iShares MSCI Global Semiconductors ETF A

Price

Discussão sobre SEMI

Postos

59Investment in semiconductors

Dear Community,

What has been $ASML (+0,76%) on everyone's lips. I sold before the figures and placed a small short, like many of you.

The short burst, the share price rose sharply - at first!

Now it is almost back to the prices before the figures. Many have used the good figures and the reaction to take profits.

I, too, am in a wait-and-see position, but have looked to the left and right and bought directly into $AVGO (-0,41%)

$TSM (+2,62%)

$AMAT (+1,53%)

$MU (+2,55%)

$LRCX (+3,29%) and even $ASML (+0,76%) invested.

Irritated?

After I $ASML (+0,76%) sold, I discovered an ETF $SEMI (+1,78%) that contains all these stocks and of course many more, which I like.

I am still convinced of ASML, but the price of the share is slowly becoming too high for me to be able to invest sensibly in other stocks. So I have decided to open a position of 435 shares in the ETF, as I continue to see high growth in the entire sector.

Even if it is not a presentation of a share, I hope that this idea of investing in the sector will be of interest to some of you.

Best regards 🐰 André

Intro & My path as a newcomer

Dear getquin community

Having been a silent reader here for a few months now, I would like to briefly introduce myself and my journey so far. Before I do, however, I would like to say a big thank you to everyone who regularly shares very exciting posts here and helps this community to grow. You are not only convincing in terms of content, but also create a really pleasant atmosphere in the forum with your appreciative way of writing.

My Story

Against the background and with the expectation of a substantial inheritance, I have been looking into investment opportunities as a complete newcomer to the stock market since the beginning of 2025. As I wanted to gain some experience first, I started investing my annual savings on a trial basis instead of paying off my mortgage as usual.

I started with an investment in $SPYI (+2.417,04%) . As I didn't like the heavy weighting of the USA, in a second step I tried to build up a 35/25/30/10 ETF portfolio with a weighting of the world regions by GDP. The result did not convince me due to the complexity (at times over six ETFs → manual rebalancing effort) on the one hand and the manageable long-term return prospects on the other. In the meantime, I had the idea of investing in slightly better-performing and riskier thematic ETFs such as $SEMI (+1,78%) and $XAIX (+1%) but in the end this only led to an even more complex setup.

I then decided to try a buy-and-hold approach based on individual stocks, but was quickly impressed by the return prospects of riskier stocks. So - also influenced by posts here in the forum - I went all-in at the beginning of November with $IREN (-6,41%) at a buy-in of around € 61 at the time. I now know that this impulse is called "FOMO" 🙂. When a sharp correction immediately began, I realized that return also means risk and that timing plays a role when buying individual stocks. Encouraged by posts here in the forum, however, I didn't sell in a panic, but continued to buy during the correction phase until I was able to reduce my buy-in to €45 at the end of December.

I am now slightly in the green again and the further prospects do not currently motivate me to sell my shares. I am setting myself a price target in the region of the old ATH in order to then reduce the position to a more reasonable size and restructure my portfolio. If I am satisfied with this, I will also invest the larger sum from the inheritance. At the moment, I can imagine a core of $VWCE (+0,76%) , $TDIV (+0,23%) and @Epis 3xGTAA Wikifolio Index as well as a somewhat smaller portion for selected, higher-risk stocks. There are numerous well-founded ideas for the individual stocks here in the forum, for which I would recommend, among others@Multibagger , @Tenbagger2024 , @Iwamoto and @Shiya are very grateful.

It's fun to be here.

Opinion on ETF portfolio

Hello dear community,

I am considering restructuring my portfolio and investing in various ETFs.

- 50 % $VWCE (+0,76%)

10 % $SEMI (+1,78%)

10 % $INRA (+0,04%)

10 % $CEBT (+3,22%)

10 % $ESIF (+1,35%)

10 % $IGLN (+1,13%)

To start with, I would like to invest €5,000 accordingly and increase it monthly according to the same distribution.

My thoughts on this:

- unagitated basis in the world ETF

- More risk and potentially more profit in sector ETFs. Sectors that I personally think will become relevant in the coming years and decades.

- Somewhat more speculative sectors such as semiconductors, green energy or precious metals. But supported by more solid sectors such as finance and gold.

