$EVT (-0,91 %) announces the sale of its plant in Toulouse for USD 300-640 million. Probably necessary to have enough cash. Unfortunately, terrible figures were announced immediately afterwards. I should have been slightly in the black beforehand. Well, you're always smarter afterwards. Waiting is the motto here. Perhaps the royalties for the biosimilars will give the company a boost in the future. No buy recommendation for the time being in my opinion.

Discussion sur EVT

Postes

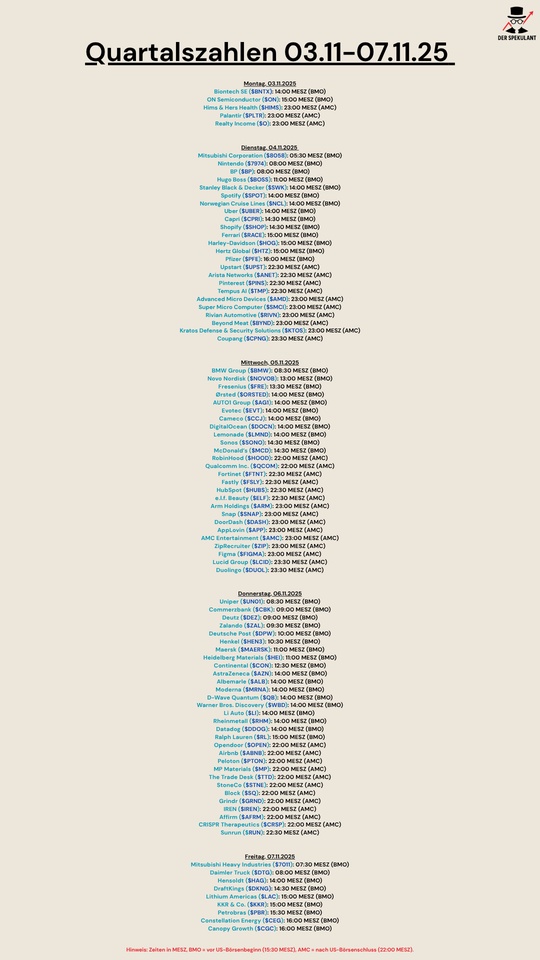

40Quartalszahlen 03.11.25-07.11.15

$BNTX (+0,67 %)

$ON (+0,81 %)

$HIMS (+1,63 %)

$PLTR (-1,38 %)

$O (-0,72 %)

$8058 (+1,31 %)

$7974 (-1,36 %)

$BP. (-0,4 %)

$BOSS (+0,16 %)

$SWK (+2,29 %)

$SPOT (-0,88 %)

$N1CL34

$UBER (+0,61 %)

$CPRI (-0,69 %)

$SHOP (-0,41 %)

$RACE (+4,18 %)

$HOG (+0,24 %)

$HTZ (-0,13 %)

$PFIZER

$UPST (+2,91 %)

$ANET (+1,2 %)

$PINS (+1,75 %)

$TEM (-2,87 %)

$AMD (+9 %)

$SMCI (+1,32 %)

$RIVN (+1,73 %)

$BYND (+4,24 %)

$KTOS (-1,14 %)

$CPNG (+0,13 %)

$BMW (+0,76 %)

$NOVO B (-3,22 %)

$FRE (-3,17 %)

$ORSTED (+4,29 %)

$AG1 (+0,41 %)

$EVT (-0,91 %)

$CCO (+2,8 %)

$DOCN (+5,75 %)

$LMND (+2,82 %)

$SONO (-0,63 %)

$MCD (-0,02 %)

$HOOD (+2,2 %)

$QCOM (+2,95 %)

$FTNT (+0,02 %)

$FSLY (+3,78 %)

$HUBS (+6,06 %)

$ELF (+4,5 %)

$ARM (+3,13 %)

$SNAP (+0,96 %)

$DASH (+0,15 %)

$APP (+3,37 %)

$AMC (+1,52 %)

$ZIP (+10,94 %)

$FIG (+10,53 %)

$LCID (+0,93 %)

