$MEUD (+0,57 %) Rest sold,

shifted into the $IMEU (+0,56 %) I had already shifted out of cash👀 (is that still called shifting? )

3xGTAA

$DE000LS9U6W1 (+1,77 %) increased by 3 shares 🥂

and another additional purchase at 0815 Futzi

Postes

113$MEUD (+0,57 %) Rest sold,

shifted into the $IMEU (+0,56 %) I had already shifted out of cash👀 (is that still called shifting? )

3xGTAA

$DE000LS9U6W1 (+1,77 %) increased by 3 shares 🥂

and another additional purchase at 0815 Futzi

Hi folks,

I'm about to make a major strategic change to my portfolio this month. I have cracked the €120,000 mark 🎉 and have taken this as an opportunity to weatherproof my allocation for the coming years.

Here is my roadmap:

1. the tax "life hack": FIFO optimization 💡

I stop my previous core ETFs ($VHVG (+1,48 %) , $MEUD (+0,57 %) , $EXCH (+1,14 %) ) and leave them untouched. Why? In Germany, the FIFO principle (First-In-First-Out) applies. By saving new ISINs from now on (MSCI World ex-USA, NASDAQ 100 & MSCI EM), I "protect" my old shares with the high book profits. Later, I can sell the younger tranches first with less profit and massively defer the tax burden.

2nd core update: USA cap & EM limits 🌍

From now on, my core (approx. 74% of the portfolio) will be re-saved with €280 per month. I love US performance, but don't want any bulk risk:

USA cap: maximum 55% in the core.

Emerging markets: cap at 10%

3. satellite & venture: my high-conviction stocks

This area should make up 20% of my portfolio. Here I invest €400-600 per month in themes that I absolutely believe in. Currently in focus:

Cloudflare ($NET (+3,36 %) ): Infrastructure & cybersecurity are the basis of everything for me.

Siemens Energy ($ENR (+2,4 %) ): My play on the energy transition and grid expansion.

Hims & Hers ($HIMS) (+5,28 %)Exciting disruptor in the telehealth sector.

Tech from the Far East: With Xiaomi ($1810 (-1,4 %) ) and CATL ($3750 (+0,52 %) ) I cover important future markets.

Coinbase $COIN (+13,16 %) complements my direct Bitcoin holdings (target: 3.5% crypto share of the overall portfolio).

Other additional stocks are $NBIS (+2,88 %) , $000660 and $RKLB (+2,11 %)

4. the big goal: retirement in 2054 🏁 or perhaps even earlier

The math is done: I am aiming for a final capital of around € 780,000 by 2054. With a sustainable withdrawal rate of 4%, this will give me a monthly pension of around €2,600 without having to deplete the capital stock in the long term, thus closing my pension gap. It should be mentioned in the calculation that I calculate with a 5% return per year instead of the expected long-term return of 7-8% and therefore include a safety factor.

The whole thing is rounded off with a 3% share of gold (Euwax Gold II) and 17% bonds as a safety anchor.

What do you think of the FIFO tactic? Do you also use different ISINs for the same market in order to remain flexible in terms of tax, or is that too much "portfolio messing around" for you? 😉 And what do you think of my selection in the venture sector?

My portfolio is currently too heavily weighted towards the US, so I bought a tranche of the Stoxx 600.

European equities have somewhat passed me by in 2025. However, a strong performance is still expected in 2026, if only because of fiscal policy incentives.

As an ardent European, I'm all the more pleased about the purchase 🇪🇺

Hello everyone,

after almost 1 1/2 years as a silent partner on gq, I have decided to have my portfolio taken apart 😋

A few words about me and then about my portfolio.

I am 31 years old, live with my girlfriend and our 4-month-old son in the heart of Bavaria in our small home.

My girlfriend and I both work as employees in an automobile company. (She is currently on parental leave, of course)

About my portfolio.

I started my investment career with physical precious metals and shortly afterwards with cryptos.