What are your opinions on this? I would be delighted to receive feedback! :)

Asking others for their opinion is also good ✅

Next, maybe read one or more basic books on the subject. I can definitely recommend Kommer here. Then reflect on your own thoughts, develop them further and share them with others. This way, your knowledge will become more and more well-founded and you can distance yourself more and more from your own feelings and (mis)assessments.

Until then, of course, don't stop investing... but perhaps focus first on the part you are most convinced of. Reserve the right to make adjustments as you go along. An intended allocation to several ETFs or asset classes, for example, does not have to correspond directly to the final result at the first attempt - that would be very, very unusual.

A model portfolio can also help you to initially observe your own more specialized approaches over a longer period of time and only later implement the investment in the more specialized investments...or simply discard them again. Long-term investing has to do with knowledge, but also with your own experience.

Greetings

🥪

Black Swan: The day AI paralyzes the stock markets

AI-driven flash crash

An AI flash crash occurs when modern trading algorithms trigger massive waves of selling in a matter of seconds.

These systems are usually programmed to react to price changes or data signals, such as stop loss limits or short-term price drops.

If a share reaches a critical price, programmed algorithms automatically trigger sales.

These orders drive the price down further, causing other algorithms with similar mechanisms to also sell ("sell side momentum").

This so-called cascade effect can cause the price to plummet within minutes.

(Example: Cascade effect of critical infrastructure during heavy rainfall)

The trading speed of AI models today is so high that the smallest triggers (e.g. false signals) can result in a storm of trades in a flash.

Experts warn that many AI models are based on similar data, which can lead to "swarm thinking":

If several systems misinterpret the same signals at the same time, a small price slide can very quickly turn into a huge sell-off.

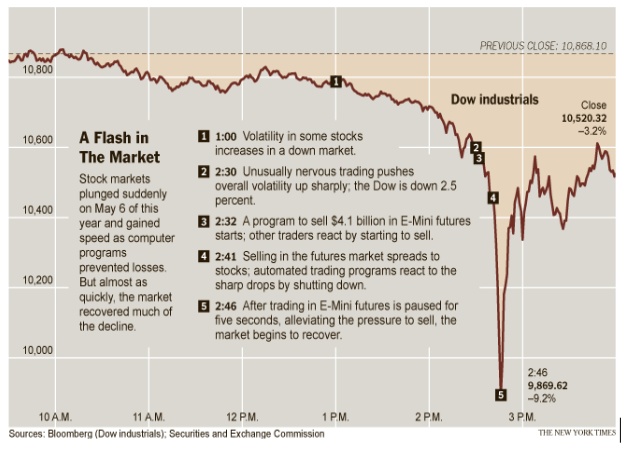

(Example: The flash crash of 6 May 2010 began with a large sell-off program being triggered for S&P 500 futures).

(https://www.advisorperspectives.com)

Although the markets recovered by the close of trading, this example shows how domino effects can be caused by automated orders.

AI can also have its own say:

Modern systems read news and social media in real time and react independently.

Bots can also incorporate completely new information (tweets or news) and generate buy or sell signals from this.

Incorrectly generated or misinterpreted messages can therefore immediately lead to sales.

1.

Possible triggers

Data error or manipulation:

Incorrect market data (prices, volumes) or cyber attacks on data can trigger false signals.

Algorithms that react blindly to data could falsely trigger sales or purchases.

The term:

"Simulation Deception"

(https://www.tencentcloud.com/techpedia/118834)

describes artificial patterns in the market that are created by manipulated data.

For example, an attacker could use fake buy/sell orders (spoofing) to artificially simulate liquidity, whereupon AI systems panic and trade in the opposite direction.

Fake news and deepfakes:

Artificial intelligence now allows deceptively real false reports (deepfake video, fake tweets, etc.).

(Example: on July 16, 2025, Congress member Anna Paulina Luna from Florida wrote on X (Twitter) that she had heard from President Trump that Fed chief Powell would be fired immediately).

(https://www.advisorperspectives.com)

(https://www.advisorperspectives.com)

AI searched all social media posts specifically for tradable news. It found what it was looking for and a violent reaction in the bond and stock markets followed, as shown above.

In previous cases, the impact might have been weaker, as the president could have reacted more quickly and dismissed the statements before many market participants were even aware of the rumor.

Even little-known posts can lead to strong market movements within minutes thanks to AI attention.

