For me, 2024 was the most successful year so far, not only because I significantly increased my savings rate, but also because the portfolio performance took off for the first time.

In the past year, I also became much more aware of economic and political issues, which is probably due to my daily consumption of various podcasts on the way to work. The older you get, the more active and involved you feel in many areas.

I feel closer to the market than ever before... as soon as I skip a day, I have the feeling of being left behind. I'll have to think about whether this can still be counted as a feeling of a lack of routine or whether it's already addictive behavior. The user-friendliness of Getquin certainly also plays a role here. 😅

Well, now to the topic.

After another year of exceptional market returns and an impressive rally, the question is what can we expect from 2025?

In this article, I therefore summarize some key findings from recent publications by Goldman Sachs and BlackRock, for example.

I have bundled the content thematically, enriched it with additional sources and added my own comments. In my opinion, the reports provide a good basis for thinking about market opportunities and classifying current trends without going into too much detail. Ultimately, they also give me the feeling that I am well positioned with my own portfolio approach. It goes without saying that the personal assessments I include are not intended as investment advice.

Overview of the topics:

1 . Introduction: Optimism and market rally

2 . Causes of returns: Valuation and earnings growth

3 . Valuations and future returns

4 . Market concentration and global differences

5 . Megatrends and their impact

6 . Political classification and protectionist trends

7 . Growing fragmentation

8 . Investment estimates for 2025

9 . Personal approach

tl;dr

Hopefully the tl;dr is not too tl;dr - the short version today is also a bit extended in bullet points.

Strong market returns since October 2023:

- MSCI World index: +40% since October 2023 (approx. +60% since low 2022).

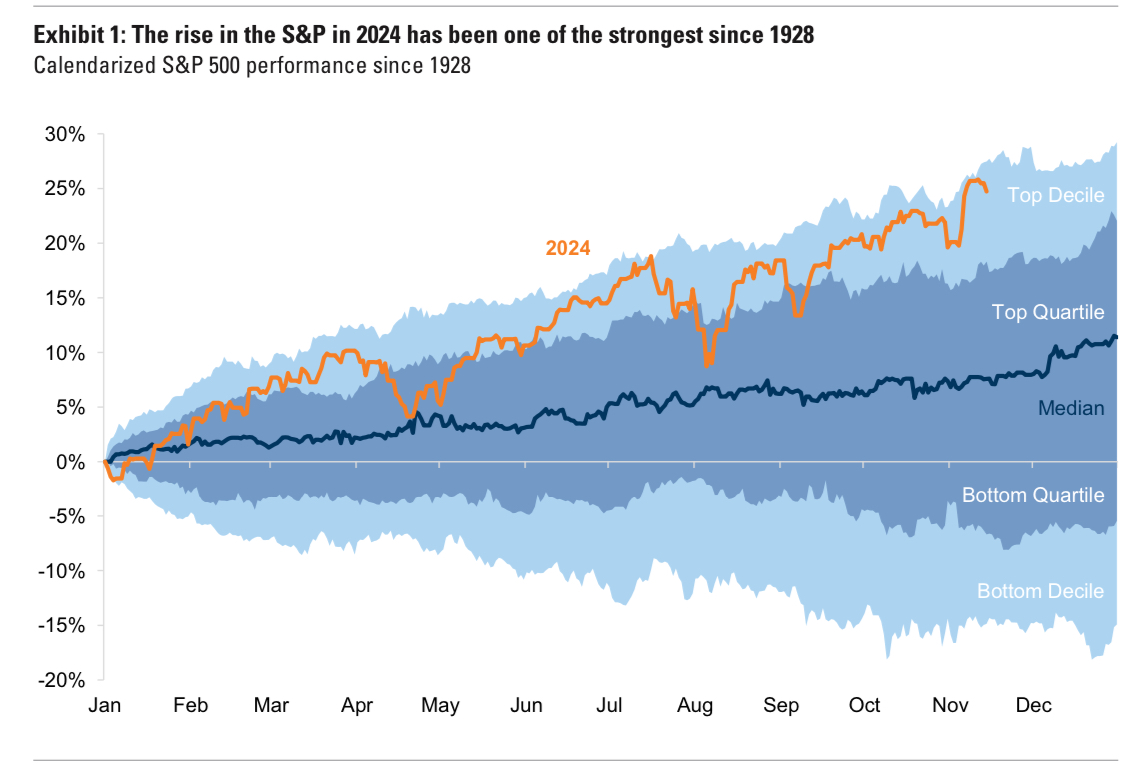

- S&P 500: One of the strongest rises since 1928, strongly influenced by optimistic expectations of falling inflation and interest rates

Driver of returns in 2024:

- Approx. 50% of returns in USA, due to valuation increases.

