January was a challenging but generally constructive month.

A strong start to the year was followed by a significant tech correction in the middle of the month, triggered by risk-off flows, interest rate sensitivity and caution after the first US earnings.

Despite this volatility, I closed the month clearly in the plus the month:

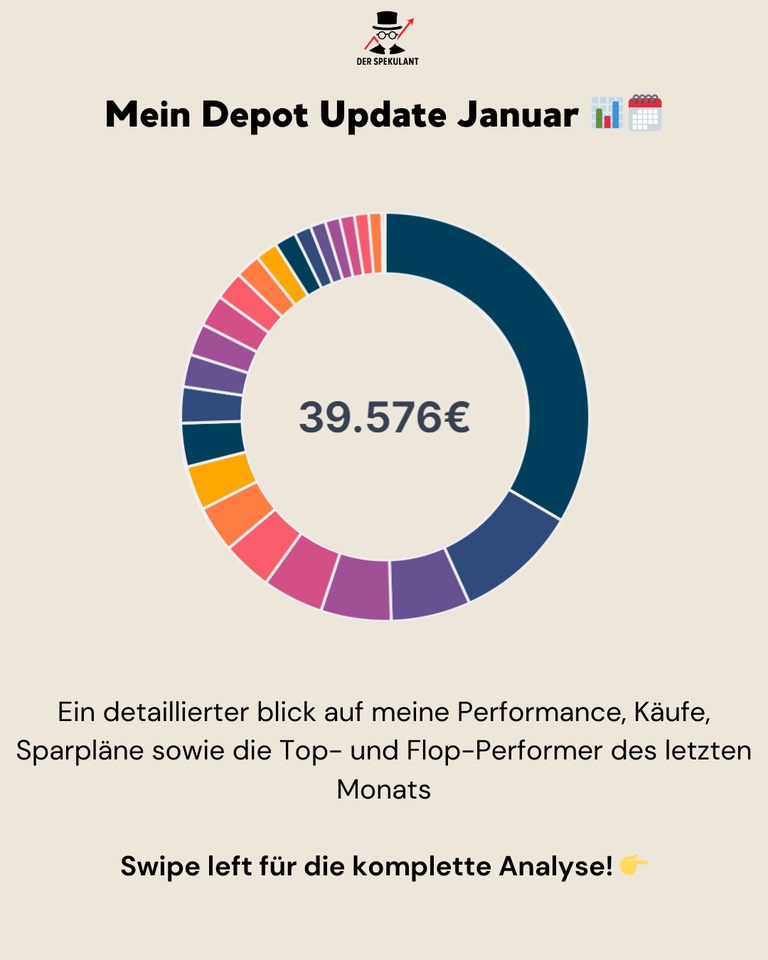

👉 Monthly performance: +2.5 %

👉 Portfolio value: € 39,576

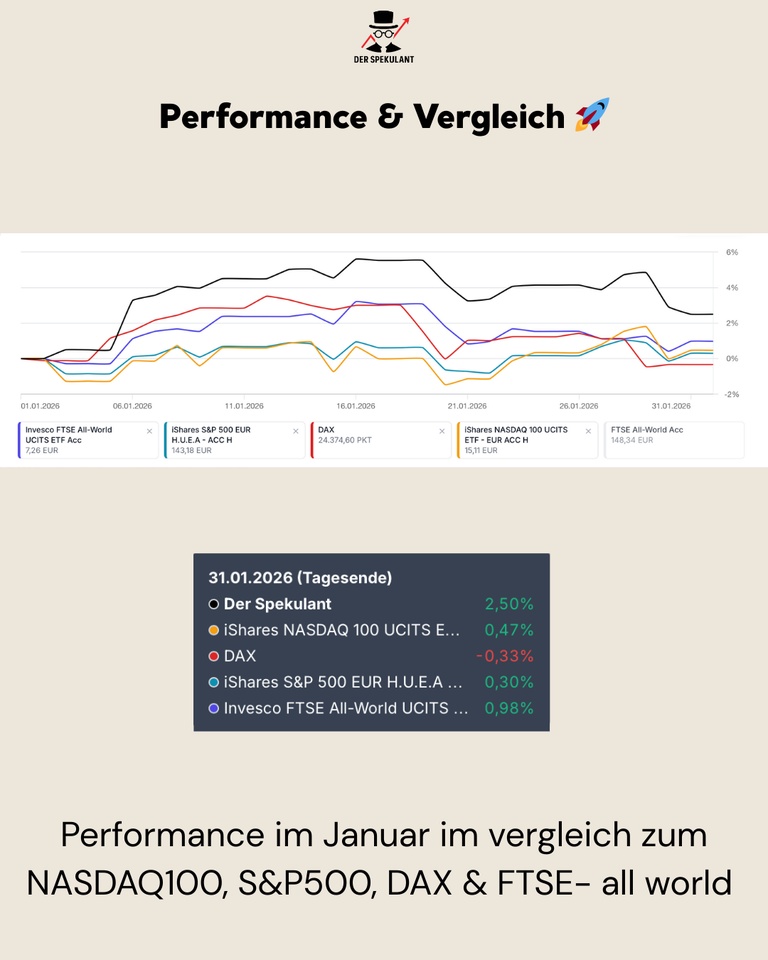

1st performance & comparison 🚀

January was characterized by sectoral rotation:

