$MNDY (+0.21%)

$TSN (-1.02%)

$OXY (+2.14%)

$WULF (-8.81%)

$PLUG (-7.14%)

$RKLB (+0.84%)

$CRWV (-1.87%)

$9984 (-3.24%)

$IOS (+4.54%)

$MUV2 (-1.26%)

$SE (-3.65%)

$NBIS (-5.5%)

$RGTI (+0.17%)

$$BYND (+0%)

$OKLO

$IFX (-7.39%)

$EOAN (-1.11%)

$TME (+0.86%)

$VBK (-0.99%)

$HDD (-0.65%)

$ONON (-4.42%)

$JMIA (-3.96%)

$MRX (-5.9%)

$HTG (+0.89%)

$DTE (-0.64%)

$R3NK (+3.01%)

$HLAG (+2.31%)

$JD (+7.9%)

$700 (+1.49%)

$DIS (-1.07%)

$ENEL (-1.23%)

$AMAT (-5.5%)

$NU (-0.93%)

$ALV (-1%)

$SREN (-1.5%)

$BAVA (-1.74%)

- Markets

- Stocks

- Heidlbrger Druck

- Forum Discussion

Heidlbrger Druck

Price

Discussion about HDD

Posts

13Quarterly figures 10.11-14.11.25

Setback after figures: Entry opportunity or warning signal?

Two days ago I wrote about the strategic transformation of $HDD (-0.65%) from from a traditional mechanical engineering company to a focused provider for system integration, digitalization and now also defence supply. The market's reaction was strong: +30 % daily increase - a strong signal.

But disillusionment came after the Q1 figuresThe share price plummeted, currently around -8 % in one dayfrom the high.

Why this abrupt market reaction?

After the +30 % rally day, the drop was large. Many market participants had expected spectacular figures - not just "solid" ones. The order intake was noticeably below the previous year's figure (Drupa special effect), which disappointed some.

The entry into the defense business is also not yet reflected in the figures - which may have led to some profit-taking.

In addition, the share was technically heavily overbought - so a setback was almost inevitable.

But was the report really that bad?

My classification:

- Incoming orders: € 559 million (previous year: € 701 million) → Decline of -20%, but: Q1'24 was exceptionally strong due to the drupa trade fair (special effect)

- Sales: € 476 million (previous year: € 403 million) → +18% growth

- EBITDA margin:+4.4 (previous year: -2.3%) → Profitability is restored

- EBIT: € +1.9 million

(previous year: € -27.9 million) → Strong improvement of € 29.8 million - Outlook for 2025/26 confirmed - Management remains at € 2.35 billion sales & approx. 8% EBITDA margin → Strong signal of confidence

Looking ahead to Q2 and H2:

- Orders from Q1 are likely in Q2 sales and margins in Q2 become effective

- Efficiency measures & personnel restructuring (e.g. segment structure) will begin to have a noticeable effect this year, according to management to have a noticeable effect

- New business areas such as defense supply and the system integration via Polar Mohr start operationally - Scaling expected from H2

- Vincorion partnership and the growing packaging division (Boardmaster) could provide additional provide an additional boost to sales and earnings deliver

Langfrist-Ausblick (2026–2028):

- Clear segment responsibility, focus on digital services & defense supply

- Strategy "Margin before volume" is consistently implemented

- CEO Otto possesses turnaround experience & clear implementation power

- $HDD (-0.65%) is still a second-line stock - but with potential for structural revaluation

My conclusion:

I personally hold my position and plan additional purchases in trancheswhen setbacks open up opportunities.

Prices of € 3-5 by 2026/2027

are realistic if the strategy is successfully implemented - possibly even more if the defense branch is scaled.

👉 How do you see it? A setback after a rally or an entry opportunity with substance?

Feel free to comment - I look forward to hearing your views!

Heidelberger Druck (HDD) - From machine manufacturer to defense play? 🚀

What a ride! Who would have thought that the good old $HDD (-0.65%) could change like that?

I've had the share in my portfolio for a while now - I got in shortly after the new management under Mr. Otto took over. At the time, I came across an article that emphasized that Otto has experience with restructuring and turnarounds. Shortly afterwards, he presented his strategy - plausible, structured, comprehensible.

At that time with a small stakeas a test balloon, so to speak: 🎈

"If the plan works, I'll go for it. If not, the learning curve is manageable."

Because for me, such investments are more long-term long-term - with a view to strategy, structure and market opportunities.

Last week's Annual General Meeting:

A clear signal to the shareholders - we are on the right track, both operationally and strategically. The outlook for 2025? Surprisingly strong.

The Executive Board is acting very differently today than just a few years ago - with with noticeable self-confidence.

