flatexDEGIRO

Price

Discussão sobre FTK

Postos

38No dividend fee at Flatex

From October 1, 2025, the previous dividend fee of EUR 5.90 will no longer apply to foreign dividend payments.

dividend payments.

Does that mean I paid a fee of €5.90 on my €26.90 last year?

How can you not love Austria, you pay more for food, but the brokers are also more expensive and you pay more KeSt. 🤣

Earning from a turbulent market

FlatexDEGIRO $FTK (+1,35%) stands out as a compelling investment opportunity amid current stock market turbulence. The company reported record revenues of €480 million in Q4 2024, up 23% year-over-year, and net income surged by 55%. Its scalable online brokerage model benefits from increased trading activity during volatile markets, (Thanks to the orange man) driving both commission and interest income higher. With over 3 million customers and robust net cash inflows, flatexDEGIRO continues to expand its market share across Europe. Strategic innovations, such as the launch of crypto trading and planned securities lending, further diversify revenue streams. Strong financial health, cost control, and positive analyst ratings reinforce its resilience and growth prospects, making it an attractive choice for investors seeking stability and upside in uncertain times

Analyst updates, 13.01.25

⬆️⬆️⬆️

- GOLDMAN raises the price target for SIEMENS ENERGY from EUR 56 to EUR 60. Buy. $ENR (-2,7%)

- BARCLAYS raises the target price for MERCEDES-BENZ from EUR 48.50 to EUR 50. Underweight. $MBG (+0,06%)

- JEFFERIES upgrades SMA SOLAR from Hold to Buy and raises target price from EUR 14 to EUR 20. $S92 (-0,31%)

- GOLDMAN raises the price target for DEUTSCHE BÖRSE from EUR 226 to EUR 231. Neutral. $DB1 (+3,11%)

- BOFA upgrades BBVA from Neutral to Buy and raises target price from EUR 11 to EUR 13. $BBVA (-0,17%)

- WARBURG RESEARCH upgrades FUCHS SE from Hold to Buy. Target price EUR 50. $FPE

- GOLDMAN raises the price target for FLATEXDEGIRO from EUR 17 to EUR 18. Buy. $FTK (+1,35%)

- BERENBERG raises the target price for IBERDROLA from EUR 12.30 to EUR 14. Hold. $IBE (-1,3%)

- JEFFERIES upgrades PVA TEPLA from Hold to Buy and raises target price from EUR 12 to EUR 19. $TPE (-1,27%)

- JEFFERIES raises the price target for FRIEDRICH VORWERK from EUR 23 to EUR 30. Hold. $VH2 (-0,18%)

- JEFFERIES raises the price target for ZEAL NETWORK from EUR 45 to EUR 58. Buy. $TIMA (+0%)

- JEFFERIES raises the price target for ADESSO from EUR 75 to EUR 85. Hold. $ADN1 (+11,77%)

- JEFFERIES upgrades NEL from Underperform to Hold. Target price NOK 3. $NEL (-0,82%)

⬇️⬇️⬇️

- BERENBERG lowers the price target for RWE from EUR 46.50 to EUR 42. Buy. $RWE (-1,06%)

- GOLDMAN lowers target price for EON from EUR 17.50 to EUR 17. Buy. $EOAN (+1,78%)

- HAUCK AUFHÄUSER IB downgrades AIXTRON from Buy to Hold and lowers target price from EUR 26.40 to EUR 13.80. $AIXA (+4,25%)

- METZLER lowers the price target for DWS from EUR 41 to EUR 40.50. Hold. $DWS (+0,42%)

- GOLDMAN lowers the price target for ASTRAZENECA from GBP 159.55 to GBP 155.58. Buy. $AZN (-0,82%)

- TD COWEN downgrades STMICRO to Hold. Target price EUR 24.50. $STM (-1,37%)

- JPMORGAN downgrades CONSTELLATION BRANDS to Neutral. Target price USD 203. $STZ (+0,11%)

- JEFFERIES lowers the price target for DOCMORRIS from CHF 65 to CHF 39. Buy. $DOCM (-0,79%)

- JEFFERIES lowers the price target for ATOSS SOFTWARE from EUR 112 to EUR 108. Hold. $AOF (+5,92%)

- JEFFERIES lowers the price target for JENOPTIK from EUR 34 to EUR 29. Buy. $JEN (-0,64%)

- JEFFERIES lowers the price target for KONTRON from EUR 29 to EUR 27. Buy. $KTN (+2,13%)