Software & high-beta corrected significantly, while selected cyclicals, commodities and special situations remained stable.

Performance in comparison (31.01.2026):

- My securities account:

+2,50 %

- NASDAQ 100: +0.47 %

- S&P 500: +0.30 %

- DAX: -0.33 %

- FTSE All-World: +0.98 %

👉 The outperformance is not the result not from broad tech exposurebut from targeted themes, anti-cyclical positions and active allocation.

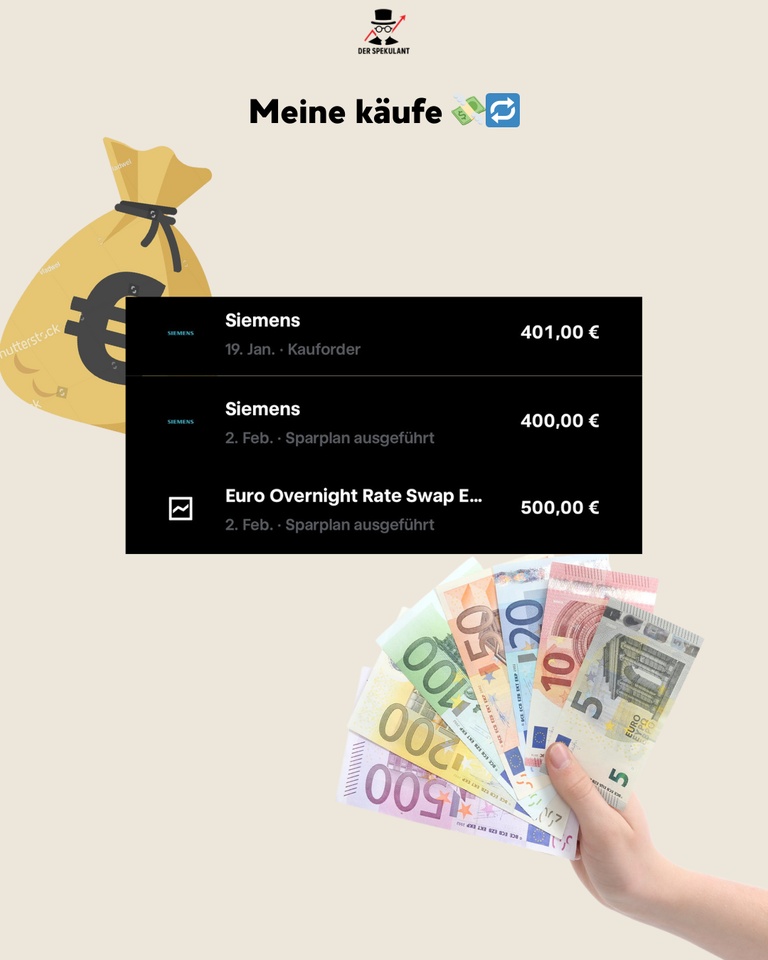

2. purchases, sales & allocation 💶

The focus in January was clearly on Risk management and cash management:

Acquisitions: Siemens ($SIE (+2 %)) (twice) - Partial reinvestment of realized gains. Euro Overnight Rate Swap ETF ($XEON (+0,02 %))- targeted liquidity build-up

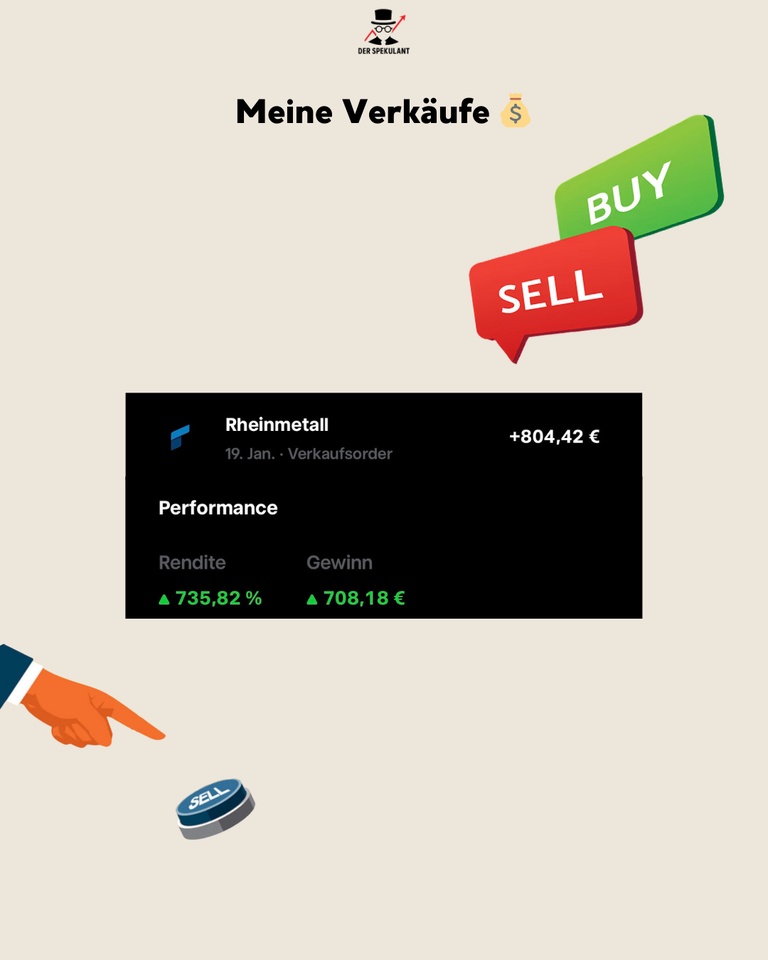

Sales: Partial sale Rheinmetall ($RHM (-2,2 %))after an extreme run (+735% since entry)

👉 Currently Cash / cash equivalents at ~4 % of the portfolio - deliberately increased in an environment of increasing uncertainty.

3rd top mover in January 🟢

January was clearly dominated by special situations and cyclical themes carried.

The strongest performer was IREN m($IREN (-1,43 %)), which rose by +40,8 % benefited massively from the recovery in the mining sector. Another strong performer was the VanEck Uranium & Nuclear ETF ($NUKL (+1,41 %))with +21,7 %driven by structural demand, supply shortages and geopolitical reassessment.

American Lithium placed +19,1 % and showed a technical countermovement after months of weakness. Alibaba ($BABA (-0,77 %)) was convincing with +15,9 %supported by valuation levels, margin stabilization and the first signs of regulatory easing.