$DUOL

$UN0 (-1,48 %)

$CBK (-0,55 %)

$DEZ (-0,38 %)

$ZAL (+1,18 %)

$HEN (+0,72 %)

$MAERSK A (+1,91 %)

$HEI (-0,83 %)

$CON (+4,22 %)

$AZN (+0,92 %)

$ALB (+5,74 %)

$MRNA (+0,85 %)

$QBTS (+3,6 %)

$WBD (+0,79 %)

$LI (+0,64 %)

$RHM (+1,75 %)

$DDOG (+1,06 %)

$RL (+2,54 %)

$OPEN (+7,88 %)

$ABNB (+2,91 %)

$PTON (-0,72 %)

$MP (+5,09 %)

$TTD (+3,24 %)

$STNE (+2,69 %)

$SQ (+1,29 %)

$GRND (+0 %)

$IREN (+7,1 %)

$AFRM (+0,82 %)

$CRISP (-4,46 %)

$RUN (+0,08 %)

$7011 (-3,18 %)

$DTG (+1,16 %)

$HAG (-2,58 %)

$DKNG (+1,94 %)

$LAC (+9,92 %)

$KKR (+3,81 %)

$PETR3 (+1,58 %)

$CEG

$WEED (+2,05 %)

Dealing with losses

How do you deal with losses? Do you realize them promptly or do you wait and see?

I mostly invest for the long term. At least until I found this portal here 😇

I actually buy stocks that I'm convinced of and then leave them. Always with money that I don't need elsewhere.

Now, for example, I have titles like $EVT (-0,91 %)

$SRT (+1,46 %) or $S92 (+0,41 %) . All deep red. Wouldn't really bother me, I don't need the money. I have enough cash to buy other stocks.

Is it still worth selling because of taxes or how do you handle such cases?

What are your portfolio corpses?

Range change in the DAX

As of September 22, 2025, Porsche AG will be removed from Germany's leading index $P911 (+1,45 %) will be removed from the leading German index DAX 40 due to a massive drop in share price of over a third last year - triggered by US import tariffs and declining demand, particularly in China. This makes Porsche one of the weakest DAX stocks in 2025. Deutsche Börse is making this change as part of the regular index recomposition. After being kicked out, Porsche will move to the mid-cap index MDAX .

Who moves up - the climbers in the DAX

Two newcomers fill the gap in the DAX:

- Scout24 AG $G24 (+0,54 %) - the online real estate platform operator, moves from the MDAX to the DAX.

- Gea Group AG $G1A (+1,5 %) - a major machinery and engineering group, also moved up from the MDAX.

Further index changes (MDAX, SDAX etc.)

The DAX is not the only index to be shaken up:

- Fielmann AG $FIE (+1,12 %) moves up from the SDAX to the MDAX.

- Evotec SE $EVT (-0,91 %) leaves the MDAX to make room for Fielmann.

- 1&1 AG $1U1 (+1,8 %) joins the SDAX and replaces SGL Carbon $SGL (-7,84 %)

In addition, 1&1 $1U1 (+1,8 %) is included in the TecDAX - instead of the biosimilar developer Formycon $FYB (-2,8 %)

What do German Braass say

Would it be necessary to accept the takeover offer of 8 euros per share from American Bude at that time?

What happens next?

However, you must bear in mind that if the majority shareholders decide to delist the company, you may no longer be able to trade your shares and could therefore be left empty-handed.

Evotec share analysis - Can the share really rise by 57% or even 400%?

Today's video focuses on the $EVT (-0,91 %) share in focus. There are several reasons why the share is currently interesting for me to take a long position and assume that prices will rise.

Firstly, there was renewed speculation of a hostile takeover last month and the new CEO Christian Wojczewski is restructuring the company massively and paving the way for profitability.

Evotec's share price performance is also very interesting - which is why I am presenting it to you today.

What are your thoughts on the share?

Evotec

$EVT (-0,91 %) is going through the roof today. Yesterday it even reached 6.60 at times.

I wonder what's coming?