World Economic Forum analyses explicitly warn:

Machine-generated fake news can act like a flash crash trigger.

More and more bots are able to spread such false information in order to deceive trading algorithms.

AI misinterpretation:

Even if the data is correct, AI models can misinterpret it.

Trading algorithms that process complex data (news, technical indicators) run the risk of interpreting irrelevant noise as a signal.

Lawfare cites as an example that AI-supported systems already "misread" the market in 2010 and 2016. "misread" the market and launched unfounded waves of selling.

"A few algorithms in use simply misread

the market. The unwarranted sell-off initiated by those mistaken models then caused other programs to respond in kind. The $1 trillion lost in that half hour period was eventually made up thanks to human intervention. "

In the future, such misinterpretations will be even more critical as AI models analyze huge amounts of data from social media and news.

Panic signals/cascades:

In a battered market, automated risk offs (stop sales after a fixed loss limit) can trigger a race.

If, for example, a key figure ($VIXindex level) reaches a critical value, many systems switch to safety at the same time - which can cause a variety of similar assets to fall as an artificial panic impulse.

2.

Affected asset classes

An AI Flash Crash affects various asset classes:

Equities:

This is often the first impetus of a crash.

Globally listed stocks (indices such as S&P 500, DAX, Nikkei) see massive price losses in a matter of seconds.

A shutdown of a large position, for example, can cause other algorithms to panic sell.

Historically, the stock market has experienced such sell-off waves several times.

2010 Dow $DJIA

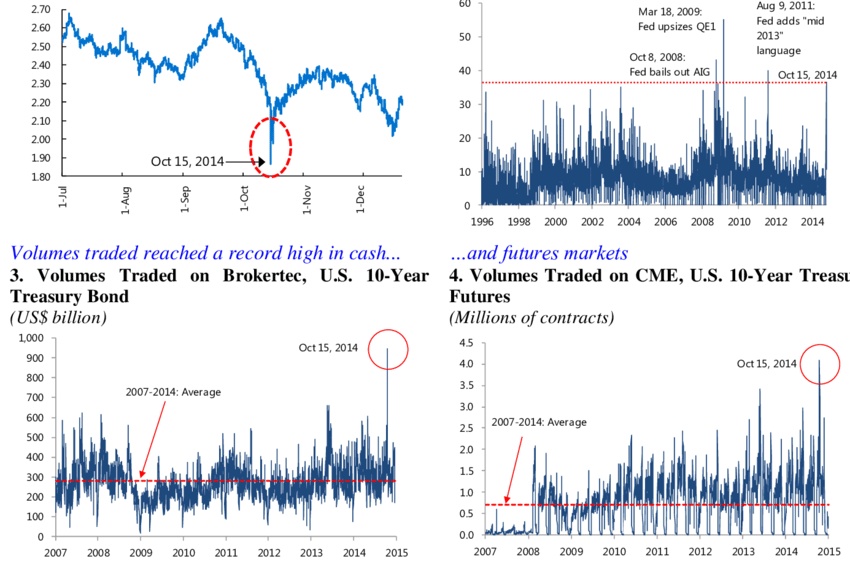

2014 US bonds

An AI-supported flash crash would accelerate this mechanism even further. A sharp slump is usually followed by a partial recovery within a few days or weeks.

Bonds:

Bond markets can also "flash".

In the famous Treasury Flash Crash of 2014, the yield on the US 10-year Treasury Yield plummeted by 1.6% in twelve minutes, followed by a recovery - triggered by algorithmic sell orders at record levels.

(https://www.researchgate.net)

(Theoretically, AI can act against this:

In a stock panic, investors often flee into bonds (price rises, yield falls).

But AI-controlled bond funds could simultaneously and automatically reach certain thresholds and trigger the sale of bonds or bond futures.

This could lead to sharp interest rate swings in the short term, even if the fundamentals do not justify this).

Commodities:

When uncertainty is high, commodity prices often tip.

Typically, oil ($IOIL00 (-0,36%) ), gas ($NGS ) and industrial metal prices ($COPA (+1,65%) , $ALUM (+1,02%) , $ZINC (+1,19%) ) in a crash phase due to expected weaker demand.

AI programs on the commodities market (e.g. in oil or gold futures trading) could intensify this crash or even trigger a "mini flash crash" in individual commodities.

