A little later, but not too late, I'll also have my say at the end of the year, together with an insight into the goings-on of the Opi before @Tenbagger2024 , @SAUgut777 and some others get impatient, as you know, old people are a bit slower. I would also like to take this opportunity to thank and appreciate all those who contribute here on GQ with great analyses and strong contributions, critical comments and a wonderful exchange. I'm deliberately not naming any individuals now, otherwise I won't be able to finish. All of you together are great, whether you're a veteran or a newcomer. The community is alive and I am happy to be a part of it. Thanks also to @christian and the Getquin team, who make this possible by maintaining the platform, even if things sometimes don't run smoothly. The Bavarian says: Basst scho

The year 2025 was exciting and, from my point of view, successful in terms of my expectations. If you don't feel like evaluating a boring dividend strategy, don't want to read about overnight and fixed-term deposits, aren't interested in certificates and don't like the Sparkasse, you are welcome to leave here after Rewind 2025. Many thanks to everyone else for reading and, if necessary, commenting.

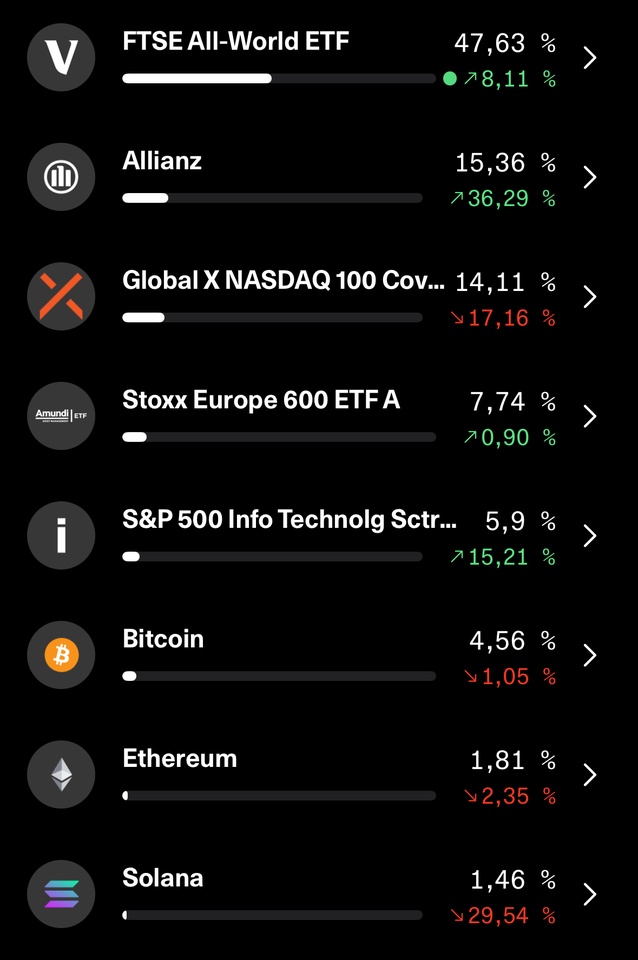

At least as far as the majority of shares are concerned, I am known to be invested in dividend stocks in order to generate the highest possible cash flow. I am now almost 62 years old and do not value excessive performance but would like to make a living from the income from my assets and decided to stop working at the beginning of the year when the company where I was employed was dissolved. I see myself as a buy and hold a while. Nothing lasts forever, especially with high-dividend shares. There are regular reallocations without getting into an operational frenzy. In 2025, for example $TRMD A (+0.28%) and a large position $HAUTO (+0.55%) had to leave the portfolio, the high dividend expectations were significantly reduced. The $QYLE (+0.58%) has not recovered from April, $EQNR (-5.86%) and $VICI (-0.41%) led to the brink of capital loss despite respectable dividends and had to give way, as did $MUX (-2.23%) with its inconsistencies. New additions were $NN (+0.88%) , $PFE (-0.43%) , $DTE (-0.27%) and a first position at the end of the year $ARCC (-0.93%) You can see the composition in my profile. I generally try to limit myself to +/- 20 positions and weight them according to purchase. A maximum of 20k per position is invested. This results in the calculation of my dividends and expected income. In its current composition, the portfolio shown here has a value of just over € 340,000 as at 31.12.2025 and has generated gross dividends of just under € 23,000 this year. This corresponds to a dividend yield of 6.73%