And immediately afterwards, the next strategic step:

$HDD (-0.65%) Acquires the technology and brand rights from Polar Mohr - an important step towards system integration. Focus: digitalization, automation, lifecycle services.

Important: No production takeover, but full control over sales, brand, service and IP.

A smart deal with clear leverage on margins, customer loyalty and internationalization.

And today the bombshell:

+30 % daily gainstrong volume, lots of momentum - even before the Q1 figures on 31.07.

Reason: The entry into the defense business - not as a weapons manufacturer, but as a as a high-precision supplier for defense technology.

A clever move: budgets rise, demand increases - and HDD delivers what is needed.

My conclusion:

$HDD (-0.65%) is (still) a second-line stock - but with turnaround potential and real future fantasy:

Industry 4.0, automation, now armaments.

If the Q1 figures confirm the momentum, prices above € 2.00 could be just the beginning.

What do you think? Already invested? Observer? Or is it all too hot for you? 🔥🤔

Where is the Getquin community ? ^^

Quarterly figures for EU companies on 01.08.2024

Hugo Boss +++ DHL +++ Symrise +++ BMW +++ Volkswagen +++ and many more

Heidelberger Druck $HDD (-0.65%) achieves sales of €403 million (previous year: €544 million), EBITDA (adjusted) of -€9 million (previous year: +€41 million) and a net result of -€42 million (previous year: +€10 million) in the 1st quarter. Forecast confirmed.

HUGO BOSS $BOSS (-0.67%) achieved sales of €1.015 billion in the second quarter (previous year: €1.026 billion, preliminary figures from July 15: €1.015 billion), EBIT (final) of €70 million (previous year: €121 million, preliminary: €70 million) and net profit of €37 million (previous year: €75 million).

Symrise $SY1 (-0.03%) achieved sales of €2.57 billion in the first half of the year (previous year: €2.41 billion, analyst forecast: €2.56 billion), EBITDA of €529.8 million (previous year: €446 million, forecast: €526.1 million) and net income of €239.5 million (previous year: €187.5 million, forecast: €251.2 million). Outlook for 2024 confirmed.

BMW $BMW (-2.17%) achieves Q2 revenues of €36.9 billion (previous year: €37.2 billion, analyst forecast: €37.4 billion), EBIT (Group) of €3.88 billion (previous year: €4.34 billion, forecast: €3.95 billion) and Group net profit of €2.71 billion (previous year: €2.96 billion, forecast: €2.62 billion). Outlook for 2024 confirmed.

Volkswagen (VW) $VOW (-3.38%) achieved sales of €83.3 billion in the second quarter (previous year: €80.1 billion, forecast: €81.9 billion), an operating profit of €5.46 billion (previous year: €5.60 billion, forecast: €5.38 billion) and earnings after tax of €3.63 billion (previous year: €3.79 billion). In the outlook for 2024, VW confirms the forecast for sales and deliveries.

Klöckner & Co $KCO (+0.18%) achieved sales of 2.3 million tons in the first half of the year (previous year: 2.1 million tons), EBITDA before material special effects of €83 million (previous year: €130 million) and net income from continuing operations of -€26 million (previous year: €39 million). In the outlook for 2024, the company expects a slight decline in sales compared to the previous year and EBITDA before material special effects of €120 million to €180 million.

DHL $DHL (+1.07%) achieved revenue of €20.6 billion in the second quarter (previous year: €20.1 billion, analyst forecast: €20.3 billion), EBIT of €1.4 billion (previous year: €1.7 billion, forecast: €1.3 billion) and net profit of €744 million (previous year: €978 million, forecast: €754 million). Outlook for 2024 and EBIT forecast for 2026 confirmed.

Merck KGaA $MRK (-2.54%) achieves final Q2 sales of €5.35 billion (preliminary: €5.35 billion), final adjusted EBITDA of €1.509 billion (preliminary: €1.509 billion) and final adjusted earnings per share of €2.20 (preliminary: €2.20). Outlook confirmed.

MTU Aero Engines

$MTX (+1.57%) achieves Q2 revenues (adjusted) of €1.755 billion (previous year: €1.57 billion), EBIT (adjusted) of €193 million (previous year: €242 million, analyst forecast: €223 million) and net profit of €185 million (previous year: €143 million, forecast: €163 million). Margin forecast for 2024 raised to around 13% (previously: more than 12%) Outlook for sales, adjusted EBIT margin and FCF confirmed.

Daimler Truck

$DTG (-1.94%) achieved order intake of 92,569 vehicles in Q2 (previous year: -5%), revenue of €13.3 billion (previous year: €13.88 billion), EBIT (adjusted) of €1.17 billion (previous year: €1.43 billion) and earnings per share of €0.93 (previous year: €1.11).