06.05.2025

Redcare Pharmacy returns to profit + Barclays lowers Porsche AG to 'Equal Weight + Zalando starts positively and attracts more customers + Evotec starts the year with a decline in sales + Teamviewer confirms annual targets despite difficult environment

Redcare Pharmacy $RDC (-5,11 %)returns to the profit zone operationally as expected

- The online pharmacy Redcare Pharmacy (Shop Apotheke) has made a profitable start to the current year despite investments in growth with e-prescriptions in Germany.

- Unlike in the fourth quarter, the company achieved an operating profit in the first three months.

- Earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted for special effects, rose by 14 million euros to 9 million euros compared to the previous quarter, the MDax-listed company announced in Sevenum on Tuesday.

- Experts surveyed by Bloomberg had expected an operating profit at this level.

- Compared to the same quarter of the previous year, Redcare Pharmacy earned slightly less operationally.

- As already known, turnover increased by 28 percent to 717 million euros compared to the same quarter of the previous year.

- The online pharmacy also confirmed its 2025 forecast and its medium to long-term targets.

Barclays lowers Porsche AG $P911 (+1,45 %)to 'Equal Weight'; target at 42.50 euros

- The British investment bank Barclays has lowered its target price for Porsche AG shares from 62.50 to 42.50 euros and consequently downgraded the shares from "Overweight" to "Equal Weight".

- According to analyst Henning Cosman's reassessment of the Zuffenhausen-based company on Monday evening, he is returning to the sidelines.

- Both demand and restructuring are weaker than expected, he wrote with a view to the quarterly results.

- His estimates up to 2027 are 5 to 10 percent below the new consensus, according to his own statement.

- He believes the valuation of the shares is still too high.

Zalando $ZAL (+1,18 %)gets off to a positive start and attracts more customers

- The online retailer Zalando has started the new financial year with growth.

- The company benefited from a good end-of-season sale, a positive start to the new spring/summer season and its bonus program.

- The number of active customers reached a new high, Zalando announced in Berlin on Tuesday.

- Sales rose by 7.9 percent to 2.4 billion euros in the first quarter.

- The gross merchandise volume increased by 6.5 percent to 3.5 billion euros.

- Adjusted earnings before interest and taxes (EBIT) improved from 28.3 million to 46.7 million euros.

- The figures were in line with analysts' expectations.

- Zalando confirmed its forecast for the current year, despite the uncertain environment.

Evotec $EVT (-0,91 %)starts the year with a decline in sales - targets confirmed

- The pharmaceutical drug researcher and developer Evotec has recorded a weaker start to the year.

- Revenues fell by four percent year-on-year to 200 million euros, as the company announced on Tuesday.

- Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) fell by around 60 percent to EUR 3.1 million due to higher selling and administrative expenses.

- On balance, the loss widened from just under 21 million to around 32 million euros. The targets for 2025 were reaffirmed.

- Evotec only recently announced that it would be realigning its focus.

- In future, the company intends to focus on high-value services and therapeutic areas and reduce its project portfolio by around 30 percent.

- The company intends to withdraw from investments and focus on the two pillars of drug discovery & preclinical development and the Just - Evotec Biologics division.

- In addition to the current cost program, the MDax-listed company plans to save more than EUR 50 million by 2028.

Teamviewer $TMV (-1,69 %)confirms annual targets despite difficult environment

- Software provider Teamviewer is maintaining its outlook for the year following revenue growth in the first quarter.

- "We are seeing continued high demand for our solutions - despite the very volatile global market environment," said Teamviewer CEO Oliver Steil on Tuesday, according to a press release.

- In the first quarter, the MDax company's reported turnover rose by 11 percent to 178.8 million euros.

- At the bottom line, the net result climbed by a third to 29.6 million euros.

- This was mainly due to falling marketing costs after the sponsorship agreement with English soccer club Manchester United was significantly reduced from the middle of last year.

- The takeover of 1E, which was completed at the end of January, also contributed to the growth in turnover, with the company reporting that its integration is proceeding according to plan.

