I don't know if the display is quite correct, but what about you? :)

$RKLB (-6,56%)

$NBIS (-9,32%)

$DLO

$HROW

$OMDA (-2,33%)

$PGY

$WIX (-0,07%)

@Klein-Anleger

@Iwamoto

@PikaPika0105

@Semos25

Postos

25I don't know if the display is quite correct, but what about you? :)

$RKLB (-6,56%)

$NBIS (-9,32%)

$DLO

$HROW

$OMDA (-2,33%)

$PGY

$WIX (-0,07%)

@Klein-Anleger

@Iwamoto

@PikaPika0105

@Semos25

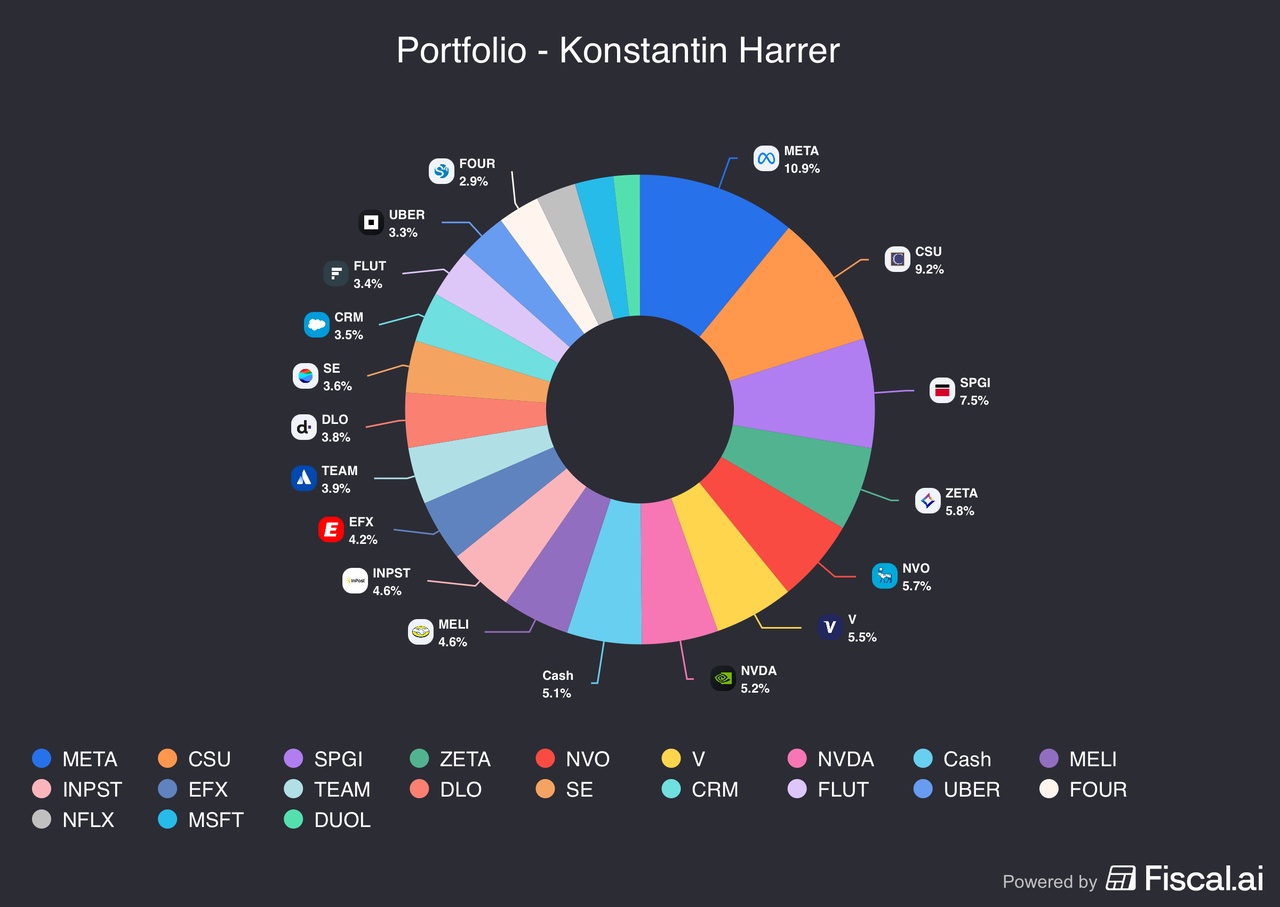

Back from my two-week winter break, I’ll start with a brief portfolio recap of last month. December was a much quieter month for me compared to previous ones, fitting with the holiday season. Portfolio activity was limited, with only a handful of buys and a lot more observation than execution. The only real macro event was the widely expected 25bp rate cut at the beginning of the month, followed by a slow but constructive Santa rally. Overall, December was about positioning and re-evaluating conviction, not trading.

