February was a challenging and volatile month.

A strong start to the year was followed by a significant sector-rotationtriggered by risk-off-flowsa reassessment of growth stocks and the need to consistently address operational weaknesses in the portfolio.

Despite the volatility, it was a month of strategic realignment:

📊 Monthly performance: -3,15%

📊 Portfolio value: ~39.144 €

📊 Performance max: +27,58%

📊 Performance YTD: -1,32%

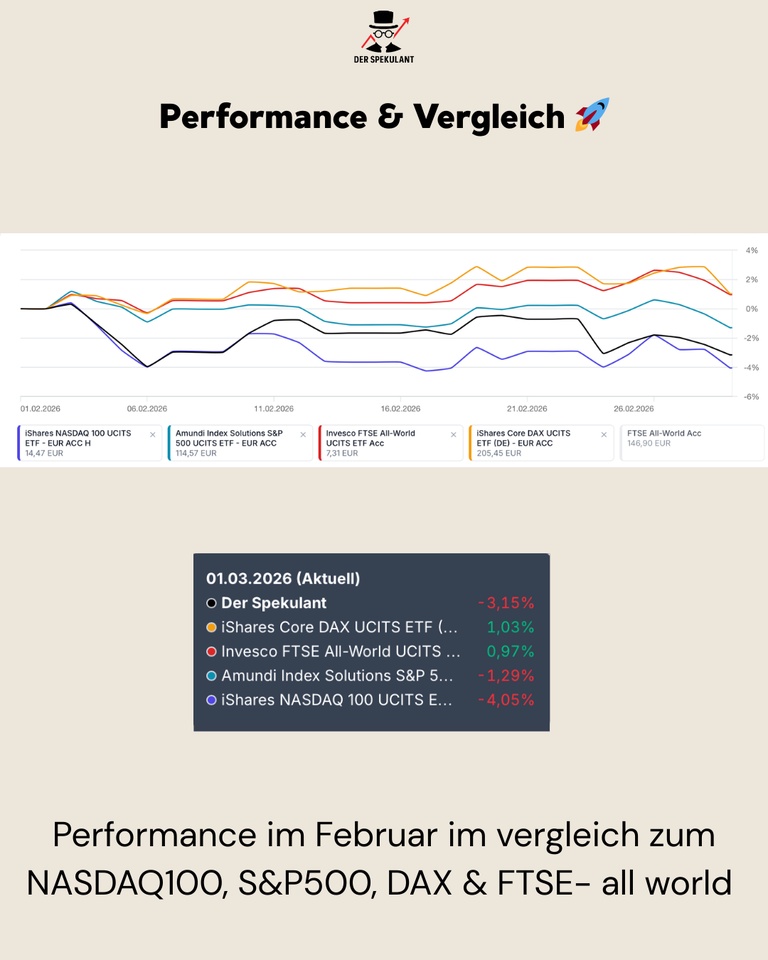

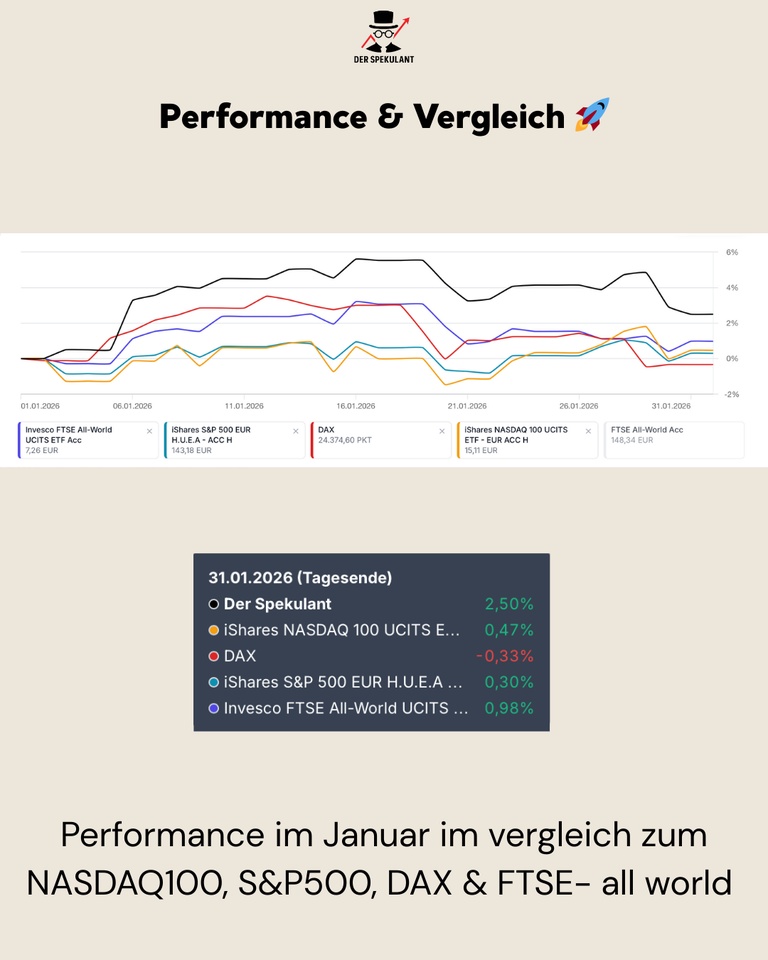

Performance & comparison 🚀

February was characterized by a clear sector rotation:

Software & high-beta tech corrected under pressure, while selected hardware stocks and broadly diversified value stocks showed relative stability.

Performance in comparison (01.02-28.02.2026):

My portfolio: -3,48%

NASDAQ 100: -4,05%

S&P 500: -1,29%

DAX: +1,03%

FTSE All-World: +0,97%

👉 The relative underperformance is due to the high growth exposure, although the portfolio just managed to outperform the NASDAQ 100, which was under heavy pressure.