- There was strong growth in the area of large corporate customers (enterprise segment). Teamviewer confirmed its targets for the year.

- In the annual outlook, the company includes the acquisition "pro forma" for comparison purposes as if it had been part of the Group since January 1, 2024.

- Accordingly, pro forma turnover is expected to increase by a further 5.1 to 7.7 percent to between 778 and 797 million euros.

- The operating profit margin adjusted for one-off effects (adjusted EBITDA) is expected to be around 43%.

- Based on this calculation, Teamviewer achieved an operating margin of 43 percent in the first quarter.

Tuesday: Stock market dates, economic data, quarterly figures

Stock market holiday in Japan and South Korea

- ex-dividend of individual stocks

- Anheuser-Busch InBev EUR 1.00

- Verbund 2.80 EUR

- Quarterly figures / company dates USA / Asia

- 13:00 Marriott International quarterly figures

- 16:00 Bristol Myers Squibb quarterly figures | General Electric AGM

- 18:00 Intel AGM

- 22:15 AMD | Coty quarterly figures

- No time specified: Electronic Arts | The Mosaic Quarterly figures

- Quarterly figures / Company dates Europe

- 07:00 Redcare Pharmacy | Kontron | Evotec | Fresenius Medical Care | Kontron

- 07:00 Evotec | Rational | Teamviewer | Zalando | Axa | Royal Philips

- 07:10 Elmos Semiconductor | Norma Group quarterly figures

- 07:30 Continental | Hugo Boss | Koenig & Bauer | Uniper

- 07:30 Raiffeisen Bank International | Scout24 Quarterly figures

- 08:00 MTU Aero Engines | Vestas Wind Quarterly figures

- 09:00 KSB SE & Co. KGaA, 1Q results | Teamviewer analyst conference | Hugo Boss PK

- 09:30 MTU Aero Engines PK

- 10:00 Deutsche Lufthansa | Nordex AGM

- 11:00 Redcare Pharmacy Conference Call | Hugo Boss Analyst Conference | MTU Aero Engines Analyst Conference

- 12:00 Intesa Sanpaolo quarterly figures

- 12:30 Continental Analyst Conference

- 14:00 Ferrari quarterly figures | Evotec conference call | Fresenius Medical Care analyst conference call

- 15:00 Rational Conference Call | Scou24 Analyst Conference

- Untimed: Amadeus Fire quarterly figures

- Economic data

08:00 DE: Turnover in the service sector February

08:45 FR: Industrial production March FORECAST: +0.2% yoy previous: +0.7% yoy

09:45 IT: Purchasing Managers' Index/PMI non-manufacturing April PROGNOSE: 51.3 previous: 52.0

09:50 FR: Purchasing Managers' Index/PMI non-manufacturing (2nd release) April PROGNOSE: 46.8 1st release: 46.8 PREV: 47.9 Total Purchasing Managers' Index (2nd release) PROGNOSE: 47.3 1st release: 47.3 PREV: 48.0

09:55 DE: Purchasing Managers' Index/PMI non-manufacturing (2nd release) April FORECAST: 48.8 1st release: 48.8 PREV: 50.9 Total Purchasing Managers' Index (2nd release) FORECAST: 49.7 1st release: 49.7 PREV: 51.3

10:00 EU: Purchasing Managers' Index/PMI non-manufacturing Eurozone (2nd release) April FORECAST: 49.7 1st release: 49.7 Previous: 51.0 Total Purchasing Managers' Index (2nd release) FORECAST: 50.1 1st release: 50.1 Previous: 50.9

10:30 UK: Purchasing Managers' Index/PMI non-manufacturing (2nd release) April FORECAST: 48.9 1st release: 48.9 Previous: 52.5

11:00 EU: Producer Prices March Eurozone OUTLOOK: -1.0% yoy/+2.7% yoy previous: +0.2% yoy/+3.0% yoy

Without time data:

- PO: Annual meeting of the ECB

- US: US President Trump receives Canada's Prime Minister Carney

25.04.2025

Google's advertising business defies AI rivals and Trump's tariffs + New Intel boss announces 'painful decisions' + Procter & Gamble lowers forecast + Pepsico cuts profit target due to tariff dispute + Evotec beckons with 75 million dollars from research alliance with Bristol-Myers Squibb

Google's $GOOGL (-0,51 %)Advertising business defies AI rivals and Trump's tariffs

- Google's online advertising business continues to grow - despite competition from new AI rivals.