- USA: S&P 500 with high P/E ratio (28.5 vs. 10-year average 22.7).

- Japan: Returns driven almost exclusively by earnings.

- Emerging markets: Negative valuation trend, limited growth.

Regional differences and outlook:

- USA dominates the MSCI ACWI (65% weight) with strong concentration on a few tech giants ("Magnificent 7").

- Europe and China: Moderate earnings, less valuation growth.

- 2025: Earnings growth should be the main driver worldwide, e.g. S&P 500 (+11% forecast return) and Japan's TOPIX (+17% growth).

Megatrends and AI investments:

- AI-driven developments remain central (data centers, chips, infrastructure).

- Investments in AI could account for around 2% of US GDP by 2030 -> USD 700 bn.

- Productivity increases through AI promote cross-sector growth.

Geopolitical and macroeconomic influences:

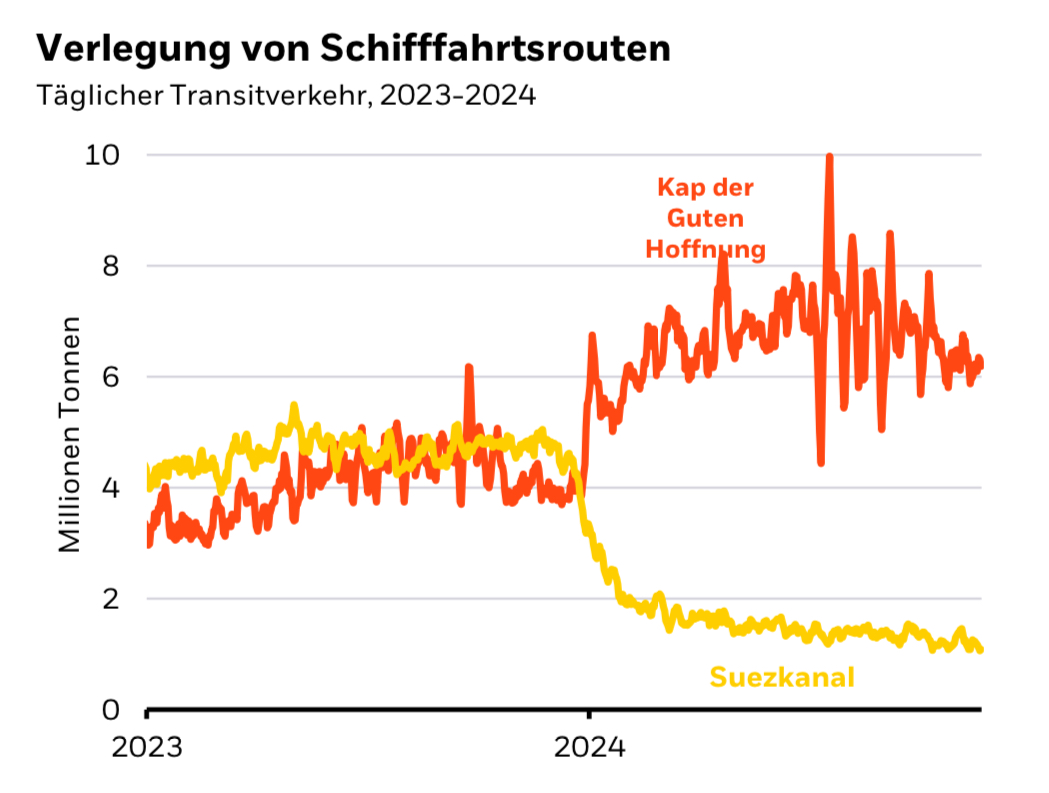

- Increasing trade restrictions (protectionism), shift in trade routes (e.g. Suez Canal).

- Political uncertainties in the USA (e.g. possible deregulation, tax cuts under Trump).