Testament to that is the fact that my first trade was only executed on December 10th, when I opened a position in Sea around $125. I won’t go into too much detail here, as I’ve covered the company extensively over the past months. In short, Sea offers one of the cleanest growth setups in global e-commerce right now. The company benefits from rising income levels and improving infrastructure across Southeast Asia — a far more favorable backdrop than mature markets like South Korea. Revenue growth is projected north of 20–30% annually through 2027, cash flow is expanding at a similar pace, the balance sheet holds nearly $8B in cash with no debt, and the stock was down close to 40% from its YTD highs. At a ~5% FCF yield, it’s not dirt cheap, but more than fair given the growth. I’m very comfortable with Sea here, alongside MercadoLibre as my emerging markets exposure.

The next addition was Microsoft. I bought 10 shares at $475, making it a relatively small position below 3% of my portfolio. Microsoft is not a screaming buy, but it’s the kind of company I’d happily hold for a decade without even looking at the stock price. You could call it a typical “Buffett buy”: a wonderful company at a fair price. The forward P/E sits around 30, dropping into the mid-20s on FY27 estimates. Free cash flow is temporarily distorted by heavy and necessary AI CapEx, but the underlying business remains close to perfect: deeply entrenched ecosystems, massive switching costs, recurring revenue streams, and Azure as the rapidly growing #2 player in the cloud market. Still, while Microsoft is an incredible business, it isn’t my favorite Mag7 right now. That crown still belongs to Meta, and second place, in my view, goes to the stock I bought a week later.

That stock was Nvidia, which I added around $170. Nvidia puts me in a dilemma. Long term, I do see risks: extreme customer concentration, hyperscalers with the resources to build their own chips, and early cracks showing as companies like Meta explore alternatives. But in the short to medium term, the setup was simply too compelling to ignore. The stock was down 15–20% from ATHs, AI demand fears were eased after Micron’s blowout earnings, and on FY27 earnings Nvidia trades at a P/E of roughly 25. I’m highly confident Nvidia will rebound from these levels and make new highs in the coming months, even if I’m less convinced about its dominance five to ten years out.

On the same day, I also bought Uber. Similar story: not a forever-hold in my view given advances in autonomy (Waymo in particular), but at ~20% below ATHs and trading at a P/E of ~10, the risk/reward looked asymmetric. Cooler inflation, a stabilizing macro backdrop, and renewed confidence in the broader market created a favorable short-term setup. Adding to that, recent readings from the Atlanta Fed’s GDPNow model pointed to surprisingly strong U.S. growth momentum into Q4, which supports a more constructive outlook beyond just the AI narrative. I can easily see 30–50% upside from these levels, even if Uber isn’t a core long-term conviction.

December was also strong relative to my benchmark. The MSCI World was essentially flat for the month, while my portfolio gained around 5.6%. I started this portfolio in July 2025, and performance has been broadly in line with the MSCI World so far. For 2026, however, my goal is clear: visible outperformance through deliberate stock picking, generally focusing on quality-growth compounders. Alongside my core holdings (e.g. Meta, Visa, S&P Global), I’ll mix in selective high-risk, high-reward satellite positions where I see significant upside potential over the next few years (e.g. Zeta, Duolingo, Shift4).

Return since inception: +13%

$SE (+0,41%)

$MSFT (-0,3%)

$NVDA (+1%)

$UBER (+0,99%)

$META (+1,59%)

$CSU (+7,38%)

$SPGI (-0,01%)

$ZETA (+4,32%)

$NVO (-2,18%)

$NOVO B (-2,32%)

$V (+0,55%)

$MELI (-0,16%)

$INPST (+0,16%)

$EFX (+1,21%)

$TEAM (+3,88%)

$DLO

$CRM (-0,11%)

$FLTR (-1,13%)

$FOUR (-0,03%)

$NFLX (+1,88%)