- In the past quarter, advertising revenue rose by 8.5 percent year-on-year to just under 66.9 billion dollars (58.9 billion euros).

- This was slightly above analysts' expectations.

- The share price rose by 4.6 percent at times in after-hours trading.

- Advertising at Google continues to generate the majority of the parent company Alphabet's revenues.

- The development of the advertising business is being monitored very closely.

- A key question is whether attempts by competitors to use artificial intelligence to display direct answers instead of links will leave a mark on Google's search engine.

- Meanwhile, Google itself is moving in this direction with AI-generated overviews of search queries.

- These "AI overviews" currently reach 1.5 billion users per month, said CEO Sundar Pichai.

- AI is also increasingly being used in another area at Google.

- "Significantly more" than 30 percent of the software code - the millions of lines of program code behind Google services - is now pre-formulated by artificial intelligence and taken over by humans, said Pichai.

- In the past, this was mainly manual work for programmers.

- There was also an unusual factor behind the strong increase in profits: the revaluation of the stake in a company not listed on the stock exchange contributed eight billion dollars, it was said.

- A name was not mentioned - but according to the Bloomberg financial service, this is Elon Musk's space company SpaceX.

- According to the report, the internet company participated in a SpaceX financing round a decade ago.

New Intel boss $INTC (+5,62 %)announces 'painful decisions'

- The new CEO of the crisis-ridden chip company Intel has announced "painful decisions" and the prospect of job cuts just a few weeks after taking office.

- Intel must reduce costs and remove bureaucratic hurdles, said Lip-Bu Tan after the presentation of quarterly figures.

- He emphasized that this would also involve cutting jobs.

- Chief Financial Officer David Zinsner said at the same time that Intel could not yet give any figures on the extent of the job cuts.

- The company also wants to reduce costs in other ways.

- The financial service Bloomberg recently reported that Intel could soon announce the reduction of around a fifth of its jobs.

- The number of Intel employees had already fallen to just under 109,000 by the end of last year from a good 124,000 at the end of September.

- Intel once dominated the semiconductor market, but has been struggling with problems for years.

- Graphics card specialist Nvidia has conquered a leading position, particularly in the business with chips for artificial intelligence.

- Intel is also under greater pressure in its traditional business with PC processors and chips for data centers.

- Intel disappointed investors with its sales forecast for the current quarter.

- The shares fell by a good five percent in after-hours trading.

- Intel forecast revenues of between 11.2 and 12.4 billion dollars for the second quarter. Analysts had expected an average forecast of around 12.8 billion dollars.

- From the investors' point of view, this weighed more heavily than the results of the first quarter, in which Intel exceeded market expectations.

- Sales stagnated at 12.7 billion dollars, while analysts had expected a decline to 12.3 billion dollars on average.

- At the bottom line, the loss of 800 million dollars was twice as high as a year ago.

- However, Intel's adjusted earnings per share of 0.13 dollars clearly exceeded analysts' forecasts of just 0.01 dollars.

Procter & Gamble $PG (+0,35 %)lowers forecast

- The gloomy consumer sentiment and the ongoing trade disputes are making the consumer goods group Procter & Gamble more pessimistic for the current financial year.

- The company lowered its sales and profit forecasts when presenting its figures for the third financial quarter.

- The company announced in Cincinnati on Thursday that revenue in the 2024/25 financial year (as at the end of June) is likely to grow organically by only around two percent.

- Previously, the Group had forecast growth of three to five percent.

- This excludes currency and portfolio effects.

- Adjusted earnings per share are also likely to increase less than expected.

- Procter & Gamble now expects growth of two to four percent instead of five to seven percent.