(Example: the slump in silver futures in July 2017:

Price plunge of over 11% during Asia close when thin trading was blamed on algorithm shifts).

AI in commodity markets can therefore both trigger selling spikes and initiate a rapid countermovement through post-buy programs.

Cryptocurrencies:

These are considered particularly volatile.

AI trading bots are everywhere, so cryptocurrencies are in free fall when many bots recognize "fear" signals at the same time.

(Example: In May 2021 $BTC (-3,91%)

plummeted by around 30% within hours, partly because many algorithms sold en masse after signals about China's Bitcoin ban).

$ETH (-4,89%) experienced a flash crash on one platform in 2017 because a huge sell order triggered many automated trades.

Crypto markets run 24/7, are unregulated and therefore more susceptible to algorithmic chain reactions.

3.

Risk matrix by region

The probability of occurrence and the extent of damage caused by a crash differ from region to region:

USA:

- Very high trading volume and dominant use of AI algorithms in New York and Chicago.

- Large index futures can act as initiators.

- Probability of a crash is considered moderate to high as there is a lot of automated trading here.

- Damage would be extremely highas the US markets are of global systemic importance.

- Trading halts mitigate the impact on the trading day, but the crash effect on global investor sentiment would be enormous.

Europe:

- Heavy reliance on passive funds and ETFs (e.g. from $BLK (+1,63%) iShares).

- Algorithms are widespread, but somewhat less so than in the USA.

- Probability rather mediumdamage high.

- ETF crashes show that sudden panic can also lead to chain reactions in equities.

- European banking crisis could arise if credit markets are burdened by US shocks.

Asia:

- Regulation and trading times differ.

- Flash crashes can have a rapid impact on Asia (Nikkei, SSE), especially if they start at night when trading is thin.

Medium probability and medium damage - because Asian markets close faster and usually react later.- Crashes in Asia could affect yen or euro performance, for example.

Crypto:

- Market open around the clock, little regulation, high leverage.

- The probability of a major crash in crypto is very highas price falls are more frequent and driven by AI bots.

- Damage is often limited to crypto investors, but can also affect traditional markets via linked financial assets (Bitcoin ETFs, leveraged crypto products).

The matrix overview could therefore show

- Short term (minutes to days):

A sudden flash crash would last seconds to minutes.

Prices plummet, many stop loss orders are triggered.

Stock exchanges switch on automatic trading pauses to stop algorithm spirals.

Investors lose billions in a very short space of time, many markets are temporarily illiquid.

Confidence collapses, many investors panic and are uninformed.

- Medium-term (weeks to months):

Markets should stabilize again in the following days to weeks as counter-cyclical AI and manual orders intervene.

In the medium term, economic data could be affected if a crash impacts financing conditions.

Media and public will question confidence in digital markets for months.

Investors report consequences such as increased demand for safe assets (gold, government bonds).

- Long term (years):

Regulation and market mechanisms would adapt.

We could expect a regulatory boost:

- Stricter rules for AI in trading

- Transparency obligations for algorithm models

- Supervision of financial AI by regulators (SEC, BaFin, ESMA etc.).

Already in the past, the 2010 flash crash led to new trading interruptions and considerations regarding trading system requirements.

An AI crash would likely have a disciplining effect:

Providers need to develop more robust AI models, and contingency plans (kill switches) could become mandatory.

In the long term, confidence could be slow to recover:

Institutional investors would only have limited confidence in AI systems, and many private investors might temporarily hold back or prefer alternative strategies.

4.

Specific players and technologies

BlackRock Aladdin:

BlackRock's Aladdin AI system currently manages more than 30,000 portfolios and permanently rebalances enormous amounts of capital.

If Aladdin is routinely programmed to sell too much for ETFs or funds, this can trigger billions of orders.

Nvidia & AI chips:

$NVDA (+1%) Supplies the hardware for many AI models and is itself a market star.

High expectations for AI have fueled Nvidia's share price for years.

Algorithms are strongly fixated on such shares.

If, for example, Nvidia's share price falls abruptly, many strategies trigger sell programs.

Such a domino effect

$NVDA (+1%) -> $SEMI (+1,78%) -> $CSNDX (+0,8%)

could fuel a crash.

In practice, it has been shown that Nvidia reacts very volatile to macroeconomic and geopolitical news, so the next AI turbulence could drag down the entire tech sector.