$DUOL

Tese de Investimento

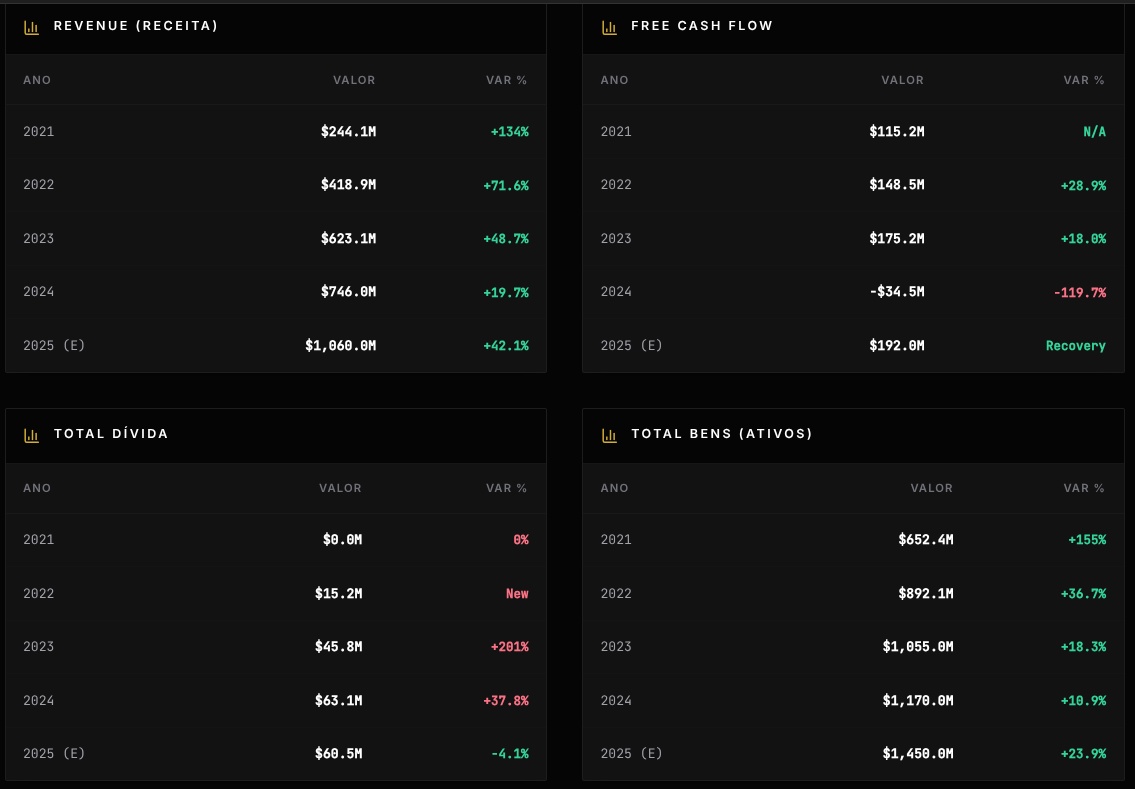

A dLocal ($DLO )consolidou-se como a infraestrutura crítica para gigantes globais (Amazon, Google, Meta) operarem em mercados de alta complexidade. O diferencial competitivo reside na capacidade de gerir pagamentos locais e cross-border com conformidade regulatória em mais de 40 países.

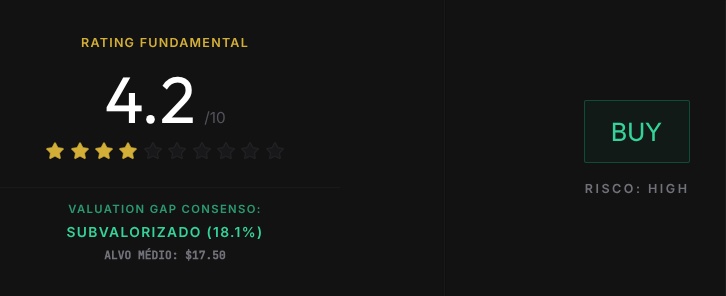

Valuation e Gap de mercado

O rácio PEG (Price/Earnings to Growth) abaixo de 1.0 sugere que o mercado ainda não precificou totalmente a resiliência das margens operacionais, que se mantêm saudáveis acima dos 20%.