- CFO Andre Schulten had already reported in February that deliveries to retailers had slowed down - the manager warned at the time that the company could miss its profit forecast.

- He also pointed to a decline in consumption in Asia, Africa and the Middle East, which he attributed to the "anti-Western sentiment" prevailing there.

- Analysts had already expected earnings per share to be below the previous Group forecast, but Procter & Gamble has now cut its profit expectations even more sharply than expected.

- In the third quarter, sales fell by two percent to 19.8 billion US dollars (around 17.4 billion euros), as the company also announced.

- In organic terms, revenue grew slightly by one percent.

- However, this was less than analysts had expected.

- At 3.8 billion dollars, net profit was roughly on a par with the previous year.

- Adjusted earnings per share increased by one percent to 1.54 dollars.

Pepsico $PEP (+0,55 %)cuts profit target due to customs dispute

- The US food company Pepsico expects lower profits than before this year due to the global customs dispute.

- Pepsico announced on Thursday that earnings per share adjusted for special effects (core EPS), excluding currency effects, are likely to remain at around the previous year's level.

- Originally, Pepsico had targeted an increase in the mid-single-digit percentage range.

- Sales, on the other hand, are expected to continue to grow organically in the low single-digit percentage range.

- The tariffs are likely to make supply chains more expensive, complained Pepsico CEO Ramon Laguarta according to the press release.

- Pepsico is trying to counteract the higher costs.

- However, volatility and uncertainty are likely to increase.

- At the same time, consumer sentiment remains weak in many regions - here, too, the outlook is uncertain.

- In the twelve weeks to March 22, Pepsico missed analysts' expectations.

- Sales fell by 1.8 percent to 17.92 billion US dollars (15.74 billion euros) compared to the same period last year.

- Net income attributable to shareholders fell by around ten percent to 1.83 billion dollars.

Evotec $EVT (-0,91 %)will receive 75 million dollars from research alliance with Bristol-Myers Squibb $BMY (+0,93 %)

- For the Hamburg-based drug researcher and developer Evotec, the long-term collaboration with the pharmaceutical company Bristol-Myers Squibb is paying off.

- The Hanseatic company announced on Thursday that it had made significant progress in the field of protein degradation.

- Evotec will therefore now receive a total of 75 million dollars in accordance with the agreement.

- The news was well received on the stock market, with the share price rising by almost four percent in pre-market trading.

- Evotec has been working with Bristol-Myers Squibb since 2018 and extended the partnership in 2022.

Friday: Stock market dates, economic data, quarterly figures

Stock exchange holiday Australia

- ex-dividend of individual stocks

- ENGIE EUR 1.48

- Semperit Holding EUR 0.50

- ABN AMRO Bank 0.75 EUR

- BE Semiconductor Industries EUR 2.18

- Quarterly figures / company dates USA / Asia

- 13:00 Colgate-Palmolive quarterly figures

- 13:45 Abbvie quarterly figures

- Quarterly figures / Company dates Europe

- 07:00 Nordex | Südzucker | Safran | Signify quarterly figures | Holcim Trading Update 1Q

- 07:30 Atoss Software quarterly figures

- 08:00 Yara | Palfinger quarterly figures

- 10:00 Bayer | Continental | Merck KGaA AGM | Holcim Analyst Conference

- 14:00 Nordex Conference Call | Akzo Nobel AGM

- Economic data

08:00 DE: Construction industry, new orders and sales February

08:00 UK: Retail Sales March FORECAST: -0.4% yoy/+1.6% yoy previous: +1.0% yoy/+2.2% yoy

08:45 FR: Business Climate Index April FORECAST: 96 previous: 96

16:00 US: Consumer Sentiment Index Uni Michigan (2nd survey) April FORECAST: 50.8 1st survey: 50.8 PREV: 57.0

16:15 US: Atlantic Council, fireside chat with member of the Monetary Policy Committee of the Bank of England, Greene

19:30 US: IMF and World Bank Spring Meetings, IMF Steering Committee (IMFC) press conference.

