After my $ADBE (+1.76%) last week, I bought again this week.

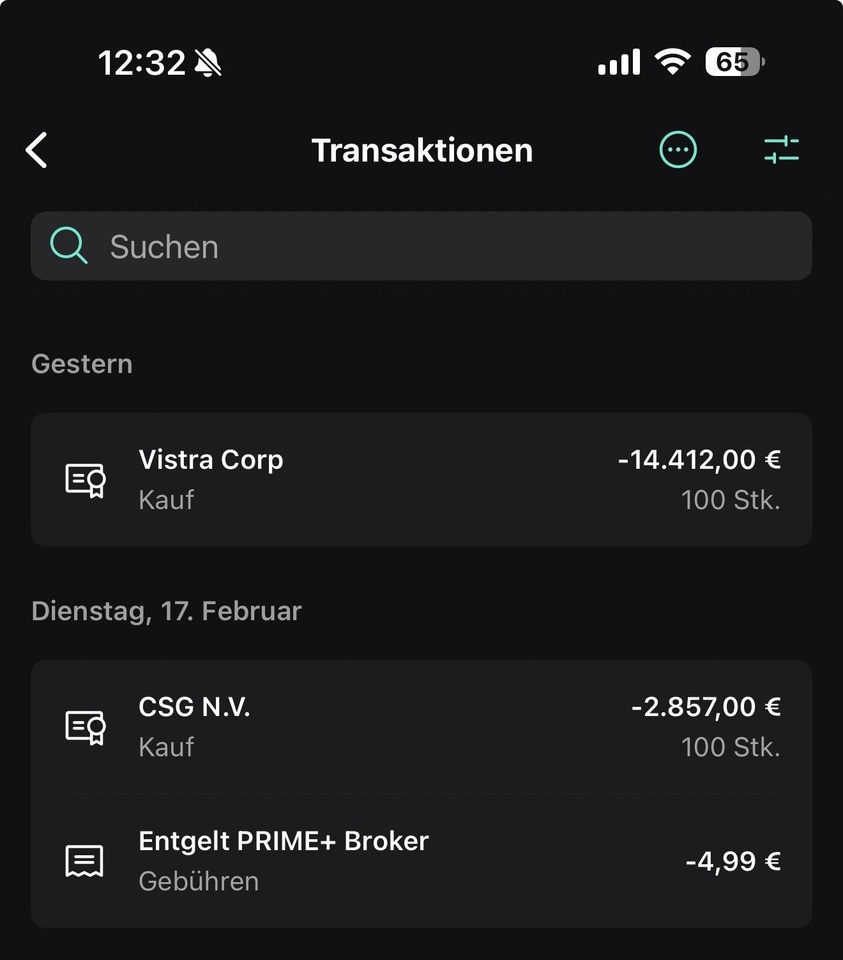

📈 The $CSG (+3.67%) -position was increased to 600 shares.

I see the structural increase in NATO defense spending and the extensive order backlog as key drivers for further diversifying my defense sleeve in a targeted manner.

✨ New in the portfolio is $VST (-1.78%) .

Vistra Corp is one of the most attractive AI energy stocks and, with a forward P/E ratio of around 14 and a PEG of 0.61, is valued comparatively favorably in relation to expected growth.

After the share price decline of around 21% below the all-time high, the fundamental situation is strong, supported by a 20-year nuclear contract with Meta, the USD 4.7bn acquisition of Cogentrix and expected earnings growth of 120% in the fourth quarter of 2025.

With nuclear and gas capabilities, the company is positioning itself as a key energy partner for AI data centers, and in my opinion, the valuation does not yet fully reflect the structural tailwinds.

🗺️ In the current macro environment, I continue to see my portfolio as robustly positioned.

My overweight in the oil and gas sector of around 10 % has delivered noticeable outperformance in the past month.

Precious metals, especially silver, are consolidating, but I do not see a sustained change in trend in the medium term and remain invested in both ETCs and mining stocks.

AI-related sectors, especially in the energy segment (e.g. $VST), remain structural winners for me, which is why I want to consistently use setbacks to expand positions.

$BTC (-2.86%) (20% weighting) remains the problem child of my portfolio and is currently trading at the level of 2 years ago.

Although I had clearly identified the trend break and the start of a new bear market here, I did not act accordingly. 🫣

What was your last purchase and why?