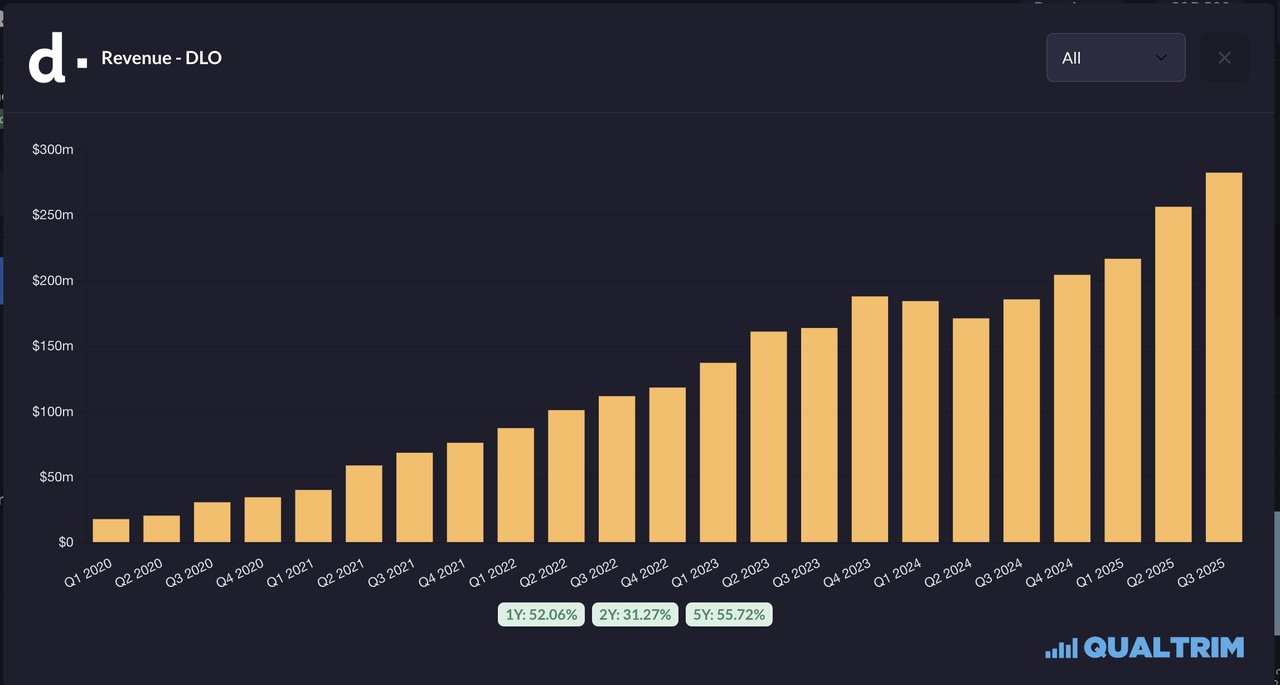

A dLocal (DLO) apresenta um perfil de crescimento agressivo em mercados emergentes, negociando com um desconto atrativo face ao seu valor intrínseco. Apesar da volatilidade operacional em 2024, a recuperação das margens e a expansão da receita para o patamar de $1B em 2025 consolidam a tese de subvalorização.

I will beat the market again with this portfolio.

Through the $RKLB (-6,56%) I have opened a few positions.

My portfolio for 2026:

$RKLB (-6,56%) 50%

$NBIS (-9,32%) 25%

Remaining 25%:

I'm looking forward to the Rewind at the end of 2026. 😌

Now, thanks to your blatant ideas of the last few days, you have actually persuaded me to feed the last of the dry powder to the market.😂 @Multibagger

@Shiya

@MrSchnitzel

All joking aside: I have read your analyses, dear @Shiya un@MrSchnitzel to $DLO and $OMDA (-2,33%) and fortunately had some time for intensive research in the last few days. What can I say, I think both are good in many respects and see corresponding potential.

As a result, both have also found their way into my portfolio today in my usual entry size.

But that's really it until the next savings plan is executed at the beginning of February 😂

Thank you very much for your great work and the super discussions that have arisen around your ideas.🙏🏻

From now on, please no more ideas until I have investable cash ready again.😜🤣 *irony off*

Please keep up the good work, the community lives from dedicated content creators like you and the many others who have already been mentioned here countless times.🫶🏻

After my post about $DLO the topic arose that stablecoins would destroy dLocal's business.

Here are my thoughts on this:

Why stablecoins are relevant for DLocal

DLocal has established itself as the leading platform for cross-border payments in emerging markets. As stablecoins (cryptocurrencies pegged to fiat currencies such as the US dollar) are increasingly used for remittances and settlements, the question arises: Are they a threat or an opportunity for DLocal?

DLocal's current business model

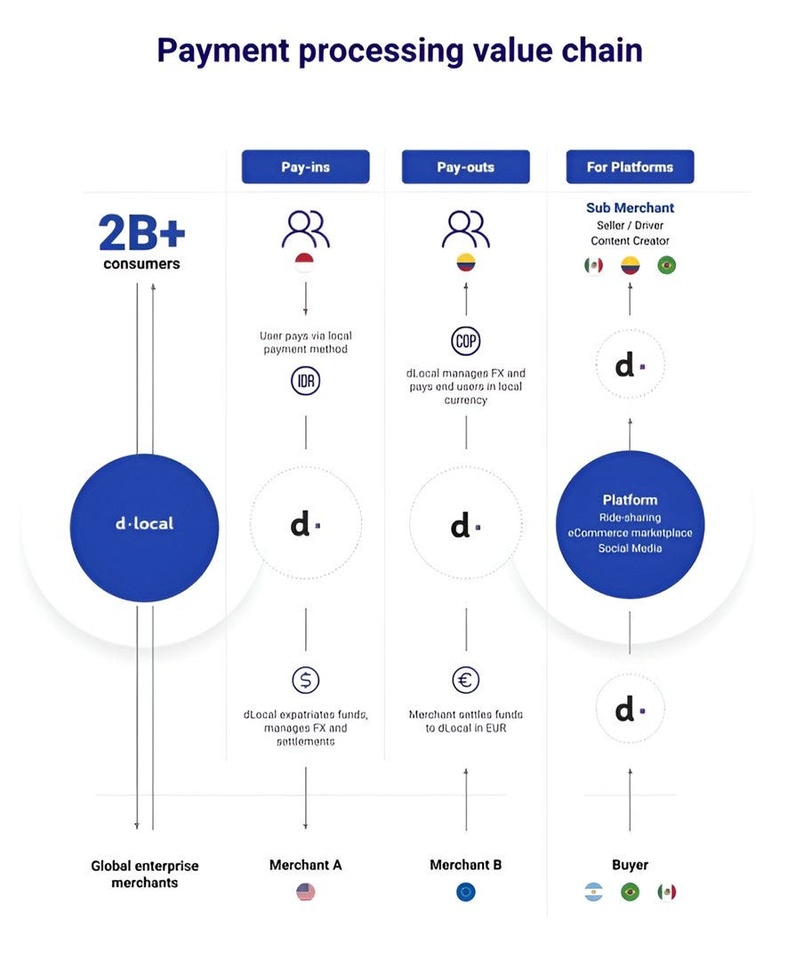

DLocal acts as a specialized intermediary between global giants (Amazon, Google, Uber) and consumers in complex markets (Latin America, Africa, Asia).