Edit:

this is 1:1 the same text: why does everyone of you have to post it?

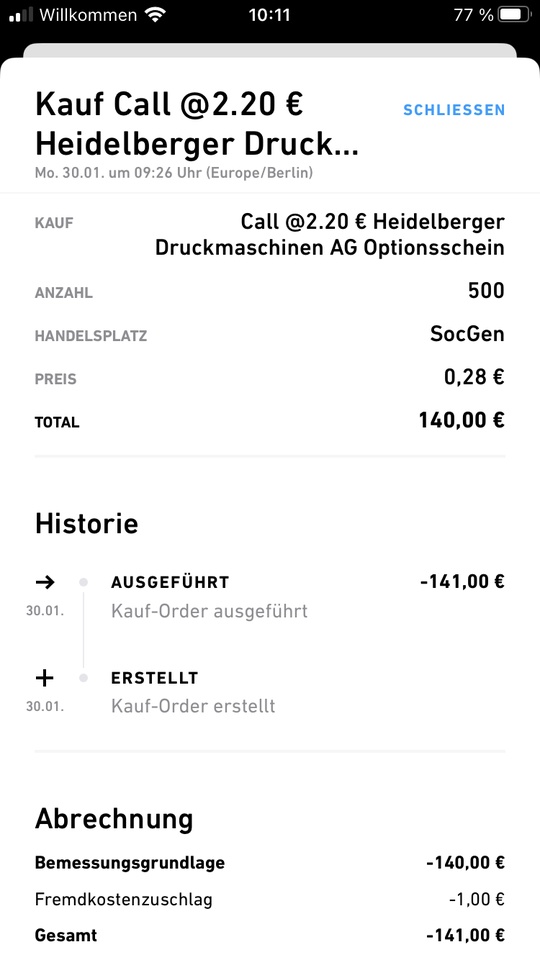

I have just gone long in $HDD (-0.65%) gone. Last Friday, the value has broken out nicely under very high volume. In addition, it is not impressed by the market weakness this morning.

What do you think?

Quarterly figures on 09.11.2022....

Pocket money for the kids only in Robux, that's the Roblox Währung⤵️

The market currently really forgives no slip-ups in the numbers! You can see that again today:

$RBLX (-3.52%)

Roblox:

misses analyst estimates of -$0.30 in the third quarter with earnings per share of -$0.50. Sales of $517.7 million below expectations of $690.79 million.

$TTD (-2.17%)

The Trade Desk Inc:

Surpassed analyst estimates of $0.22 in the third quarter with earnings per share of $0.26. Revenue of $394.77 million exceeded expectations of $385.98 million.

$ADS (-1.52%)

adidas:

Posts Q3 sales of €6.40 billion (PY: €5.75 billion), gross profit of €3.14 billion (PY: €2.88 billion), operating profit of €564 million (PY: €672 million), pre-tax profit of €411 million (PY: €629 million). In its outlook for fiscal year 2022, adidas now expects low-single-digit percentage sales growth for the overall company on a currency-neutral basis. The company expects a gross margin of around 47.0% in 2022. Operating margin in 2022 is expected to be around 2.5% according to the new expectations and profit from continuing operations to reach a value of around €250 million.

$SIX2 (-1.81%)

Sixt:

Achieves Q1-3 revenue of €2.32 billion (PY: €1.63 billion, analyst forecast: €2.32 billion), EBT of €506.3 million (PY: €317.4 million, forecast: €496 million). In its outlook for 2022, Sixt now expects to achieve the upper forecast range for EBT.

$DEZ (-4.01%)

DEUTZ:

Achieves Q3 sales of €465.4 billion (PY: €403.2 billion), order intake of €442.1 million (PY: €485.2 million), Ebit (adjusted) of €23.3 million (PY: €14.1 million), free cash flow of -€45.1 million (PY: +€5.5 million) and net income of €17.1 million (PY: €10.4 million). In its outlook for 2022, the company now expects unit sales of between 175,000 and 185,000 DEUTZ engines, leading to revenue growth to between €1.75 billion and €1.85 billion. The adjusted EBIT margin is expected to be in a range of 4.5 to 5.0 percent. Free cash flow is expected to be in the low to mid double-digit negative million euro range.

$LXS (-18.72%)

LANXESS:

Posts Q3 sales of €2.185 billion (PY: €1.58 billion, analyst forecast: €2.0 billion), Ebitda (Pre Ex) of €240 million (PY: €229 million, forecast: €237.6 million) and net income of €80 million (PY: €74 million). In the outlook for 2022, the company expects Ebitda (adjusted) of €0.90 to €0.95 billion (previous year: €0.90 to €1.0 billion, forecast: €942 million).

