First of all:

Thank you for the warm welcome to the getquin community!

Unfortunately, I did not read the HowTo:Portfolio feedback on GetQuin from @DonkeyInvestor

for a detailed presentation only later and this time I'm trying to write in more detail than the first time and to substantiate the decisions I made in order to possibly receive even more precise feedback from the community. 💛

My personal goal is to become completely debt-free and at the same time start steadily building up assets 📈to improve my private pension provision in 2026. I am expressly prepared to take a higher risk in the first year of my investment and am therefore trying out almost everything.

This year, I would like to operate according to the conscious principle of "set and forget" and consciously review my strategy at the end of 2026 between the holidays and adjust it if necessary.

Instead of "keep it simple", it's more likely to be "overenginerring."

I see your numerous tips as the reason for this, for which I would like to thank you again at

@Epi

@Gehebeltes-EFH

@Stullen-Portfolio

@Metis

@Wealth-Accelerator

@Multibagger

@Sunrise-Mantis

@EisenEnte

@PositivePossum

@schlimmschlimm

@Brazzo_Muc and @GoDividend

and my general motto in life:

"Anyone can do simple!"

I think at this point in time, investing with "putting everything into the AllWorld ETF" would only be half as much fun for me and would rather bore me. Everything is still so new and unknown. 🤯

I'll then see whether the different investments were generally a good thumbs 👍🏻 or a very bad thumbs down 👎🏻Idee.