What are stablecoins and why are they booming?

Stablecoins offer a stable alternative to volatile cryptocurrencies.

Opportunities through stablecoins

Stablecoins could help DLocal to become even more efficient:

Risks and threats

DLocal's lead and strategy

Stablecoins may not revolutionize global payments overnight, but their long-term potential is hard to ignore, especially in regions where traditional infrastructure remains slow, costly or unreliable.

dLocal's approach reflects both strategic foresight and operational discipline, integrating stablecoins where they offer real value while continuing to build trust with merchants, regulators and financial institutions.

For now, stablecoins serve more as enablers than threats. However, should broader adoption take hold, driven by regulatory clarity and merchant demand, dLocal is well positioned to capitalize on this. The company is supported by a leadership team that understands both the promise and the pace of change.

The path may be gradual, but the direction is clear. While I don't see stablecoins as a near-term threat, they remain a relevant factor to keep in mind when evaluating dLocal's competitive advantage.

I had been planning to expand my EM and especially Latin America exposure for several weeks and see the best opportunities in fintechs. $NU (+1,09%) As you'd expect, the EM was at the top of my list, but there was more than one point here that has put me off investing so far.

But thanks to the community, Shiya introduced DLocal yesterday. I very quickly realized that this was the perfect addition to my Mercadolibre position and that I wanted to have it.

Thank you for your stock presentation @Shiya 😇

Here is the original presentation:

And here are a few more fundamental graphs and short-term charts:

