I was surprised to see that the portfolio value has fallen quite a bit today. But this is mainly due to the ex-days of $RIO (-0.64%) and $TDIV (-0.25%) which coincide on one day and make up a large chunk of my portfolio as positions.

VanEck Vectors ETFs NV - Morningstar Dev. Mrkts. Div. Ldrs.

Price

Discussion about TDIV

Posts

353Something boring again

Good evening everyone,

here again something from the boring DDepot category :)

I have recently regrouped and have moved away from $QCOM (-1.01%) & $WFG (-0.66%) . The money that was freed up was invested in $MSFT (-0.48%)

$V (-0.47%) & $JPM (-1.48%) as these are longterm positions.

With $QCOM (-1.01%) I had hoped for a better short term outlook, but this was not really fulfilled, so the money went into $MSFT (-0.48%) flowed into

With $WFG (-0.66%) I got rid of one of my first positions, which I entered at a pretty bad time, which is why I got out with a slight loss. However, I may get back in again when the raw material wood recovers cyclically and demand in house construction increases - I had actually speculated on this, but it seems to be taking a while yet.

Hopefully the loss pot has had enough for now and I'm constantly learning :)

A savings plan is currently running $VWRL (-1.61%)

$TDIV (-0.25%)

$WGLD (+1.76%) and $BTC (-0.65%)

Some capital is still available, but I'm not really sure yet where or how I will invest it. The positions in $MSFT (-0.48%) and $V (-0.47%) I don't want to expand any further for the time being, unless it becomes cheap. I'm not sure whether the other stocks are worthy of being fed further, I might want to get another 2 shares in $ALV (-1%) but they are currently quite expensive.

My WL currently contains things like

- $AMZN (-2.34%)

$UNP (-2.49%) (just become expensive again)- $OTTR (+0.65%)

$BLBD (-3.09%)

$MAIN (-3.15%) (just running down a bit again)- $SJ (+0.82%)

$TGLS (-5.82%)

My portfolio is mainly focused on high-quality and boring companies, the aim is to generate cash flow from the outset and I want to feel comfortable with this. The investment horizon is basically long, >20-30 years, but I want to get something out of it now. Probably nothing for most people here, but I'm currently very happy with it. Let's see how the journey continues, I'll probably wait for the start of next week.

I'm always open to feedback, tips or stocks that fit in well here :)

You're clearly overweight in the US. That can quickly make things less boring. USD weakness, sovereign debt crisis, shadow banking collapse, private debt orgy, government restructuring - this will not leave US equities unscathed.

Why don't you have any EM value stocks?

Savings plan February 2026 - Part 2

Be able to invest a total of €3,000 this month. Of which €1,000 in the $TDIV (-0.25%) and €2,000 in the $VWRL (-1.61%) .

In January, only €750 could be invested in the $TDIV (-0.25%) otherwise hotels were booked for the trip to Japan in April.

Depot stands today at: 159.000€

My absolute favorite travel destination!

Savings plan February 2026 - Part 1

Be able to invest a total of €3,000 this month. Of which €1,000 in the $TDIV (-0.25%) and €2,000 in the $VWRL (-1.61%) .

In January, only €750 could be invested in the $TDIV (-0.25%) otherwise hotels were booked for the trip to Japan in April.

Depot stands today at: 159.000€

Best / Least performers February

What are your top 3 best performers in February?

My top ETF in February

$TDIV (-0.25%) +6.2%

$JEGP (-0.32%) +4.8%

$IDVY (-0.71%) +3.2%

My top individual stocks February

$DTE (-0.64%) +24.7%

$ENGI (-0.35%) +8.6%

$WKL (-0.82%) +6.4%

Laggards February

$HTGC (-1.58%) -10%

$MAIN (-3.15%) -7.7%

$CSG (+1.35%) -10.5%

Top ETF

$TDIV +6%

Top Stocks

$DTE (Deutsche Telekom) +25%

$WAWI (Wallenius Wilhelmsen) +24%

$TRMD A (Torm) +23%

'Flops'

$BAYN (Bayer) -5%

$ARCC (Aares Capital) -3%

Aares Capital has just entred my portfolio. I am chill with that and that is a long term position.

Bayer is my problem child. I am 45% in the minus. Bought them years ago. Even though stock has gone up quite a bit it still has to go a long way to get to the point where my invest is at 'zero'.

Reallocation Immo->Depot

At the turn of the year I had already mentioned that I would try to shift a little more from real estate investments into securities, as I already have a very strong imbalance towards real estate.

The first part has now worked. I sold a small apartment that no longer really fitted into my real estate strategy. The money is now (partly) going into the portfolio and into securities that pay out dividends (to overcompensate for the rental income that no longer exists). However, part of the proceeds will probably go into a new real estate project as an equity share, which will then have relatively strong debt leverage, but is not yet signed at the moment.

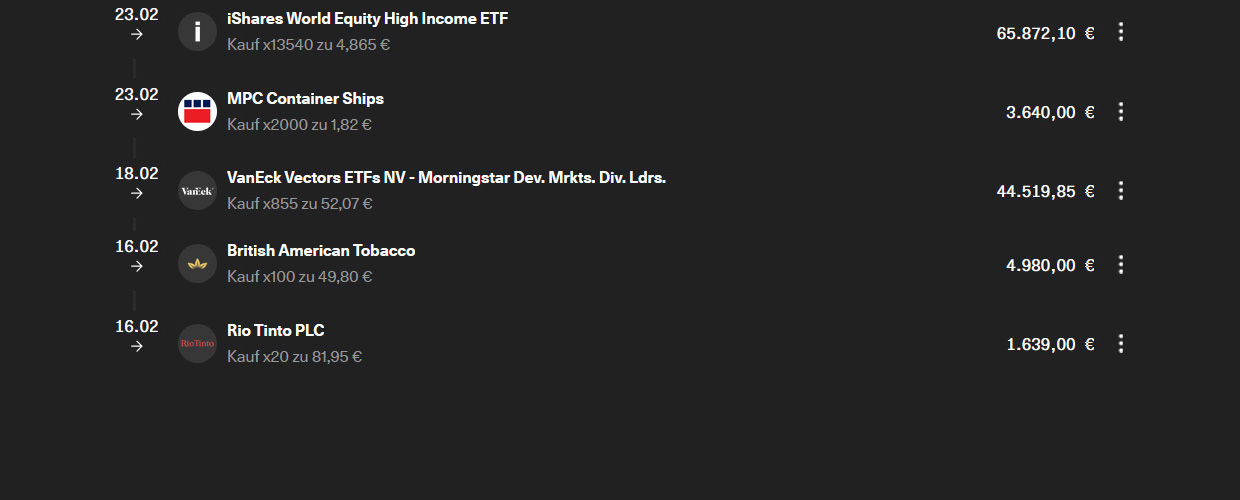

$TDIV (-0.25%) , $WINC (-0.71%) , $BATS (-1.48%) and $RIO (-0.64%) are all additions. $MPCC (-0.46%) is a new addition.

Boring Boring Boring

Again $TDIV (-0.25%)

Also €250 to $BTC (-0.65%) Side-bought.

Nice going Maarten!

Trending Securities

Top creators this week