Also Novo Nordisk ($NOVO B (-2,16 %)) (+15,4 %) also benefited from sustained demand in the GLP-1 segment, while Rheinmetall despite a partial sale again +14,1 % and confirmed its role as a structural profiteer.

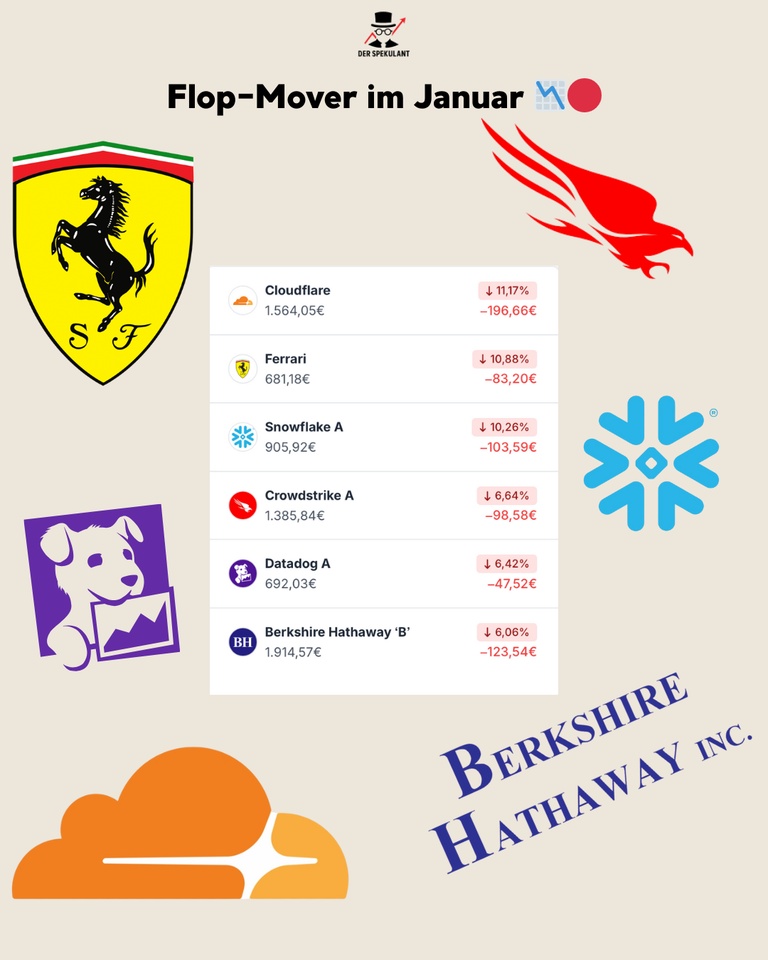

4th flop mover in January 🔴

The weaker side of the portfolio was clearly in the high-multiple-tech segment segment.

Cloudflare ($NET (+3,8 %)) lost -11,2 % in the wake of a massive revaluation of AI and infrastructure software. Ferrari ($RACE (+0,62 %)) (-10,9 %) and Snowflake ($SNOW (+3,46 %)) (-10,3 %) suffered from profit-taking and higher expectations after strong previous quarters.

Also CrowdStrike ($CRWD (+3,16 %)) (-6,6 %) and Datadog ($DDOG (+5,06 %)) (-6,4 %) were under pressure, although there was little change in operational quality. Berkshire Hathaway ($BRK.B (-0,44 %)) rounded off the list of losers with -6,1 % burdened by interest rate and insurance discussions.

👉 Important: These are primarily valuation and sentiment moves. valuation and sentiment movesnot fundamental breaks.

5. conclusion 💡

January was not an easy month, but a good start to the year:

- Outperformance against all relevant indices

- Profits realized, cash increased

- Volatility consciously accepted instead of blindly smoothed out

The environment remains challenging:

Interest rates, Fed expectations, political uncertainties and earnings will continue to shape the markets in February.

The focus therefore remains clearly on quality, liquidity and selective opportunities.

❓ Question for the community

Which stock surprised you the most in January - positively or negatively?

👇 Write it in the comments!