My goal is

55/60% $WEBN (-0,18%)

10/15% $BTC (-1,01%)

10% $EIMI (-1,55%)

10% $ZPRV (+1,79%)

Messaggi

10My goal is

55/60% $WEBN (-0,18%)

10/15% $BTC (-1,01%)

10% $EIMI (-1,55%)

10% $ZPRV (+1,79%)

estimated reading time: 4 minutes

Twenty years ago, the new market crash wiped out my first stock market money and my ego. I swore off the stock market, but my pension certificate showed me that ducking out has an expiry date.

So the first attempts to start again followed. Here on Getquin, I have learned from positive critical voices from e.g. @DonkeyInvestor and @Epi that there is more to it than "just picking something". Since my last post 6 months ago, this was followed by extreme late-night brooding, Excel monsters, AI research, reading Kommer and countless "new agains".

I have tried to read up on modern optimization models such as Mean-Variance, Black-Litterman and Fama-French etc. and implement them in the best possible way.

The result was this portfolio!

As thoroughly tested as you can in a private garage, and coupled with the insight that we only have to leave the uncontrollable to chance.

And one thing first. I am convinced of this and will not change it.

I just want to share my thoughts and ideas about the direction with you. It's difficult to really explain every detail here, I'm sure I could do it better in a conversation, but that's not possible here. I can assure you that the selection and combination definitely makes sense - at least for me and the construct. Among other things, it was important to me to be able to control individual regions separately. I think I have achieved that.

Global (30%)

- SPDR MSCI All Country World, $SPYY (-0,14%)

- L&G Global Equity UCITS ETF, $LGGG (+0,26%)

- iShares Edge MSCI World Momentum, $IS3R (-0,24%)

- Xtrackers MSCI World Value, $XDEV (-0,69%)

- Invesco Global Active ESG Equity, $IQSA (-0,39%)

- VanEck World Equal Weight Screened, $TSWE (-1,34%)

- VanEck Morningstar Developed Markets Dividend Leaders, $TDIV (-0,77%)

USA (31.5%)

- L&G US Equity, $LGUG (+1,54%)

- iShares MSCI USA Mid-Cap Equal Weight, $IUSF (+1,55%)

- JPMorgan BetaBuilders US Small Cap Equity, $BBCS (+2,38%)

- SPDR MSCI USA Small Cap Value Weighted, $ZPRV (+1,79%)

Europe (17.5%)

- HSBC EURO STOXX 50, $H50A (-1,94%)

- L&G Europe ex-UK Quality Dividends Equal Weight, $LDEG (-0,84%)

- SPDR MSCI Europe Small Cap Value Weighted, $ZPRX (-1,45%)

Emerging markets (19%)

- iShares Edge MSCI Emerging Markets Value Factor, $5MVL (-0,04%)

- UBS LFS MSCI Emerging Markets ETF, $EMMUSA (-0,76%)

- L&G Emerging Markets Quality Dividends Equal Weight, $LDME (+0,11%)

- SPDR MSCI Emerging Markets Small Cap, $SPYX (-0,92%)

Japan (2%)

- L&G Japan Equity UCITS ETF, $LGJG (-0,62%)

Ø TER = 0.25%

In summary, this gives the following breakdown

Regional breakdown

- USA (North America) ~ 48%

- Asia ~ 22%

- Europe ~ 22%

- UK ~ 3.6%

- Japan ~ 4.4%

Market capitalization

- Large Cap ~ 52%

- Mid Cap ~ 26%

- Small Cap ~ 22%

The portfolio deliberately allocates its capital to the regions and - where possible - to all capitalization classes. The world building blocks provide the global beta; value, momentum and quality satellites add factor premiums. In the USA, a complete large/mid/small stack provides a pronounced size bias, while Europe receives a value bias via quality and small value ETFs. The emerging layer combines large-cap value stocks, quality leaders and a small-cap module - a diversification anchor beyond the developed markets.

Due to the almost equal weighting of the 18 positions, the Herfindahl index of ETF weights falls to ~633; indirectly, the portfolio contains several thousand individual stocks. The weighted TER is ≈ 0.25 % p. a., spreads below 0.1 %. This means that, compared to a $GERD (-0,38%) a favorable multifactor portfolio myself.