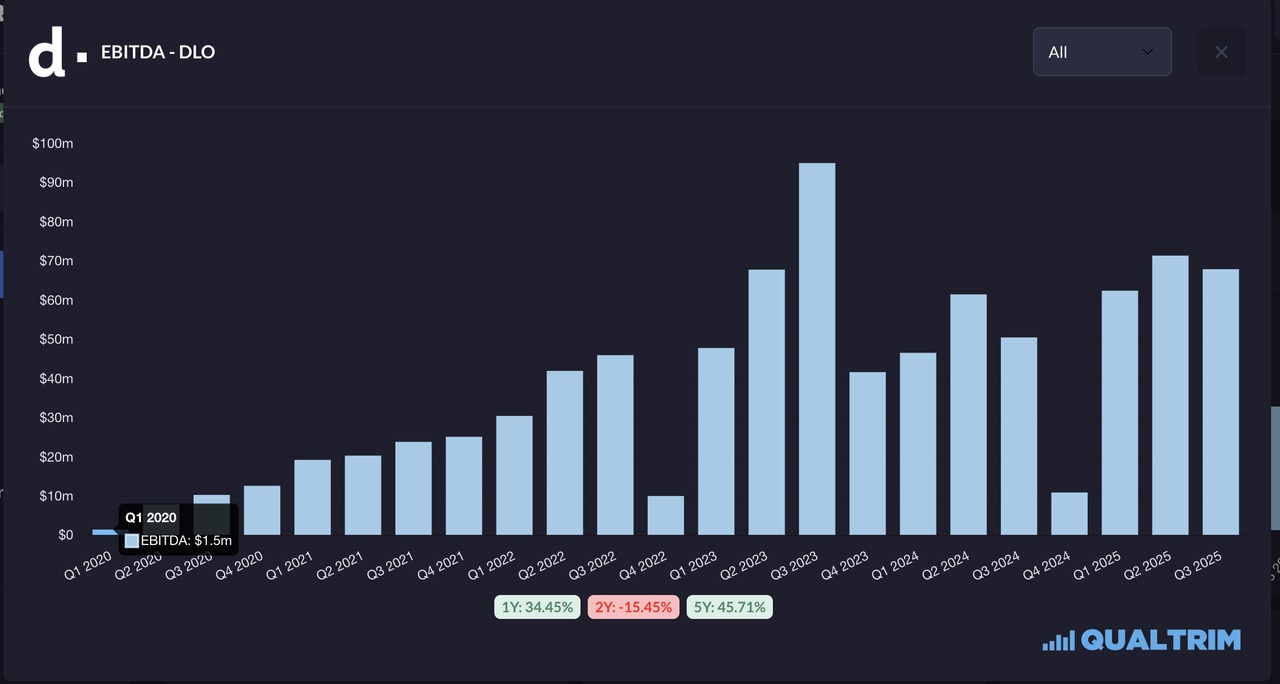

We see massive growth at DLO ☝️ and already have a very profitable company 👇

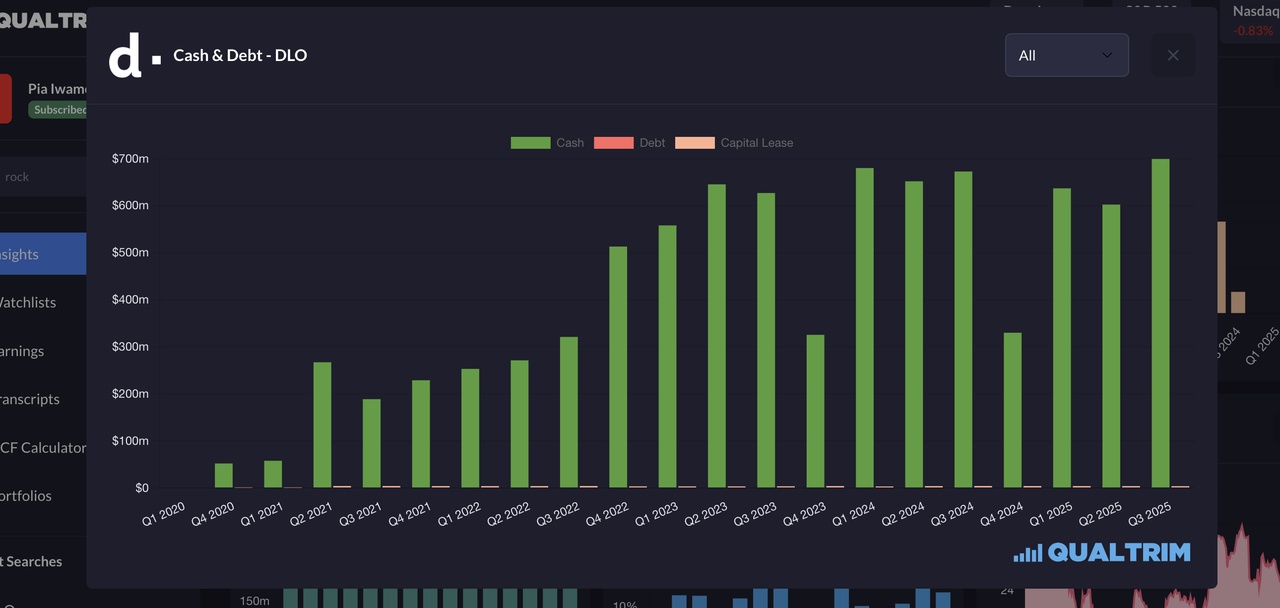

As if that wasn't enough, the company is sitting on a mountain of cash and is debt-free. 👇

The number of shares is fairly constant and is only increasing very slowly. ☝️ I assume this relates to employee or management remuneration. Also worth noting that shares were bought back in 2023 and 24 for around $200m in total.

Risks and side effects 🤪

As "always", the geographical and currency risk.

Specifically, I have only noticed that margins are declining somewhat. 👇

The chart ⚖️

(Sorry for the presentation in euros. I normally use the home currency, but the drawings disappear when I convert and I'm lazy. Nevertheless, this is the home exchange and is sufficient for a short-term view)

The chart shows an intact upward trend within a rising trend channel, with a very bullish trend. 👩🏻🚀

A strong upward movement was followed by a healthy consolidation back to the EMA 200, where the price found support.

The coming days are likely to be exciting: The price has failed several times at resistance at around € 12.20. The EMA 100 currently runs in the € 11.60-11.70 range.

I hope that the price will bounce off this and rise parabolically.

But a particularly important level is around € 11 (1️⃣). Several factors come together here: EMA 200, 38 Fibonacci, several trend lines, etc. . This area could be approached and should hold in my opinion.

In a worst-case scenario, a setback to the 2️⃣ zone would also be conceivable, but I consider the probability of this to be lower.

I plan to buy the first tranche immediately and would add to 1️⃣ and 2️⃣ accordingly.

+ 3

DLocal $DLO has developed from a local payment service provider from Uruguay to a global infrastructure provider for emerging markets in just a few years. With over 900 integrated payment methods and customers such as Amazon $AMZN (+2,51%) and Google $GOOGL (+3,81%) the company is positioning itself as a key player for international expansion.

Incidentally, the company is currently led by the former CEO of MercadoLibre $MELI (-0,16%) at the moment. (There was also a great presentation of @Iwamoto).

History

The company was founded in Uruguay out of the personal frustration of co-founder Sebastián Kanovich. He recognized a problem: in Latin America, international online payments were almost impossible without local credit cards.

Current operating business

dLocal's mission is to enable global merchants to seamlessly connect to billions of users in emerging markets. The company provides payment solutions for some of the world's largest corporations, including but not limited to Amazon, Uber, Microsoft, Shopify, Google, Spotify, Tencent, Shein, Salesforce, Nike, Booking and Shopee. By simplifying the complex payment landscapes in emerging markets, dLocal helps companies expand into high-growth regions without the usual friction associated with cross-border transactions.

How dLocal makes money

dLocal operates a high-margin, scalable business model based on direct integrations with global merchants. Once connected, businesses can access the full range of dLocal's payment solutions through a single interface and contract, eliminating the need for multiple legacy providers. This direct connection serves as both a competitive advantage and a barrier to entry, making any additional transaction volume highly accretive.