Investment assessments:

- Overweight: US and Japanese equities, especially technology and healthcare sectors.

- Opportunities in emerging markets such as India and Saudi Arabia with moderate weighting.

Long-term changes:

- Megatrends such as digitalization, AI and ageing societies are permanently shaping the economy.

- Geopolitical tensions (USA vs. China) and fragmentation make forecasts difficult, but also offer opportunities.

____________________

- 1 . Introduction: Optimism and market recovery

Driven by optimism about inflation peaking and the prospect of a Fed pivot, the recovery began in October 2023. Since then, the MSCI World Index (see ex. $IWDA (-0.3%) ) alone has gained around 40% (and around 60% since the low point triggered by rising interest rates in 2022) [1].

The S&P 500 (cf. ex. $CSDX ) also had one of the strongest rises since 1928 in 2024 (see Fig. 1).

Fig. 1: Rise in the S&P 500 in 2024 is one of the strongest since 1928

Source: Bloomberg, Datastream, Goldman Sachs Global Investment Research

- 2 . Causes of the returns: Valuation and earnings growth

The return is partly due to strong earnings growth, but almost half is also due to an increase in P/E ratios triggered by growing optimism about lower inflation and lower interest rates (see Fig. 2).

Fig. 2: Half of the global equity return in 2024 is due to an increase in valuations reflecting growing optimism about lower interest rates.

Source: Datastream, Goldman Sachs Global Investment Research

The dark blue area shows the proportion of the return generated by increases in valuation. The light blue area shows the share of returns from earnings growth and the gray area ultimately shows the share from dividend payouts.

The increase in P/E ratios in the current bull market has pushed valuations to historic levels, particularly in the USA. Economies outside the US, such as Europe and China, which are facing greater structural headwinds, have also seen their equity markets re-rate since the low point in Q4, 2023 [1].

Fig. 2 also shows that the MSCI ACWI (see ex. $ISAC (-0.22%) ) was also able to achieve double-digit returns driven by higher valuations due to the high US exposure, whereas the valuation level in the rest of the world has remained "relatively" stable.

The STOXX 600 (cf. ex. $MEUD (-0.17%) ) was only able to achieve a low single-digit gain in this area, with the remaining return coming equally from earnings growth and dividends.

The Tokyo Stock Price Index: Topix (cf. ex. $TPXE (-0.22%) ), which covers the majority of the Japanese stock market, is certainly also worth a look, as the return here is almost exclusively due to earnings growth. Things get interesting for Japan later in the outlook for 2025.

Only in the emerging markets was there even a negative effect on returns in 2024 due to falling valuations.

What remains striking is that the US, with the S&P 500, stands out considerably from the rest in terms of valuation levels in 2024. Many hopes are being pinned on the US, as it is likely to see higher earnings growth and grant companies ever higher multiples.

If we take a look at the historical P/E ratios of the S&P 500, we can see that the current P/E ratio of around 28.5 is well above the 10-year average of 22.7 [3]. In comparison, the current P/E ratio of the S&P 500 Equal Weight, which weights all companies in the index equally, is around 22 and therefore only slightly above the 10-year average of 19.1 [4, 5].

This suggests that the increase is largely due to a changing sector concentration in the S&P 500 and not because the "broad market" has become much more expensive.

In view of the already high growth expectations, there may now be less room for further optimism and the high valuations also allow for less upside potential driven by valuation increases [1].

The following chart shows what partly contradicts this. It shows the MSCI EMU Index in relation to the S&P 500 excluding Nvidia and implies a past outperformance of the eurozone.

(The MSCI EMU Index shows the performance of the eurozone with 222 companies, as at 29.11.2024, approx. 85% of the eurozone).

Fig. 3: European equities outperform the S&P 500 excluding Nvidia

Source: Charles Schwab, Macrobond

It should certainly be noted here that there has been a lot of cherry-picking, along the lines of: "I'll take the period and delete the share, then we'll be better". For me, it does not so much illustrate the superiority over the US equity market, but rather reinforces the relativization of an overvalued level.

- 3 . Valuations and future returns

Will valuations determine future returns? - No, the fact that equity markets have already risen sharply does not affect the prospects for further records. In the current scenario, one could assume that much of the future potential is already priced into the current price level. This could reduce the attractiveness, as the ratio of risk to potential return appears less favorable.

