is about the accumulating ETF $ISAC (-0,46%)

Does anyone know whether it is possible to track the returns directly in Getquin or TR or are they only shown in the performance?

If it doesn't work here, do you have another solution?

Thank you 🙌

Postos

70is about the accumulating ETF $ISAC (-0,46%)

Does anyone know whether it is possible to track the returns directly in Getquin or TR or are they only shown in the performance?

If it doesn't work here, do you have another solution?

Thank you 🙌

Hello everyone,

I am 20 and would like to build up a portfolio for long-term growth and security.

The breakdown of my monthly savings plans:

66,7% $ISAC (-0,46%)

8,3% $WSML (-2,4%)

8,3% $MEUD (-0,8%)

8,3% $QDV5 (-0,36%)

8,3% $IGLN (+2,12%)

I would like to hear your opinion on whether you think this makes sense or would exchange/add a position or maybe you also say it is smarter to just save the $ISAC (-0,46%) to save.

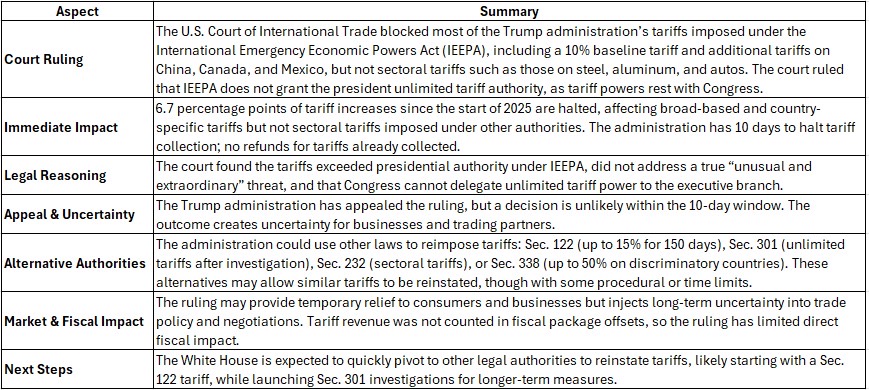

Reading time: approx. 5-6 minutes

Many of my recent articles have focused on key figures that help to clearly classify business models, risks and valuations. Beta is part of this series - and at the same time the key figure plays a special role. It is available everywhere and can be looked up quickly, but only becomes truly meaningful in the context of an entire portfolio. This is because beta does not describe the company itself, but the behavior of a share in interaction with the market.

Mathematically, beta measures the relationship between share returns and market returns. The basis is the covariance of these returns - and this is always based on historical data. However, the interpretation is inevitably forward-looking because past patterns are used to derive how a stock will typically behave in relation to the market in the future.

Formally, the key figure is

Beta = covariance(stock return, market return) / variance(market return)

In practical terms, this means that when the market moves, how much does the share typically move with it? Values around 1 mean market-like movements, higher values show stronger fluctuations, lower values a calmer behavior.

The reason why beta is often misinterpreted is that it is not stable. It depends heavily on the time period, the market phase and the chosen index. A company can continue to perform solidly, but suddenly have a different beta due to changes in interest rates or the risk environment. Beta therefore measures behavior - not quality.

To make it clearer how beta works in a portfolio, it is worth taking a look at my portfolio. It combines robust quality stocks such as Visa, Alphabet and Honeywell, growth-oriented technology stocks such as ASML, Nu Holdings and Innodata, defensive infrastructure and water stocks such as Consolidated Water, Energiekontor and Energy Recovery, the global ETF on the MSCI ACWI and a uranium block as a cyclical idea with Cameco, NexGen, Denison Mines, Paladin Energy and Yellow Cake. Bitcoin complements the whole as an independent, significantly more volatile component.

This mix shows well why beta is useful for me on a day-to-day basis. Different stocks can be fundamentally strong and yet contribute very differently to the fluctuation profile of the portfolio. Some positions smooth out, others strengthen - regardless of whether the companies are well managed or highly profitable. It's about market behavior, not balance sheet quality.

