For a long time I looked at the crypto market and saw nothing but a digital casino.

Between the 10,000% "to the moon" pumps and the endless sea of meme coins, it’s hard not to feel like the whole thing is just a giant game of bulls***.

I’ve spent the last few weeks watching YouTube videos and I have to admit that the Bitcoin ecosystem is an absolute masterpiece. Seeing it explained as a decentralized, self-sustaining machine changed my perspective from " bulls*** " to "speculative innovation."

Very good videos:

https://www.youtube.com/watch?v=vclZlAFXpEI

https://www.youtube.com/watch?v=-D3ChoNtlX8

Please recommend more!

My Current Setup (Noob)

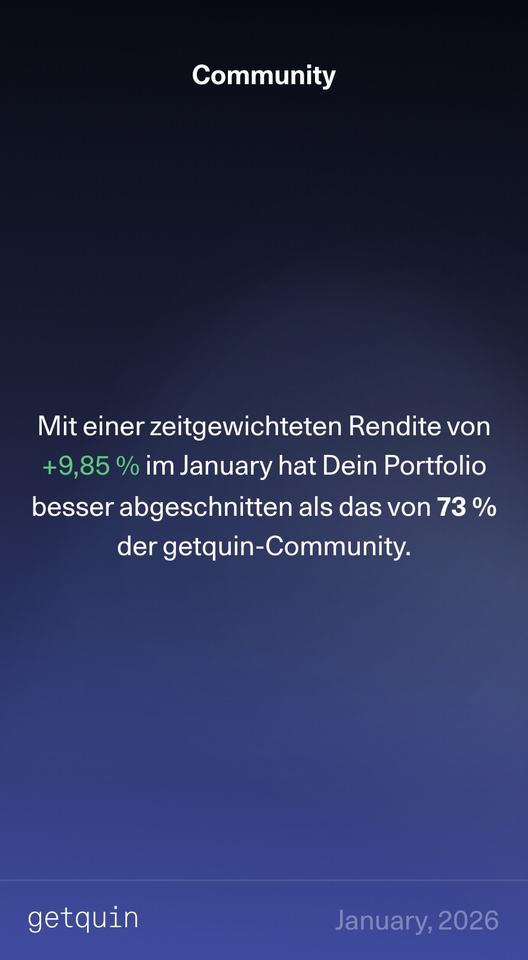

I’ve decided to start small. A low allocation just to start playing the game. Currently, I’m running a 90/10 split: (100€ monthly)

- 90% Bitcoin ($BTC (-0,49 %)): It’s the king for a reason I guess.

- 10% Binance Coin ($BNB (-0,66 %)): Just because of the 25% discount on trading fees on binance and it is too good to ignore.

I’m fully aware I’m still "uneducated" in this space. I love the idea of decentralized tokens, but I’m struggling to understand the utility of other altcoins without them feeling like a roll of the dice.

Is a 90/10 BTC/BNB split too "safe," or is it the smartest way to start?

Are there other "beautiful machines" (actual utility projects) I should look into that are not just hype and noise? Because when I look at $ETH (-0,66 %) for example isn't it just Bitcoin but worst?

The 100€ montlhy deposit on binance is all automated but is it the best? I transfer to binance and then it auto converts 25€ each week to btc and bnb. I feel that I am paying more in spread for than I usually pay on spot trading for some reason. Please help

$BTC (-0,49 %) , $ETH (-0,66 %) , $SOL (-0,8 %) , $USDT (-0 %) , $USDC (-0,07 %) , $XRP (-0,34 %) , $AVAX (-2,06 %) , $BNB (-0,66 %) , $ADA (-0,69 %) , $SHIB (+0,01 %) , $DOT (-0,21 %) , $DOGE (-0,33 %) , $LUNA (-0 %) , $ASML (-5,28 %) , $NVDA (-2,56 %) , $NVO (-1,12 %) , $NOVO B (-0,55 %) , $V (-0,47 %) , $PLTR (+2,91 %) , $MSFT (-0,48 %) , $NFLX (-0,39 %) , $IREN (-7,48 %) , $NBIS (-5,5 %) , $DAPP (-5,83 %) , $CIFR (-8,85 %) , $DUOL , $MCD (+0,3 %) , $MA (-0,55 %) , $MARA (-8,61 %) , $SE (-3,65 %) , $OSCR (-4,03 %) , $UNH (-0,68 %) , $CRM (-0,17 %) , $NOW (+2,94 %)