Goldman Sachs believes that given the high starting point of valuations, the performance of the index is largely dependent on earnings growth. The next 12-month returns are generally only good if earnings are positive in line with expectations. Periods of high valuations and additional earnings declines are usually associated with relatively flat market returns [1].

However, Goldman Sachs' forecasts generally point to positive earnings growth, with returns of 11% forecast for the S&P 500 over the course of 2025.🔮

In the following Figure 3, the forecast for 2025 shows that the majority of the return in the S&P 500 is expected to be driven by earnings growth (see light blue area), with a small proportion coming from dividend payouts and even a decline in valuations, which will then have a negative impact on returns.

What is really exciting is Goldman Sachs' valuation for Japan's TOPIX $TPXE (-0.22%) which is expected to grow by a full 17% and significant valuation increases are to be expected.

Fig. 4: We expect earnings to become the most important driver of index returns in most regions over the course of 2025.

Source: Goldman Sachs Global Investment Research

- 4 . Market concentration and global differences

As we head into 2025, Goldman Sachs emphasizes the vulnerability of a correction due to already strongly anticipated returns on the one hand and the unusual degree of market concentration on the other. The US equity market accounts for around 65% of the MSCI ACWI and the ten largest US stocks account for more than 20% of the total value of the global index (the weight of the five largest US companies already accounts for almost 15%) [1].

The good news is that the largest US companies have significantly outperformed the index and have achieved much stronger earnings growth. Their outstanding position can therefore also be explained by their first-class fundamentals and not just by excessive valuation [1].

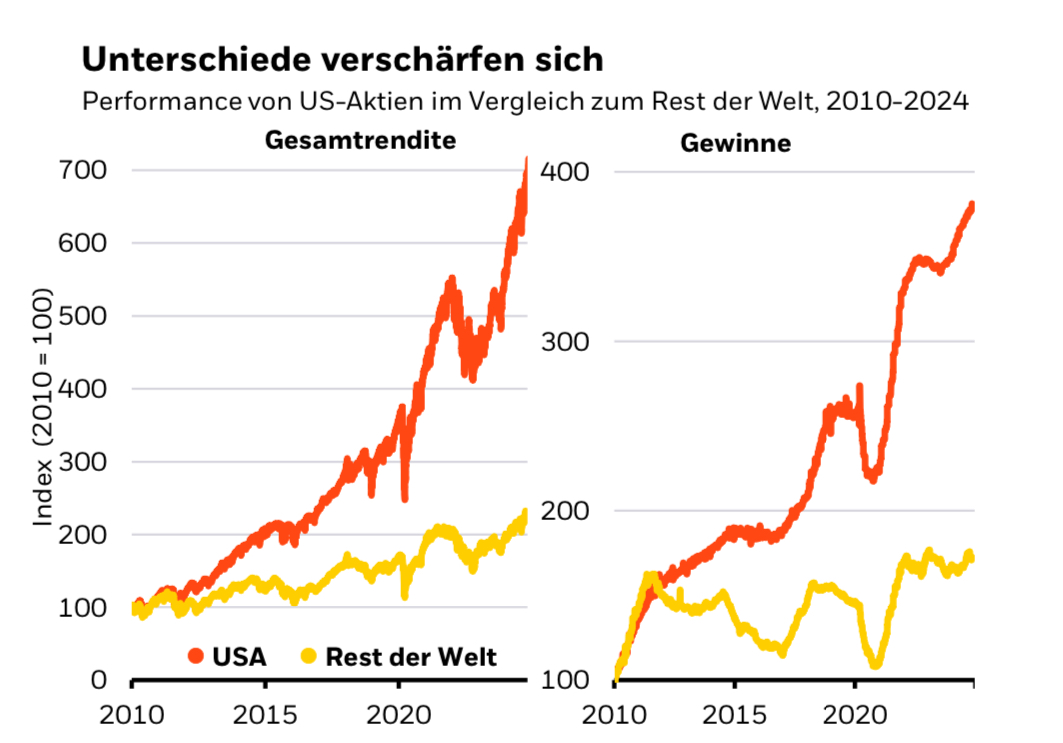

The following chart illustrates once again how total returns and earnings are tightening and developing compared to the rest of the world. Thanks to solid corporate earnings, US equities have outperformed the rest of the world. BlackRock sees the divergence between markets widening as megatrends reshape more and more economies and sectors, creating further opportunities but also risks [2].