AI bots on Binance (Crypto):

On crypto exchanges like Binance, many users trade with automated bots.

A large part of the crypto trading volume comes from AI-supported systems.

These bots can generate simultaneous sell or buy waves.

AI-driven ETF rebalancing:

Large index ETFs and passive funds (BlackRock iShares, Vanguard etc.) use automated systems to implement index changes.

If indices rise or fall quickly, many ETFs start rebalancing at the same time.

If the AI signal is negative, all AI-based funds could sell at the same time.

This creates massive sell orders in a short space of time.

Because the volumes involved are in the billions, rebalancing alone can drive a crash further.

Other players:

News agencies, index operators (eg. $MSCI (+1,09%) ), hedge funds with AI strategies and social trading platforms also contribute.

Any sudden outage (e.g. power failure at NYSE) or hacker attack on stock exchange systems could further irritate the AI systems on the stock market.

"When algorithms collide and markets tremble in fractions of a second, the new power of AI is revealed: speed without mercy, precision without emotion. One spark is enough - and the domino effect races through indices, derivatives and crypto-spheres. The AI-driven flash crash is no longer a distant shadow, but the echo of a future in which machines set the pace of the financial world."

Feel free to write your feedback on this post in the comments and tell me if you're interested in something like this.

My plan this morning was actually just to write a short post about this topic, but it turned out to be a bit longer. It's so easy to sit and write all day.

@Kundenservice Please increase the maximum number of pictures for a post, unfortunately I didn't get all the pictures in that I had picked out.

Sources:

- https://www.ig.com/en/trading-strategies/flash-crashes-explained-190503#:~:text=speeds%20based%20on%20pre,as%20the%20prices%20go%20down

- https://www.advisorperspectives.com/articles/2025/07/28/ai-transforming-markets#:~:text=I%20started%20this%20article%20by,a%20flash%20crash%20or%20surge

- https://www.lawfaremedia.org/article/selling-spirals--avoiding-an-ai-flash-crash#:~:text=an%20otherwise%20normal%20trading%20day,up%20thanks%20to%20human%20intervention

- https://www.ig.com/en/trading-strategies/flash-crashes-explained-190503#:~:text=2010%20flash%20crash%3A%20Dow%20Jones

- https://www.advisorperspectives.com/articles/2025/07/28/ai-transforming-markets#:~:text=For%20example%2C%20on%20July%2016%2C,last%20week%20was%20lightning%20fast

- https://www.binance.com/en/square/post/22230680857314

- https://www.tencentcloud.com/techpedia/118834

- https://www.weforum.org/stories/2023/04/technology-vulnerabilities-financial-system/#:~:text=However%2C%20IoT%20botnets%2C%20which%20tamper,grid%20and%20influence%20market%20prices

- https://www.lawfaremedia.org/article/selling-spirals--avoiding-an-ai-flash-crash#:~:text=But%20this%20was%20not%20a,speed%20selling%20spirals.”

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/flash-crashes/#:~:text=Using%20algorithms%20to%20trade%20has,plunge%20in%20the%20market%20occurs

- https://www.ig.com/en/trading-strategies/flash-crashes-explained-190503#:~:text=The%20flash%20crash%20of%20the,impact%20these%20events%20can%20have

- https://www.tastyfx.com/news/flash-crashes-explained-190503/#:~:text=The%20DJIA%20suffered%20yet%20another,NYSE

- https://www.occ.gov/news-issuances/speeches/2024/pub-speech-2024-61.pdf#:~:text=flash%20crashes%2C%20which%20have%20been,4

- https://www.zerodaylaw.com/blog/ai-compliance-safeguarding-financial-markets#:~:text=The%20reliance%20on%20AI%20for,reaching%20consequences

- https://www.nasdaq.com

- https://medium.com

- https://corporatefinanceinstitute.com

- https://www.tastyfx.com

- https://www.binance.com/en

- https://www.lawfaremedia.org

- https://www.weforum.org

- https://www.ig.com/de

- https://www.tencentcloud.com

- https://www.occ.gov

- https://www.ssrn.com/index.cfm/en

- https://www.advisorperspectives.com

- https://www.zerodaylaw.com

- https://www.curiousmonky.com

+ 6

Incidentally, the most famous algo crash was on October 19, 1987, when the Dow Jones fell by 22% within hours. That caused a few suicides! 🥶