For the beta analysis, I use conservative, market-standard 3-5 year values of major providers. Most betas are calculated on the basis of daily or monthly returns over precisely such periods - long enough to be statistically stable and short enough to realistically reflect current market phases. Where there is no official data, suitable sector values are used.

The betas used are as follows:

Large Caps

- $ASML (-5,28%) : 1,25

- $GOOGL (-0,59%) : 1,05

- $V (-0,47%) : 0,95

- $HON (-1,78%) : 1,00

Midcaps / Infrastructure

- $CWCO (-4,28%) : 0,80

- $EKT (-2,75%) : 0,75

- $ERII (+0,11%) : 1,20

- $SOP (+4,01%) : 1,10

Small Cap / High Beta

- $INOD (-0,68%) : 1,80

Uranium segment (cyclical)

- $CCO (-4,28%) : 1,40

- $NXE (-2,57%) : 1,60

- $DML (-4,95%) : 1,70

- $PDN (-10,06%) : 1,50

- $YCA (+0%) 1,30

ETF

- $ISAC (-0,46%) : 1,00

Crypto

- $BTC (-0,47%) : 2,50

The only thing that counts for the portfolio beta is how large each position is in relation to the portfolio.

This is how the portfolio beta is determined:

You look at how large each position is in the portfolio, multiply this proportion by the beta of the respective share and add up all the contributions. Each position therefore contributes to the overall beta in exactly the same proportion as its weighting.

If you put the weightings of my portfolio in this context, the result is as follows: the portfolio has a beta of around 1.33. This value fits the structure: a stable base, several growth-oriented building blocks and a deliberately used uranium block as well as Bitcoin as a stronger lever.

A beta at this level means a fundamentally more offensive portfolio.

This shows that beta is no substitute for fundamental analysis, but it makes it clear how a portfolio is moving and why. It helps to calibrate expectations, classify fluctuations and manage the structure more consciously. A beta of 1.33 is not a judgment of quality - it is a description of movement. The only important thing is whether this dynamic fits your own investment strategy.

Finally, two questions for you:

Do you know the beta of your portfolio?

And does it play a role for you in your portfolio strategy - or not?

$IWDA (-1,16%)

$CSPX (-1,24%)

$EIMI (-0,69%)

$CSNDX (-1,55%)

$ISAC (-0,46%)

$VUSA (-1,24%)

$HMWO (-1,04%)

$XDWD (-1,14%)

$SPPW (-1,13%)

$WSML (-2,4%)

President Trump shakes hands with Chinese President Xi Jinping.

"He is a VERY tough negotiator. That's not good!" 🤣

"Nice to see you again!"

"We're going to have a very successful meeting!"

"We have ALWAYS had a great relationship."

Chinese President Xi Jinping says he is happy to finally meet President Trump.

"It's very nice to see you again! It's been many years. Since your re-election, we have spoken on the phone three times, exchanged several letters and stayed in close contact."

"Given our different national circumstances, we don't always see eye to eye. It's normal for there to be friction between the world's two leading economies."

"In the face of winds, waves and challenges, you and I, who are at the helm of Sino-US relations, should stay the right course and ensure the steady progress of these relations."

Chinese President Xi Jinping declares President Trump the PEACE PRESIDENT of the whole world!

"Mr. President, you care deeply about world peace! You are deeply committed to resolving regional conflicts. I greatly appreciate your significant contribution to the ceasefire in Gaza."

"During your visit to Malaysia, you witnessed the signing of the joint peace declaration along the Cambodian-Thai border, to which you also contributed."

