$MUM (-0.2%) very interesting at first glance. A company with 3.8% dividends and very strong dividend growth in the technology sector...

In the last financial year, the values deteriorated... starting with sales.

Posts

26$MUM (-0.2%) very interesting at first glance. A company with 3.8% dividends and very strong dividend growth in the technology sector...

In the last financial year, the values deteriorated... starting with sales.

The DZ Bank analysts have drawn up two lists of shares that they consider to be particularly attractive. For more defensive investors and for investors who rely on continuous cash flows, they recommend the so-called "dividend aristocrats": In other words, companies that have regularly paid and raised dividends.

Top dividend aristocrats:

Pfizer $PFE (-0.35%), Verizon $VZ (+0.48%), BNP Paribas $BNP (+0.1%)Zurich Insurance $ZURN (+1.2%), Enel $ENEL (+1.44%), Sanofi $SAN (-0.18%), Hannover Re $HNR1 (+0.84%) , Man and Machine $MUM (-0.2%), Generali $G (+2.07%) and Allianz $ALV (+0.18%)

Another list has been compiled for investors with a somewhat higher risk appetite: Stocks with attractive dividend yields and additional share price potential. These not only pay a good dividend of at least three percent, but could also increase significantly in price in the future. However, the continuity of dividends in the past plays a lesser role - and this strategy is correspondingly riskier.

Top dividend rockets:

Man and machine $MUM (-0.2%) , Cancom $COK (+2.02%), Bastei Lübbe $BST (-1.31%), Sixt $SIX2 (+4.95%), Kontron $KTN (+0.98%), Fresenius Medical Care $FME (-2.32%), Vonovia $VNA (-1.52%), Hawesko $HAW (-0.24%), ElringKlinger $ZIL2 (+3.73%) and Hannover Re $HNR1 (+0.84%)

Source text (excerpt) & graphic: World | AAA, 19.02.2026

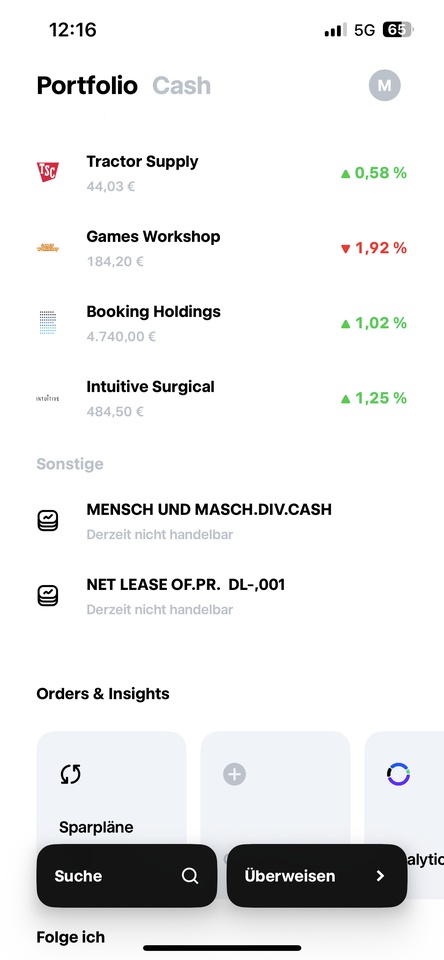

The idea of further diversifying my portfolio had solidified somewhat in recent weeks. $IREN (+11.14%) I left it at my self-imposed partial sell target of EUR 55 and started to build up the first positions on Friday. I am sticking to my target of investing around EUR 5k in each position. $IREN (+11.14%) remains in the portfolio with 500 shares and will (probably) not be touched in the near future. $DEFI (+3.33%) Now also full with 5,500 shares.

19k liquidity left and will still be invested in top-ups + new shares.

Individual shares are now:

$DSFIR (-1.48%) possibly increase

$MUM (-0.2%) possibly increase

$FSLR (+0.8%) Increase if necessary

$NICE Increase if necessary

Does anyone else have an idea for a share, possibly also from the German-speaking region? The Asian region would also be very interesting, although I am looking a little at $1810 (+4.11%) look at.