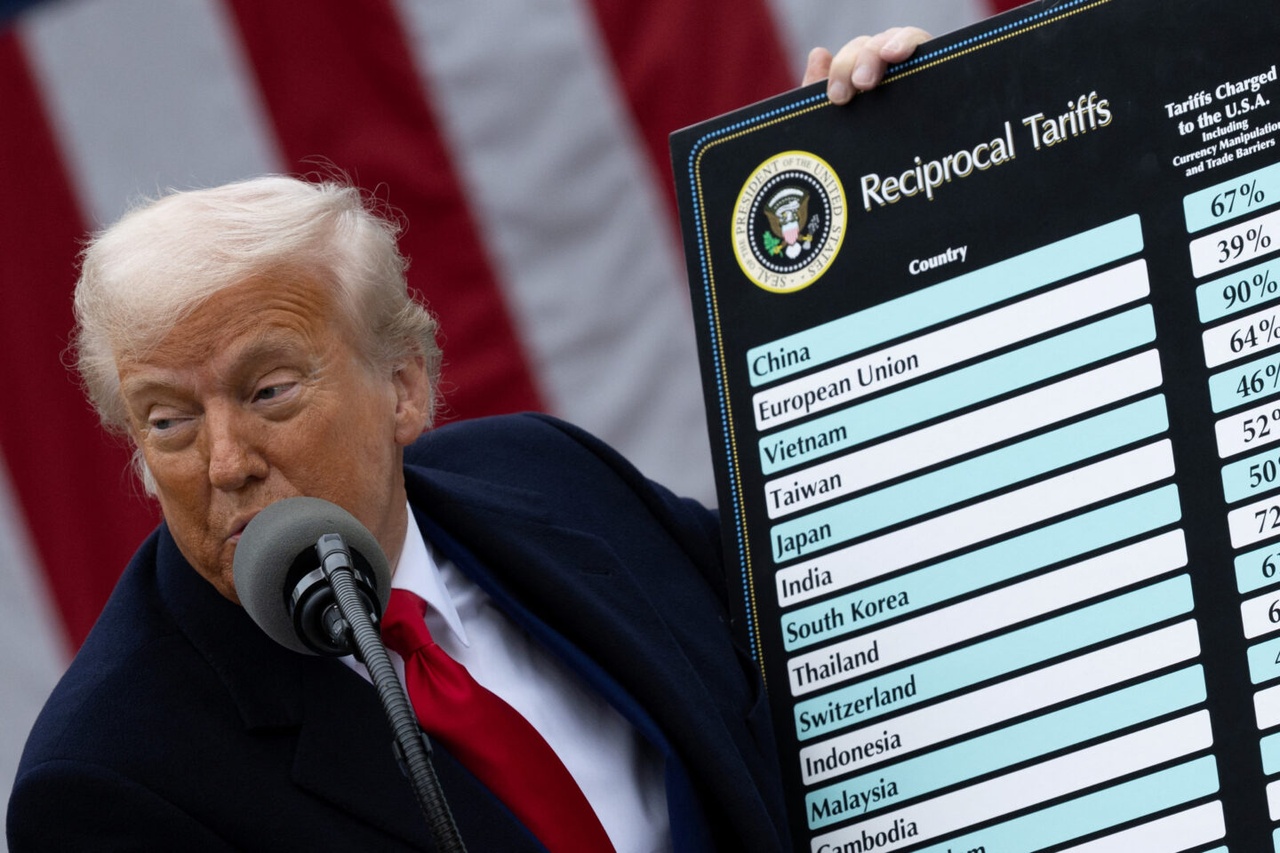

Aug 6 / Now India Must Pay

After Switzerland, Brazil and the EU, India has become the latest target of Donald Trump’s trade war fantasies. India now faces a tariff rate of up to 50% for purchasing oil from America’s legacy enemy Russia.

Why is President Trump doing this? Doesn’t it do more harm than good to his economy and global trade relations? Probably, but the truth is that the former businessman doesn’t seem to care much. By know, we know his tactic: Scare the enemy. No matter how mighty their economy may be, slap a ridiculously high tariff on them, then start negotiating.

While seasoned diplomats or old-school presidents might prefer to talk first, threaten later, if inevitable, Trump flips the script. In fact, he’s a bully, the greatest of them all. And the negative connotations of the word “bully” aside, his strategy seems to work. President Trump has a unique ability to force outcomes that favor his agenda.