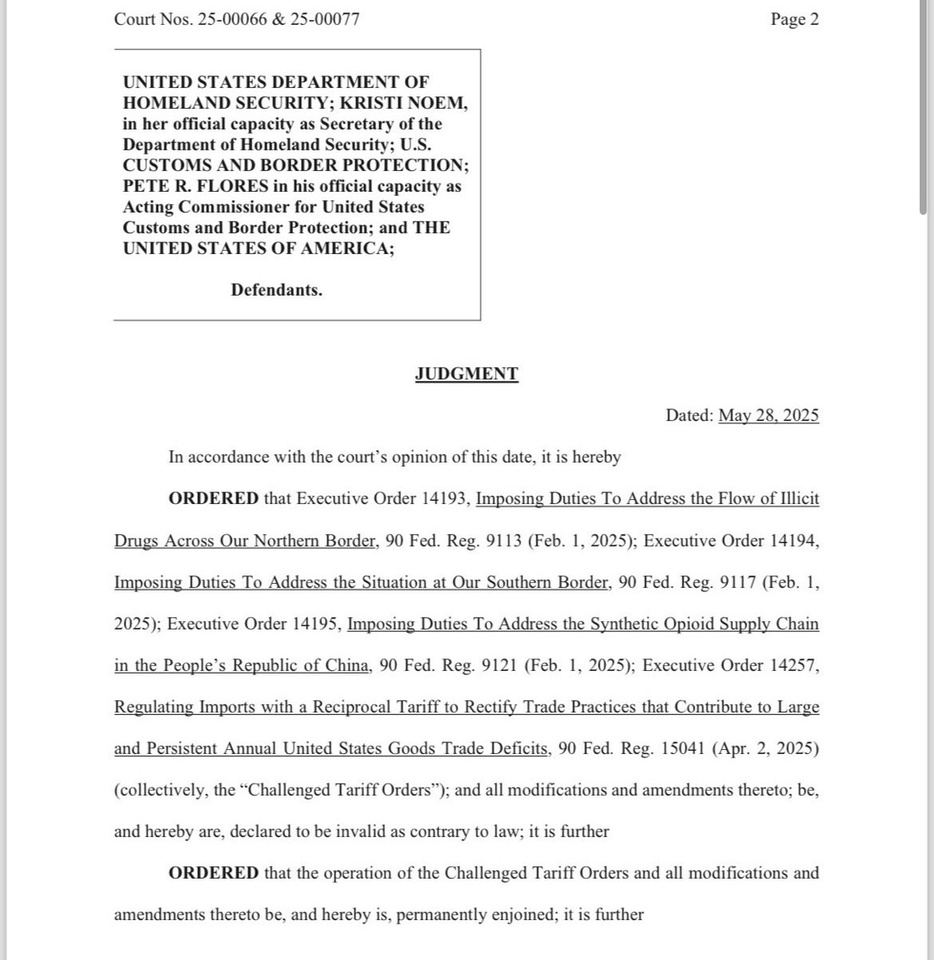

Reading time: approx. 10 minutes

The last article was about leveraged daily ETFs - in other words, about momentum, short-term market movements and strategies where timing is crucial. Today it will be much quieter. It's about what remains when markets fluctuate and hypes fade: the fundamentals.

This article is aimed primarily at beginners and is intended to help them find their way through the ETF jungle - to understand which products are truly global, how they differ and how to build a stable core portfolio.

After all, long-term wealth accumulation does not start with the search for the highest return, but with a solid core. In my case, this core consists of three pillars:

These three positions form the backbone of my portfolio. The rest - i.e. rotation strategies, thematic investments or leveraged products - complement the foundation.

Why an ETF comparison is important

"World ETF" sounds like global diversification. In practice, however, many of these funds only cover industrialized countries. The difference between $XDWD (-1,14%) (iShares MSCI World UCITS ETF), $ISAC (-0,46%) (iShares MSCI ACWI UCITS ETF) and $VWCE (-0,86%) (Vanguard FTSE All-World UCITS ETF) is not a marginal detail, but crucial for your own investment strategy.

Anyone who understands these differences quickly realizes how much the selection of the index determines the actual distribution in the portfolio - and how much "world" is actually in your own ETF.

The $ISAC (-0,46%)

(iShares MSCI ACWI UCITS ETF)

The $ISAC (-0,46%) tracks the MSCI All Country World Index - around 2,800 stocks from 47 countries, covering around 85% of global market capitalization.

