Hello getquin community, welcome to the year 2026! 🚀

To kick off the year, I'm giving you an insight into what I consider to be the optimal growth portfolio: the "Global Quality Compounder 15" (as of 01.01.2026).

The strategy behind this portfolio should be simple, but also effective: I focus exclusively on the absolute market leaders with insurmountable economic moats ("moats"). These are companies that are benefiting from the advancing digitalization and the deep integration of AI into the economy. No experiments, no unprofitable hopes - just pure pure operational excellence right now,

pricing power and massive free cash flow.

Here is the current line-up and my analysis.

👇👇👇

The portfolio "Global Quality Compounder 15" (as at January 2026) is a top-class selection of companies that impress with their enormous pricing power, high margins and deep-rooted competitive advantages ("moats"). The focus is clearly on scalability and technological advantage. I currently have some of these stocks in my real portfolio. I will add the missing ones in periods of weakness.

Here is an analysis of the investment theses for each of the 15 stocks:

1. the cloud & advertising giants

Amazon $AMZN (-0,22%)

The thesis is based on the operational leverage. While the trading business provides the foundation, AWS drives profitability. In 2026, we see a re-acceleration of AWS through AI workloads. However, the real "hidden champion" is the advertising business: Amazon uses its first-party data so efficiently that advertising margins are expanding massively and diversifying cash flow. Mass introduction of robots in the AMZN warehouses should raise cash flows to new levels. My favorite now!

Microsoft $MSFT (-0,35%)

Microsoft remains the safest haven in the software sector. With Azure as the operating system of the cloud and Office 365 as an indispensable work tool, the company has the most stable subscription market in the world. 2026 will be dominated by the monetization of Copilot and AI integrations, which will further increase user loyalty. The upcoming IPO of OpenAI will massively increase the MS stake (profits) on a one-off basis. MS holds 27% of OpenAI (!)

Meta Platforms $META (-0,36%)

Despite the investments in the metaverse, the core business (Instagram/WhatsApp/Facebook) remains a money-printing machine. The investment thesis is based on the PEG ratio (Price/Earnings-to-Growth): Meta often offers the strongest growth per dollar of profit paid compared to other tech giants, supported by AI-powered advertising algorithms that maximize ROI for advertisers.

Alphabet $GOOG (-0,14%)

Alphabet is the ultimate cash machine. Despite regulatory pressure and AI competition (such as Perplexity or ChatGPT), search remains the gateway to the internet. With a moderate P/E ratio of around 30 (as of 2026), Alphabet offers downside protection, while YouTube and Google Cloud are driving up growth. Gemini 3 Pro is an Open AI scare. Have you ever tried the Deep Search mode in Gemini?

It's incredibly good. The upcoming IPO of SpaceX will massively increase the $GOOG (-0,14%) (profits) will increase massively on a one-off basis.

2. the financial market toll stations

Mastercard $MA (+0,32%)

& Visa $V (+0,14%)

Both companies form a global duopoly. They participate in every percentage point of inflation and the structural trend away from cash. Mastercard is favored here because it invests more aggressively in new tech layers (cybersecurity, data analysis), while Visa has the most massive basic infrastructure.

Moody's $MCO (-0,2%)

& S&P Global $SPGI (-0,1%)

These two firms act as regulatory tollbooths. No large company can raise debt on the capital market without a rating. As global debt levels tend to rise and the complexity of the markets increases, they benefit from stable, high-margin fees.

MSCI $MSCI (-0,02%)

MSCI is the "shovel salesman" for the asset management industry. As more and more capital flows into ETFs and index-based products, almost every fund manager has to pay fees to use the MSCI indices. The model is extremely crisis-proof, as the data subscriptions run even in bear markets.

3. the technological basis (semiconductors & software)

Broadcom $AVGO (-0,49%)

Broadcom is the perfect mix of hardware cyclicality and software stability. By integrating VMware, Hock Tan (CEO) has transformed the company into a cash flow giant. They provide the essential chips for AI networks while benefiting from highly profitable software subscriptions.

Netflix $NFLX (+0,06%)

Netflix has won the "streaming war". While the competition is still struggling with profitability, Netflix is scaling its margins through advertising subscriptions and price increases. The thesis: unchallenged economies of scale in content spend per subscriber.

ASML $ASML (-0,26%)

There is no progress in chips without ASML. As a monopolist for EUV lithography (extreme ultraviolet) lithography, ASML is the bottleneck of the entire semiconductor industry. Anyone who wants to produce chips below 2nm in 2026 will not be able to avoid the high-NA machines from Veldhoven.