$HDD (-0.65%)

Heidelberger Druck:

Achieves 2nd quarter sales of €590 (previous year: €542 million), incoming orders of €622 million (previous year: €593 million), Ebitda of €68 million (previous year: €60 million), Ebitda margin of 11.6% (previous year: 11.0%), and net profit of €39 million (previous year: €27 million). Outlook for 2022/2023 confirmed.

$BNR (-2.55%)

Brenntag:

Reports Q3 sales of €5.1 billion (PY: €3.738 billion, analyst forecast: €4.6 billion), Ebitda (adjusted) of €459.7 million (PY: €342.9 million, forecast: €453 million) and net profit of €248.8 million (PY: €161 million). Profit outlook for 2022 confirmed.

$EVT (-1.25%)

Evotec:

Achieves Q1-3 revenues of €510.8m (PY: €431m, forecast: €520.5m), Ebitda (adjusted) of €44.6m (PY: €70.1m), 2022 outlook and mid-term targets confirmed.

$CBK (-2.79%)

Commerzbank:

Reports Q3 revenues of €1.886 billion (PY: €2.006 billion, analyst forecast: €1.780 billion), an operating profit of €282 million (PY: €472 million, forecast: €137 million) and a net profit of €195 million (PY: €403 million, forecast: €116 million). Loan loss provisions were reported at €84 million in Q3 (PY: €22 million, forecast: €133 million). Commerzbank expects 2022 loan loss provisions of around €700 million, a CET1 ratio of over 13.5%; net interest income of over €6 billion and net profit of over €1 billion (forecast: €1.18 billion). Further dividend of 30% of net profit after deduction of AT-1 planned. In the outlook for 2024, Commerzbank sees operating profit rising from €3.0 to €3.2 billion, with earnings guidance now expected at €10 billion (previously: €9.1 billion).

$SHL (-0.72%)

Siemens Healthineers:

Reports Q4 sales of €6.0 billion (previous year: €5.16 billion, outlook €5.8 billion), Ebit (adjusted) of €1 billion (previous year: €0.793 billion, analyst forecast: €0.977 billion) and net income of €636 million (previous year: €466 million). In the outlook for 2022/2023 the company expects adjusted earnings per share of €2.00 to €2.20 (forecast: €2.23). Proposed dividend 2021/2022 of €0.95 (PY: €0.85) per share. Diagnostics business to be restructured.

$EOAN (-1.11%)

E.ON:

Reports Q1-3 sales of €81.6 billion (PY: €48.1 billion), Ebitda (adjusted) of €6.1 billion (PY: €6.3 billion) and net income of €2.1 billion (PY: €2.2 billion). E.ON confirms outlook for 2022 at Group level.

#investieren

#aktien

#aktie

#börse

#boerse

#community

#communityfeedback

#news

#newsroom

#lernen

#wirtschaftswachstum

#quartalszahlen

#dividende

#finanzen

#eon

#roblox

#adidas

#thetradedesk

Heidelberger Druckmaschinen AG - Sustainable Turnaround?

Since December 20, 2021, Heidelberger Druck is back in the SDAX after one and a half years and wants to create a new business segment to complement the weakening classic business, in which it is slowly getting back on track.

For the new e-mobility business area, the company is relying on the charging station technology of the utility EnBW.

The production of wallboxes will not only attract private customers who charge their cars at home, but above all municipal utilities, local authorities and companies.

Heidelberger Druck has already established itself as one of the leading suppliers of wallboxes with sales in Austria and Switzerland, demonstrating its international competitiveness.

Following strong growth in the 1990s, the Heidelberg-based company has had to contend with declining sales since the beginning of the 2000s, which was exacerbated by the slump in the advertising industry following the September 11 attacks and the financial and economic crisis in the spring of 2008.

The strong growth did not prove to be sustainable and Heidelberger Druck had to undertake a number of sales and restructurings. In addition, RWE sold its stake in the company in 2004.

With its basic business of sheetfed offset presses, with a market share of over 40%, it is the market and technology leader in the printing industry. Together with the restructuring measures of recent years and the new business area, Heidelberger Druck aims to be more effective and flexible.

In your opinion, will the sustainable growth now work out and would the share be a buy for you or would it at least get a place on your watch list?

Current share price: 2.65€

Performance 1 year: +230.6%

Performance 5 years: +3.5%

_______

No investment recommendation

Sources: finanzen.net,

heidelberg.com

Trending Securities

Top creators this week