23.04.2025

Tesla with sales decline + SAP maintains cloud growth rate and confirms outlook + Danaher's statements also drive Sartorius, Stedim and Evotec

Tesla $TSLA (+2,52 %)with decline in sales

- Tesla recorded a nine percent drop in sales to 19.3 billion dollars and a 71 percent drop in profits to 409 million dollars in the past quarter.

- Analyst Dan Ives from Wedbush Securities estimates that Elon Musk's political activities could permanently reduce demand for Tesla by 15 to 20 percent.

- In its current quarterly report, Tesla refrains from its usual forecast of a return to growth.

- For the first time in its Q1 earnings report, Tesla does not mention when the company intends to return to growth.

- Tesla Inc. misses analysts' estimates of USD 0.42 with earnings per share of USD 0.27 in the first quarter. Revenue of USD 19.34 billion below expectations of USD 21.4 billion.

- Tech billionaire Elon Musk initiates withdrawal from Washington.

- From May, he will spend "considerably" less time in the government apparatus as President Donald Trump's cost-cutter, said the Tesla boss.

- Instead, he will focus more on the interests of the electric car manufacturer.

SAP $SAP (-0,43 %)maintains cloud growth rate and confirms outlook

- SAP maintained its cloud growth in the first quarter and significantly increased its operating profit.

- The Walldorf-based software group confirmed its outlook for the current year.

- According to the DAX-listed company, the environment is characterized by high dynamics and uncertainty and further developments are difficult to predict.

- SAP is targeting currency-adjusted cloud growth of 26 to 28 percent to 21.6 to 21.9 billion euros this year.

- Cloud and software combined are expected to grow by 11 to 13 percent to 33.1 to 33.6 billion euros.

- The non-IFRS operating result is expected to reach EUR 10.3 to 10.6 billion after EUR 8.15 billion in 2024.

- In the first quarter, cloud revenue rose by 26% in constant currency to just under EUR 5 billion.

- Analysts had expected a consensus of EUR 5.06 billion from Visible Alpha.

- Currency-adjusted growth had already amounted to 26% in the fourth quarter.

- Non-IFRS operating profit rose by 58% to EUR 2.46 billion.

- The Current Cloud Backlog (CCB), which quantifies secured orders over the course of a year, rose by 29% to EUR 18.2 billion after adjusting for currency effects.

- The initial reaction of the share in after-hours trading in Germany was positive. They rose by more than 5 percent to 231 euros at the broker Lang & Schwarz.

- The SAP share had closed 3.32 percent lower at 218.50 euros on XETRA on Tuesday.

- SAP ADRs traded on the NYSE rose 6.48 percent to 268.75 US dollars in after-hours trading.

Danaher's $DHR (-1,19 %)statements also drove Sartorius$SRT (+1,46 %)Stedim $DIM (+1,74 %)and Evotec $EVT (-0,91 %)on

- The quarterly figures of the US pharmaceutical equipment manufacturer Danaher boosted the shares of Sartorius and its subsidiary Sartorius Stedim Biotech on Tuesday.

- The shares of pharmaceutical contract researcher Evotec also benefited.

- The reason for this was not only the better than expected results in the first quarter and the confirmation of the Group's annual targets.

- The fact that Danaher performed particularly well in the bioprocess technology segment, which is also an important pillar of the Göttingen-based Sartorius Group, probably put investors in a good mood.

- In addition, Danaher spoke of continued robust spending on research and development in the pharmaceutical sector.

- In the afternoon, the Sartorius preference share rose 5.9 percent to 221.30 euros at the top of the leading German Dax index and is thus back at its highest level since the end of March.

- The 21-day line, which signals the short-term trend, had already been overcome on Wednesday.

- The 50-day line as an indicator of the medium-term trend at just under EUR 226 and the long-term 200-day line at just over EUR 234 are now the next decisive resistances.

- The shares of French company Stedim Biotech recently rose by 3.9% to EUR 194.35 in Paris.

- In the MDax, the mid-cap index below the Dax, Evotec shares rose by 6.7 percent to 6.82 euros, while in the USA Danaher shares rose by 5.0 percent to 194.09 US dollars.