The company generates revenue primarily through transaction fees for pay-in (customer payments) and pay-out services (payouts to merchants). These fees can be a percentage of the transaction value, a fixed fee per transaction or a spread for currency conversions. dLocal also charges fees for services such as chargeback management and installment payments, which contribute additionally to the revenue stream.

Revenue breakdown:

Cost structure

dLocal's cost of sales (COGS) consists primarily of fees paid to financial institutions such as banks and local acquirers for processing payments. These costs vary depending on the billing period and payment method. Other expenses include infrastructure costs, salaries for operational staff and the amortization of internally developed software.

One of the main risks in dLocal's model is the currency riskas transactions often involve multiple currencies. However, the company mitigates this risk through hedging strategies by using derivatives to offset currency fluctuations.

Apart from cost of sales, dLocal's main costs fall into two categories:

Since the new CEO took office, dLocal has increased spending on technology infrastructure and back-end capabilities to enhance its solutions and maintain its position as an innovator with a long-term mindset. While these investments initially put pressure on margins, they are strategically important for long-term value creation.

Overall, dLocal's business model is highly scalable with minimal marginal costs, enabling the company to unlock significant operating leverage as it continues to grow.

Key figure: TPV growth

The Total Payment Volume (TPV) (i.e. the total payment volume) is probably the most important key figure for assessing the relevance and implementation of dLocal in recent years.

With a huge untapped market ahead, the company still has significant room to scale.

1. superiority over global giants (Adyen, Stripe)

Although Adyen and Stripe dominate the global market, dLocal differentiates itself through a niche strategy:

2. superiority over local providers (EBANX, PayU)

Compared to regional specialists, dLocal scores above all through Size and efficiency:

The "flywheel effect" (self-reinforcing growth)

The business model benefits from a cycle:

More volume lowers the costs per transaction.

Lower costs enable more attractive prices for merchants.

More merchants (such as Amazon or Google) further increase the volume.

Conclusion: Merchants are willing to pay higher fees for dLocal than in industrialized countries, as the savings in legal and operational costs from the "all-in-one" solution far justify this surcharge.

Massive market opportunities

dLocal operates in some of the fastest growing digital economies in the world, giving the company long-term access to a trillion dollar market. This is not a "winner-takes-all" industry. Instead, several key players will emerge and dLocal is well positioned to be one of the market leaders.

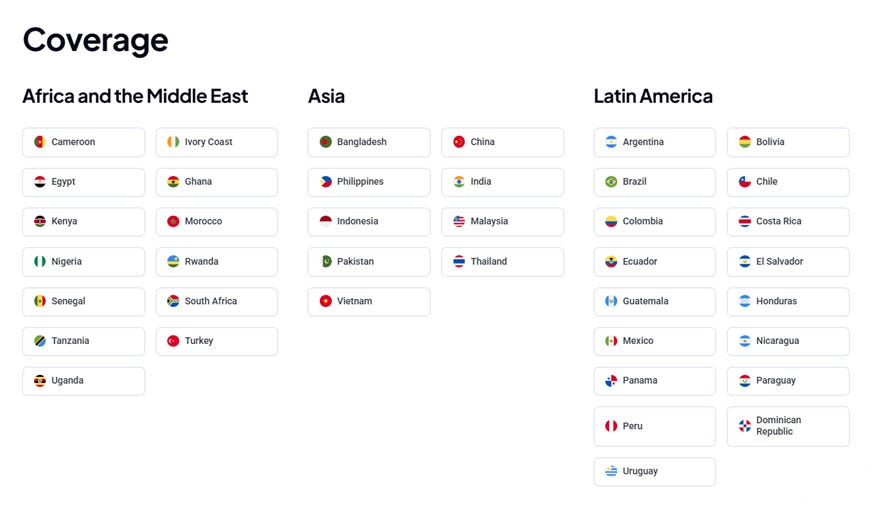

Global reach in high-growth markets

dLocal is deeply rooted in the emerging markets of Latin America, Africa, the Middle East and Asia - regions with a combined population of over 2 billion peoplewhich are still at an early stage of digital adaptation. The company currently operates in over 40 countries, including:

A "pure play" on the digitalization of emerging markets

While tech giants are expanding into emerging markets, these regions often account for only a tiny fraction of their overall business. For global giants such as Amazon, Google or Microsoft, sales generated in Latin America, Africa or Southeast Asia barely move the needle in their consolidated results.

dLocal, on the other hand, is a "pure play"that focuses exclusively on these high-growth regions. It therefore offers a direct opportunity to invest in the explosive growth of internet penetration, digital commerce and the introduction of fintech solutions.

Strong tailwinds for long-term growth

dLocal is pursuing a five-stage plan to expand its market leadership in emerging markets and to open up the "Global South" in terms of payment technology:

Instead of acquiring large competitors, dLocal 2025 has primarily targeted smaller payment institutions in South East Asia and Africa acquired smaller payment institutions in Southeast Asia and Africa.

The purpose: Instead of waiting years for government approvals, dLocal bought companies that already had the necessary local e-money and payment gateway licenses. licenses.

