Because sometimes lower expectations mean higher long-term upside

Flutter dropped guidance and the stock instantly reacted like someone kicked out the power cable of the casino. The WSJ framed it as a soft consumer story, analysts panicked a bit, and the market decided to punish the stock for daring to invest in itself. But honestly? I like it. Actually, I like it a lot. So much so that I initiated a buy today and made it a mid-size position in my portfolio.

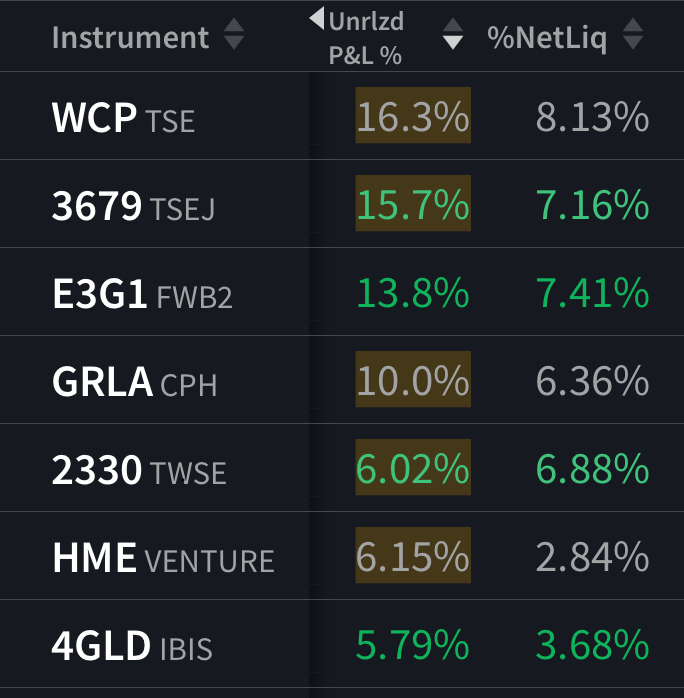

I sold half my Evolution position today (around 5k) and rotated straight into Flutter, not because Evolution suddenly turned into a bad company, far from it actually, it’s another company that is experiencing an overreaction right now, but because the risk/reward imbalance in gaming is shifting, and Flutter is sitting right at the center of everything I find exciting about this space.

Look around for a second and you see that Polymarket is booming, Kalshi is booming, prediction markets are going mainstream at a pace nobody would’ve expected a year ago, the U.S. betting environment is normalizing, and the big players are entering with real conviction. The market is expanding, and whenever the pie grows this fast, you want to own the company holding the biggest knife. And surprise, surprise, that’s Flutter. FanDuel is still the monster in the U.S., the international footprint is huge, and the ecosystem is beginning to look like the AWS of gambling, positioned as the default option.

I appreciate that Flutter isn’t pretending this year is perfect. Free cash flow is dipping because they’re spending heavily, but spending on the right things is completely justifiable. Revenue growth is projected in the mid-teens for the next few years, FCF is expected to take off after this investment-heavy year, and even though debt sits around 3× EBITDA, it’s manageable and temporary. FCF yield is around 3% now, but closer to 7% by 2027, and the valuation sits at historical lows. That combination doesn’t come around often, especially for a company this dominant with strong growth prospects ahead.

Analysts keep trying to spin this as a “cautionary” story, but the fundamentals are screaming the opposite. To be fair, even the consensus among analysts is more than 60% upside from the current levels, so despite slightly negative comments on a few fronts, the majority remains bullish on the stock. This is exactly what long-term winners look like: They sacrifice a bit of momentum to expand the moat for the future. They take the hit now to reap the rewards for the next decade. The companies that don’t invest aggressively in a time of change, just to please some short-sighted shareholders, will be the first losers of the future.

So yes, the stock dipped. And yes, the headlines are full of negativity. But I don’t buy into noise and short-term momentum. I buy narratives with long runways, and Flutter is building something much bigger right now with a betting ecosystem that is the strongest it has ever been.