$BNTX (+1,09 %)

$ON (+1,79 %)

$HIMS (+2,74 %)

$PLTR (+4,8 %)

$O (-0,27 %)

$8058 (-0,35 %)

$7974 (-2,78 %)

$BP. (+1,5 %)

$BOSS (+0,31 %)

$SWK (+0,76 %)

$SPOT (+3,6 %)

$N1CL34

$UBER (-0,46 %)

$CPRI (-0,32 %)

$SHOP (+2,08 %)

$RACE (+1,6 %)

$HOG (-0,06 %)

$HTZ (+1,62 %)

$PFIZER

$UPST (+1,82 %)

$ANET (+5,38 %)

$PINS

$TEM (+3,76 %)

$AMD (+7,17 %)

$SMCI (+6,76 %)

$RIVN (+11,4 %)

$BYND (+8,05 %)

$KTOS (+4,61 %)

$CPNG (+2,37 %)

$BMW (+0,68 %)

$NOVO B (+1,14 %)

$FRE (+0,83 %)

$ORSTED (-0,69 %)

$AG1 (+4,62 %)

$EVT (+0,31 %)

$CCO (+2,86 %)

$DOCN (+4,46 %)

$LMND (+0,03 %)

$SONO (+1,02 %)

$MCD (-0,93 %)

$HOOD (+3,51 %)

$QCOM (+1,34 %)

$FTNT (+1,43 %)

$FSLY (+0,57 %)

$HUBS (+0,23 %)

$ELF (+4,16 %)

$ARM (+0,93 %)

$SNAP (-0,78 %)

$DASH (+1,87 %)

$APP (+4,25 %)

$AMC (-0,66 %)

$ZIP (-2,49 %)

$FIG (+6,33 %)

$LCID (+2,55 %)

$DUOL

$UN0 (+0,45 %)

$CBK (+2,31 %)

$DEZ (+2,4 %)

$ZAL (-1,53 %)

$HEN (-0,04 %)

$MAERSK A (-0,23 %)

$HEI (+0,62 %)

$CON (-0,2 %)

$AZN (+1,08 %)

$ALB (+4,25 %)

$MRNA (+8 %)

$QBTS (+8,3 %)

$WBD (+1,14 %)

$LI (+4,87 %)

$RHM (+1,17 %)

$DDOG (+1,95 %)

$RL (-2,43 %)

$OPEN (+1,5 %)

$ABNB (+1,51 %)

$PTON (-0,94 %)

$MP (+4,17 %)

$TTD (+0,25 %)

$STNE (-0,41 %)

$SQ (+1,85 %)

$GRND (+1,72 %)

$IREN (+11,91 %)

$AFRM (+0,21 %)

$CRISP (-0,01 %)

$RUN (+0,91 %)

$7011 (+0,43 %)

$DTG (-0,53 %)

$HAG (+0,34 %)

$DKNG (+0,03 %)

$LAC (+5,43 %)

$KKR (-0,9 %)

$PETR3 (+0,42 %)

$CEG

$WEED (-18,45 %)

Lithium Americas

Price

Debate sobre LAC

Puestos

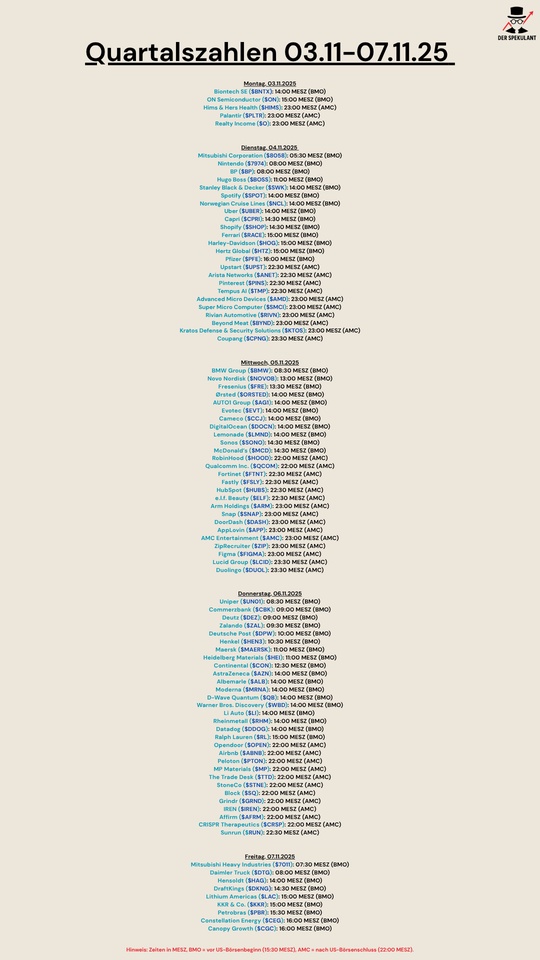

3Quartalszahlen 03.11.25-07.11.15

🚨 Morgan Stanley just dropped a list of 39 “National Security” stocks

This isn’t your typical watchlist — it’s a who’s who of the companies the U.S. needs to stay ahead in energy, defense, and AI supply chains.

Let’s break it down 👇

⚛️ Nuclear Energy & Uranium:

The U.S. wants energy independence — and that means uranium.

Names like $UUUU (+7,32 %) , $LEU (+14,96 %) , $CCO (+2,86 %) , and $NXE (+7,4 %) are at the center of the nuclear revival. Even micro-reactor plays like $OKLO are making noise as America rebuilds its atomic backbone.

🔋 Batteries & Energy Storage:

$TSLA (+0,1 %) is still here, but the real upside could come from lesser-knowns like $AMPX (next-gen lithium-ion) and $MVST (+1,62 %) (solid-state tech).

These are the quiet enablers of the EV and grid storage boom — and every megawatt stored is national security now.

🪨 Rare Earths & Strategic Metals:

China controls 70%+ of this market — and the U.S. wants out.

Morgan Stanley highlights $MP (+4,17 %) , $CRML (+5,28 %) , $IVN (+5,97 %) , and $WPM (+3,65 %) as key players in securing rare earth supply chains critical for chips, missiles, and EVs.

⚡ Lithium:

Without lithium, there is no clean energy transition.

Watch $ALB (+4,25 %) , $LAC (+5,43 %) , $SGML (+5,29 %) , and $SLI (+0,35 %) — these are the lifelines for the world’s next battery superpowers.

💡 The takeaway:

This “National Security Index” isn’t just about defense — it’s about control of the future’s raw power: energy, data, and materials.

And the firms on this list aren’t just suppliers — they’re the gatekeepers of U.S. sovereignty in a world of rising geopolitical tension.

If you’re betting on where the big government money flows next… this might be your roadmap.

Interesting video on a long-shot investment into $LAC (+5,43 %) investment who has the rights to extract the largest lithium deposit in the world.

I am waiting for the right signal if they will be succesful in pulling through or will need to sell parts of their rights.

Valores en tendencia

Principales creadores de la semana