Hello everyone,

I have been following this forum for some time now and have decided to present my experiments and current strategies.

On the one hand, because I want to avoid losing track of things, and on the other hand, to prepare my thoughts for myself and also to get other perspectives and opinions.

Briefly about myself

I am 22 years old and graduated last year with a Bachelor of Engineering in Energy Technology.

I am currently working in a medium-sized company in the energy industry in Germany.

I have been rather frugal with money since I was a child. As I got older, my interest in increasing money wisely grew.

I was also lucky that my uncle opened a junior custody account for me when I was born. As a result, at the age of 18 I already had a small starting portfolio worth around 3,000 euros.

At the beginning, I focused intensively on precious metals and also invested in them. I don't plan to touch these holdings in the long term. If I don't need them, I see them more as a legacy for the next generation. I will buy more from time to time.

Basic start

As a first step, and I am aware that this will be assessed differently, I have taken out a unit-linked pension plan with the savings bank, which I save 150 euros per month.

I also took out a building society savings plan, as I basically want to buy my own home in the long term. I am currently renting.

The building society saver is also 150 euros per month per month.

At the same time, I have been working with neobrokers, from which my current portfolio has gradually developed.

Yes, there are still quite a few stocks in it at the moment. I will probably clean that up in the long term.

1st approach, accumulating ETFs

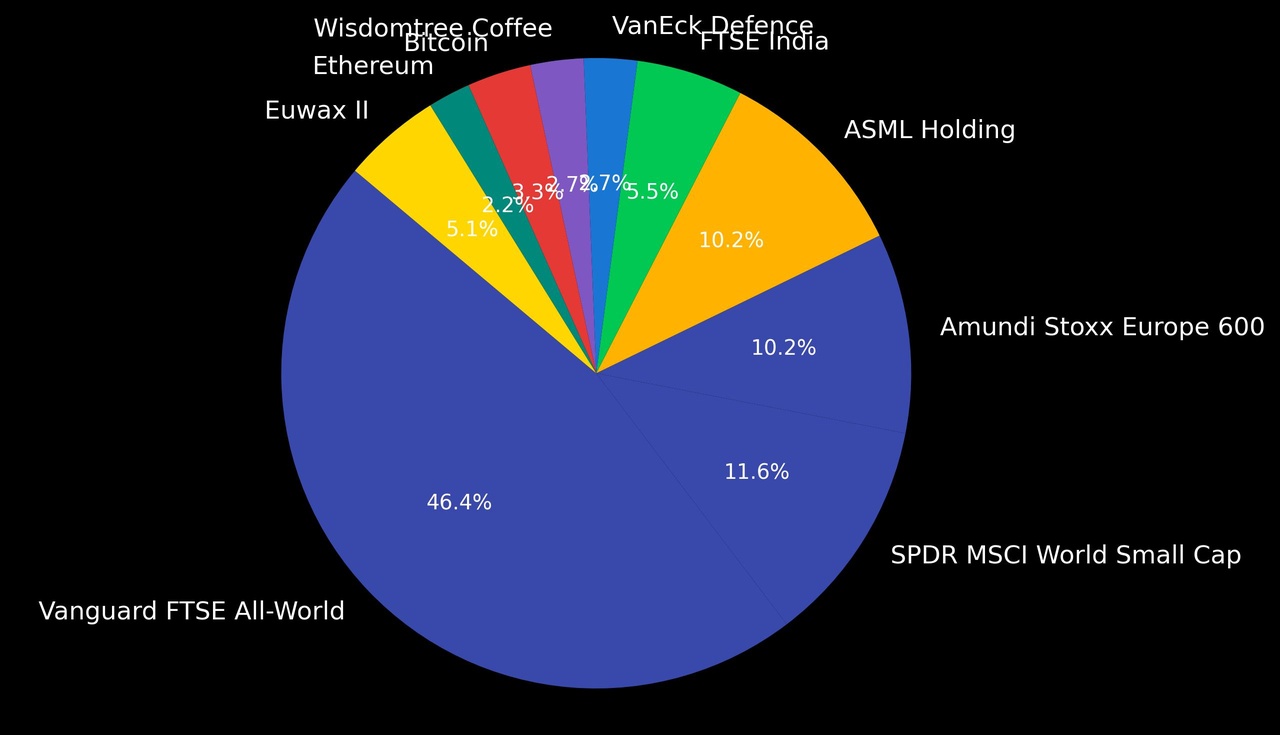

My first approach was to invest in classic accumulating ETFs.

Smaller side bets were added later.

I also bought my first individual shares to gain experience. Among other things, I had success with $RHM (+1.15%) . At the same time, I learned how quickly losses can occur if you are not sufficiently diversified, for example with $ABR (+0%) ,$1SXP (+0.13%) and other stocks.

This ultimately led me to my second approach.

2nd approach, dividend strategy

As I already have a pension plan through LBS and don't want to be the richest man in the cemetery, I focused more on a dividend strategy.

The first attempt consisted of the following combination

The idea came from a business magazine and was aimed at making monthly distributions as even as possible. I also added $QYLE (-0.01%) to gain initial experience with option strategies.

However, as this combination is only diversified to a limited extent and I deliberately wanted to move away from the USA, I adapted my strategy further.

Current strategy

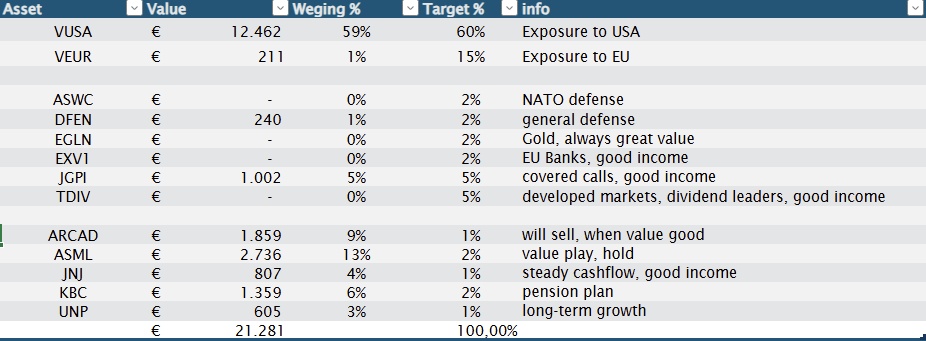

Fixed savings rates

- LBS, retirement provision, 150 euros per month

- Building society, residual debt for future home ownership, 150 euros per month

Dividend strategy with 115.24 euros per month

Side bets with 81 euros per month

Trading 212 experiment with 100 euros per month

Here I am pursuing the goal of bundling individual shares in a common pot, partially saving them and automatically reinvesting distributions in order to benefit from the compound interest effect in the long term.

I welcome tips and constructive criticism so that I can continue to improve my strategy.

Best regards

Mister Kimo