$LXS (-0,48%)

$DBXD (+0,85%)

$IWDA (+0,57%)

$CSNDX (+0,8%)

$CSPX (+0,58%)

Eight percent reality, fifty percent hysteria? The psychology behind price jumps and how investors can deal with them correctly.

Volatility: normality instead of risk?

Hardly a day goes by without some share in the DAX environment recording a significant price swing. This could look like this, for example: A Quartalsberichtminimally misses expectations - minus ten percent. An outlook sounds a touch more optimistic than feared - up eight percent.

But a look at the long-term figures reveals this daily excitement for what it usually is: Irrationality.

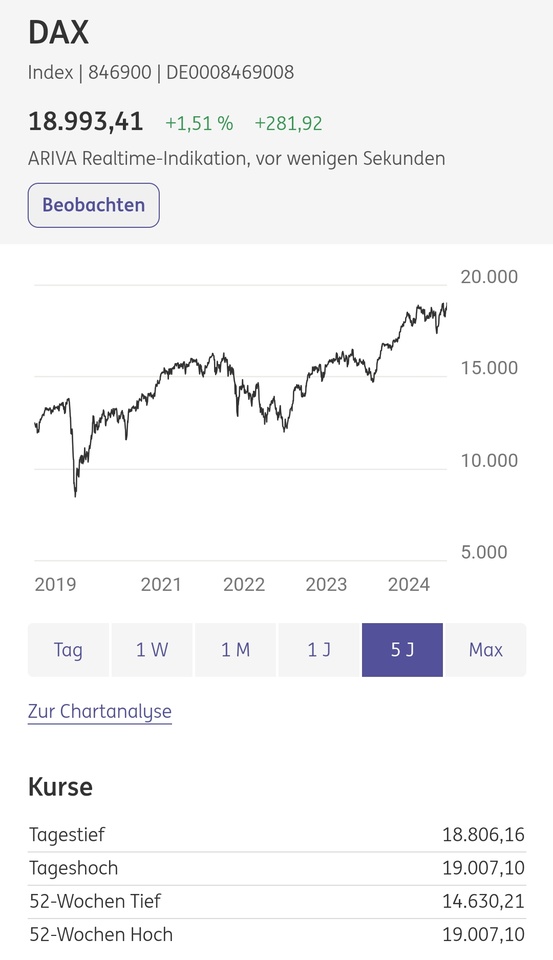

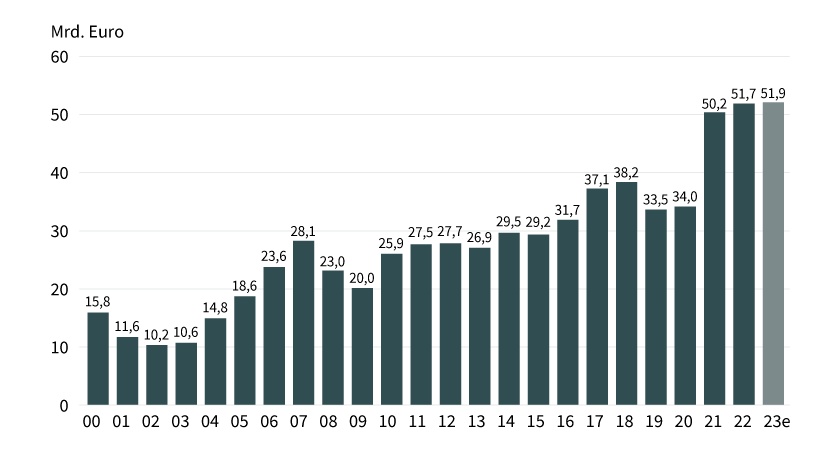

Because the bottom line is that the DAX over the past 25 years - including Dividenden - around eight percent per year. Eight percent. Not 20, not 30, eight.

And since the Index is ultimately nothing more than a basket of its constituent companies, this inevitably means that the share prices of these companies have also risen by an average of around eight percent per year over the long term.