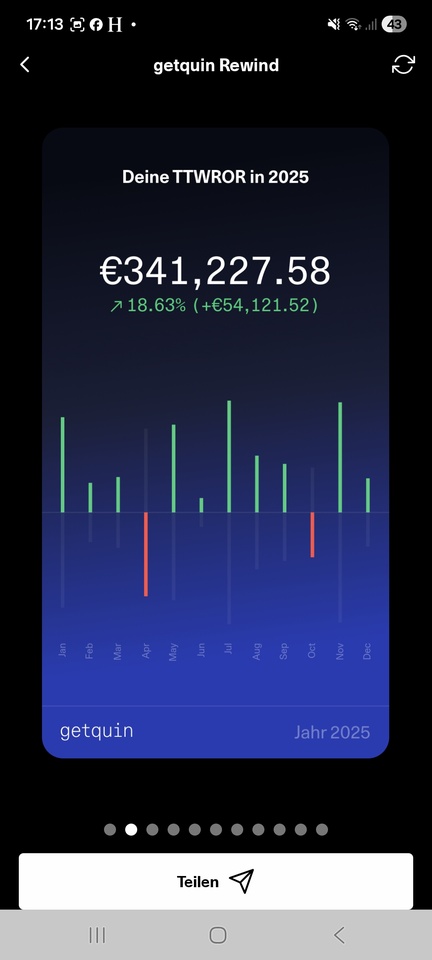

The time-weighted yield was 18.63% and therefore well above average, at least better than 67% of the getquin community. I wasn't able to beat the DAX, but at least I outperformed the S&P500 and beat the relevant MSCI World index by some distance. Even on a 5-year view I am on a par. Tobacco stocks did very well $BATS (+0.8%) , $IMB (+0.98%) and $MO (+0.75%) , $HSBA (+1.52%) , and $RIO (+1.13%) and of course $965515 (-0.76%) that I physically hold and the $EWG2 (-0.14%) .

That's all there is to the part of my investments shown here in GQ. What follows is a piece of my life story and the first part inside Dividendenopi.

As I said, I now live off my assets. This amounts to just under € 1.2 million in all the forms of investment I hold. Is that enough for a carefree life? For me in any case. Because on top of that, I have a debt-free, owner-occupied property (a single-family home with a large garden in a quiet rural location near a city of 600,000 inhabitants) and a rented two-family home, appropriately enough, as a neighboring property. Partly financed, rent surplus after installment to the bank a good € 700 per month, flows completely into the maintenance reserve. Claims from BAV, life insurance, building society savings contracts will be added on top in the next few years, but are not taken into account here. There's even a savings account with €18,000..... half of which belongs to my wife and she doesn't want to close it.

My wife (still) works and has a decent income despite working part-time and has other liquid assets in the lower six-figure range. She does it herself, the stock market is the devil's work. Her story is not included here either.

So I / we are doing pretty well after all. It wasn't always like that, anyone who is or was self-employed knows that. But consistent financial planning is important, no matter what the situation, as is sticking to your savings rate. I started investing in real estate at the beginning of the 1990s and have been liquidating it over the last few years. In conjunction with my own wealth accumulation and an inheritance, I am now in a comfortable situation for me.

What do I do with the rest of the money outside the getquin portfolio? A good € 500,000 is (still) in call money and fixed-term deposit accounts. Interest rate hopping on call money and fixed-term deposits from 2 years ago yields around 3% on call money and over 4% on fixed-term deposits. The remaining capital is invested in certificates. Mainly in fixed-coupon express certificates with quarterly payout and partly in bonus certificates with CAP and barrier.

My investments currently generate a net monthly cash flow of € 4000, which is enough for me to live on. Plus € 800 ALG on top until the beginning of 2027.... But before the company closed, I only worked 16.5 hours a week. With my wife's income, that's a good €6500, which is bearable. You can certainly do more with your assets, depending on your needs. We live rather modestly, don't have any children and aren't the consumer type.

How am I invested outside of dividends, why certificates and which broker, where and how overnight and fixed-term deposits? I thought that would go beyond the scope of this article, so I'll come back to it in a second part. Thanks for your participation so far and see you soon