- JEFFERIES lowers the price target for SILTRONIC from EUR 95 to EUR 90. Buy. $WAF (+4,9%)

- JEFFERIES downgrades VERBIO from Buy to Hold and lowers target price from EUR 22 to EUR 11. $VBK (-1,65%)

- JEFFERIES downgrades SGL CARBON from Buy to Hold and lowers target price from EUR 9.50 to EUR 4.40. $SGL (+0,26%)

Leveraged products & certificates part 2

@Finanzaristokrat

@Der_Dividenden_Monteur

@Spacepanda

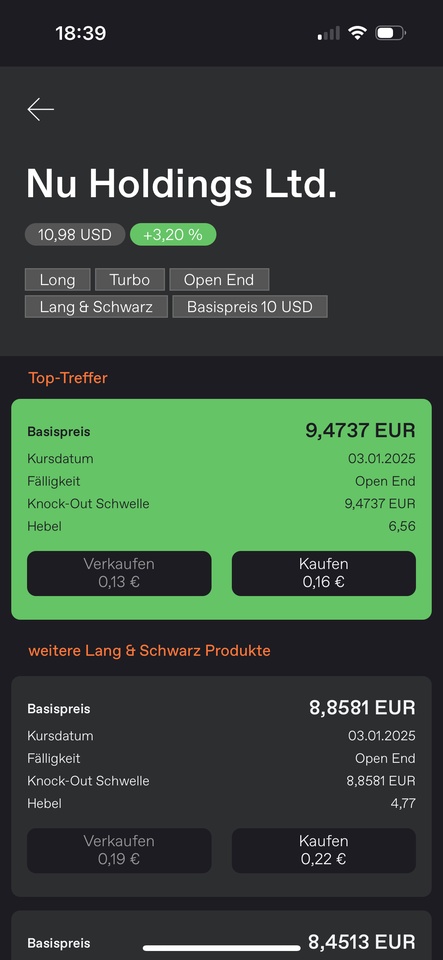

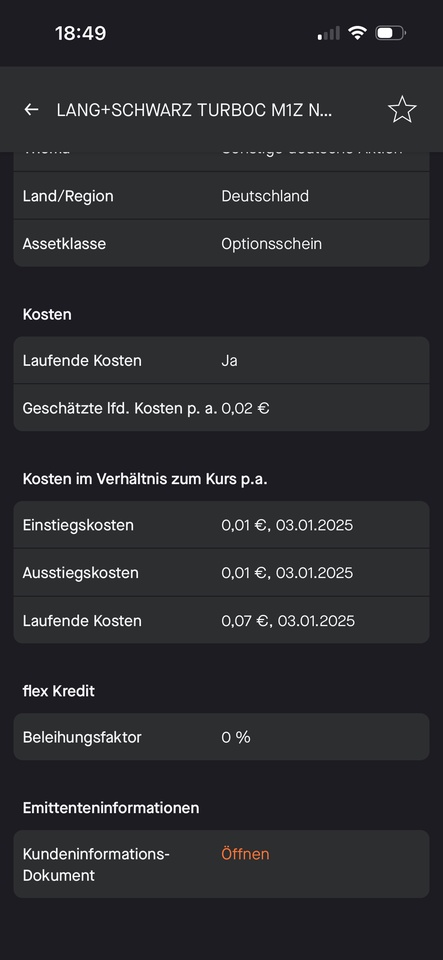

today the display should be correct price in $ and strike price/knock-out threshold also in $

Probably due to the weekend

Leverage products & certificates Functionality

Question of understanding:

Dear community, since there is not really a sample portfolio at flatex, or you can test this without losing money 😁, can someone explain the mechanics to me ?

Using the example of $NU (-5,81%) when will I be undocked ? When does the bill expire?

Assuming I now buy 10,000 shares at 0.16 = 1,600.00 euros, how much of a loss do I have to make for it to become worthless?

Is the strike price equal to the knock-out threshold? Or do I have to start from the USD 10.98 (about 10.65 euros) and at -11 % the bill expires ?

Perhaps someone here has some experience, learning by doing could be quite expensive, especially as I am not yet sure how the costs will be affected ?

Maybe it's a display error because of the weekend? 😁

The explanatory videos from flatex are usually not helpful here.

Thanks in advance ✌️

minus. The spread should be no more than 1 cent.

Mr. Rossi seeks his fortune

Hello everyone,

Some of my acquaintances had quietly made big money with investors in Tesla/Nvidia, others hit the big time with Bitcoin. In hindsight, of course, they were very lucky, but they tried it and were lucky.