Acquisition in the field of AI & fraud prevention

In the summer of 2025, there were reports of the integration of a specialized fintech start-upthat focused on AI-based fraud detection for emerging markets.

The purpose: This paid directly into the goal of increasing approval rates to increase approval rates. In emerging markets, distinguishing between legitimate payments and fraud is particularly difficult; the new technology helped dLocal to differentiate itself even more clearly from global giants.

Why is the stock down >80% from its all-time high? Time for a comeback

dLocal shares experienced a massive drop of over 80% due to a mixture of market conditions, temporary setbacks and misperceptions. Nevertheless, the company is well positioned for a recovery.

1) The short report - A "storm in a teacup"

One of the main reasons for the sell-off was a short report accusing dLocal of fraud. On closer inspection, this turned out to be insubstantial - filled with technical jargon but without any real evidence. The new CEO Pedro Arnt described the report as an attempt to throw accusations around to see what sticks. The company's fundamentals remained unaffected.

2) Devaluation of emerging market currencies

Currency volatility, particularly in Argentina, put pressure on the financials. But what started as a headwind could become a tailwind: Despite the devaluation, dLocal tripled its transaction volume on Black Friday in Argentina compared to the previous year, highlighting the huge demand in e-commerce.

3) Change of leadership

The fact that the founder stepped down as CEO initially unsettled the market. But with Pedro Arnt (formerly MercadoLibre $MELI (-0,16%) ), dLocal has gained an experienced leader. His success and his vision for dLocal are now clear catalysts for a recovery.

4) One-time price adjustment in Brazil

In the first quarter of 2024, there was a price adjustment (repricing) with the largest customer in Brazil, which briefly depressed growth and margins. This was a necessary correction to an atypically high fee and is a one-off event. Regulatory changes in Brazil also caused temporary disruptions, but these do not jeopardize the long-term business model.

5) Margin pressure - stabilization and improvement

Margins were under pressure from falling fees across the sector and deliberate investments in technology. Pedro Arnt decided to make long-term investments in personnel and IT despite short-term market reactions. It is now apparent that fee rates are stabilizing and the operating leverage (economies of scale) will ensure rising margins in the coming quarters.

Conclusion: The market has overly punished dLocal due to temporary issues and misunderstandings. However, the fundamental growth story in emerging markets is more intact than ever.

Pedro Arnt - The right leader for dLocal

Pedro Arnt is a key factor in my high conviction for dLocal. His background makes him a key asset to the company and it is clear that he has the right vision to catapult dLocal into the next phase of growth.

From garage to giant

Before joining dLocal, Pedro was CFO of MercadoLibre ($MELI (-0,16%)). Pedro's time at MELI was incredible: he joined the team in his first year and stayed for over 24 years. He played a central role in building what is now the most valuable company in Latin America.

Interestingly, Pedro came across dLocal through his work at MercadoLibre. He recalls how his team at MELI was struggling to make their digital wallet appealing to global corporations, while dLocal's model was precisely designed to serve these enterprise customers in emerging markets. This realization made him understand the immense potential of dLocal.

+ 5

I am probably the biggest bull in $RKLB (-6,56%) bull in Getquin, but I have to say that I sold most of my shares today.

Not for the reason that I am no longer convinced, on the contrary. I think Rocket Lab will outperform most stocks over the next few years if we remain in a bull market. Last year I was 100% invested for a while and had no other position.

The first time I bought in was in August 2024 at around €6 and I bought in every month until the stock reached €29. In March 2025, I took out a loan to continue investing because I knew the share wouldn't stay at €29 for long. I also bought other shares here, but I didn't hold them for long. I don't recommend anyone to take out a loan for shares, but my conviction was so strong that I had to do it and in hindsight it was a good decision.

Then Trump came along with the tariff policy and things started to go downhill, which I didn't think was possible. I suddenly "lost" half of my book value. But what did I do? I did nothing. I just kept holding on, because I knew that sooner or later it would rise again and it did. I sold my small second-line stocks again and went all-in again with $RKLB (-6,56%) again.

The share price continued to rise to over €40. Had 2900 shares at the peak (summer 2025).

That was the first time I sold most of my shares. However, it didn't take long before I regretted this step somewhat and bought more at around €40 and was almost all-in again.

I am currently holding my remaining 1000 shares. My portfolio still consists of 50% Rocket Lab.

Rocket Lab is and will always be in my heart, it has opened up new paths for my life and gives me hope for a better personal future.

But you shouldn't fall in love with a stock and "marry" it.

It's mentally hard to endure the volatility. I have had to watch my portfolio "halve" twice in 2025 in a very short period of time.

(My trick is to simply delete Getquin at these times and not even look at the share price)

For this reason, I am reducing my portfolio share to 50% and investing in highly undervalued stocks that have enormous potential, perhaps even more than $RKLB (-6,56%) as Rocket Lab currently simply has a premium valuation.

As of today, my portfolio for 2026 consists of the following companies:

We'll see at the end of 2026 whether this was a good decision or whether I regret selling Rocket Lab again.

Principais criadores desta semana