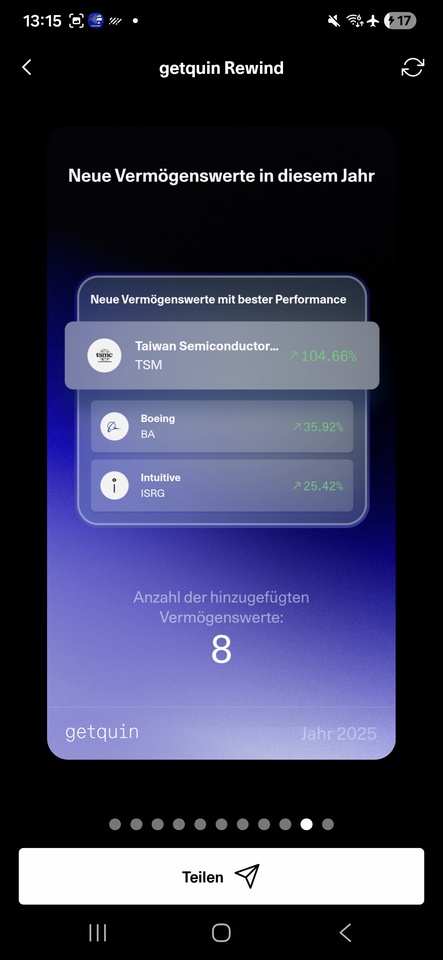

TSMC $TSM (-0,8%)

TSMC is the operational backbone. Almost all companies in this portfolio (Apple, Nvidia, Broadcom) have their components $TSM (-0,8%) manufacture. The 3% weighting is due to geopolitical risks (Taiwan), but fundamentally TSMC remains unrivaled in terms of manufacturing efficiency.

ServiceNow $NOW (+0,05%)

ServiceNow has become the standard for enterprise workflows workflows. It combines legacy IT systems with modern interfaces. In a world where companies need to digitize their processes to become AI-enabled, ServiceNow is the platform of choice.

Nvidia $NVDA (+0,09%)

Nvidia is the "engine". Although they are leading the AI revolution, the weighting of 2% compared to the 8% figures is more of a strategic satellite position due to the high valuation or the expected normalization of the hardware cycle by 2026.

Conclusion on the portfolio structure

This portfolio is extremely defensive in terms of market position ("quality"), but offensive in terms of technological growth. It is betting that the world will be even more dependent on digital payments, cloud infrastructure and semiconductors in 2026 than it is today.

⚖️ Opportunities & risks Analysis of the overall strategy

This portfolio is a bet on the stability of the global digital infrastructure. It is "high quality", but not without risks.

The opportunities (Why this portfolio should outperform over the long term):

- Unchallenged pricing power: Whether inflation is high or low, companies like Visa, Microsoft or Moody's can raise their prices without losing customers. Their services are "must-haves", not "nice-to-haves".

- The AI supercycle (monetization): In 2026, we are beyond the hype. These companies (Broadcom, ServiceNow, the cloud giants) are the ones actually turning AI into profitable applications and providing the necessary infrastructure.

- Cash flow machines: The combined free cash flow yield of this portfolio is enormous. This enables massive share buyback programs and rising dividends, which supports the share price even in volatile market phases.

- Economies of scale: The digital business models ($META (-0,36%) , $NFLX (+0,06%), $GOOG (-0,14%)) scale almost without marginal costs. Every additional dollar of revenue is almost pure profit.

The risks

- Valuation risk (multiple compression): Quality has its price. These shares will not be "cheap" in 2026 either (high P/E ratio). If growth disappoints even slightly, share prices can fall disproportionately, even if the companies are still operationally healthy.

- Regulatory headwinds: The dominance of these "oligopolies" is a thorn in the side of governments worldwide. Antitrust proceedings against Google, Amazon or the Visa/Mastercard duopoly remain a constant threat.

- The geopolitical cluster risk (Taiwan): With $ASML (-0,26%), $AVGO (-0,49%), $NVDA (+0,09%) and $TSM (-0,8%) over 20% of the portfolio is directly or indirectly dependent on the stability of the semiconductor supply chain in Taiwan. A conflict there would be devastating for this portfolio.

- Concentration risk: With only 15 stocks, diversification is low. An accounting scandal or an operational disaster at one of the top stocks (which are weighted at 8%) would severely drag down the overall performance.

Nevertheless, I believe in this portfolio, even with the knowledge that some stocks are currently highly valued. Just collect them like postcards during weak phases and hold them. Don't trade ;-)

What do you think? I'm really interested in your opinion - and criticism too.