I always thought that shares etc. were generally reserved for the "upper class" and without tens of thousands of euros you can forget it.

Since learning these things, I've watched a lot of YouTube videos to at least pick up a few basics.

In this day and age, it's very easy for anyone to participate.

After the tenor of the "financial professionals" was, don't spend weeks/months comparing which broker and what type of investment, just get started and you can always readjust later.

Well, now that I'm over 40 and have had a very unfortunate financial path so far, I've also taken the plunge. The decisive factors were the success stories of my friends and then a look at my pension fund that my insurance broker once talked me into. In other words, I am a Skandia/FWU "victim". Since I live in Austria, I'm at least lucky enough to still have my deposits, but de facto 0 performance.

There's about 5k coming out soon that I could invest, let's see.

I now have a broker $FTK (+1,35%) then this app for the management/collected overview. Unfortunately, the broker was there first, so I'm currently complaining that Getquin doesn't have an automatic connection and has to be updated manually, but maybe that will come, and I've already set up a savings plan for an ETF (MCSI World), as it doesn't "start" until 15.01.25 I'm curious how it will develop. I actually wanted to put the 5k mentioned above into the ETF, but I haven't found a way to make a one-off payment and then a savings installment. I will probably do this by increasing the savings rate until the 5k is there.

Since the money is not sitting so loosely and everyone is talking about diversification from different investment opportunities, I have bought a few more cryptos. As I said, since there's not much risk involved, but I still want to be involved, I also bought a few more coins. I'm sure they're the wrong ones, but the feeling was great when I bought 2 million coins for EUR 40. The value has now grown to almost 50 EUR and I'm really enjoying it (it may sound ridiculous to many, but as I said, it's fun).

Today I spent another 60 EUR of my play money on a share package. It's a similar issue to coins. I can't afford a Tesla/Nvidia share at the moment and with one share (you can't even download a "copy" of the share to hang on the wall at home) it doesn't make much sense either.

But I have found a share $ATO I know the name of the company and because they are going through difficult times at the moment, I bought 30000 shares for the money. I'm convinced that the guys and gals there will get things going again.

With Getquin, I actually thought that you enter your data and the AI then makes suggestions for investments and then sends messages a la, hey watch out because this and that, but we're probably not that far with AI yet or you still have to switch it on somewhere 🤣

If anyone has a tip or two, I'd love to hear it.

So here's to a year with lots of positive experiences and learnings.

LG

As I said, I am very new and not (yet) really experienced. Furthermore, I cannot give you any investment advice, so the following topic is not one. You are responsible for yourself.

However, I also want to be honest: I'm mainly writing to you because I was in the same places as you at the beginning and I want to explicitly warn you about this. So here are my learnings:

1. never rely on small "penny stocks". Atos and Canadian "companies" in particular are deliberately hyped in social media (Reddit) to take money out of your pocket. You can of course gamble consciously - but be aware that you can lose with incalculable risk. In any case, I would advise you to say goodbye to the idea of making a quick profit with something like this.

2 The same applies to crypto. Completely incalculable. I hold BTC and HBAR myself - both in the knowledge that the amount could halve overnight. Whether you want to put yourself through that with your starting position is up to you.

3. the aim should not be to greedily and quickly achieve a 1000% return. In my opinion, the probability of actually achieving this is close to zero. Make friends with the idea that we have no idea what will really happen on the market tomorrow. At best, you can "gamble" with derivatives at some point - in the knowledge that this is exactly what will happen.

4. now a positive tip: think about exponential growth. A return of 5% per month seems small at first. But do it over 30 years and the profit is enormous. That should be your goal.