The factor tilts (value 42 %, size 35 %, quality/div ≈ 12 %, momentum ≈ 8 %) increase the expected volatility moderately to 18-20 % p.a.; however, historical data on small and value indices indicate 1-2 percentage points additional return over long horizons. Large caps remain present at around 52 %, mid caps at 26 % and small caps at 22 % support the size premium .

With my "multi-factor all-cap portfolio", I combine global market coverage with five proven premiums, without cost or concentration ballast. Of course, I will have to endure additional fluctuations, but I believe that I have created a robust source of returns over the long term.

I have tried to consider everything and leave nothing to chance, except the uncontrollable.

Anyone who has made it this far. Thanks for reading.

I'm looking forward to your feedback.

PS:

YES, I have Bitcoin😉 and also two themed ETFs. They just stay like that.

- ARK AI & Robotics ETF, $AAKI (+1,43%)

- HanETF Future of Defense ETF, $ASWC (+4%)

- ETC GROUP CORE BITCOIN, $BTC1 (+6,99%)

---

no investment advice; DYOR

Thanks also to @VPT , @Mister_ultra , @Ph1l1pp , @ShrimpTheGimp , @MoneyISnotREAL , @Staatsmann and @Smudeo for commenting and providing approaches.

Did the most scared thing ever with my money… but also the most exciting. I’ll (hopefully) thank myself for someday! 💸

While the first 33K is invested now, I’m just waiting for a ‘good’ moment to jump into Bitcoin for 45% of my portfolio.

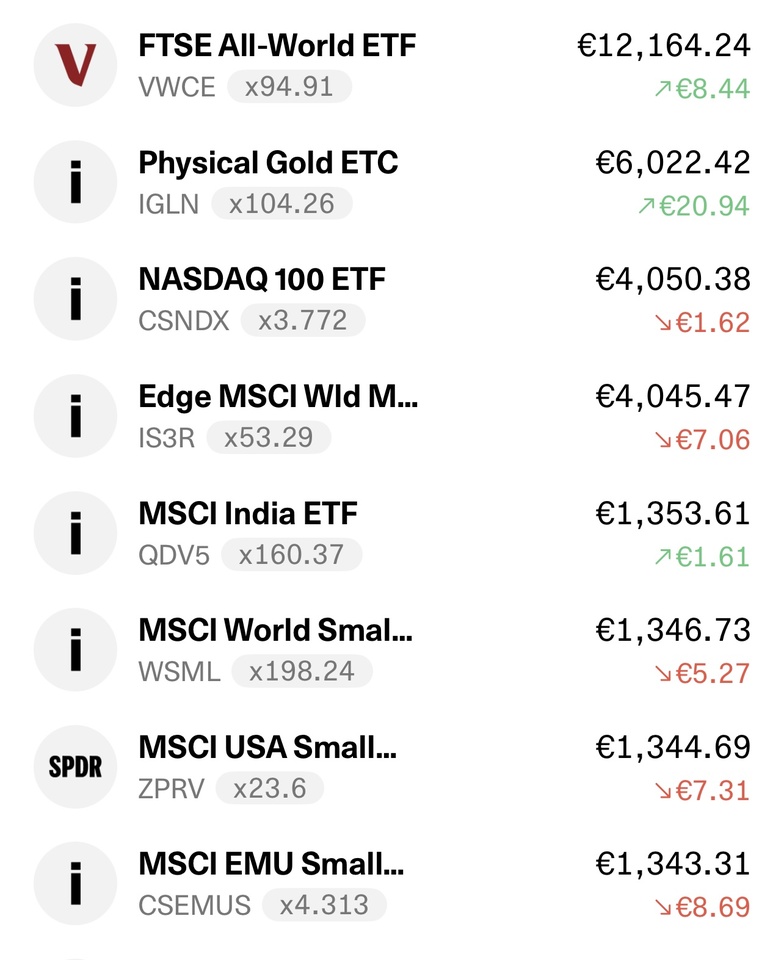

$VWCE (+0,47%)

$CSNDX (+1,32%)

$IS3R (-0,24%)

$IGLN (+2,46%)

$ZPRV (+1,79%)

$WSML (-0,44%)

$CSEMUS (-1,62%)

$QDV5 (-0,9%)

Hi everyone,

I’m 28 and planning to invest €80,000 with a long-term, offensive strategy. I’m aiming for broad global diversification, focused on both value and growth. I’m totally fine having 60–70% of my portfolio allocated to the U.S. and with exposure to emerging markets as well.

