A popular ETF on the MSCI World $LCUW is merged with another index fund. What sounds like a formal act poses a major problem for savers - they are falling into a tax trap.

Amundi is the largest capital manager in Europe, and the world fund in question is worth as much as 6.7 billion euros. In this respect, many savers appear to be affected by the merger.

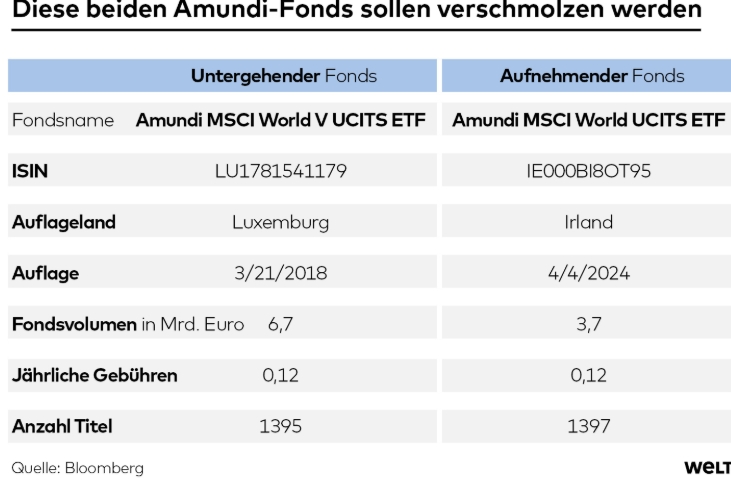

Amundi currently has two almost identical global ETFs in its range. The EUR 6.7 billion MSCI World ETF (ISIN: LU1781541179), which was launched in Luxembourg in 2018, and a world counterpart with the ISIN: IE000BI8OT95, which was only launched last year and is based in Ireland. This new fund is now worth 3.7 billion euros.

The older MSCI World ETF is now to be merged into the newer ETF. In purely technical terms, this is a "merger by absorption". The older ETF, the ETF that is being absorbed or taken over, will be transferred to the newer MSCI World ETF. The owners of the "merging" ETF receive shares in the "absorbing" ETF, while the original ETF is dissolved. The absorbing Amundi MSCI World ETF remains unchanged and continues to manage the assets of the other fund.

The background to the fund merger is the different tax treatment in Europe. The older MSCI World fund is launched in Luxembourg, the other in tax-privileged Ireland. The merger is scheduled to take place on February 21. Physically backed ETFs have to pay withholding tax on dividends, which is 30 percent for US equities. Ireland has concluded a more favorable tax treaty with the USA, so that ETFs domiciled in Ireland only pay 15 percent withholding tax. The aim of the ETF merger at Amundi is to obtain better tax conditions. However, this comes at a high price for the old holders of the Luxembourg MSCI World. A fund merger that crosses a national border is considered tax-relevant in this country. The merger is treated as if the Luxembourg MSCI World ETF had been sold. All accumulated gains must be taxed in one go, i.e. final withholding tax including solidarity surcharge and, if applicable, church tax are due. And that can be expensive. And above all unpleasant.

Anyone who has invested in the Luxembourg MSCI World ETF from the outset is sitting on a profit of no less than 135 percent. The problem for investors is that since the fund is merged, investors do not receive a cent. Instead, tax is due on "fictitious" profits and this is deducted from the reference account of the custody account. However, if the reference account is not covered, savers could slip into the expensive overdraft facility or experience other inconveniences.

If savers do nothing and everything goes according to plan, the fund will be merged on February 21. This will take around five to ten bank working days, during which savers will not be able to access their money in the MSCI World ETF. The tax is then withdrawn from the reference account on the conversion date.

An example calculation makes it clear what sums are involved: Assuming savers have a capital gain of 10,000 euros and have already exhausted their saver's allowance of 1000 euros. Then 70 percent of this gain will be taxable. As the Amundi MSCI World ETF is an equity ETF that invests at least 51 percent of its fund volume in equities, it falls under the partial exemption of 30 percent. This means that EUR 7,000 is taxable, of which 26.4 percent is subject to withholding tax including solidarity surcharge, i.e. EUR 1,848. This liquidity should be in the clearing account.

Source: welt.de