- Analyst Rachel Vatnsdal from the US bank JPMorgan spoke of Danaher "comfortably exceeding expectations" and "remarkable strength" in the bioprocessing sector.

- The bioprocessing division was the leader in the first quarter, she wrote.

- Compared to the previous quarter, orders there had increased significantly, while the company had also noted that it had not noticed any pull-forward effects in view of impending tariffs.

- According to stock market analysts, this should also have a positive effect on the industry as a whole.

- Like Sartorius, Danaher is broadly positioned in the healthcare sector with businesses in biotechnology and diagnostics.

Wednesday: Stock market dates, economic data, quarterly figures

- ex-dividend of individual stocks

- Lenzing EUR 3.00

- Heineken EUR 1.17

- Proximus EUR 0.10

- Adecco Group 1.00 CHF

- Quarterly figures / company dates USA / Asia

- 12:30 AT&T | GE Vernova | Boston Scientific quarterly figures

- 13:00 Philip Morris quarterly figures

- 13:30 Boeing quarterly figures

- 15:30 Goldman Sachs AGM

- 16:00 Cigna AGM

- 22:00 IBM | Texas Instruments | Lam Research

- 22:00 ResMed | Whirlpool quarterly figures

- No time specified: BYD quarterly figures

- Quarterly figures / Company dates Europe

- 07:30 Danone | Essilor-Luxottica 1Q sales

- 07:30 Volvo AB | Akzo Nobel quarterly figures

- 08:00 Reckitt Benckiser Trading Update 1Q

- 09:00 Just Eat Takeaway Trading Update 1Q

- 10:00 ASML | Sulzer Holding AGM

- 17:45 Kering quarterly figures

- Economic data

09:15 FR: Purchasing Managers' Index/PMI non-manufacturing | Purchasing Managers' Index/PMI manufacturing (1st release)

09:30 DE: Purchasing Managers' Index/PMI non-manufacturing (1st release) April PROGNOSE: 50.3 PREVIOUS: 50.9 Total Purchasing Managers' Index (1st release) PROGNOSE: 51.0 PREVIOUS: 51.3

09:30 DE: Purchasing Managers' Index/PMI manufacturing (1st release) April FORECAST: 47.6 PREVIOUS: 48.3

10:00 EU: Purchasing Managers' Index/PMI non-manufacturing Eurozone (1st release) April FORECAST: 50.5 PREVIOUS: 51.0

10:00 EU: Purchasing Managers' Index/PMI Manufacturing Eurozone (1st release) April FORECAST: 47.5 previously: 48.6 Total Purchasing Managers' Index (1st release) FORECAST: 50.4 previously: 50.9

10:30 UK: Purchasing Managers' Index/PMI non-manufacturing (1st release) Apri PROGNOSE: 51.6 previous: 52.5 | Purchasing Managers' Index/PMI manufacturing (1st release) April PROGNOSE: 44.2 previous: 44.9

11:00 EU: Trade Balance February

15:00 US: IMF, Fiscal Monitor

15:30 US: Fed St. Louis President Musalem and Fed Governor Waller, participate in Fed Listens Event

15:45 US: Purchasing Managers' Index/PMI Services (1st release) April Forecast: 52.8 Previous: 54.4 | Purchasing Managers' Index/PMI Manufacturing (1st release) April Forecast: 49.5 Previous: 50.2

16:00 US: New Home Sales March FORECAST: +1.3% yoy previous: +1.8% yoy

16:30 US: Crude oil inventories data (week) from the Energy Information Administration (EIA) previous week

18:00 US: Governing Council member Knot, speech at Peterson Institute conference

20:00 US: Fed, Beige Book

21:15 US: ECB Chief Economist Lane, participation in panel at IMF Spring Meetings

21:45 US: ECB Director Cipollone, participation in panel at IMF Spring Meetings

No time specified: CN: Auto Shanghai 2025 exhibition in Shanghai

Titres populaires

Meilleurs créateurs cette semaine