5. next year I will try to achieve this with as little risk as possible. I find Meb Faber's GTAA approach interesting. But I'm not an expert on this - I just find the concept promising. You can find it here: https://download.ssrn.com/14/03/03/ssrn_id2403936_code649342.pdf?response-content-disposition=inline&X-Amz-Security-Token=IQoJb3JpZ2luX2VjEO3%2F%2F%2F%2F%2F%2F%2F%2F%2F%2FwEaCXVzLWVhc3QtMSJGMEQCIDJ5Y9YoTuxyKYKz2lEMYvuE8u66rEQrIuTtAMVvNQL1AiAWl8ppClBvuCFuFxZ0PnCOGYqYJQvj9QgUJmKmP%2B8YlirHBQjG%2F%2F%2F%2F%2F%2F%2F%2F%2F%2F8BEAQaDDMwODQ3NTMwMTI1NyIMUHH9Q0C4Bunz8j5aKpsFyjmPaU9gJaO1N7dRBccnAomDgimSPIBUjvPQtSzJVmjVzSJf9ZXnonB31%2Bqvs000EPXchkecUHJ4nKwqxzHJNDl5xqOTtwtgANDNTThaP0ties8%2Fn5CcGt5eEiRNGaGDOsDPE3OuaqovY4dYC5C6s4vd3iDhdhujUSnNEi3bkHLqFGUaIbWI6ab8LKlDX1W7h1CFHai4FH%2F6nJzb%2B7l2NfQrVFTwVK%2BX%2FH2oXcEpnbSF7nibKNG1nxKV1orYpQKOJVgWQFUlvfkjHegFu4GSTNyyYTIdVv2GGs%2FDh29iLFSTFUq%2F0QDN57RjvE2x%2FR9J5M0V3EIzUS0LhxXDTmjuUSiaHetMWaCbDDvp6xR5IXZngDSWl3r1CLNQ0Nu0G1la5NmNQremS8dIIaOlg8L0Yj3mAJE732X4cEOW2S%2BHUx9xH8VpFiQQKmZ6DVzq%2FFz4IuEbI7qkz8LfdXTRYDT3LweA%2BbwnkqBF4RpsVZZkuOLLsEJRi0e%2FX2xZC2Yle%2BKN9CeaaHC865HRHXLavIYwUjM5B1RQ6Il1KzYX1dswJsQlRCaJp9UcMLVd5GmLSfXeoPnhdhD8P%2BxzgAWIB01ZxfVwAJJlSP

All the best!

Matthias

Online broker flatexDEGIRO launches crypto trading in Germany. $FTK (+1,35%)

$BTC (-1,49%)

With over three million customers, the online broker flatexDEGIRO is launching crypto trading in Germany. The company plans to enter Austria and the Netherlands in 2025.

The online broker flatexDEGIRO launched trading in 20 cryptocurrencies in Germany today, December 16. This is according to a press release made available to BTC-ECHO.

According to the company, it is "setting new standards in terms of total costs and price transparency." In addition, flatexDEGIRO is the first broker with full cost transparency for order fees and the spread.

Oliver Behrens, CEO of flatexDEGIRO, explains: "Cryptocurrencies add a relevant asset class to our broad product portfolio. With market-driven reference prices, very tight spreads and the lowest order fees, we want to create the leading crypto offering in Germany for our customers."

The new products are available to German customers of the brokerage platforms flatex and ViTrade. The online broker works with the securities trading bank tradias, while Tangany takes care of custody.

flatexDEGIRO plans to enter the Austrian and Dutch markets in 2025. "In the future, flatexDEGIRO wants to introduce further products and features, such as staking and crypto savings plans," the press release states.

According to its own statements, flatexDEGIRO AG is one of the leading and fastest growing online brokers in Europe and offers its services in 16 countries. The company has three million customers.

The crypto brokers operating in Germany and Austria are now facing new competition with flatexDEGIRO. After all, one of the leading providers for Bitcoin and Co. in Europe, Bitpanda, is based in Vienna.

Meanwhile, Bitpanda is continuing its expansion. According to a press release obtained by BTC-ECHO, the crypto broker has secured a Virtual Assets Regulatory Authority (VARA) in the United Arab Emirates.

Reminds me more of the offer from JustTrade...

⬆️⬆️⬆️

- UBS raises its price target for NVIDIA from USD 150 to USD 185. Buy. $NVDA (-6,66%)

- METZLER raises the price target for MUNICH RE from EUR 535 to EUR 543. Buy. $MUV2 (-1,35%)

- GOLDMAN lowers the target price for NOVO NORDISK from DKK 1040 to DKK 1025. Buy. $NOVO B (-0,67%)

- GOLDMAN upgrades MTU from Neutral to Buy and raises target price from EUR 276 to EUR 400. $MTX (-2,86%)

- GOLDMAN upgrades BASF from Neutral to Buy and raises target price from EUR 45 to EUR 53. $BAS (+0,48%)

- DEUTSCHE BANK RESEARCH raises the price target for FRESENIUS SE from EUR 42 to EUR 44. Buy. $FRE (+0,43%)

- DEUTSCHE BANK RESEARCH raises the price target for EMBRACER from SEK 24 to SEK 28. Hold. $TH9A