When it came to cryptos, I got carried away by friends, I didn't know my way around them back then (I probably wouldn't take such a risk today). Fortunately, this turned out to be a good thing in hindsight.

A good three years ago, I added the first of what are now three portfolios with different strategies.

Depot (presumably for retirement)

$IWDA (+0,6 %) / $MEUD (+0,57 %) / $CSPX (+0,6 %) / $EXS1 (+0,63 %) / $EIMI (+0,75 %) / $WSML (+0,88 %)

2.dividend deposit (for cash flow as a reward on the joint account)

$HMWO (+0,57 %) / $ISPA (+1,12 %) / $TDIV (+0,43 %) / $VFEM (+0,51 %)

3.JuniorDepot

$VHYG (+0,44 %) / $VWRL (+1,33 %) as an accumulator.

Both ETFs are being saved in because the grandparents are financing one of them and I would like to keep them separate and not open an extra custody account.

All custody accounts are saved monthly.

So much for me and my portolio.

I would be very happy to receive any criticism, suggestions for improvement or similar and wish everyone happy holidays ✌🏻

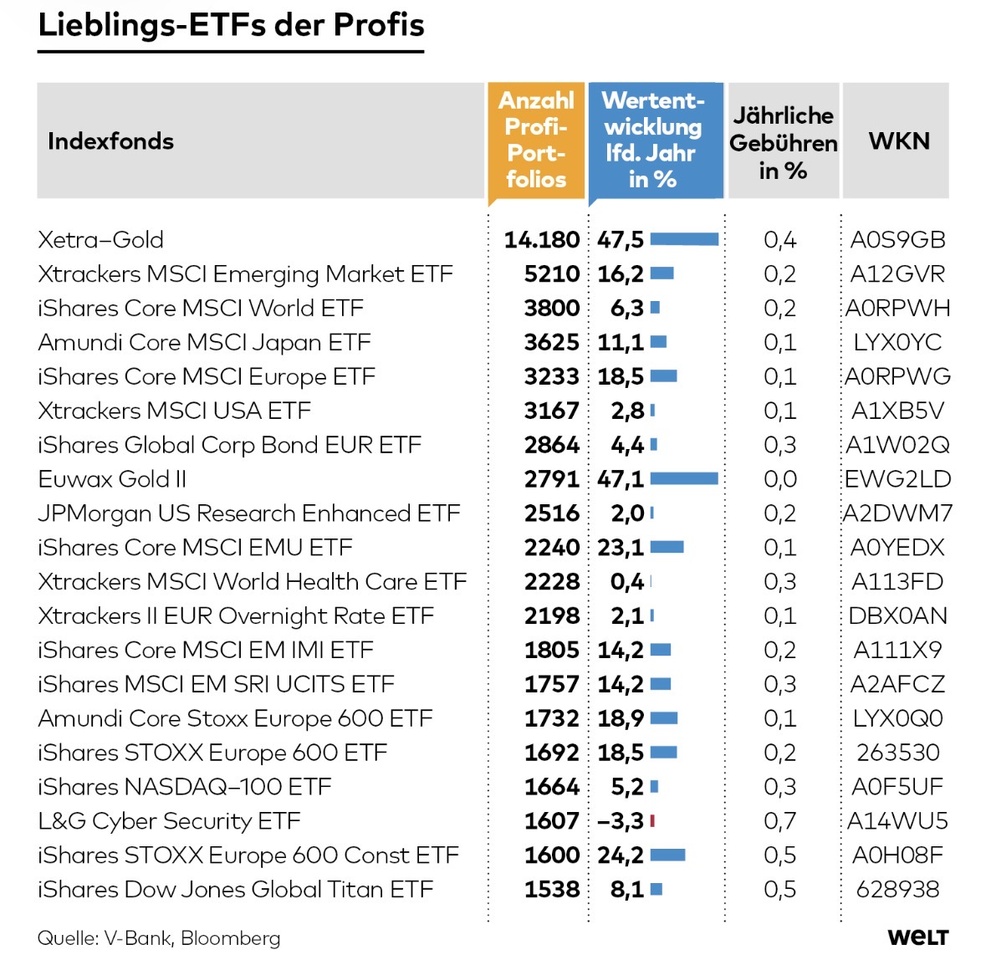

A joint analysis by V-Bank and the Institut für Vermögensaufbau provides fascinating insights. More than 53,000 custody accounts managed by 170 independent asset managers were examined. V-Bank is a custodian bank that holds the securities and carries out transactions on behalf of the asset managers.