Fig. 5: Performance of US equities compared to the rest of the world, 2010-2024

Source: BlackRock Investment Institute with data from LSEG Datastream

- 5 . Megatrends and their impact

This is precisely why BlackRock believes that the outperformance of US companies will continue, as the US is benefiting from the megatrends that are driving earnings. This is supported by favorable growth prospects, as well as possible tax cuts and deregulation [2].

While some valuation metrics such as P/E ratios may appear high, they may only tell part of the story. For example, the changing composition of sectors in the equity markets shows that change is taking root. Comparing today's index to that of the past would be like comparing apples to oranges, similar to what Goldman Sachs suggested above with changing sector concentration [2].

Even though in 2024 outperformance of US large cap technology stocks was only achieved by 15% of companies globally and the Magnificent 7 remain attractive, Goldman Sachs believes that the investment universe should be broadened more and returns should come from a broader front in the index as the trend towards lower interest rates increases.

Goldman Sachs also points to greater geographical diversification. While they are confident about the US economy, the extent of outperformance allows for selective opportunities for geographic diversification. As mentioned above, the highest return forecasts are for Japan, for example [1].

Taking into account projected growth, there are also some areas such as the UK, selected emerging markets and China, all of which have lower PEG ratios. Again, this should not be seen as a reason to overweight these markets at the expense of US exposure, but selectively undervalued companies can be found here and there are good opportunities [1].

Ultimately, the largest companies will continue to benefit the most from efficiency gains, as they are also investing heavily in megatrends, which is currently very evident in the Magnificent 7's investments in AI infrastructure, for example. [2]

BlackRock also sees great potential in the area of AI development in particular and emphasizes that we are still in the development phase - an important part of the general infrastructure boom. According to estimates, investments in data centers, chips and energy systems could exceed USD 700 billion by 2030, which would correspond to around 2% of US GDP [2].

The question of whether too much is being invested in AI is a valid one, but should be considered in the bigger picture given the potential to generate new revenue streams across the economy. Further winners may emerge in unexpected areas, with productivity gains in one sector driving value creation in others. Signals that investors should look out for include new revenue streams and cross-sector impacts [2].

BlackRock continues to present various near-term scenarios (see Fig. 6) for how 2025 may unfold based on the lessons learned. BlackRock sees the most likely scenario for the next six to twelve months as weaker US growth than before the pandemic, but with returns overall above the current level and not too high an AI valuation for the current fundamentals. As a result, US companies are showing strength, the AI-driven rally is broadening and US equities continue to outperform [2].

Fig. 6: Adjustment of our short-term scenarios

Source: BlackRock Investment Institute, December 2024

For decades, economies were characterized by stable long-term trends. It was possible to focus almost exclusively on managing temporary deviations from these trends. Sooner or later, growth would return to trend. This was one of the key principles of portfolio construction. According to BlackRock, the environment has now changed fundamentally. Megatrends can fundamentally reshape economies. Taking AI as an example, it emphasizes that the AI transformation could well eclipse the Industrial Revolution, for example [2].

Furthermore, the world is grappling with increasing geopolitical fragmentation that is redirecting traditional trade flows and disrupting supply chains. New trading blocs and protectionism can change structures and hinder trade. The digitalization of finance is changing the way people and businesses handle cash, credit, transactions and investments. With ageing populations, the labor shortage is growing, which could slow down production and growth if productivity is not increased through AI. Increasing immigration is counteracting this in some countries, but probably only temporarily... especially in the USA [2].

For these reasons, the current data says nothing about the economic cycle, but shows how the trend is changing. What might be surprising is how permanent these trend changes are.

BlackRock uses the following chart to show how the global economy could change as a result of new and short-term trends. It represents a break with the period before the pandemic, when there were only minor deviations from a "central" trend [2].