Here’s a rough outline of the allocation I have in mind:

30–40%

Nasdaq 100

$EQQQ (+1,31%)

$XNAS (+1,32%)

$CSNDX (+1,32%)

15–25%

S&P 500

$VUAG (+1,29%)

$CSPX (+1,24%)

$SPYL (+1,08%)

10%

World ex US

$WEXU (-1,45%)

$IE000R4ZNTN3 (-1,35%)

$EXUS (-1,21%)

10%

Small Cap US Value

$ZPRV (+1,79%)

5% Small Cap World $WSML (-0,44%)

$ZPRS (+0%)

5% Emerging Markets (EM)

$EIMI (-1,55%)

$XMME (-0,58%)

5%

EM Small Cap

$SPYX (-0,92%)

5–10%

India UCITS ETF

$FLXI (-0,73%)

$QDV5 (-0,9%)

Additionally (5-10%), I’m considering adding one or two of the following ETFs – would love your thoughts on which one(s) you’d choose and why (or not):

Finally, I’m thinking of picking around 10 individual stocks as a satellite component. Any suggestions? 🚀

Curious to hear your feedback:

• What do you think of this ETF setup overall?

• Would you add or remove anything?

• Would you tweak the allocation? If yes, how and why?

I prefer accumulating ETFs only, and I plan to add €1,000–1,500 every month going forward.

Your thoughts are much appreciated! 🙏🏼😀

Preface:

In the following, I would like to present how my portfolio has developed over the course of 2024.

This includes

1) my strategic orientation

2)Return on the portfolio.

The main topics are:

Finally, I will give my own thoughts on how to proceed.

The main changes to my portfolio that have led

to my current strategy are presented below using a short timeline.

timeline:

My timeline

Beginning of 2024

At the beginning of the year, I pursued a 70/30 core satellite

strategy. The 70% ETF core again consisted of STOXX Europe.

MSCI World, Emerging Markets.

The 30% consisted of stocks such as: $CSIQ (-0,88%) , $O (+1,63%) ,$TSM (-0,32%)

$ADM (+2,37%)

$UMI (-0,11%)

$D05 (-2,15%)

$BMW (-4,17%)

$UKW (+0%)

$8031 (+1,9%)

$MUV2 (-0,67%)

February

Addition of gold to my portfolio. Target size 10%. Build-up in batches.

The remaining 70/30 strategy therefore only relates to the remaining

90%.

April-June:

Entry into Bitcoin via Trade Republic in several batches

at prices between 50k and 63k.

After exchange with @Epi to the fee schedule at Trade Republic

I sold them there in order to sell Bitcoin on a dedicated crypto exchange.

exchange.

June:

Thanks to @PowerWordChill I got to grips with factor investing. A Gerd Kommer book later, and after some internet research, I decided to

decided to transform my ETF strategy into a factor ETF strategy.

July-August 2024:

Sale of my shares. Concentration on the factor portfolio.

August - September 24:

Renewed build-up of Bitcoin with the aim of making Bitcoin a

a fixed component of the portfolio. Consideration is 5%-10%

of my portfolio.

The idea. Build up an initial position, then make regular

investments of €50 per week with the aim of growing to the target size

to grow to the target size. The rapid rise in October/November led me to

led me to leave it at €50 per week. And individual purchases in

larger tranches at an early stage with a portfolio size of 2.x%.

End of December 2024:

Position size of Bitcoin almost 5%.

I am not yet including Bitcoin in my gold/ETF quota. I'm still running it on the side.

I re-evaluated my factor weighting at the end of the year

and would like to fine-tune it a little. I will briefly present the result in the

following section.

In addition, I have decided to include a small

include a small proportion of real estate stocks. However, this will probably never

part of my strategy worth mentioning and contains - as of today - only

about 3% of my portfolio and only $O (+1,63%) ).