vg and have a nice WE

Micha

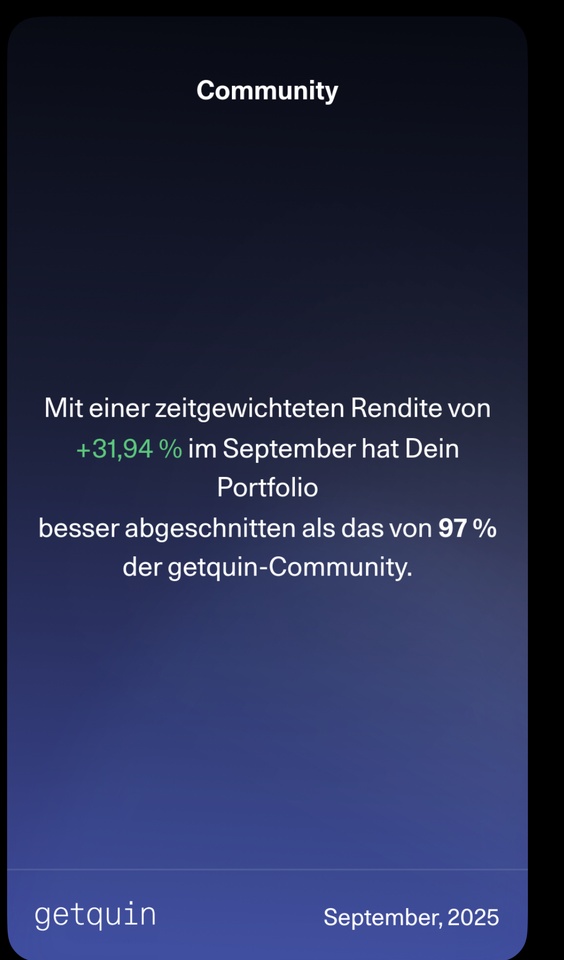

After September also provided a decent return, I'm hoping for 150k at the end of the year. I have also recently started betting on a boost of $DEFI (+3.33%) . $KSPI (-2.18%) is out for me with +20% after a good run.

A bit of "stability" is provided by $DSFIR (-1.48%) and $MUM (-0.2%) although I hope to have bought them at a relatively low level. We will see...

Otherwise, onwards:

good investment to all!

Hi everyone, can someone answer what this is? Do you mean the man and machine.div.cash at TR? $MUM (-0.2%)

The EBIT margin increased significantly from 16.7% to 24.4%, which is primarily due to the successful conversion of the Autodesk business model. Sales amounted to EUR 66.02 million (previous year: EUR 100.87 million), whereby the decline was expected due to the new commission rule in the Autodesk business. Gross profit fell only slightly by 1.5% to EUR 49.44 million, while net profit reached EUR 10.39 million, the second-best figure of all time

Outlook and targets: The ambitious targets for 2025/26 were confirmed: For 2025, M+M expects gross profit to grow by 5-7% and EBIT and EPS to increase by 9-19%. For 2026, a further acceleration with 8-12% gross profit growth and 13-25% EBIT/EPS growth is forecast. The dividend is expected to rise to 205-215 cents in 2025, with a further increase planned for 2026

Strategic development: The internal investments in new IT systems and the external conversion of the business model are having an impact. The company continues to focus on organic growth and strict cost management, which is reflected in its high profitability

Conclusion: M+M has started the year with a very strong quarter, confirming its ambitious targets and benefiting sustainably from the recent changes to its business model. There are currently no negative surprises, but rather a continuation of the success story

$MUM (-0.2%)

https://www.mum.de/investor-relations/investor-relations-deutsch/unternehmensmeldungen/2025-04-23

My goal is to beat the market, I'm still relatively young and want to see if I can do it, if not I'll put everything in an etf in 5 years.

Regarding my portfolio, I currently have a cash ratio of 23-25% depending on the fluctuations in the last month.

Purchases of existing stocks:

I plan to increase the financial stocks by 50%, $CG (+0.4%)

$KKR (+2%)

$APO (+3.68%)

$TPG (+2.36%) .

In addition, a little $DMP (+1.45%) by 25%.

Sales:

I made the mistake of wanting to $EVO (+2.69%) and $CPRX (+2.91%) trade, but then I was too greedy.

I am convinced of both positions in the long term but not in this size in the portfolio, which is why I will reduce both stocks by 33%.

Potential purchases:

$HALO (+0.53%)

$CUV (-2.1%) - Will invest a little extra, otherwise just the 33% from sale of $CPRX. Both around 50 - 50

$SL (+1.64%) - the same as $TISG (+0%)

$KSPI (-2.18%) - about as high as $MUM (-0.2%)

$FIH.U (+0%) - about as high as $MUM (-0.2%)

$2GB (+2.73%) - about as high as $MUM (-0.2%)

$M12 (-2.79%) - about as high as $MUM (-0.2%)

$CPR (+5.24%)

$DGE (-2.07%)

$RI (-2.42%) - I'll wait and see, but I can imagine that they will develop in a similar way to the tobacco shares. Since I don't want to decide, I'll just buy three for the sum of one. And divide the amount between these 3.

In general:

I'm generally a fan of putting together baskets like with alcohol or the yacht builders.

What would you change because you see a high risk? I am relatively poorly positioned in the tech sector, do you have any other titles that I could take a closer look at in this area?

You like to hear that:

Dividend 185 cents/+12%- 75 cents without tax deduction

- Medium-term target: doubling profits in 4-5 years.

The share has even fallen. Maybe there will be another buy. $MUM (-0.2%)

Top creators this week