- DEUTSCHE BANK RESEARCH raises the price target for AMADEUS IT from EUR 62 to EUR 65. Hold. $AMS (+4,38%)

- DEUTSCHE BANK RESEARCH raises the price target for NEMETSCHEK from EUR 85 to EUR 100. Hold. $NEM (+4,55%)

- WARBURG RESEARCH raises the price target for DÜRR from EUR 32 to EUR 33. Buy. $DURYY (-1,64%)

- HAUCK AUFHÄUSER IB upgrades CANCOM from Hold to Buy. Target price EUR 32. $COK (+2,5%)

- ODDO BHF upgrades GENERALI to Neutral. Target price EUR 26.10. $G (+0,1%)

- METZLER raises the price target for HEIDELBERG MATERIALS from EUR 131 to EUR 138. Buy. $HEI (-5,25%)

- BERENBERG raises the price target for FLATEXDEGIRO from EUR 16 to EUR 18. Buy. $FTK (+1,35%)

- BERENBERG raises the price target for FREENET from EUR 29 to EUR 32. Buy. $FNTN (-10,9%)

- JPMORGAN raises the target price for HEIDELBERG MATERIALS from EUR 108 to EUR 149. Overweight. $HEI (-5,25%)

⬇️⬇️⬇️

- UBS lowers the price target for MUNICH RE from EUR 560 to EUR 540. Buy. $MUV2 (-1,35%)

- ODDO BHF downgrades MODERNA to Outperform. Target price USD 86. $MRNA (+0,56%)

- UBS downgrades VALE from Buy to Neutral and lowers target price from USD 14 to USD 11.50. $VALE (-1,68%)

- DZ BANK lowers target price for DEUTZ from EUR 6.80 to EUR 5.80. Buy. $DEZ (+1,63%)

- DZ BANK lowers the price target for BECHTLE from EUR 51 to EUR 45. Buy. $BC8 (+2,49%)

- BERENBERG lowers the target price for ESTEE LAUDER from USD 87 to USD 76. Hold. $EL (-0,93%)

- RBC lowers the target price for ASOS from GBP 4.60 to GBP 4. Sector Perform. $ASC (-0,31%)

- RBC lowers the price target for EVOTEC from EUR 12 to EUR 11.60. Outperform. $EVT (-0,95%)

- RBC lowers the price target for VESTAS from DKK 222 to DKK 156. Outperform. $VWS (-0,21%)

- BERENBERG lowers the price target for SUSS MICROTEC from EUR 80 to EUR 75. Buy. $SMHN (-0,75%)

- JEFFERIES downgrades NEL from Hold to Underperform and lowers target price from NOK 5.50 to NOK 3. $NEL (-0,82%)

- RBC lowers the price target for BMW from EUR 81 to EUR 80. Sector Perform. $BMW (+0,47%)

- JEFFERIES lowers the price target for KNAUS TABBERT from EUR 26 to EUR 20. Hold. $KTA (+0,49%)

Update analyst assessments:

$TSLA (-1,76%) | RBC raises target price for TESLA from USD 236 to USD 249. Outperform.

$KO (-0,15%) | JPMORGAN lowers the price target for COCA-COLA from USD 78 to USD 75. Overweight.

$TMUS (-2,36%) | UBS raises the price target for T-MOBILE US from USD 210 to USD 255. Buy.

$T (-0,57%) | UBS raises the price target for AT&T from USD 24 to USD 25. Buy.

$AOF (+5,92%) | WARBURG RESEARCH raises the price target for ATOSS SOFTWARE from EUR 142 to EUR 144. Buy.

$UA (+1,56%) | UBS raises the price target for UNDER ARMOUR from USD 11 to USD 12. Buy.

$JST (+1,01%) | WARBURG RESEARCH raises the price target for JOST WERKE from EUR 62 to EUR 77. Buy

$IBM (+2,77%) | UBS raises the price target for IBM from USD 145 to USD 150. Sell.

$FTK (+1,35%) | HAUCK AUFHÄUSER IB downgrades FLATEXDEGIRO from Buy to Hold and lowers target price from EUR 16 to EUR 15.

$ROG (-1,15%) | DEUTSCHE BANK RESEARCH raises the price target for ROCHE from CHF 235 to CHF 250. Sell.

$EBAY (+4,28%) | UBS raises the price target for EBAY from USD 59 to USD 72. Neutral.

$KER (+0,42%) | RBC lowers the price target for KERING from EUR 280 to EUR 230. Sector-Perform.

Títulos em alta

Principais criadores desta semana