The first thing that stands out is that index funds (ETFs) now dominate when it comes to equity vehicles. While actively managed equity funds account for a good eight percent of portfolios, more than eleven percent are invested in equity ETFs. The situation is different for mixed funds or bond vehicles. Here, the professionals still rely on the skills of fund managers, i.e. actively managed products.

When selecting their products, the professionals rely on the large, liquid battleships of the ETF world with low costs from well-known providers. The logic behind this is simple and consistent: maximum diversification at minimum cost. The ongoing charges of the favorites are usually between 0.07 and 0.20 percent. Special sustainability criteria hardly play a role in the choice of ETF.

One thing is striking in the construction of the underlying investments. In their global index funds, the professionals do not rely on combined products that combine industrialized countries and emerging markets in one ETF, such as the MSCI All Country World or the FTSE All World, but prefer to invest separately in the MSCI World and the MSCI Emerging Markets and can thus mix the two components individually. The advantage: the emerging markets are weighted very low in the combined products, and this problem can be better addressed by the professionals' strategy.

Gold is a must for the professionals. It is not high-tech shares or exotic theme funds that dominate the professional portfolios, but the oldest safe haven in financial history. Xetra-Gold is by far the most frequently represented product: the ETC is held in 14,180 professional portfolios. Alternatives such as Euwax Gold II can also be found thousands of times over. And the courage to be safe has been rewarded. While traditional stock markets only made moderate gains in 2025 - the iShares Core MSCI World is up around 6.3% - gold shone with an impressive performance of 47.5%. The message is clear: in uncertain times, gold is not jewelry, but a foundation.

To stabilize the overall portfolio, asset managers are also turning to bonds. Around 28% of assets are invested in bonds, preferably in corporate bonds with good credit ratings. In the ETF segment, the iShares Global Corporate Bond EUR is in the top 20, combining a defensive approach with current yields. In the current year, the ETF has made 4.4 percent, while many bond products are in the red. In the money market, the Xtrackers II EUR Overnight Rate ETF is the most popular ETF product. The principle of balance applies to currency risk: although the euro dominates at 53%, the US dollar is a key component of the hedge at 34%.

In the end, the professionals' figures do not tell a story of hectic changes of direction, but one of structure, cost awareness and clear priorities. Gold serves as both a protective shield and a yield driver. Equities are broadly and favorably represented via global, US, emerging market and Japanese indices. Fees are consistently kept low. And ETFs and ETCs are playing an increasingly important role: almost 20 percent of customer funds are now invested in these instruments - and the trend has been rising since 2023.

This is a reassuring realization for the overburdened private investor. There's no need to reinvent the wheel. A look at the books of the professionals shows that it is often the simple, cost-effective and broadly diversified solutions - supplemented by a good portion of gold - that point the most reliable course in a storm.

$4GLD (+0,92 %) | $EWG2 (+0,61 %) | $CSEMU (+0,66 %) | $EIMI (+0,75 %) | $MEUD (+0,57 %) | $EXSA (+0,56 %) | $XMME (+1,41 %)

Source text (excerpt) & graphic: World, 20.12.25

$VWRL (+1,33 %) 700€

$EIMI (+0,75 %) 120€

$MEUD (+0,57 %) 100 €

What does your basic/coreinvestment look like?

Due to the booking of the inherited shares from my father's portfolio, my annual rewind is heavily distorted. Nevertheless, I would like to present my surprising "top performer windfall".