We started the year with practically zero tariffs on major imports. Then came April 2nd, “Liberation Day”, where markets experienced a cold awakening. That day, everybody’s worst fears came true: exorbitant tariff rates on every country from Germany to the Easter Islands. No one was spared. And what was the cherry on top? The rates were based on a flawed formula not even his advisors seemed to fully grasp, though I doubt Peter Navarro could grasp the breakfast menu, let alone math. The man that managed to start a feud with everyone, from Elon Musk to John Doe.

Since then, several deals have been struck, with varying degrees of success. The EU, for instance now faces 15%, which is celebrated as a massive win, while forgetting that it’s 15% points more than before. And what did markets do? Nothing. Completely disconnected from fundamentals, equities marched higher setting fresh all-time highs.

While that’s largely due to the phenomenon of the “TACO-Trade”, what investors take lightly is the fact that tariffs remain elevated and significantly higher than last year. Yes, Trump tends to chicken out, but his plan is more calculated than it appears: The order of events is repetitive:

1. Look for a camera

2. Announce absurd tariffs, while markets collapse and WSJ’ journalists type their fingers sore

3. Extend the deadline a few days later

4. Strike a “historical”, though rather symbolic deal

5. Redistribute corporate profits into Treasury coffers

But enough criticism for now. In the end, only time will tell whether Trump’s strategy results in an economic boom and global investment into the U.S., or a lasting decline in American influence and global standing. Though I would bet on the latter.

$IWDA (+0,57%)

$EIMI (+1,48%)

$LYPS (+0,63%)

$QDV5 (+1,98%)

$VWRL (+0,63%)

$VWCE (+0,76%)

$MEUD (+0,81%)

$MEU (+0,89%)

$SEMI (+1,78%)

$CSNDX (+0,8%)

$AAPL (+1,51%)

$NVDA (+1%)

$AMZN (+2,51%)

$NOVO B (-2,32%)

$AMD (-1,53%)

$MU (+2,55%)

$ASML (+0,76%)

$TSLA (-0,19%)

When do I save myself?

$XDWD (+0,7%)

$IWDA (+0,57%)

$SEMI (+1,78%)

My portfolio is currently in free fall. When do I get out to reduce my loss? I'm only up 8%. My goal has always been to invest in ETFs for the long term.

With such broadly diversified ETFs, you generally only sell when you change strategy or want to liquidate your portfolio. With such ETFs, the investment horizon is long, i.e. such setbacks are basically even good for you. You can buy more and have a "discount" on top, so to speak.

So, if you are not about to retire, continue with your savings plan and accept the correction. Even if, for whatever reason, it falls by 50% now, it would make sense to buy more, as you can buy the shares more cheaply.

I hope that was understandable.

Best regards

Moin

Do you still see $SEMI (+1,78%) potential to rise much further or is the hype over?

Technology growth ETFs

Hello dear community!

I have been looking into some growth ETFs and am a bit undecided. The focus here is already on strong growth and also a little more in the technology/software sector, as I don't have enough in this area in my portfolio.

I'm also convinced that technology will always be omnipresent and indispensable....I'm only in my early 30s, so I want to go for strong and "sustainable" growth first.

I have looked at the following ETFs and compared them, e.g. via extraETF, with my favorite "-->" in terms of TER, performance and portfolio:

Information Technology:

--> $IUIT (+0,64%)

NASDAQ100:

--> $EQQQ (+0,83%)

SEMICONDUCTOR:

--> $IE00BMC38736

DEFENCE:

--> $ASWC (-0,67%)

S&P500:

ALL-WORLD:

Can you tell me if I am currently looking too much at the performance of the last 5-10 years instead of sustainable growth in the 4 ETFs, i.e. my selection:

$IE00BMC38736

Looking forward to your feedback!

Hey guys,

Question: Which broker do you use for shares and ETFs?

Savings plan and occasional individual purchases. Profit taking from time to time.

I've been with Comdirect for years and yesterday I paid €15.30 for the sale of $SEMI (+1,78%) yesterday.

Thanks in advance...

Thorsten

The differences are marginal, you may just have to take an etf from a different brand or set up several custody accounts.

Títulos em alta

Principais criadores desta semana