The sensible use of saved capital in retirement requires good planning. Especially if you want money to flow out of it regularly to secure or sweeten the third stage of your life.

Financial brokers then like to offer pension insurance based on a single payment, often called an immediate annuity.

With a normal life expectancy, the return is usually not generous because insurers usually invest very conservatively. In addition, the costs and profit margins of the insurance company further reduce the return. Consumer advocates point out that you usually have to live to be 94 years or older before you receive the investment sum back via guaranteed pensions.

It is often more profitable to park the money in a call money account.

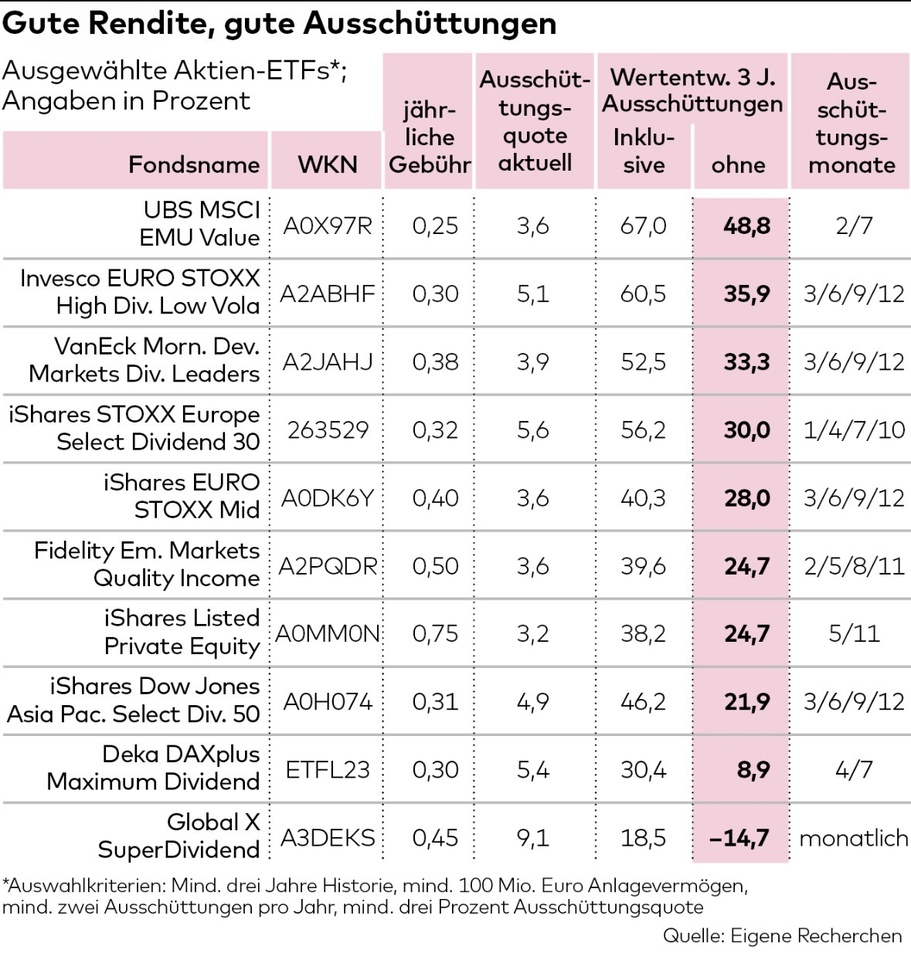

Investments with regular distributions are an alternative. Investors are spoiled for choice between several thousand dividend-paying equity funds.

What are the relevant selection criteria? Quality and cost structure.

For some, the level of distributions may also be an important criterion in the selection process. But caution is advised here: For example, the payout ratio of the Global X Super Dividend ETF $SDIP (-0.43%) is currently over nine percent. With an investment sum of 100,000 euros, this results in a monthly inflow of around 750 euros before tax.

This is possible because the ETF invests stubbornly in the 100 companies with the highest dividends worldwide, but without any consideration of the sustainability of these distributions and the quality of the companies.

This in turn means that, without the dividends, the ETF generated a return of zero over one year and even minus 14% over three years. Investors therefore received high regular payouts, but the investment capital decreased significantly at the same time.

Savers should therefore always pay attention to how the ETF invests. There are various positive counter-examples, such as the Invesco Euro Stoxx High Dividend Low Volatility ETF $EUHD (-0.65%). Although this also focuses on high-dividend companies, it also selects according to qualitative criteria. Result: Although the payout ratio is currently "only" 5.1% per year, this amounts to around EUR 425 per month before tax for an investment sum of EUR 100,000.

However, the ETF has also achieved growth of almost 36% over the past three years, and including distributions, the gain was even over 60%. There are similarly good ETFs for various other investment regions or sectors.

Bond ETFs, on the other hand, are rarely a real alternative for private investors. Although distribution rates of four or five percent can be achieved, this is ultimately only possible with high-risk bonds or US securities with a corresponding currency risk. In addition, a positive return can rarely be achieved over and above the distribution.

A (possibly riskier) alternative is to invest in individual shares with high dividends. However, quality is even more important here. "We value companies with a strong balance sheet that are characterized by a high equity ratio and above-average returns on capital and sales," says Franz Kaim from Kidron Vermögensverwaltung in Stuttgart.

Continuity is also important. "The so-called dividend aristocrats are the gold standard for income-oriented investors," says Rainer Laborenz, Managing Partner of Azemos Vermögensverwaltung in Offenburg. "Companies that have increased their dividends for at least 25 consecutive years are included in this select group."

There are currently around 150 dividend aristocrats worldwide, 117 of which are from the USA and 33 from the rest of the world. The best-known names include Coca-Cola $KO (+3.01%)Procter & Gamble $PG (+2.49%) and Johnson & Johnson $JNJ (+1.32%) from the USA, Fresenius from Germany $FRE (+0.54%) and Unilever $ULVR (+1.75%) from Great Britain.

Other attractive dividend stocks recommended in a WELT survey of ten leading asset managers in Germany include Allianz $ALV (-0.22%)BASF $BAS (-0.38%)Beiersdorf $BEI (+1.23%)Deutsche Post $DHL (+0.22%) and Munich Re $MUV2 (+0.29%).

In other European countries, they rely on BAT $BATS (+1.79%), BP $BP. (+0.74%), Nestlé $NESN (+0.21%), NN Group $NN (-0.06%)Shell $SHEL (+0.01%) and Swiss Life $SLHN (-0.89%).

In the USA, names such as Altria $MO (+4.73%), Chevron $CVX (+4.28%)Cisco $CSCO (+0.75%), Coca-Cola, Kimberly-Clark $KMB (+2.09%) , McDonald's $MCD (+0.89%) or Pepsi $PEP (+4.55%).

Source: Text (excerpt) & table: Welt, 05.12.25