Expectations, forecasts, whispered estimates

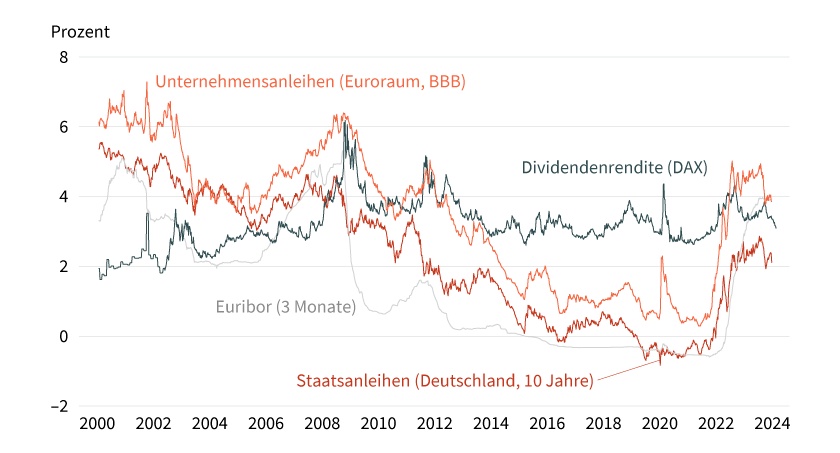

Anyone who realizes this should find the daily Volatilität seem absurd. If the "fair" value of a company grows by eight percent annually over the long term, how rational can it be that the share price of most Aktienfluctuate by 50% during the year?

Or plummet by eight to ten percent or shoot up after the publication of individual quarterly figures - even though the long-term earning power has often hardly changed?

Of course: information must be priced in. Profits, margins, outlooks, risks - all this is part of the valuation. But in reality, companies Märkte rarely react to facts, but to expectations upon expectations.

In addition, there is a structural problem of modern capital markets: the time horizon has shrunk. It is now only about whether the share price will rise tomorrow - and no longer about where a company will be in a few years' time.

Algorithms, ETFs, short-term funds and a media news cycle that declares every decimal place a "game changer" amplify minimal signals into drastic price movements.

Drama vs. reality

If the daily price fluctuations were taken seriously, the economic reality of DAX companies would have to change radically on a permanent basis. But it doesn't. Mechanical engineering companies, chemical groups or insurers are not suddenly worth ten percent less just because one quarter was a little weaker. Nor are they fundamentally ten percent better overnight because an analyst raises his forecast slightly.

The long-term return of the DAX shows how little remains of all the drama. Eight percent per year - calm, steady, unspectacular. The daily swings are the noise around this trend, nothing more.

And that is exactly what investors should understand. Don't let yourself go crazy if share XY comes under pressure again. In most cases, there is little or hardly anything behind it.

From depression to euphoria - a lesson

Industries and sectors fall out of favor and come under pressure. A few months later, they are back in vogue.

In 2022, for example, we experienced a major tech depression. Meta, NetflixGoogle and many more were on the hit list, only to go on to soar to incredible heights.

Today, everything labeled "AI loser" or "software" is on the brink. In retrospect, the current sell-off in many of these stocks is probably just as incomprehensible as the fact that Meta collapsed to below USD 100 in 2022 from today's perspective.

Those who understand this separation between price and value experience volatility in a completely different way. Price fluctuations lose their horror because they are no longer perceived as a threat, but as the normal state of an irrational market. The Börse is not a precise measuring instrument, but a barometer of sentiment - and sentiment fluctuates more than fundamental data

Lanxess share: Chart from 10/02/2026, price: EUR 20.91 - symbol: LXS | source: TWS

Lanxess, for example, is trading up 7.6% today at EUR 20.91. The only relevant news I could find on the company was an upgrade by Goldman Sachsfrom sell to neutral and an accompanying price target increase from 10 to 23 euros.

What could better illustrate all the short-term madness than this Rating? It fits like a glove. Yesterday Lanxess was only worth EUR 10, today it is worth EUR 23.

New factories must have sprung up overnight.

Source