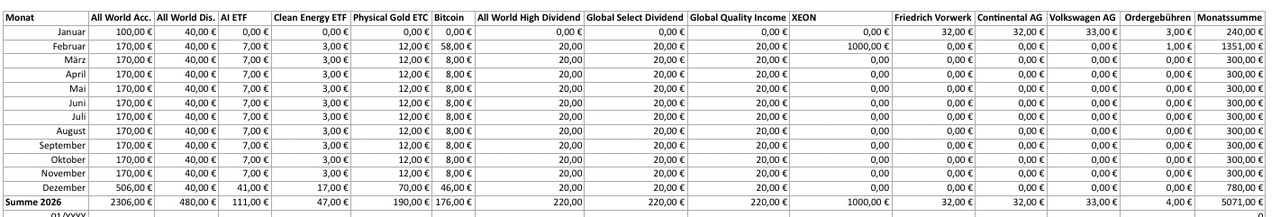

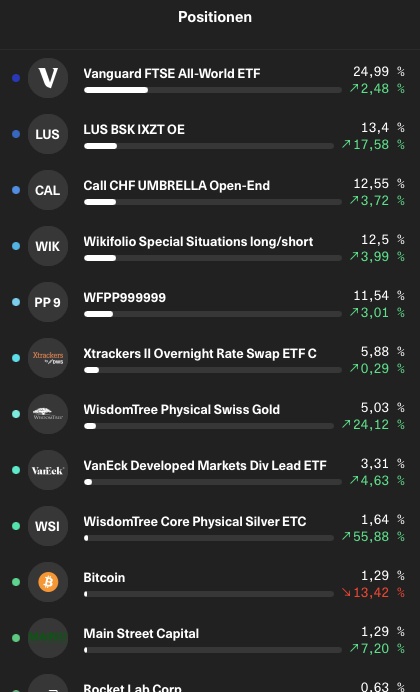

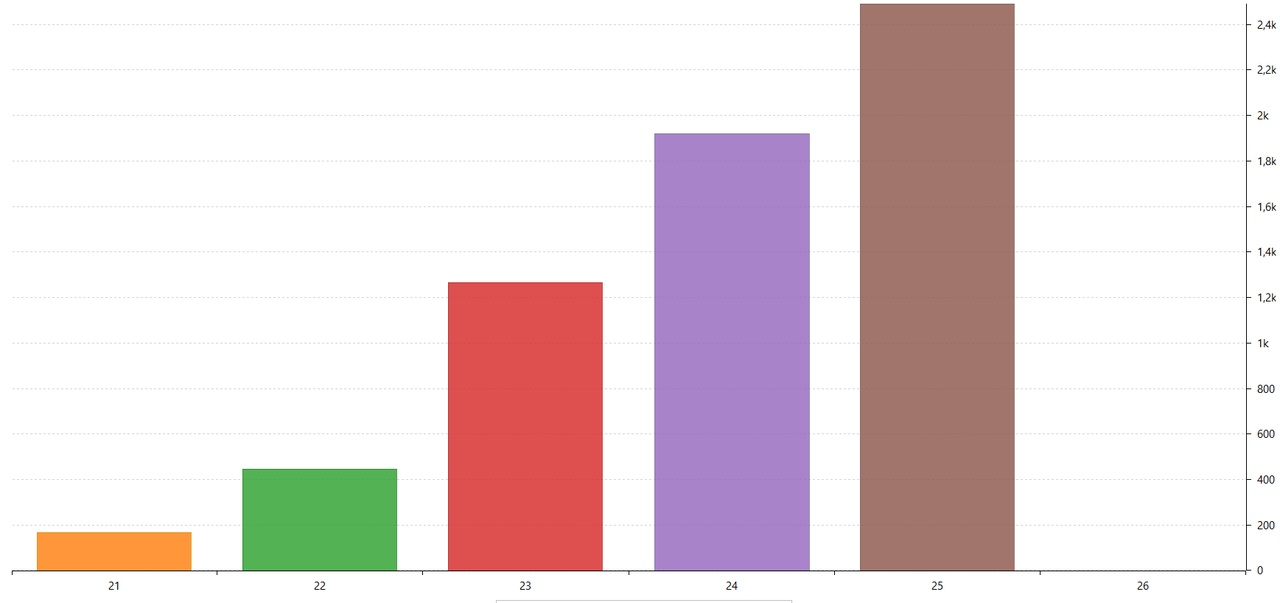

The sum of € 5,071.00 that I have already firmly capped and gradually planned to invest in this first year 2026 has already been completely written off in my mind as play money.

For the necessary diversification (ETF, ETC, individual shares and crypto) in my portfolio, I have taken further INCENTIVES and have switched from the initial €100 per month savings plan to an accumulating AllWorld ETF and have set up an additional savings plan of €40 per month on the same AllWorld ETF in distributing form in mid-January 2026.

In the meantime, I came up with the idea at the end of January 2026 and added the two existing savings plans $VWCE (+0,09 %) and $VWGL additional savings plans ($AIQG (+0,65 %)

$RENW (+0,63 %)

$IGLN (+0,27 %)

$BTC (+0,45 %)

$VHYL (+0,1 %)

$ISPA (+0,45 %)

$FGEU (+0,2 %) to a total of 9 savings plans with a monthly sum of €300.

Unfortunately, it was already too late to execute the savings plans by direct debit at Trade Republic at the beginning of 02/2026. Therefore, they will now only be executed in the middle of this month.

Yesterday I spontaneously decided to place a €50 single order in bitcoin. I just let myself be carried away by the postings. 🤑

The planned unscheduled repayment (€500 per month) for my car loan has now worked well for two months and will be prioritized in order to actually become debt-free more quickly.

The specific amounts and items invested to date and in the future can be seen in this Excel table.

Regarding the 6 suggestions from you @Epi (Yes, you'll get the promised feedback here), I've given the following thoughts in detail, from which my plan is then based.

Deka funds:

The two savings plans of €50 per month each were already suspended by me and were actively used to service the first savings plan of €100 per month.

In addition, I am now liquidating the two sub-custody accounts belonging to the savings plans one by one and selling €100 per month in order to achieve the best possible average value in the sale.

The €100 is then immediately reallocated in the form of five savings plans per month and reinvested as follows:

Core: 65%

Satellites: 35%

of which:

Clean Energy 10%

AI: 10%

Bitcoin: 10%

ETC Gold: 5%

VWL:

I will keep the monthly €40 VWL on the third sub-deposit with Deka until I develop the motivation to inform my employer of another contract. At the moment I have no need to be in contact with the HR department any more than necessary.

Nevertheless, I have set up an additional savings plan of €40 per month for the All World ETF distributing from February 2026.

I'm keeping the three individual shares plus the Xiaomi bonus share in my portfolio to develop a feel for shares.

No further individual stocks are currently planned. This fits quite well in this respect, as I have to hold the bonus share for a year before it can be sold.

Bonus savings contract:

The premium savings contract with a term of 99 years under the "old law" has an annual investment of €150 per month at €12.50 with a guaranteed premium of 50% plus interest and compound interest. After checking the terms and conditions of the contract, switching to 0 would result in an immediate loss of the premium. For this reason, I have decided to keep the contract.

Saving & winning without savings:

Just as I was about to decide whether to cancel the savings tickets, one of the tickets won €1,000 in January 2026. For this reason, I decided to keep my 10 tickets after all.

A key point of my savings lottery tickets is that I get €480 of the €600 back at the end of the year.

These will also be distributed by me to the 5 selected savings plans in December in the same weighting as for the reallocation from the Deka Depot.

The profit from the savings lots in the amount of €1,000 goes to$XEON (+0 %) for "max. interest".

Nest egg:

My real nest egg, on the other hand, I keep completely in the call money account so that it is always immediately available to me.

To give me a feel for dividends, I've also picked out three dividend ETFs that I invest €20 a month in.

In combination, these three ETFs ensure that I receive a planned dividend every month. That sounds like a lot of dopamine, at least in theory, so I really like it.

What will actually still be there in 01/2027 from the €5,071 invested is already a 100% profit for me, because after I fell for the game "WOS" 🥶(who knows it?) almost a year ago and blew around 5k on digital crap in 3 months and above all to improve my stove 🔥🪵, this is clearly the better alternative to spend my money on dopamine boosts and pass the time. And being part of a community online at the same time. What more could you want?

So, I'm already looking forward to your feedback. Be honest, I can take it! 🤞🏻

VG

QW3RTY

PS: I could not share my portfolio. The function was grayed out.