$JNJ (-0,25 %) + 30.21% since the beginning of June

2nd and 3rd place go to the Europe and Emerging Markets ETFs

$MEUD (+0,57 %) +19.84% over one year

$XMME (+1,41 %) +15.8% over one year

The $VUAG (+0,56 %) I've only had it since the middle of the year, when I $XZW0 (+1,45 %) when I reallocated.

The following had a negative impact on performance $1211 (-1,41 %) and $NOVO B (-2,43 %) have had a negative effect. However, I realized the losses here for tax reasons, so I cannot state the performance for the year.

I have reallocated quite a bit this year and am already very happy with my portfolio. I still have my eye on some interesting individual stocks, but my initial goal is to get back to a 70 percent ETF share. This means that next year I will mainly continue with the savings plans, provided I can keep myself under control :)

I wish everyone in the community a Merry Christmas and a successful 2026

Hello everyone,

I am 20 and would like to build up a portfolio for long-term growth and security.

The breakdown of my monthly savings plans:

66,7% $ISAC (+1,4 %)

8,3% $WSML (+0,88 %)

8,3% $MEUD (+0,57 %)

8,3% $QDV5 (-1,2 %)

8,3% $IGLN (+0,87 %)

I would like to hear your opinion on whether you think this makes sense or would exchange/add a position or maybe you also say it is smarter to just save the $ISAC (+1,4 %) to save.

Greetings,

I generally don't think much of posts on feeds from any media, as they don't bring me any added value but merely serve to present myself. Now that I have followed the publications and reactions a bit, I think I have seen more than less constructive members here.

For this reason, I have decided to make the first post of my life here. It's not directly about sums, I just want to ask for your assessment of my savings plan and target allocation. Constructive criticism and suggestions for improvement are expressly welcome.

The whole thing is intended to reflect a core-satellite strategy with a 1:1 risk/reward ratio.

Global diversification (core) - 60%:

Individual securities (satellites) - max. 20%:

Buffer (security) - approx. 20%:

Raw materials:

Bonds:

Real estate:

My thought process should be clear. The core should cover global performance with a percentage distribution based on economic strength. Separately, the World Health Care ETF, as people are getting older and sicker and, in my opinion, the healthcare sector is not so strongly represented in the other ETFs.

For the satellites, my thought process is as follows:

Berkshire can be seen as an ETF and covers successful individual stocks.

Nothing works without energy, hence BWX (USA) and Iberdrola (Europe). I see digital security threatened by AI and the further development of data centers etc., hence CrowdStrike. Companies will always need good software to be able to expand and still keep track of things, hence HubSpot. In connection with AI and the armed conflicts in our world, I see drones as a future-oriented technology in all possible areas, hence AeroVironment. And I discovered Intellia as a medical catapult, which is admittedly a bit of a gamble, but always gets a lot of drugs into the test phase.

I don't think I need to say much about the buffers, as in my view these are the investments that remain stable or grow in difficult market phases when everything else is falling.

This gives you a little insight into my thinking and actions. Please don't tear it apart, I'm not a professional but I'm sacrificing some of my remaining free time to get a bit of an insight into the world of capital and maybe get a small slice.

I welcome any opinions and suggestions for improvement.

I wish everyone a successful week!

Best regards

Nils

Good morning everyone,

In the past, the community has clearly demonstrated that together we are an absolute added value for 🤑🤑🤑.

That's why I'm asking for your help :-) I am looking for mid-/long-term growth stocks to complement my core around $IWDA (+0,6 %)

$CSPX (+0,6 %)

$MEUD (+0,57 %)

$EIMI (+0,75 %)

$QDV5 (-1,2 %) to complement it.

Currently set are $NVDA (+1,86 %)

$GOOGL (-0,4 %)

$IBM (+3,71 %)

$SOFI (+4,11 %)

$IREN (-1,22 %)

$LMND (-0,81 %)

$RKLB (+2,11 %)

$BTC (+7,21 %) - DCA

What ideas do you have?

LG

Meilleurs créateurs cette semaine