooperation are often lacking. I would also like to see more impetus, incentives and rewards from the admin side to make commitment worthwhile. As long as there is little movement here, I will deliberately remain a little more reserved.

What many people may not know: This account is not just about me. My husband and I take care of it together 👨👩👧👦 He contributes a lot of work, time and knowledge, but deliberately wishes to remain anonymous. A lot of joint work goes into more complex research such as cybersecurity or batteries as an energy source. In the near future, he will support me a little more in the background, sometimes also on my behalf.

It was important for me to say that openly. The community here still means a lot to me 🤍 even if I can't always be as present as I would like to be.

Review of the year 2025 📊

I started in April 2025, very classically with ETFs. MSCI World, MSCI Emerging Markets IMI, MSCI World Small Cap and Euro Stoxx 50. A solid start to get started.

However, the market movements and general uncertainty quickly made me want to understand more. Not just to save passively, but to make my own decisions. So I started to take a closer look at companies, business models, key figures and earnings and gradually switched to stock picking.

As is so often the case, then came the learning phase 😅

At times I had over 100 positions in my portfolio. Far too many. Too confusing. Too little focus. The consequence was clear: radically reduce, even with losses, to bring structure and calm to the portfolio.

Today I have just over 50 positions and my goal is 40, which makes me feel much calmer and clearer in my head.

Current structure:

Core 61 %

Satellites 17 %

Commodities 10%

Crypto 10 %

High risk 2 %

Regions:

USA 46.5 %

Europe 25.6 %

Asia 16.3 %

Canada and Australia 7%

Crypto consists only of Bitcoin and Ethereum 4.6%

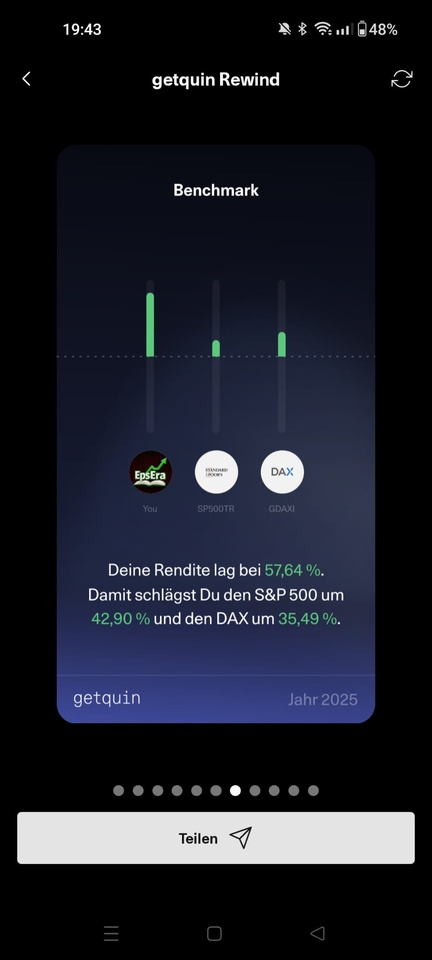

The getquin figures show a clear outperformance compared to the S&P 500 and DAX.

Honestly: This presentation feels too optimistic to me. That's why I show here my own figures, my real development and my learnings.

Top winners 2025 🏆

$IREN (-6,41%) Iris Energy +113 % (~€ 420)

$GOOGL (+3,81%) Alphabet +63.5 % (~€380)

$PNG (+1,38%) Kraken Robotics +78 % (~€195)

$ASML (+0,76%) ASML +35 % (~€110)

Losers and learning decisions 📉

$DRO (-0,77%) DroneShield with a return of around -500 %. The position was very small, the absolute loss was around €60 with a stake of around €80-85. Extreme in percentage terms, easily manageable in real terms.

$1211 (-0,75%) I sold BYD, although I still see the company as a strong player in the field of electromobility. The automotive sector, especially in China, is extremely competitive, the pressure on margins is high and there is hardly any real moat. In addition, there was a stock split and a lot of unrest surrounding the share. My priorities have shifted and the loss was around €50.

$AMT (+1,11%) I sold American Tower because the company is too complex for my approach, offers little growth potential and hardly delivers any returns. It simply no longer fitted my strategy.

$1810 (-2,06%) I sold Xiaomi based on the opinions of several China experts. One expert said very directly that he had been involved with China for years and had never made any sustainable money with Xiaomi. That was the decisive factor for me. The position was very small and a clear learning decision.