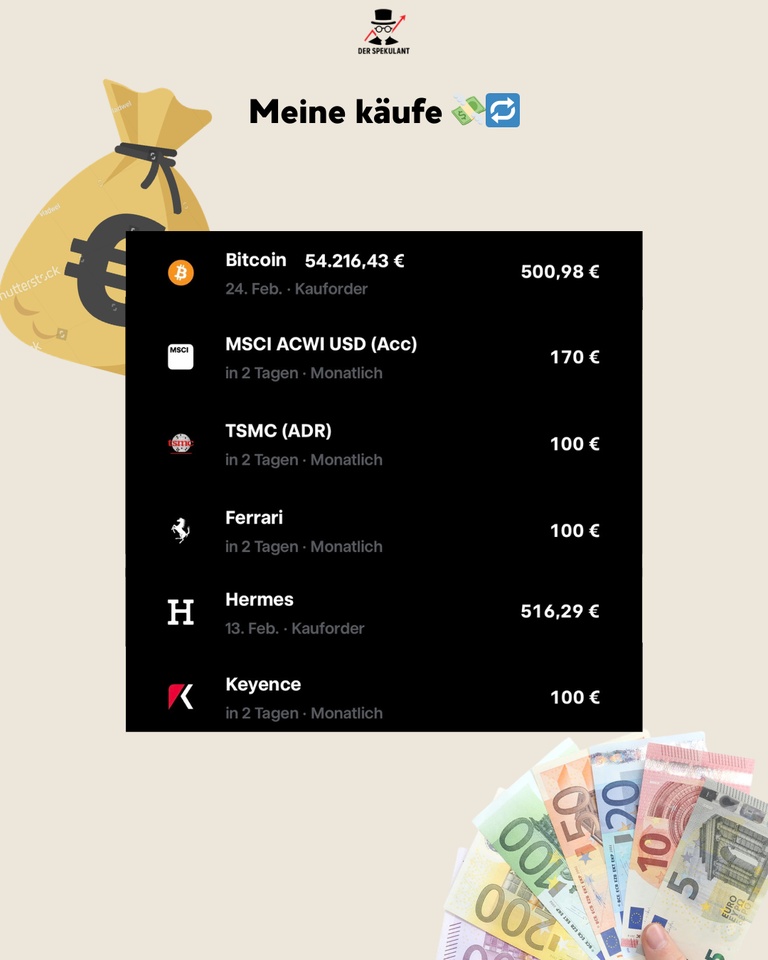

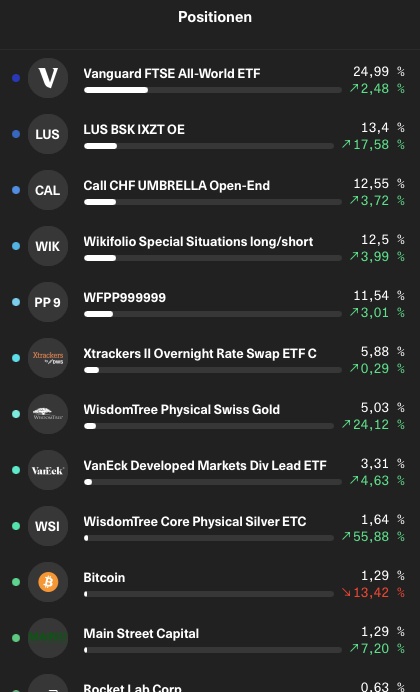

Purchases, sales & allocation 💶

The focus in February was clearly on portfolio streamlining and strategic shift:

Acquisitions 💰

Hermes ($RMS (+1,29 %)) targeted expansion in the quality segment. TSMC ($2330) tactical entry due to the observed shift on the stock market from software to hardware. Bitcoin ($BTC (+2,44 %)) - purchase of € 500 from the Euro Overnight Rate Swap ETF ($XEON (+0 %)) at € 54,216 to lower the average price to € 63,000.

Sales ❌

Complete separation of Tomra Systems ($TOM (-1,67 %)) and Novo Nordisk ($NOVO B (+2,75 %)), as the companies have been operationally disappointing in recent quarters and there were no clear signs of a turnaround from management.

👉 The cash ratio is currently being used dynamically for opportunities through targeted acquisitions.

Top movers in February 🟢

Despite the market environment, February was driven by quality stocks and successful rebounds.

The strongest performer was Keyence ($6861 (-2,18 %)), which showed massive relative strength with +16.21%. Another strong performer was Ferrari ($RACE (-1,46 %)) was also strong with +13.45%, followed by Berkshire Hathaway ($BRK.B (-0,56 %)), which acted as a stable anchor with +6.22%.

The iShares MSCI World Small Cap ($WSML (+0,04 %)) gained +3.61%, while the iShares MSCI ACWI ($ACWI) formed a solid base with +0.70%. The Xtrackers II EUR Overnight Rate ($XEON (+0 %)) rounded off the picture with +0.15% and served as a source for the Bitcoin investment.