Overall breakdown of my portfolio:

As described above, I do not yet include Bitcoin in my overall strategy

part of my overall strategy so that rebalancing remains easier. This will

change when Bitcoin reaches its target size.

The rest is made up as follows:

ETFs:

$XDEM (-0,23%) 30.3% (MSCI World Momentum)

$XDEB (-0,16%) 10.1% (MSCI World Minimum Volatility)

$XDEV (-0,69%) 10.1% (MSCI World Value)

$ZPRV (+1,79%) 15% (MSCI USA Small Cap Value Weighted)

$ZPRX (-1,45%) 6.5% (MSCI Europe Small Cap Value Weighted)

$PEH (-0,06%) 4.5% (as a quality factor on emerging markets)

$5MVL (-0,04%) 4.5% (Edge MSCI EM Value)

$SPYX (-0,92%) 9% (MSCI EM Small Cap)

Gold

$EWG2 (+1,76%) 10% Gold ETC

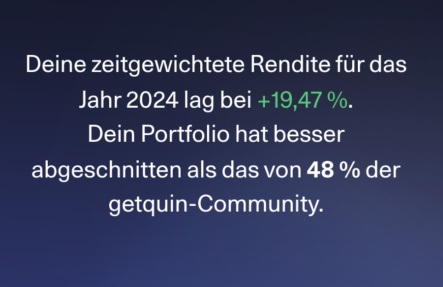

Getquin Rewind and own data:

At the end of the post you will find my Getquin Rewind, as I was not able to embed the image in the text:

However, according to my own calculations, this cannot be correct.

My portfolio volume at the start of the year was around €103,500 with a return of €16,693. This would correspond to a total return of 19.2%. However, we are not yet talking about a time-weighted return, as my invested capital has roughly doubled over the course of the year. I therefore estimate my TTWROR to be higher.

My own thoughts and outlook:

I do not expect any major changes in strategy over the next few years. At some point, a strategy will have to be established. If necessary, I will make some adjustments to this strategy.

This includes the fact that I am dissatisfied with the costs of the emerging markets factor ETFs. So far, however, I intend to live with it. Should I

stumble across better products, I will consider switching. Especially as long as I stay within the tax allowance when switching.

I'll also have to decide how big my Bitcoin holding should ultimately be.

If you've been reading carefully, you'll notice that a lot of money has accumulated in the last year. Big profits, big investments. Due to personal circumstances, I will not maintain these rates in the same style, but will reduce them somewhat. I expect to be able to continue investing around 1.5-2k per month. This means that my financial goals are

with an expected return of 5% adjusted for inflation over many years.

I am half hoping for major setbacks in the near future and the associated favorable entries. However, in view of the impact that minor price jolts have had on society as a whole (thanks to populism), I don't really wish for them.

Do you have any suggestions, questions or comments? Is there anything that particularly interests you?

I am also happy to receive suggestions for improvement for future posts.

Best regards,

Your Smurf

PS: @DonkeyInvestor and me, that's love ❤. And now send me your coins! (So I can reward your next post appropriately).

PPS: I hope someone is interested.

Hi guys! Any thoughts on my portfolio? I started investing on march 2024, starting from 100€ and 0 knowledge. I’ve done many mistakes and already sold some positions (every time with profit, even if only 10€ profit). I’m still a noob and keep studying every day so please be kind 🤣

As you can see I also have some single stocks, these are just fun money and I’m using them just for buy and sell and make profit. I’m reinvesting on ETFs all the profits I make from stocks.

Basically I’m going to build my portfolio this way:

50% $VWCE (+0,47%) (this one will always be the core)

10% $WGLD (+2,18%)

10% $ZPRV (+1,79%)

5%/10% fun money (single stocks and a just a lil bit of cripto)

Aside from this portfolio I also have 10k on $XEON (-0,02%) (this is basically my “emergency funds”, since I don’t like/know a lot single bonds and etf bonds).

Thank you in advance!

Hi there🙂↕️

I’m a relative beginner, I invested for two years or so, monthly and long term, in only 2 assets which are $VWCE and $ZPRV (+1,79%) , to have a world one and a small caps.

i’m 31 yo, employed. 30k portfolio. Am I missing something?

thank you for your tip.

I migliori creatori della settimana