Regional breakdown (as at October 2025):

This combines the $ISAC (-0,46%) industrialized and emerging markets in one product - exactly what many investors replicate themselves with two ETFs (MSCI World + MSCI Emerging Markets).

The total expense ratio (TER) is currently 0.20% p.a. - extremely favorable for a global fund of this breadth.

I use it as a core building block because it combines global diversification with simplicity: one ETF, one decision, global participation.

$ISAC (-0,46%)

vs. $XDWD (-1,14%)

(iShares MSCI World)

The $XDWD (-1,14%) (iShares MSCI World UCITS ETF) only tracks 23 industrialized countries - no emerging markets, no China, no India. It contains around 1,500 stocks and is heavily dominated by the USA.

The $ISAC (-0,46%) (iShares MSCI ACWI UCITS ETF) expands this base to include 24 emerging markets and thus has around 2,800 stocks. This means:

In recent years, the MSCI World has been slightly ahead because the emerging markets have underperformed. In the long term, these phases tend to even out - and this is precisely where the ACWI shows its strength: It automatically grows with the global economy, even if the regional focus changes.

$ISAC (-0,46%)

vs. $VWCE (-0,86%)

(Vanguard FTSE All-World)

The $VWCE (-0,86%) (Vanguard FTSE All-World UCITS ETF) is the best-known alternative to the $ISAC (-0,46%) . It also combines industrialized and emerging markets, but according to the FTSE index methodology and with around 4,000 shares - i.e. somewhat broader.

Both funds fulfill the same purpose: global coverage in a single product. The differences lie in the details - for example in the country classification (e.g. South Korea is listed as an industrialized country in FTSE, but as an emerging country in MSCI).

The performance is also almost identical. The TER of the $VWCE (-0,86%) at 0.19% p.a. is even slightly lower than that of the $ISAC (-0,46%) . Both funds therefore offer an almost equivalent opportunity to invest globally over the long term.

Concentration in the $ISAC (-0,46%)

Despite its breadth, the ACWI is also concentrated on a few heavyweights. The top 5 positions account for around 18% of the fund (as at October 2025):

This shows how strongly the US technology sector shapes the global markets. This weighting is not a disadvantage, but a true reflection of global market capitalization. I consciously accept this structure, but balance it out with my other core components: $BTC (-0,47%) (Bitcoin) as an uncorrelated asset and $SEGA (-0,17%) (iShares Core Euro Government Bond ETF) as an anchor of stability.

Five-year performance (as at October 2025)

The differences are manageable. The MSCI World benefited more from the dominance of the USA, while $ISAC (-0,46%) and $VWCE (-0,86%) are more broadly based. This global diversification can lead to more stable returns in the long term because it is less dependent on individual markets.

What newcomers can take away from this

In my opinion, an ETF is often sufficient. A global fund like the $ISAC (-0,46%) covers almost all markets - ideal for getting started.

Keep an eye on costs. A TER of 0.20 % is very favorable for this breadth.

Global means USA-dominated. Around two thirds of the fund comes from the United States - and that is currently the market reality.

Simplicity is an advantage. Those who manage fewer products remain more consistent in the long term.

Time beats actionism. The compound interest effect unfolds its power over years - not months.

The $ISAC (-0,46%) (iShares MSCI ACWI UCITS ETF) is the centerpiece of my portfolio. It stands for breadth, simplicity and global participation - and realistically reflects the global economy.

Together with the $BTC (-0,47%) (Bitcoin) - which not only brings potential returns but also diversification to the portfolio - and the $SEGA (-0,17%) (iShares Core Euro Government Bond ETF) as a defensive counterpart, a robust core setup is created that covers all dimensions: Growth, stability and risk diversification.

The rest - thematic or individual investments, rotation strategies or leveraged ideas - completes the foundation.

Questions at the end:

Min-Vol ETF $MVOL (-0,05%) bought at ATH, now ~ -200 €.

Thinking about selling + shifting into MSCI ACWI $ISAC (-0,46%) after.