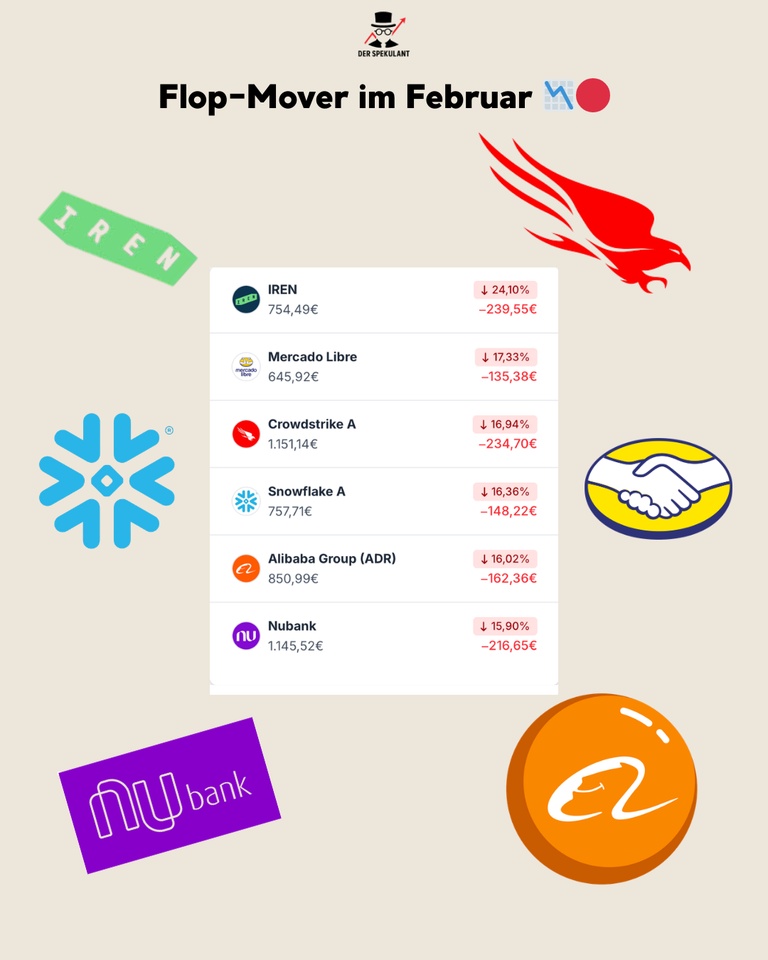

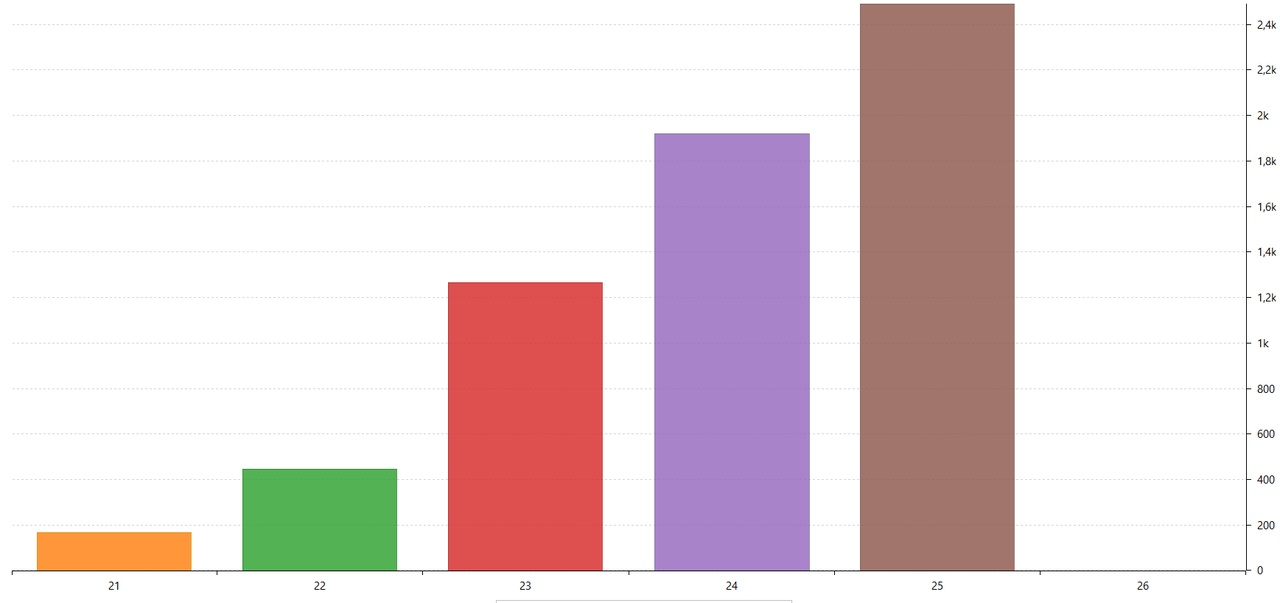

Flop movers in February 🔴

The weaker side of the portfolio was clearly to be found in the growth and crypto segment.

IREN ($IREN (+4,14 %)) corrected by -24.10% after the strong previous month. Also Mercado Libre ($MELI (-1,34 %)) also came under significant pressure at -17.33%. CrowdStrike ($CRWD (+0,74 %)) -16.94% and Snowflake ($SNOW (+0,9 %)) -16.36% suffered from the general shift in sentiment in the software sector.

Also Alibaba ($BABA (+1,78 %)) also gave back the gains of the previous month with -16.02%. Nubank ($NU (-0,55 %)) rounded off the list of losers with -15.90% due to the poor sentiment among payment providers.

👉 Important: These are primarily valuation and sentiment moves, not fundamental breaks - nevertheless, the lack of operational momentum made it necessary to sell positions.

Conclusion 💡

February was not an easy month, but a necessary for rebalancing:

➡️ Strategic separation of stocks without operational momentum

➡️ Focus shiftFrom software/high growth to hardware (TSMC) and focus on quality (Hermes)

➡️ Volatility deliberately used to lower the average Bitcoin price

The environment remains challenging:

Interest rates, Fed expectations and the rotation into hardware stocks will continue to shape the markets in March. The focus remains on quality, operational excellence and liquidity.

❓ Question for the community

Which stock surprised you the most in February - positively or negatively?

👇 Write it in the comments!