Good morning everyone. What is your opinion on the subject of covered calls and the $XYLP (-0.34%) ? Buy or stay away

- Markets

- ETFs

- Other Global X S&P 500 Covered Call ETF

- Forum Discussion

Other Global X S&P 500 Covered Call ETF

Price

Discussion about XYLP

Posts

16New weekly update

New weekly update with another purchase.

#dividend

#dividends

#dividende

#etf

#etfs

$JEGP (+0.27%)

$JEPQ

$JEPI

$QYLE (-0.7%)

$SDIP (+0.57%)

$XYLP (-0.34%)

$JPM (-1.47%)

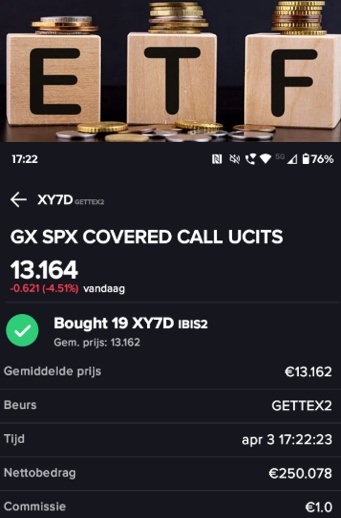

Bought !!!!

Bought another 19 shares of XY7D ( $XYLP (-0.34%) ) today.

This ETF can be found on #getquin under the ticker $XYLP (-0.34%) .

I currently own 106 shares, these shares give me +- €143 dividend per year.

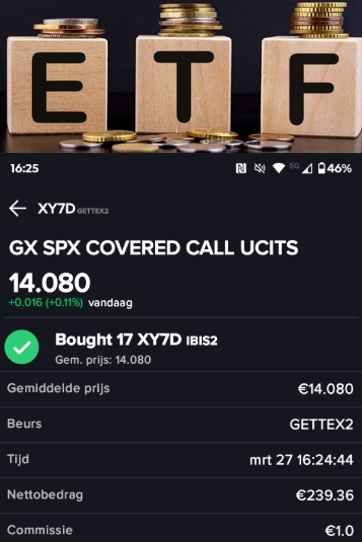

Bought another 17 shares of XY7D

Bought another 17 shares of XY7D ( $XYLP (-0.34%) ) today.

This ETF can be found on #getquin under the ticker $XYLP (-0.34%) .

I currently own 87 shares, these shares give me +- €117 dividend per year.

#dividends

#dividend

#growth

#investing

#investment

#finance

#getquin

Short Update of the past week

Short Update of the past week, we discuss the purchase / Discuss the price targets / dividends received

#dividends

#dividend

#invest

#investing

$XYLP (-0.34%)

$VUSA (-0.59%)

S&P500 Covered call Etf

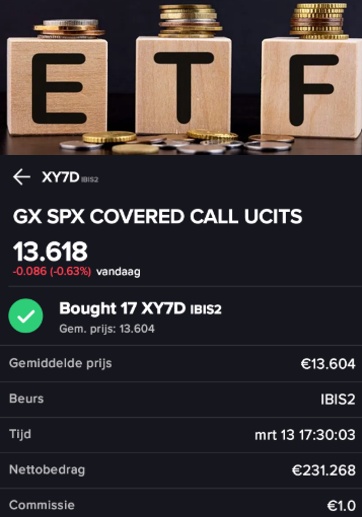

Bought another 17 shares of XY7D ( $XYLP (-0.34%) ) today.

This ETF can be found on #getquin under the ticker $XYLP (-0.34%)

I currently own 70 shares, these shares give me +- €86 dividend per year

New weekly update

New weekly update, in which I discuss last week's purchases

#investing

#stocks

#dividends

#dividend

XY7D

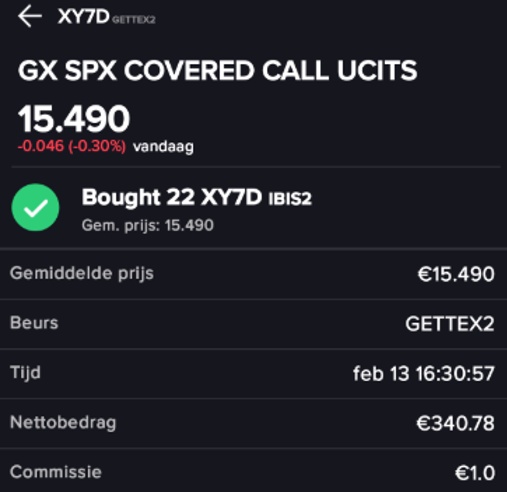

Bought another 22 shares of XY7D ( $XYLP (-0.34%) ) today.

This ETF can be found on Getquin under the ticker $XYLP (-0.34%) .

I currently own 53 shares, these shares give me +- € 60

dividend per year

Weekly Update Youtube

New weekly video with the purchase of the past week + price targets that I have set for myself.

$XYLP (-0.34%)

$MDLZ (+1.88%)

$PEP (+0.69%)

#INVESTMENTS

#DIVIDEND

#INVEST

#STOCKS

#AANDELEN

#StockMarket

#mondelez

#pepsico

Trending Securities

Top creators this week