Fig. 7: If the trend is constantly changing - hypothetical development of our GDP

Source: BlackRock Investment Institute, December 2024

- 6 . Political classification and protectionist trends

Many governments in developed countries are facing major constraints such as high inflation, low voter support and, outside the US, a lack of growth. One can expect a strong focus on national issues, such as the economy and security, possibly at the expense of other issues. A stronger focus on short-term goals, forcing governments to implement their agenda quickly, is also possible given frequent changes of power. As a result, politics itself could promote instability in an already fragile world with increased strategic competition between the US and China.

Trump has promised voters big changes. Tax cuts, deregulation and support for fossil fuels are viewed positively by the markets in the short term [2]. This is less true for other plans. These include restrictions on immigration and the many announced tariffs, which could fuel geopolitical fragmentation and inflation [2].

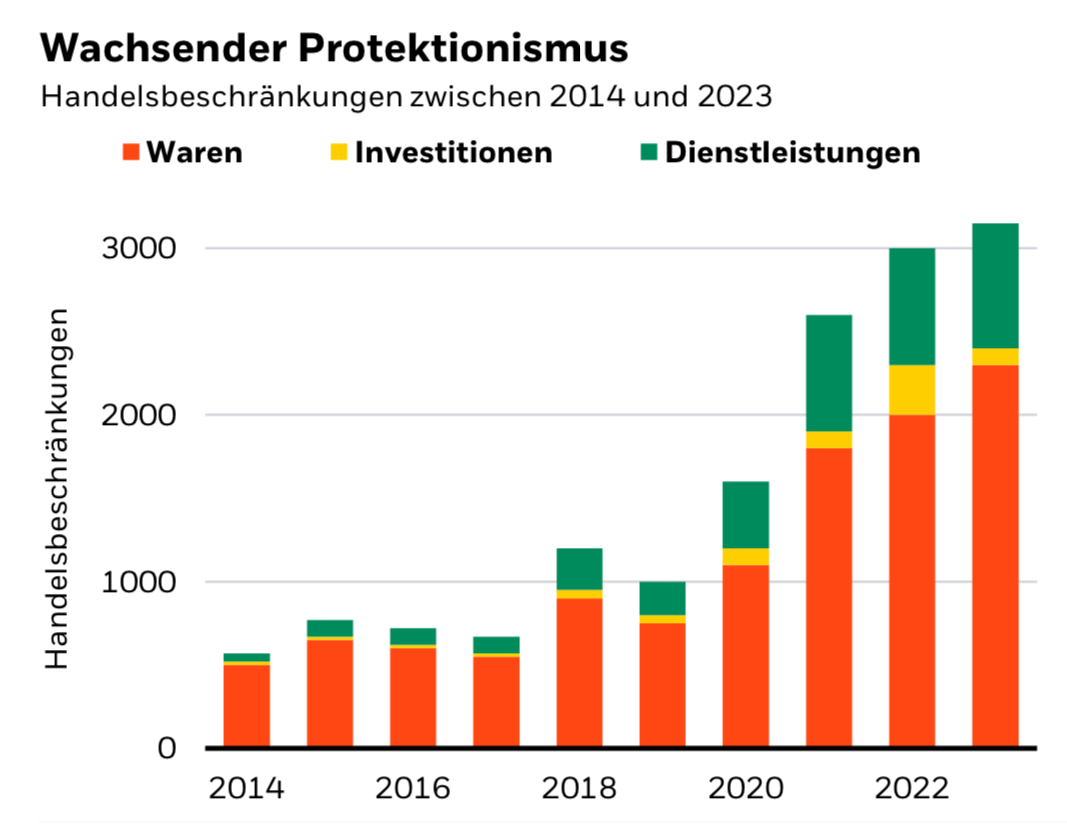

The chart below reinforces the current picture and shows the number of unilateral trade-restrictive interventions in the form of trade restrictions by countries around the globe. More and more trade restrictions have been imposed worldwide in recent years. The globalization that defined the period after the Second World War is giving way to increasing protectionism.

Fig. 8: Growing protectionism - trade restrictions between 2014 and 2023

Source: BlackRock Investment Institute

If a government lets macroeconomic stabilization measures such as fiscal policy framework conditions and inflation targets slide, the financial markets could be left with the task of demanding more fiscal policy [2].

- 7 . Growing fragmentation

Competition between the US and China is likely to intensify in 2025 as more tariffs and measures to protect strategic sectors, especially cutting-edge technologies such as semiconductors, are expected. Competitive advantages in the race to expand AI will also depend on how quickly infrastructures such as power grids and data centers can be built [2].