Advantage:

Loss makes my dividends tax-free this year (FSA already full).

Question for you:

Are there any disadvantagesif I do this - or would you take the tax effect with you?

After the post by our good Sina @lawinvest and never-ending complaints about Traderepublic, I would like to point out the current deal from Smartbroker+: when you open a new account and make 6 trades (until October, free of charge), you get a whole $ISAC (-0,46%) as a bonus (84€) - more than our federal government has invested in the retirement portfolio!

Maybe one of you could use it? I'm already there. I didn't get anything from the tip.

Except maybe a reprimand from customer service. 😅

$IWDA (-1,16%)

$CSPX (-1,24%)

$EIMI (-0,69%)

$CSNDX (-1,55%)

$ISAC (-0,46%)

$US09258C4188

$VWRL (-1,61%)

$VWCE (-0,86%)

$VUSA (-1,24%)

$VA

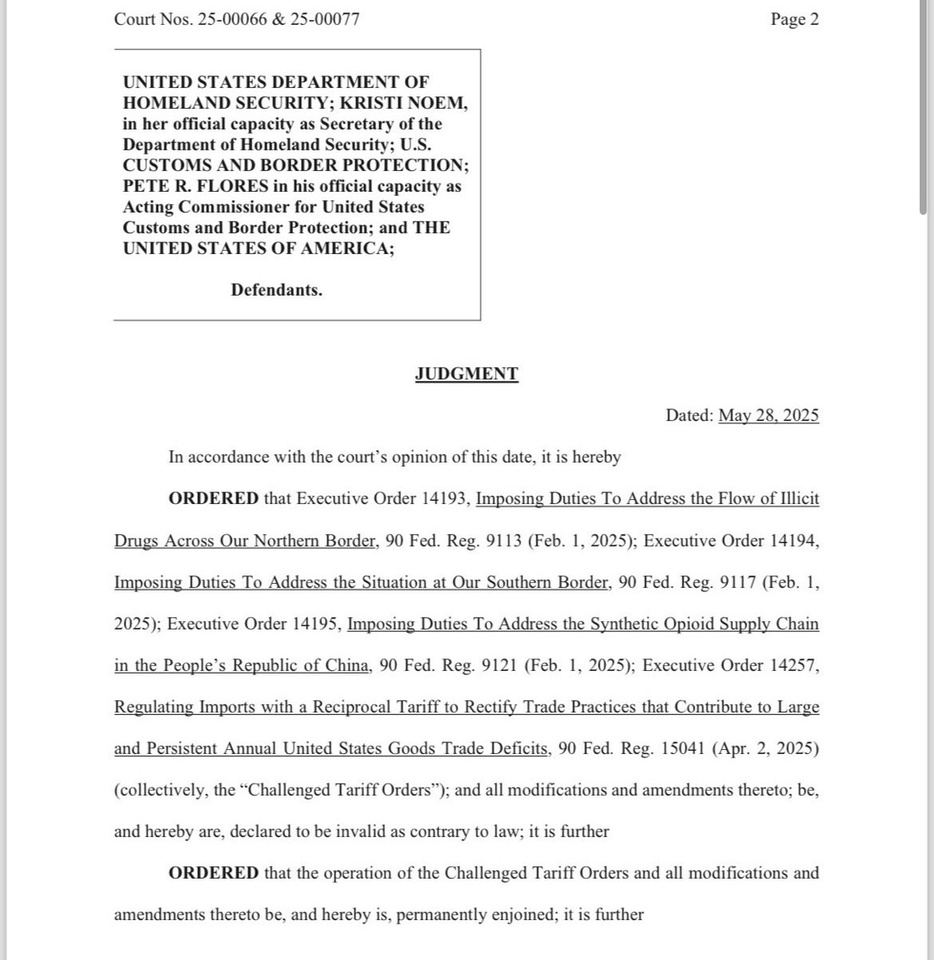

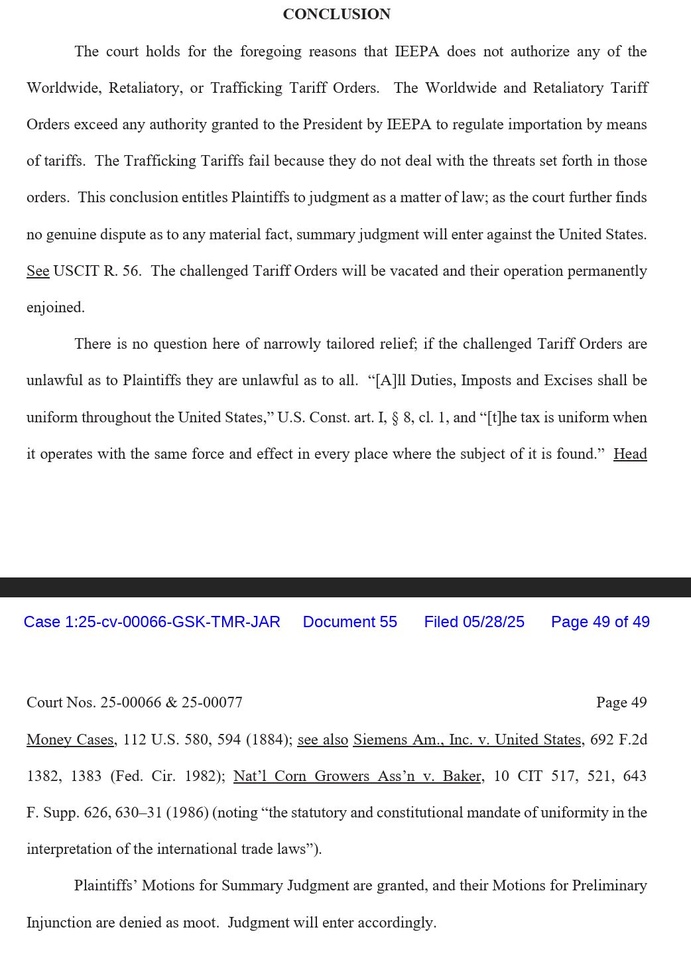

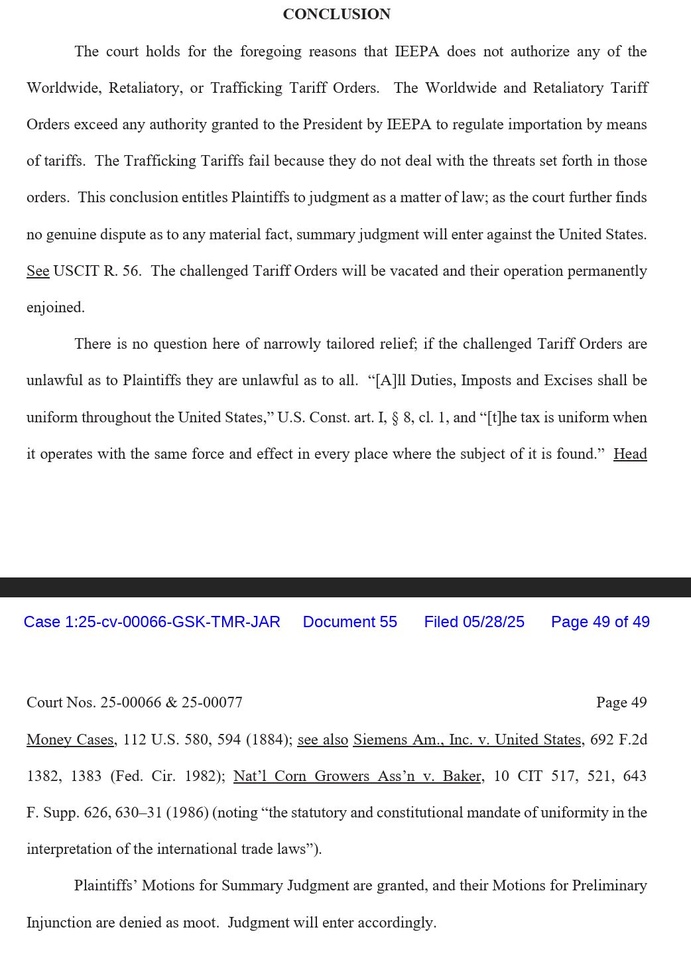

U.S. COURT OF INTERNATIONAL TRADE INVALIDATES PRESIDENT TRUMP'S TARIFFS UNDER THE IEEPA - THE PRESIDENT IS NOT AUTHORIZED TO IMPOSE TARIFFS UNILATERALLY.