The bottom line 💡

Capital invested: approx. 12.000 €

Realized profits 2025: approx. 1.560 €

Return: approx. 13 % over about 8-9 months.

Some of the gains were deliberately realized in order to reduce the tax-free allowance for me and my husband. and my husband. This was a strategic decision at the end of the year. I let small profits run their course and closed larger positions with the plan to rebuild high-quality stocks later in a structured manner.

This puts me around 5 percentage points above the $IWDA (+0,57%)

or $VWRL (+0,63%) . For my first year on the stock market, I am more than satisfied 😊

Conclusion and outlook for 2026 🚀

2025 wasn't a perfect year, but it was extremely instructive. I made mistakes, learned from them and set up my portfolio in a much more structured way. I now know better what I hold and why.

I want to sharpen my focus further for 2026. Less breadth, more conviction. More time for individual companies, less actionism.

Focus 2026: these companies are at the forefront of my mind 👀

I want to sharpen my focus for 2026. Less breadth, more conviction. I am selectively expanding some positions and keeping a very close eye on others for possible entries.

$INOD (-1,3%)

InnoData

Remains one of my clear favorites. The company is located at a crucial point in the AI value chain: data preparation, data structuring and quality assurance. Exactly where many AI projects fail or become expensive. InnoData doesn't benefit from the AI hype, but from the fact that AI simply doesn't work without clean data.

$FEIM (-3,96%)

Frequency Electronics

Frequency Electronics is highly specialized in extremely precise time and frequency systems. This technology is critical for satellites, space, defense and modern communication systems. The barriers to entry are enormous, the development cycles long and the know-how almost irreplaceable. This is precisely what creates a strong moat. Once you are qualified, you usually remain so for years.

$HY9H (+8,21%)

SK Hynix

SK Hynix is one of the key beneficiaries of the global AI infrastructure. Memory is currently one of the biggest bottlenecks in data centers. SK Hynix has positioned itself early and consistently and holds a very large share of the storage solutions currently most in demand. While others have to catch up, SK Hynix is already at the table. For me, this is a structural winner for the next few years.

$VST (-0,75%)

Vistra

An energy supplier that is benefiting greatly from the rising demand for electricity. Data centers, AI applications and cloud infrastructure require enormous amounts of energy. Vistra is positioned precisely where this demand arises. Not a classic tech value, but an elementary building block of AI development.

Watchlist: possible candidates 🔍

$DSY (-0,14%)

Dassault Systèmes

The topic of digital twins is currently becoming increasingly important. Industry, automotive, manufacturing and infrastructure are increasingly being digitally mapped, simulated and optimized. This narrative is attracting additional attention due to the fact that $NVDA (+1%)

NVIDIA and $SIE (+1,82%)

Siemens have entered into a partnership in the field of digital twins. When two such heavyweights focus specifically on this topic, it shows the strategic relevance that digital twins will have in the future. Companies whose core competence lies precisely in this area will benefit in particular. Dassault Systèmes has been deeply integrated into industrial processes here for years and, for me, is one of the clear beneficiaries of this trend.

$6506 (+1,86%)

Yaskawa Electric

Yaskawa is a key player in the field of robotics, automation and drive technology. I find the growth potential in industrial automation and logistics particularly exciting. Rising labor costs, a shortage of skilled workers and pressure for efficiency are driving precisely these solutions. Yaskawa is benefiting directly from this trend.

$9880 (+5,31%)

UBTECH Robotics

A Chinese company in the field of humanoid robotics. Technologically very advanced, with a strong focus on industrial and service-oriented applications. Still clearly high risk, but one of the most exciting companies when humanoid robotics makes the step from the laboratory to reality.

$PATH (-3,47%)

UiPath

A potential comeback story for me. UiPath develops software agents and automation solutions that companies use to make processes more efficient. The customer base is large and the product is mature. If the topic of agents and AI automation comes back into focus, I see significant potential here.

$BC8 (+0,91%)

Bechtle

A German IT service provider with substance. Bechtle benefits from digitalization, cloud conversions and increasingly also from AI projects in the SME sector. No hype, but a reliable beneficiary of long-term IT investments.

Finally, I would like to wish you all the best for the new year good health, happiness in love and good luck with your investments 🍀📈

And now I'm looking forward to your feedback 😊