Energy supply is also of central importance. China's low-cost, low-carbon technologies, particularly electric cars, solar panels and batteries, are putting pressure on companies in other major economies and triggering protectionist reactions. Europe's car manufacturers are feeling the pressure, while Brussels is looking for a coordinated response [2].

The rerouting of shipping routes since 2023 also reflects the severity of the increasing conflict in the Middle East, which is leading to a shift in trade flows away from the Suez Canal (see Fig. 9)

Fig. 9: Relocation of shipping routes - daily transit traffic, 2023 - 2024

Source: BlackRock Investment Institute and IMF with data from UN Global Platform and PortWatch, December 2024

- 8 . Investment estimates for 2025

In view of the findings, BlackRock is increasing its overweight in US equities. BlackRock also remains overweight Japanese equities and sees opportunities from a tactical and strategic perspective [2], similar to those already indicated by Goldman Sachs [1]. Among the emerging markets, India and Saudi Arabia are mentioned, which are caught up in the megatrends. In individual sectors, the focus continues to be on technology and healthcare.

The following table provides a good summary of the possible positioning and orientation:

Table 1: Six to twelve month tactical views on selected assets and major asset classes and our positioning in December 2024

Source: BlackRock Global Outlook 2025

- 9 . Personal approach: Core satellite

What is my personal takeaway? I am sticking to my tried-and-tested "core-satellite" strategy. The FTSE All-World$VWRL (-0.41%) forms the core of my portfolio with its broad diversification. Despite the high proportion of US equities, I still feel well positioned here and benefit from the expected outperformance.

My Nasdaq 100 $CSNDX (-0.41%) complements the focus on the tech sector and takes the AI rally and future trends with it. For the time being, I am refraining from additional investments in individual stocks from areas such as cloud computing, semiconductors or renewable energies. Together, the two ETFs make up around 70% of my portfolio and form a solid core that lets me sleep soundly.

Further stability is provided by individual stocks such as McDonald's $MCD (+1.5%) Coca Cola $KO (+1.3%) and Munich Re $MUV2 (+0.86%) which shine with defensive characteristics and are less dependent on valuation increases.

LVMH $MC (-3.04%) , Waste Management $WM (+3.61%) and Siemens $SIE (-1.27%) out of conviction and personal interest. And yes, Bitcoin $BTC (-3.13%) should not be missing, the speculative volatility is simply fun 🙂. The Tonies SE $TNIE (-0.52%) is my speculative outlier: a deliberate risk, but one that I believe has a lot of potential. Maybe I'll write a longer article about this in the future.

What remains? I'm relatively sure about my core. However, in view of the investment horizon of several decades, I need to think more carefully about whether the weighting and selection of satellites should ultimately be more closely aligned with potential "megatrends". I feel well positioned for the next stock market year, although FOMO still regularly kicks in for me too.

- How did you feel in 2024 and what lessons have you learned for this year? Be bolder and take more chances, or would you rather be more defensive?

- What are you most looking forward to this year?

- How do you rate the current valuations?

- What other risks do you see in the dynamic global environment?

Take your pick 😬

Thanks to everyone who has read this far!

#2024

#2025

#goldmansachs

#blackrock

#megatrends

Sources & Links:

[1] Goldman Sachs (2024) 2025 Outlook: The Year of the Alpha Bet

https://www.goldmansachs.com/pdfs/insights/goldman-sachs-research/2025-equity-outlook-the-year-of-the-alpha-bet/2025Outlook.pdf

[2] BlackRock (2025) Global Outlook 2025 https://www.blackrock.com/de/professionelle-anleger/literature/brochure/blackrock-bii-ausblick-2025-pc-de-at.pdf

[3] Stock finder: This is how expensive the S&P 500 is

https://aktienfinder.net/index-profil/SP%20500-Index

[4] ishares portfolio key data for the S&P 500 Equal Weight UCITS ETF https://www.ishares.com/de/privatanleger/de/produkte/328658/ishares-s-p-500-equal-weight-ucits-etf?switchLocale=y&siteEntryPassthrough=true

[5] Invensco S&P 500 Equal Weight ETF Key Statistics https://shorturl.at/jL05h