The President is not authorized to impose comprehensive tariffs under the IEEPA. The Trump administration has already filed an appeal

US court blocks most Trump tariffs, says president exceeded his authority

In a sweeping new ruling, the U.S. Court of International Trade has just blocked President Trump's Liberation Day tariffs, saying that authority is with Congress.

FACT CHECK: While the Constitution grants Congress the power to impose tariffs, Congress delegated much of that power to the Executive Branch in the Trade Expansion Act of 1962, which allows for adjustments to tariff rates without needing Congressional action. Courts have given the executive branch broad authority to negotiate trade, that is until now.

https://www.reuters.com/world/us/us-court-blocks-trumps-liberation-day-tariffs-2025-05-28/

https://www.theguardian.com/us-news/2025/may/28/us-court-blocks-trump-tariffs

https://www.cnbc.com/amp/2025/05/29/court-strikes-down-trump-reciprocal-tariffs.html

https://www.nytimes.com/2025/05/28/business/trump-tariffs-blocked-federal-court.html

$IWDA (-1,16%)

$CSPX (-1,24%)

$EIMI (-0,69%)

$CSNDX (-1,55%)

$ISAC (-0,46%)

$US09258C4188

$VWRL (-1,61%)

$VWCE (-0,86%)

$VUSA (-1,24%)

$VA

U.S. COURT OF INTERNATIONAL TRADE INVALIDATES PRESIDENT TRUMP'S TARIFFS UNDER THE IEEPA - THE PRESIDENT IS NOT AUTHORIZED TO IMPOSE TARIFFS UNILATERALLY.

The President is not authorized to impose comprehensive tariffs under the IEEPA. The Trump administration has already filed an appeal

US court blocks most Trump tariffs, says president exceeded his authority

In a sweeping new ruling, the U.S. Court of International Trade has just blocked President Trump's Liberation Day tariffs, saying that authority is with Congress.

FACT CHECK: While the Constitution grants Congress the power to impose tariffs, Congress delegated much of that power to the Executive Branch in the Trade Expansion Act of 1962, which allows for adjustments to tariff rates without needing Congressional action. Courts have given the executive branch broad authority to negotiate trade, that is until now.

https://www.reuters.com/world/us/us-court-blocks-trumps-liberation-day-tariffs-2025-05-28/

https://www.theguardian.com/us-news/2025/may/28/us-court-blocks-trump-tariffs

https://www.cnbc.com/amp/2025/05/29/court-strikes-down-trump-reciprocal-tariffs.html

https://www.nytimes.com/2025/05/28/business/trump-tariffs-blocked-federal-court.html

2020 started with tr to gain first experience on the financial markets with manageable funds. 600€

many shares with very small amounts...

naaaja...

With $9626 (-3,2%) and $9866 (+1,23%) had large short-term gains in the portfolio during Corona. But just as quickly accumulated losses again due to overpriced speculative assets.

2024 strategy Switch to etf savings plan and diversification of countries and sectors as well as $BTC (-0,47%) admixture.

long-term investment idea:

Energy sector should be a safe bet, as global consumption is increasing annually, not decreasing.

then generally modern technologies

ETF

$ISAC (-0,46%) - Main position 50%

$EXXT (-1,55%) - usa technology boost distributing 30%

$EXSH (-0,36%) - Europe hedge (finance and insurance) distributing 20%

I will continue to buy or sell shares from time to time, depending on whether it is worthwhile or not.

Now you...

Any suggestions?

Principais criadores desta semana